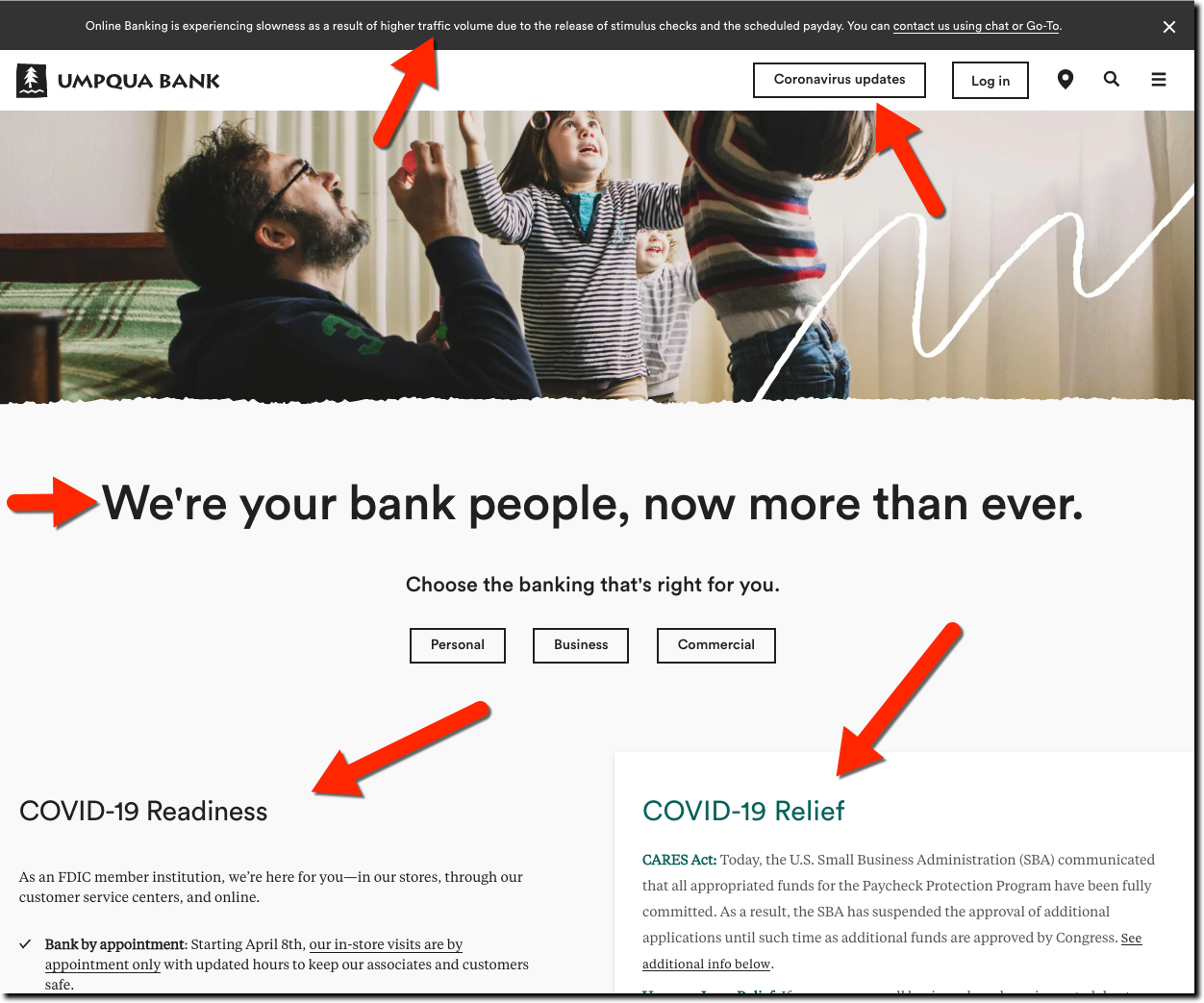

Umpqua Bank’s Homepage During Middle of Coronavirus Crisis (15 Apr 2020)

In my 25 years in the fintech space, I’ve had the misfortune to experience three massive ecosystem shocks. And they seem to be getting worse each time:

- Dot-com crash (and 9/11)

- Financial crisis

- Coronavirus crisis

The three downturns are very different, but all are utterly terrifying when in the midst of them. One can only assume we’ll get through this one and be stronger for it. But that doesn’t make it any less horrible for those on the front lines today, or for those who will lose family and friends. So first and foremost, thanks to healthcare workers keeping us alive, the essential workers keeping us fed, and everyone doing their best to keep the virus from spreading.

To help gauge where fintech is now and how and when it will get back on its feet, let’s compare and contrast the three downturns and their recoveries.

