Featured Startups

Fintech in Fast Company: 15 Companies Named to 2025 List

We are suckers for business lists (we now regularly update 27 here). One that we've long admired is the Fast Company annual list of the most innovative companies. Their main list highlights the 50 most innovative across all industries. This year it includes two...

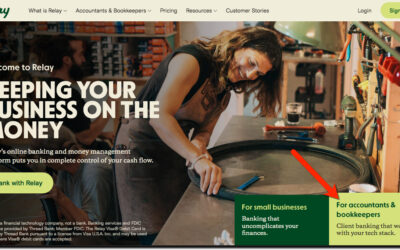

The SMB Challenger Banks: Relay Financial Moves Up the Value Chain with Advanced Money Management Tools

Founded just 5 years ago (Oct 2018), Toronto-based Relay Financial is the only non-USA company on our list of the largest USA digital-first small-business focused banking providers. With $15M in funding in 2021 (Series A, May 2021), it has built a full-featured small...

Top 12 U.S. Online Digital Banks for Small Businesses (SMB) August 2021

SMB Fintech Stack (Source: Canapi) The first pure-play online bank Security First Network Bank (SFNB) launched in 1995, just a year after Amazon.com. But unlike ecommerce, digital-only banking was slow to catch on. The legacy players held onto their market share by...

UK Fintech Startup Vauban Wins Canada Fintech Forum “Million Dollar Startup” Pitch Competition

Fintech Startup Interviews: Vauban founder Remy Astie (22 minutes, 17 Nov 2020) My favorite conference is Finovate, the best TV show is Shark Tank, and my go-to podcast is The Pitch. So, I can't believe I missed this competition 2 months ago that is mashup of all...

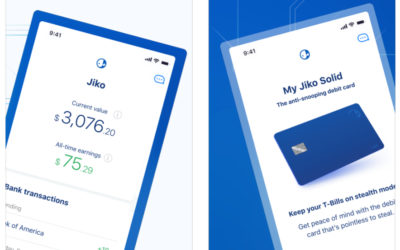

Challenger Jiko Buys $100M U.S. Bank (Fintech Startup of the Week)

At one time or another, every consumer fintech company wonders if they should buy a bank. When I advised Elon Musk back in the X.com/PayPal days, he had his sights on American Express (and now, astonishingly, PayPal is worth 3x American Express). But most fintech...

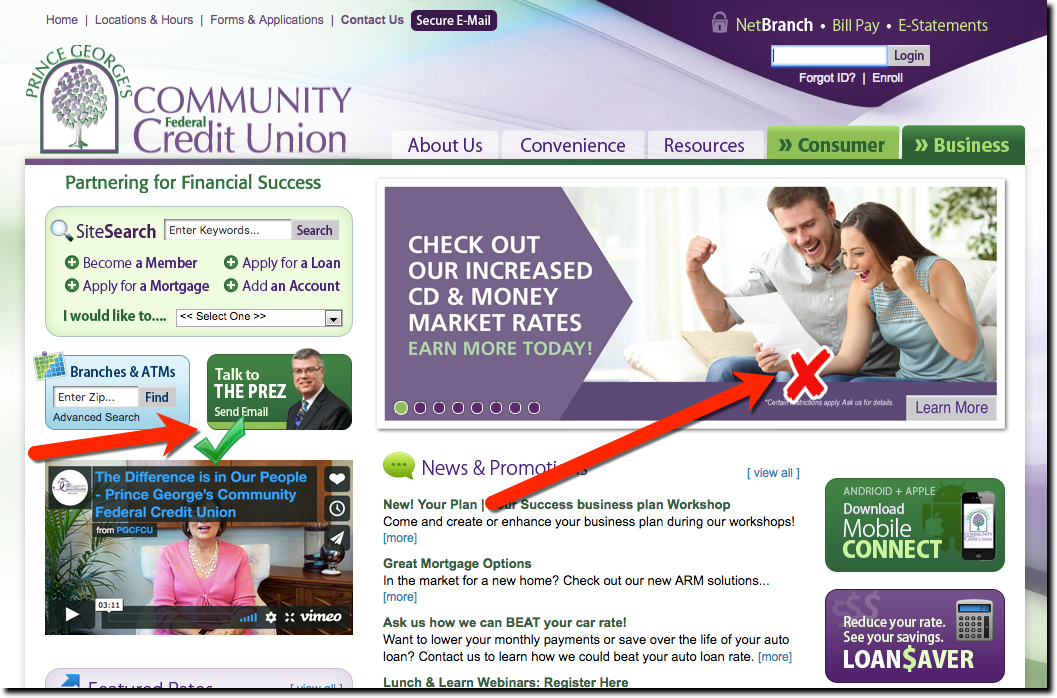

Friday Fails:

It's easier to find examples of poor user interfaces than great ones, so on Friday afternoon here are some examples to learn from. Silly stock photography: The reason I grabbed a screenshot of Prince George's Community Credit Union was to showcase the cool Talk to the...

