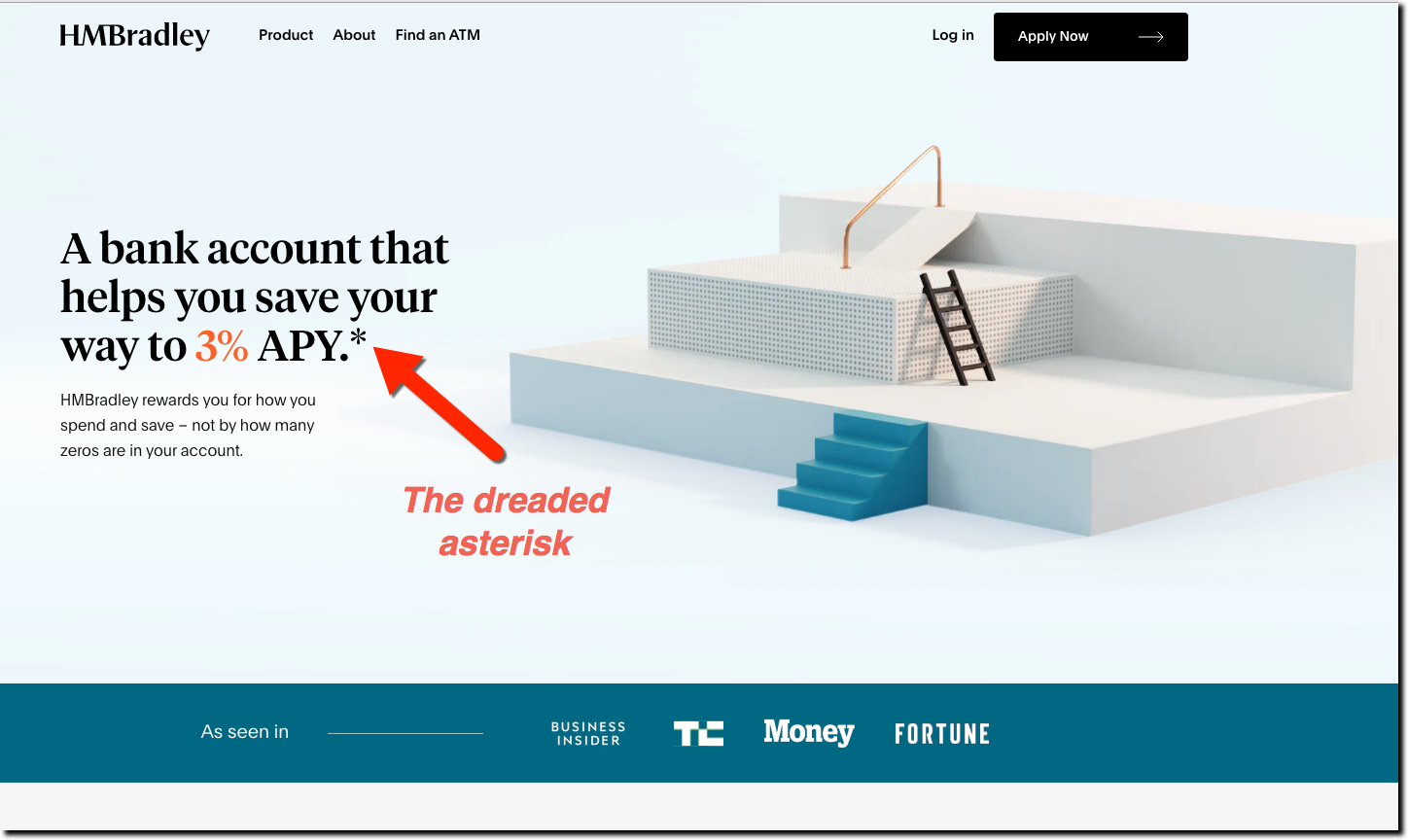

The latest USA challenger bank, with the odd, albeit memorable name, HMBradley, launched the first phase of its banking product line March 30. The Sant Monica, CA-based neobank offers a high-yield consumer checking account with a unique twist: tiered rates depending on how much of your direct deposit amount you save each quarter.

The tiers:

- No interest: Save less than 5% (of the direct deposit amount)

- 0.5%: save 5% to <10%

- 1%: save 10% to <15%

- 2%: save 15% to less than <20%

- 3%: save more than 20%

The fine print:

- The rate is good only on balances up to $100k (then back to zero).

- You earn it not the rate no only on the direct deposit amount, but also whatever else you transfer into the account.

- The tiers reset each calendar quarter.

- The first quarter new customers receive 1%, then the next quarter the rate resets to the amount listed above assuming there is a direct deposit made at least once per month.

- Direct deposits have to be from an employer or government

- Deposits are held at Hatch Bank ($68M asset, $37M deposit

The company secured seed funding of $3.5M in November from PayPal’s Max Levchin and others. That means at least a $6M to $7M pre-money valuation, a hefty number that’s a tribute to the experience of the three founders, including founding prior startups, attending Y-Combinator and working at Goldman. (And a shoutout to founder Zach Bruhnke who was an intern at early Finovate alum, Fee Fighters).

Thoughts: It’s a clever approach to drive direct-deposit relationships, the holy grail in retail banking. Though, in practice, for most savers, the interest rate difference may not be significant enough to budge them out of Bank of America. With $5k in savings, the top 3% tier only nets $12/month before-tax (or $9 to $10 after-tax). However, for the top savers that bank is targeting, e.g. those with $50k in savings, the extra yield (130 BP over other high-yield accounts) amounts to a meaningful $600 to $700 annually (before tax). Though, new customers must wait a quarter to get bumped to the top tier (while witing they earn 1%).

The bigger issue is the complicated tiering system. The bank posted an eleven-hundred-word blog post explainer, but I still had to email customer support with questions to decipher some of the fine print (outlined above). But it’s early days and I’m confident the startup will be able to find a way to easily communicate the tiered structure.

I also wonder if customers with higher balances will actually use the account as their primary checking account. Someone with $50k in the bank isn’t going to risk dropping down a tier because they charged one-too-many meals to their debit card (e.g., $125 lost interest on a $50k balance). Higher-balance customers may direct deposit to the account, then transfer 80% out to their “main” checking account and spend from that one. That’s a tradeoff HMBradley will likely accept since the bank will still have data on the customers paycheck along with customer’s attention every few weeks.

Bottom line: Overall, I really like how HMBradley’s approach aligns the interest of the bank with its customers. But it’s not enough to build a venture-scale franchise. And from the sounds of it, the founders agree. In a recent Tearsheet podcast, founder Zach Bruhnke seemed most excited about their plans for “instant” credit for its direct deposit customer base. The neobank will do a soft pull every month so as to always have an amount of credit ready and available to clients via a single click. The bank is also moving forward with a credit card rollout to some of its customers. But given today’s uncertainties, the bank is likely to move slower on the credit side than it hoped when raising that inspiring seed round last year.