Dot-com crash (2000-2001)

The crash: This was a case of the hype getting way, way ahead of reality across all things Internet-related, including financial services. The pull-back was swift and crushing with the Nasdaq falling 78% from its peak in March 2000 to the low point in Oct 2002 (a 2.5 year run from high to low; for comparison the S&P dropped 48%). Projects were halted. Companies were abandoned and it led to a 5- to 6-year drought in fintech innovation.

The recovery: From a fintech standpoint, there really wasn’t ever a full recovery. Just as things were beginning to pick up with the so-called Web 2.0 movement in 2005/2006, the financial crisis hit.

The fintech hits: The seeds of several important companies were sown in the 1999 to 2007 stretch (Paypal, Prosper, Zoka, Mint, Credit Karma).

Financial crisis (2007-2008)

The crash: Banks were just starting to test the digital waters in 2006 and early 2007 when the bottom dropped out of their balance sheets. Most discretionary spending was cut to zero as financial institutions went into survival mode. The S&P dropped 56% from its peak in Oct 2007 to the bottom in Mar. 2009 (a 17-month dive). From a financial institution standpoint, it was the equivalent of what restaurants are going through now, doing anything they can to survive for another month.

The recovery: As financial institutions got to the other side in 2010/2011, there was a massive pent-up demand from consumers for digital services, as broadband was now common in most developed markets and the iPhone turned 3 in 2010. Other than the brief 2005/2006 period, there had really been relatively little investment in digital for more than 10 years and things just took off like a rocket ship. And it didn’t really slow down until crashing in March 2020.

The fintech hits: Most of the fintech unicorns were created after 2008 including: Stripe, Ant Financial, Bitcoin, Chime, Robinhood, Betterment, Transferwise, Revolut, Coinbase, Monzo, and hundreds more. It will be viewed as one of the most robust periods of new company formation of all time.

Coronovirus crisis (2020-2021)

The crash: We are at the beginning of the crash, so it’s hard to predict when we’ll hit bottom. The S&P dropped 34% from its 19 Feb peak to the 23 March low (5 weeks). But based on the last two shocks, we likely haven’t hit bottom. Though hopefully, we’ve at least passed “peak fear.” Regardless, it’s not too soon to start plotting a way forward out of this mess.

The recovery: From a fintech standpoint, the recovery from this crisis will be very different than the previous two. Why? First, we are much, much further ahead technology-wise than during the last 2 crashes. Both of those came at a time when the tech hadn’t really been built out, so the 2010+ recovery featured a massive number of new ideas seeking funding. And it took the rest of the decade for the capital to gravitate to all the good ideas.

Similar to the last two recoveries, the first part of the post-corona era will see consolidation and fewer companies being funded since seed capital will dry up (something that was already underway in the second half of 2019 (ref: Techcrunch). But unlike the previous initial recoveries, we’ll see strong traction from the existing fintech brands as banks finally toss out their legacy branch-based systems (which will have been proven unnecessary during the coronavirus) and funnel buckets of that money into digital tech.

The more difficult question is what happens 4 or 5 years out? Will there be a slew of new startups feeding the pent-up demand for innovation after the relatively slower 2020 to 2023 period, or will the winners of the first part of the decade just get stronger? It’s hard to predict 5+ years out especially when we are at the beginning of painful few years. But I think there is enough transformative new tech in the labs (voice, AI, AR, etc) that we’ll see a proliferation of new fintech companies in the latter part of the decade. Many of those ideas will start germinating in the next few years by would-be entrepreneurs working in established companies.

Recovery road map

No matter whether you are a 100+ year-old bank, community-based credit union, or a pre-seed startup, this is your chance to shine. Be the one-stop source for trusted info on money, credit and community resources. And forget about going back to “business as usual” (e.g. branch banking). This is the time to break from that system and embrace the fully-digital future.

- Now: Empathy

– Communicate frequently through all channels (see Umpqua Bank example at top)

– Give employees a voice both internally and externally (to customers)

– Identify options for financially strapped consumers and small businesses - Next 12 to 18 months: Extend customer lifelines

– Stimulus packages: Bonus for banking stimulus checks, enhanced unemployment assistance, paycheck advance, overdraft fee waivers

– Small business aid packages: Help SMB customers maximize government assistance

– Community service: Food-bank fundraisers, gift card marketplace for local businesses, etc.

– Debt restructuring & interest deferrals

– Retirement (re)planning - 2021 to 2023: Digital-first (on our way to digital-only)

– Ditch the branch expenses as fast as possible, converting front-line employees to hybrid in-person/phone/chat

– Focus on digital-first solutions for all financial activities

– Concentrate on markets you can serve digitally

– Ramp up digital sales & service until its clearly ahead of anything experienced in a branch of yore - 2024+ Digital-only era

– In-person visits down 95% from pre-coronavirus traffic

– No one born after 2005 will ever picture a physical branch when they think of a “bank”