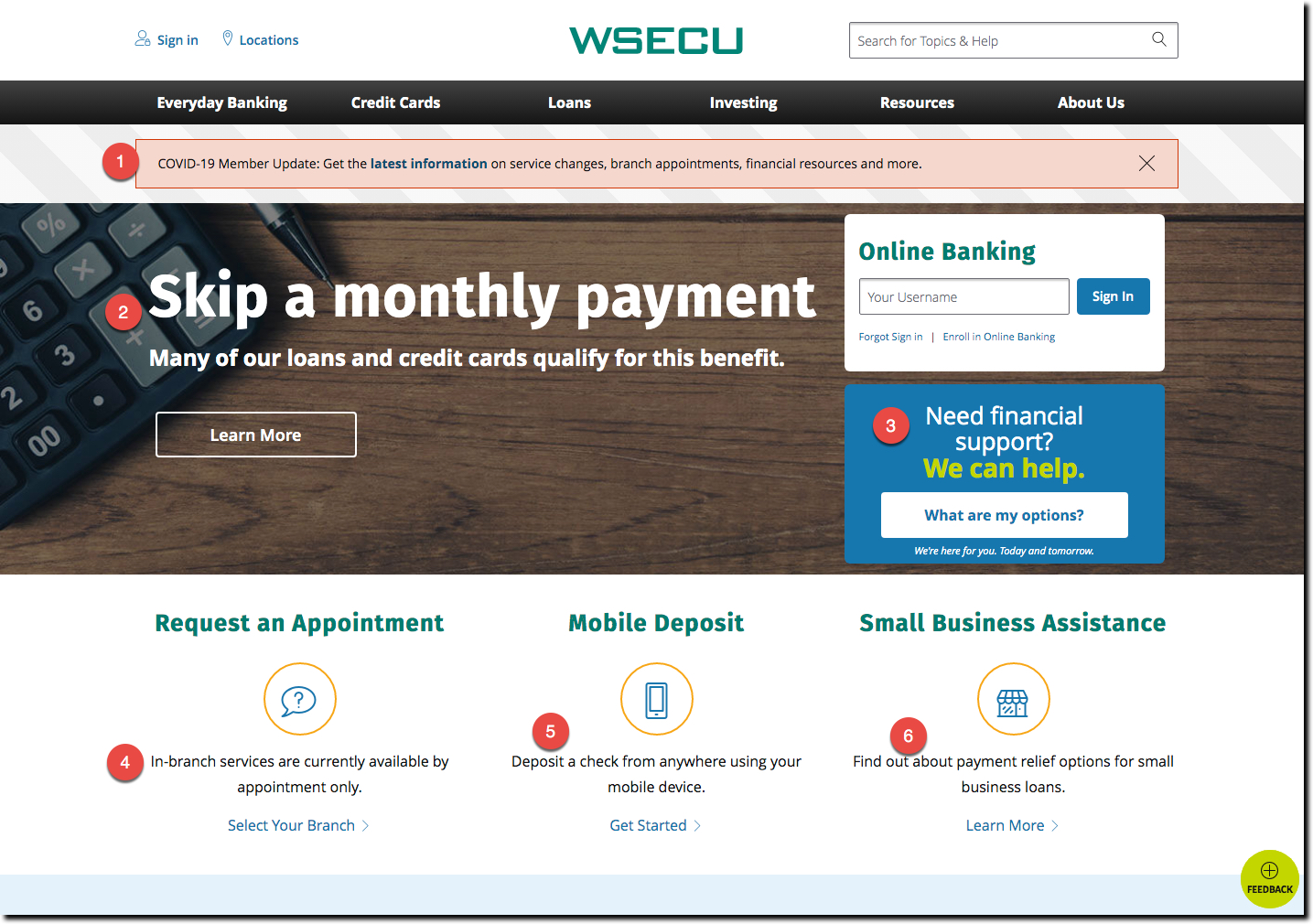

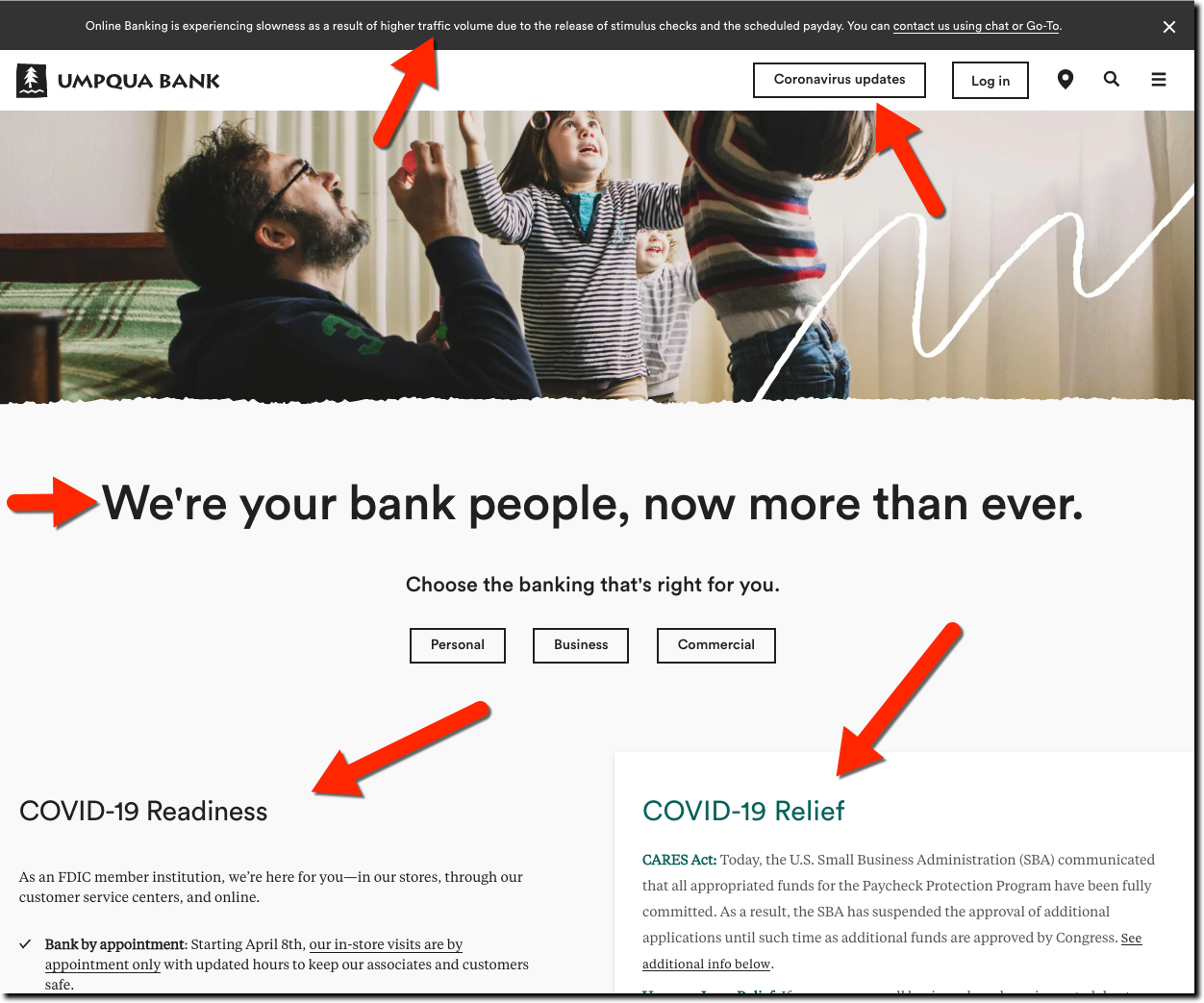

WSECU Website Rewrite Addresses COVID-19 Reality

When I wrote my first pandemic-era post in April, I looked around for financial institution examples that illustrated the much-needed empathy as well as clear discussion of issues customers were facing such as where their stimulus check might be. That was still early...

Banking, Trust & Black Swans

As usual, I've been listening to my favorite podcasts (Finovate of course, go Greg!, Breaking Banks, Jim Marous, 11:FS, and Bank On It to name a few) and there has been much talk about the covid crisis and what it means for digital banking and the fintech challengers....

