At one time or another, every consumer fintech company wonders if they should buy a bank. When I advised Elon Musk back in the X.com/PayPal days, he had his sights on American Express (and now, astonishingly, PayPal is worth 3x American Express). But most fintech startups want to buy a ticket to the financial rails, not a large customer base.

But regulators are not exactly on board. There have been just two examples in the last 20 years. Back in the early post-financial-crisis days, 2011, Green Dot picked up Utah’s Bonneville Bancorp for $16M. And more recently, Lending Club has a $185M acquisition of Radius Bank pending, though the lender’s $80M Q2 loss is not going to help ease regulators’ concerns. And going back a bit further, I’d put Suresh Ramamurthi and Suchitra Padmanabhan’s 2009 acquisition of $3.5M CBW Bank in a similar category.

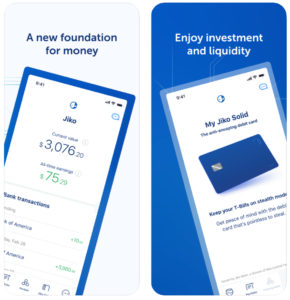

But we haven’t seen a pre-revenue, basically a stealth fintech startup, buy a bank. So congrats to the persistent team at Oakland-CA-based Jiko that stuck with it for 3 years and are now the proud owner of Minnesota based Mid-Central Federal Savings Bank, its $100M in assets and BankSITE-powered website.

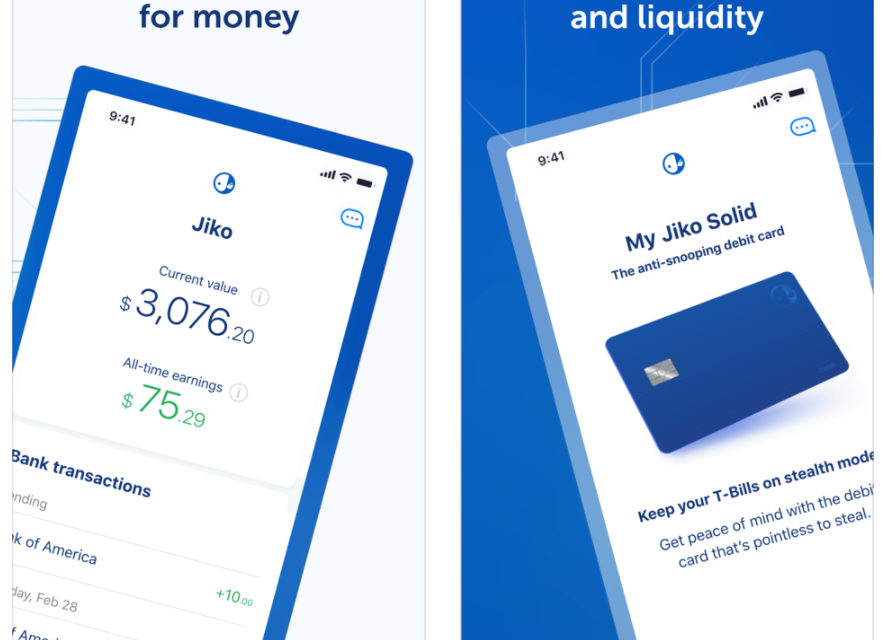

You’d think that Jiko was looking to leverage FDIC insurance to put its customers at ease. But that’s not the current plan. Money deposited into Jiko, which is essentially a brokerage account with a debit card, will go into T-bills. Technically not insured, but if T-bills go down, FDIC insurance will probably be insolvent as well. Whether they can convince customers of that, especially when T-bills are paying nearly zilch (0.11% this week), remains to be seen. However, Jiko may not care as they are positioning to be a B2B/BaaS play.

Jiko has raised $9.4M (all in 2017) according to Crunchbase. However, they have likely raised more to make the OCC happy as well as pay their 23 person team located in the SF area and with developers in Iceland. (Update: The company announced a $40M raise,29 Oct 2020).

Founders are Stephane Lintner and Rocky Motwani two Wall Streeters looking to make Jiko into the next big BaaS thing. The company is currently beta testing with friends and family and is inviting visitors to sign up for the waitlist. Its iOS app has 20 reviews and website traffic is about 2,000 per month.

—————————–

Note: Had we been following the Wadena, MN Pioneer Journal, hometown paper of Mid-Central bank, we’d have known about this in June.

Update: For a lengthier profile of the startup, see the 10 Sep 2020 Financial Brand feature.