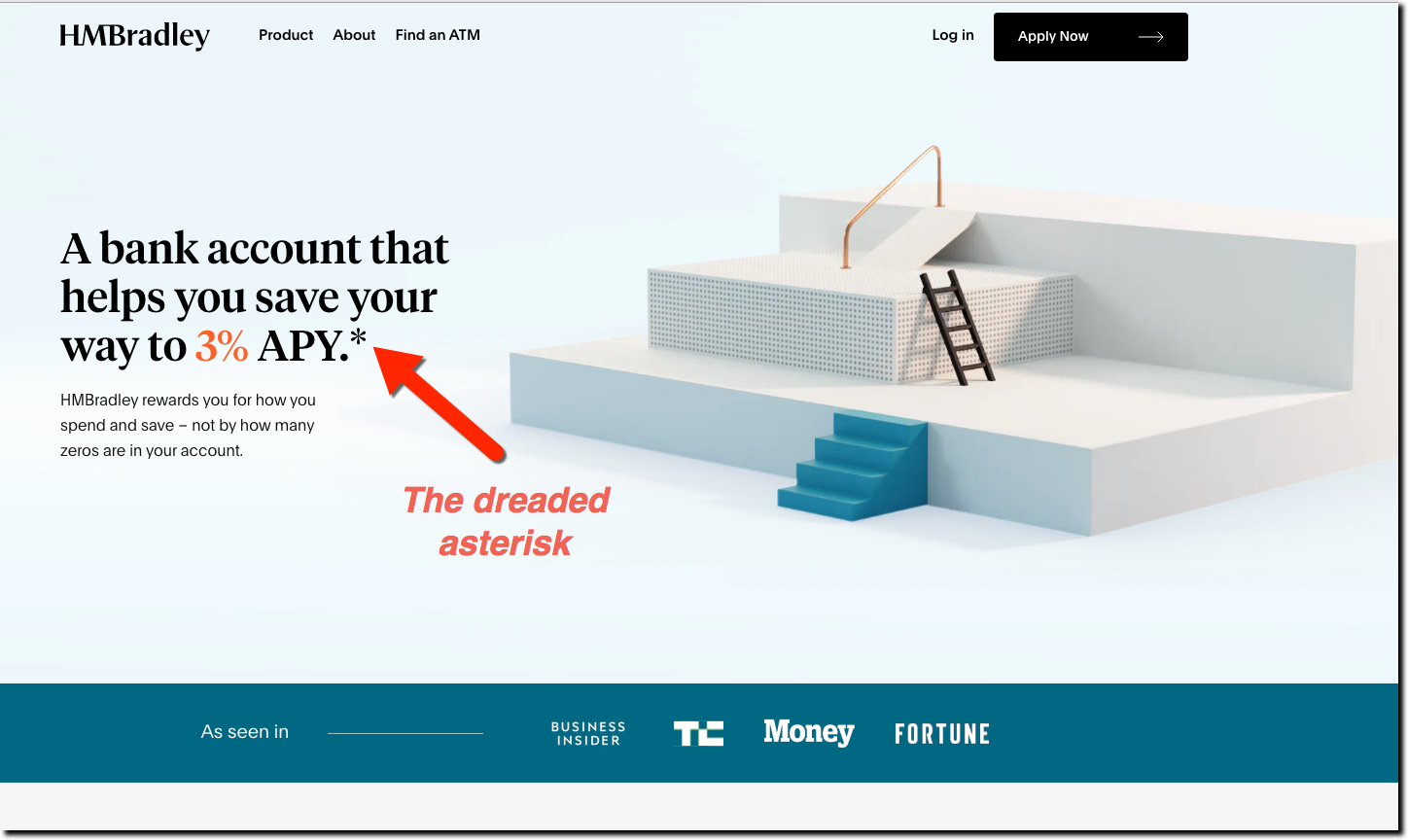

First Look: LA-Based Neobank HMBradley Braves the Pandemic with March 30 Launch

The latest USA challenger bank, with the odd, albeit memorable name, HMBradley, launched the first phase of its banking product line March 30. The Sant Monica, CA-based neobank offers a high-yield consumer checking account with a unique twist: tiered rates...

Fintech’s Third Crisis is Tipping Point to a Digital-Only Future

In my 25 years in the fintech space, I've had the misfortune to experience three massive ecosystem shocks. And they seem to be getting worse each time: Dot-com crash (and 9/11) Financial crisis Coronavirus crisis The three downturns are very different, but all are...

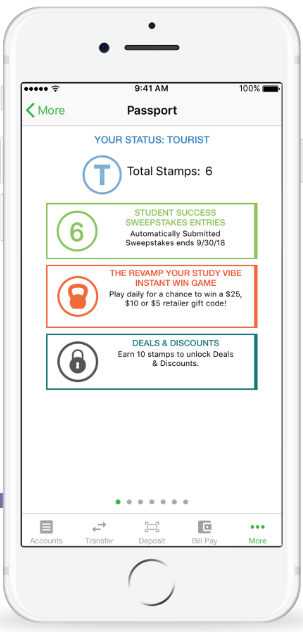

Student Banking UX: BankMobile Passport Program Encourages Digital Banking + Academic Achievement

Consumers love games of chance, discounts, and limited-time promos (e.g., Black Friday). Financial institutions are in an enviable position to profit from this consumer behavior by gamifying debit/credit cards and mobile app usage. While MasterCard and Visa have run...

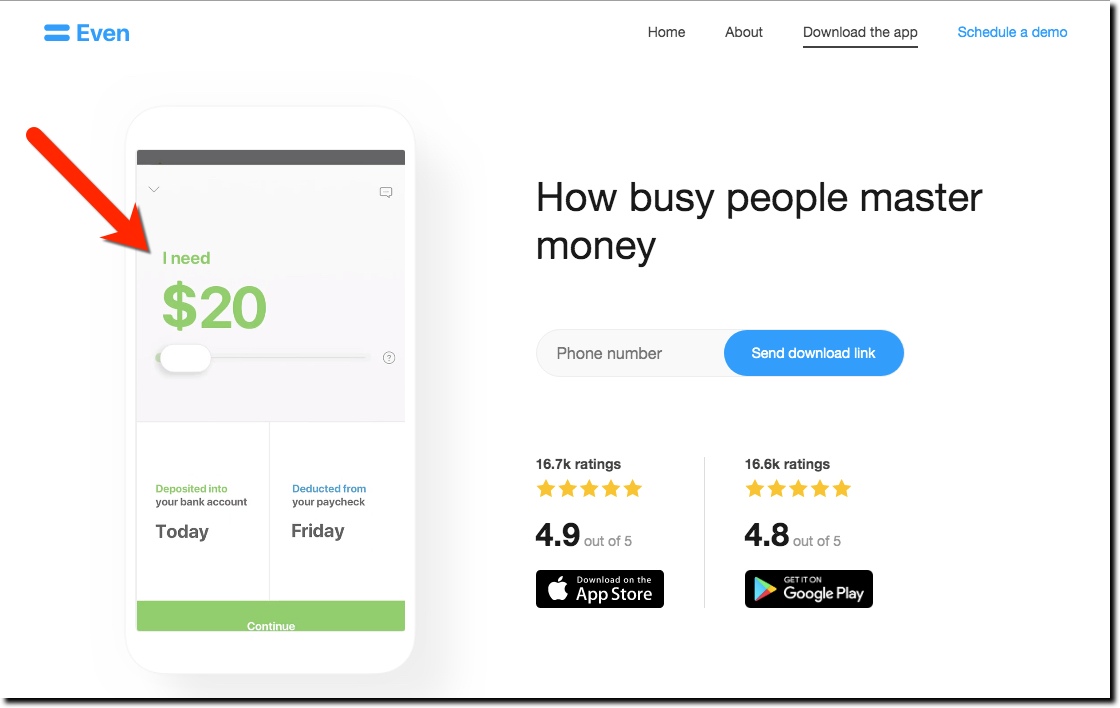

Checking Profits: Snagging the Paycheck Direct Deposit

There is little dispute that the primary financial relationship follows the paycheck. If you can snag the weekly/biweekly direct deposit, you have a very sticky customer. You have to really let them down to lose them at that point. Traditionally, banks have dangled...

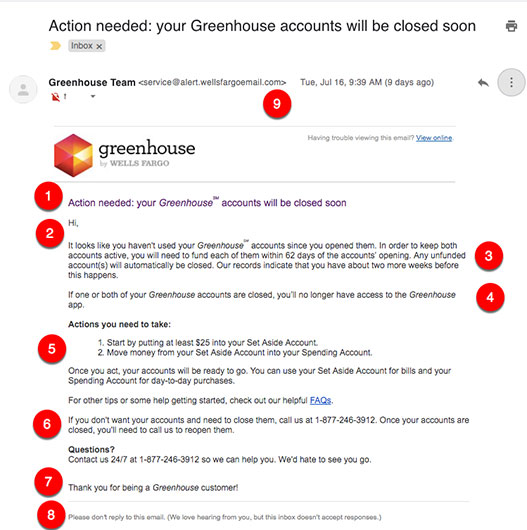

Wells Fargo’s Greenhouse has UX issues to overcome ahead of national rollout

Wells Fargo announced its Greenhouse mobile bank/app in late 2017 (press release). The bank began limited trials a year later and is expected to make it available nationwide by the end of this year. It's similar to Chase's ill-fated Finn, in that it's trying to be a...

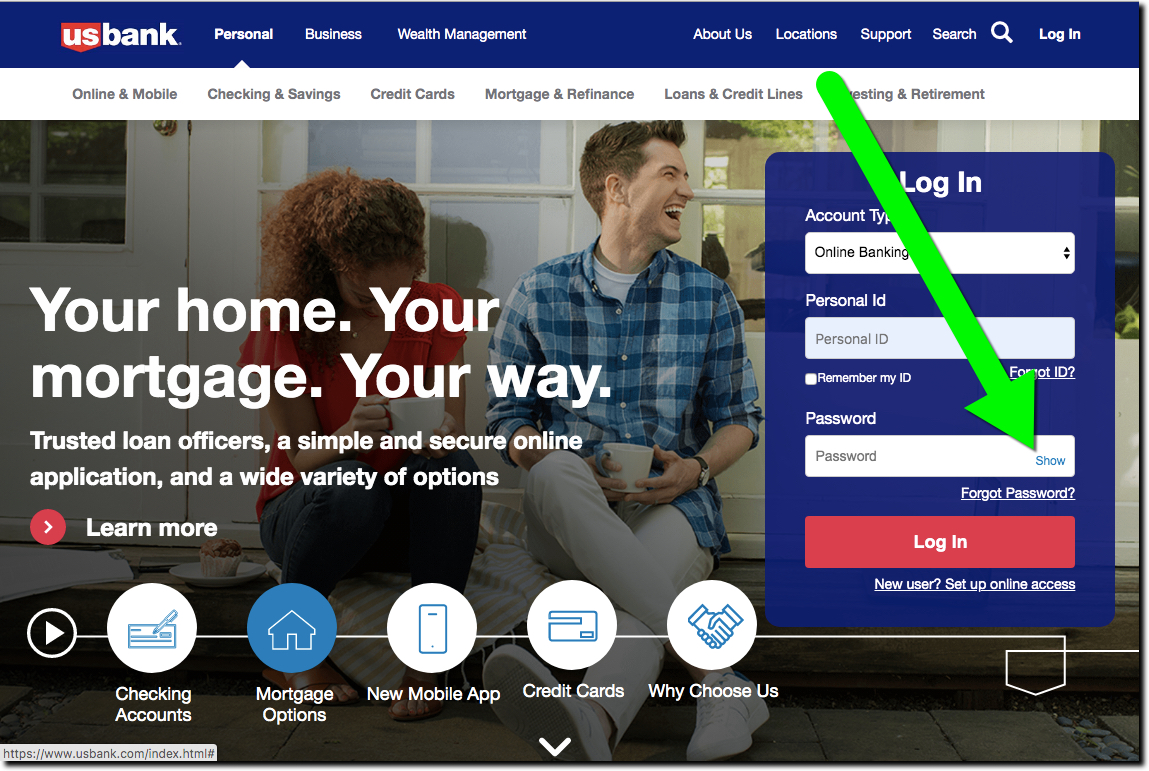

UX Tips: U.S. Bank Offers Option to Show Password at Login

For much of the Internet era, users had no way to check their password data entry before hitting login. A few companies, notably Apple, were the exception. Fast-forward to 2019. Many secure sites now offer an option to see your password before logging in. It's an...

How Should Banks Respond to Facebook’s Libra Coin?

I've read as much as I can take for now about Facebook's Libra crypto coin and Calibra digital wallet announcement. Most observers are skeptical given the many hurdles. But analysts like the upside if Facebook successfully gains adoption among its 2.7 billion users....

Investment CX: Kindur Simplifies Retirement Income by Converting 401(k) into “Paychecks”

Kindur has been in the fintech news lately, first when it raised $10M in December (led by Anthemis) and then more recently when it launched its investment management service. One of the best profiles was on a recent episode of The Bank On It podcast which interviewed...

Banking CX: Keep Calm and Bank On

No one visits a banking site for entertainment. Users are either there to make sure nothing bad has happened or that bad thing already occured and they need help fast. It's a digital banking fact: Every login is accompanied with some level of anxiety. That's why it's...

Student Loan Repayments as a Service

Yesterday, one of my favorite recent YC grads (Summer 2018) Goodly, announced its $1.6 million seed round with participation from Norwest Venture Partners (which has historically been affiliated with Wells Fargo, which acquired its parent bank back in the 1990s). And...

American Express 2.0? First Look at Brex, Fintech’s Youngest Unicorn

Most banks wouldn't hire a 22-year college dropout to be a teller, let alone give them product responsibility. Yet, a pair of 22-year-olds have built a brand worth more than $1 billion. Even more amazing, it's not a consumer or social play, it's good old B2B and in...

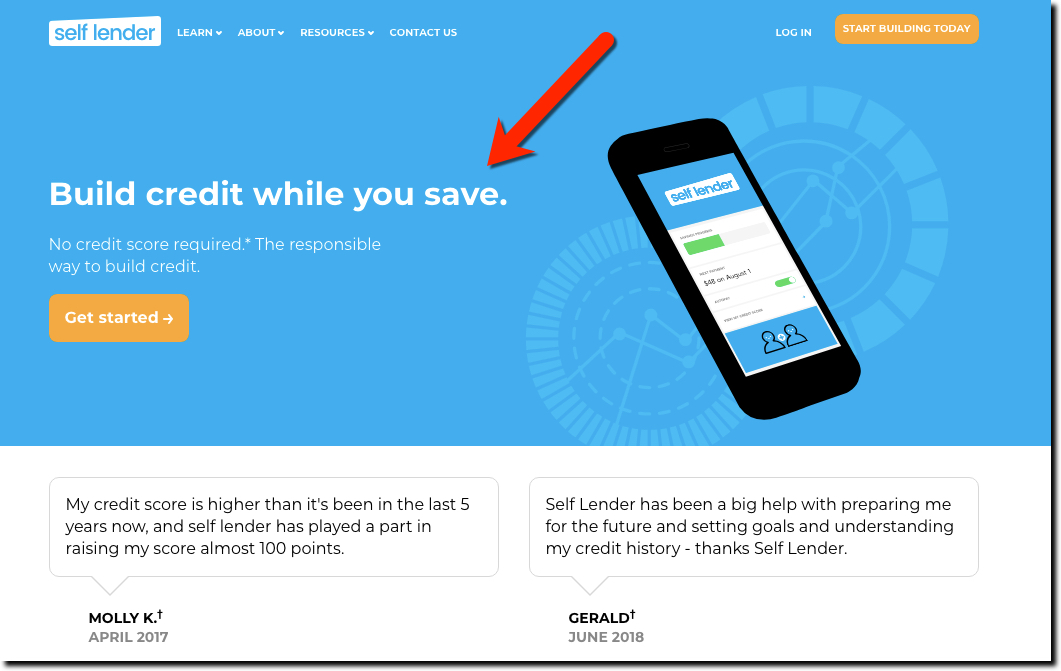

Credit UX: Starter Loans from Self Lender

Since the financial crisis in 2008, it's been much harder for U.S. youth to obtain a credit card. So most rely on debit cards for spending. However, debit cards don't help in establishing credit for the estimated 45 million American adults without a credit score (see...

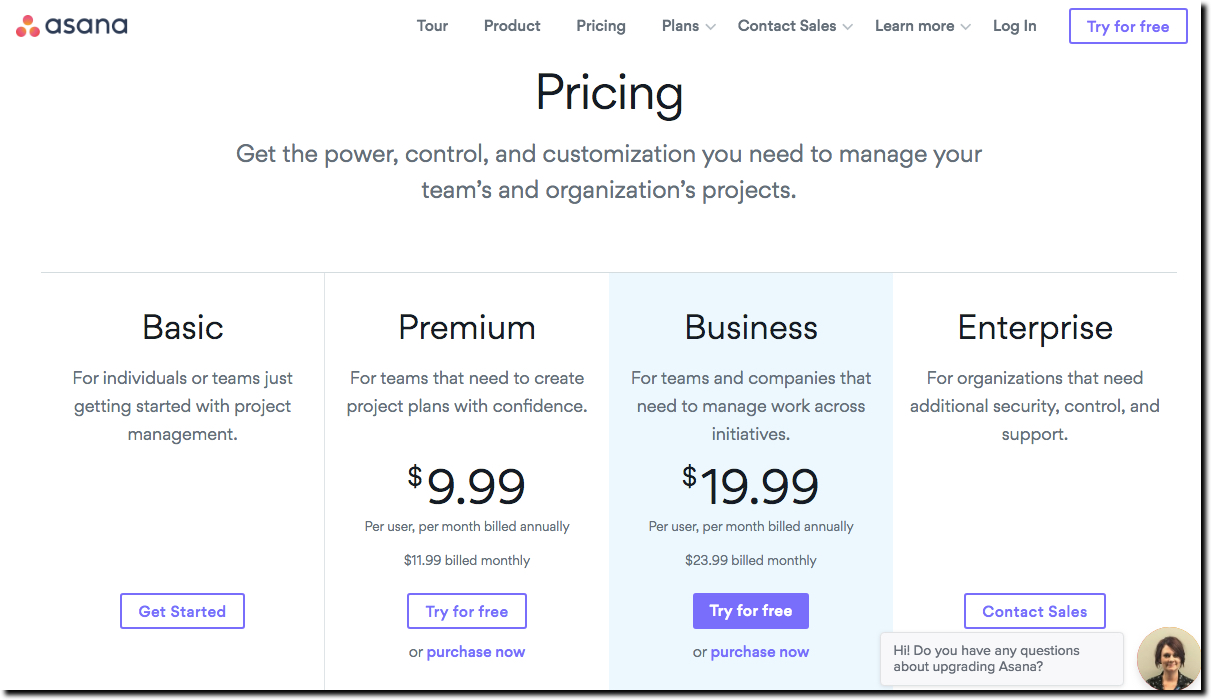

Pricing UX: Down with Fees, Up with Subscriptions

Most consumer banking research finds that "high fees" are one of three or four primary reasons to close an account. But what does that mean? Is it transaction fees at the ATM? Monthly checking account fees? Or penalty fees from overdrafting? I suspect it's often the...

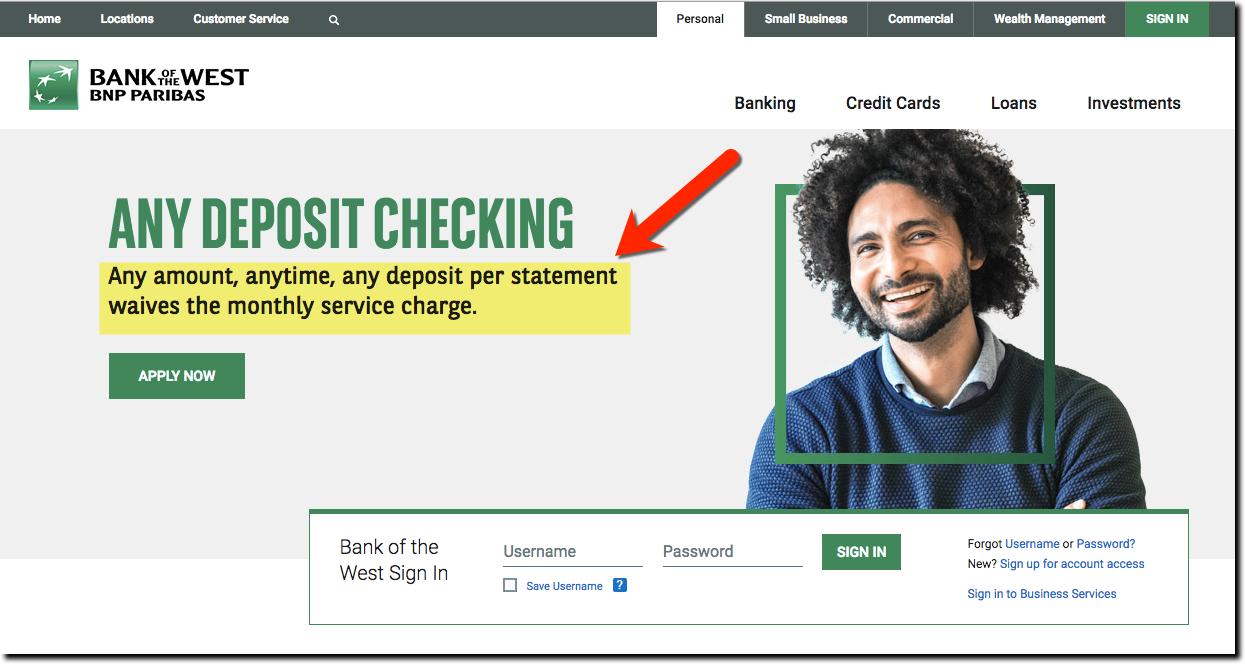

Penalty Fee UX: Bank of the West Formalizes the OD Mulligan*

Many customers know they can get at least one overdraft fee waived by appealing to customer service or the branch manager. But it's not a good experience. Driving to a branch or calling an 800 number and sucking up to some stranger that you hope isn't having a bad...

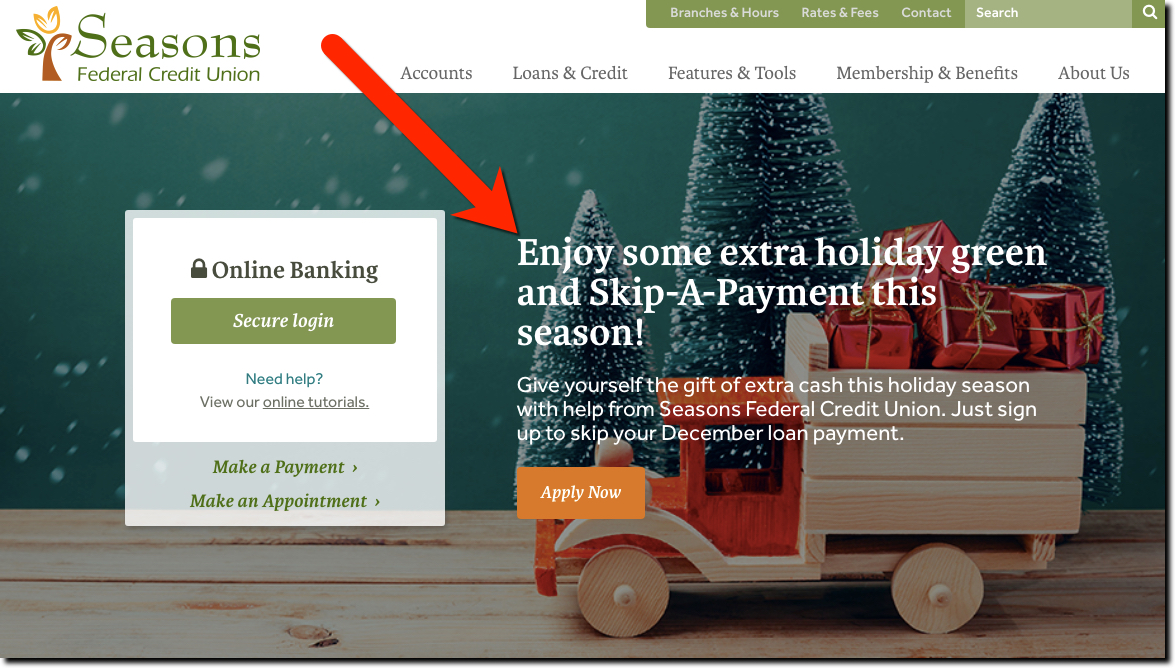

Feature Friday: December Skip-a-Payment

I've always liked the (mostly) credit union tradition of allowing members to skip a loan payment, especially in December. It's a win-win. Members get financial relief during a time of increased spending and the financial institution creates goodwill and increased loan...

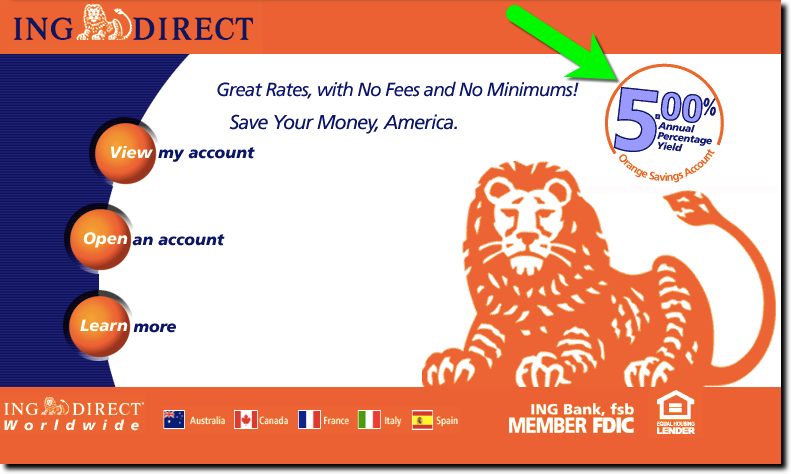

Youth Banking: BECU Boosts Savings APY for Kids Under 18

When my kids were young (early 2000's), there was a lot more incentive to save. I remember setting up their first savings accounts at ING Direct when the direct bank touted its 5% APY in bold orange advertising all over the east coast (see below). Even with low...