Yesterday, one of my favorite recent YC grads (Summer 2018) Goodly, announced its $1.6 million seed round with participation from Norwest Venture Partners (which has historically been affiliated with Wells Fargo, which acquired its parent bank back in the 1990s). And it’s not the first time financial institution capital has backed startups in this area. Tuition.io counts MassMutual as an investor and Gradifi was acquired by First Republic Bank in 2016.

Bank opportunity: Student loan repayment services provide a new way for banks and credit unions to help employers, and family members, easily contribute to student loan repayment. We are big proponents of giving student loan principal payments as Christmas gifts. Currently, we give an IOU and then wait for the recipient to get us the account info needed to pay down the loans. It’s not a simple process for either side. I’d love to see the friction removed from the process so that it becomes a common perk/gift. There is some chance that student loan repayment could get tax perks along the lines of 401(k)s or IRAs, which will incent the market even more.

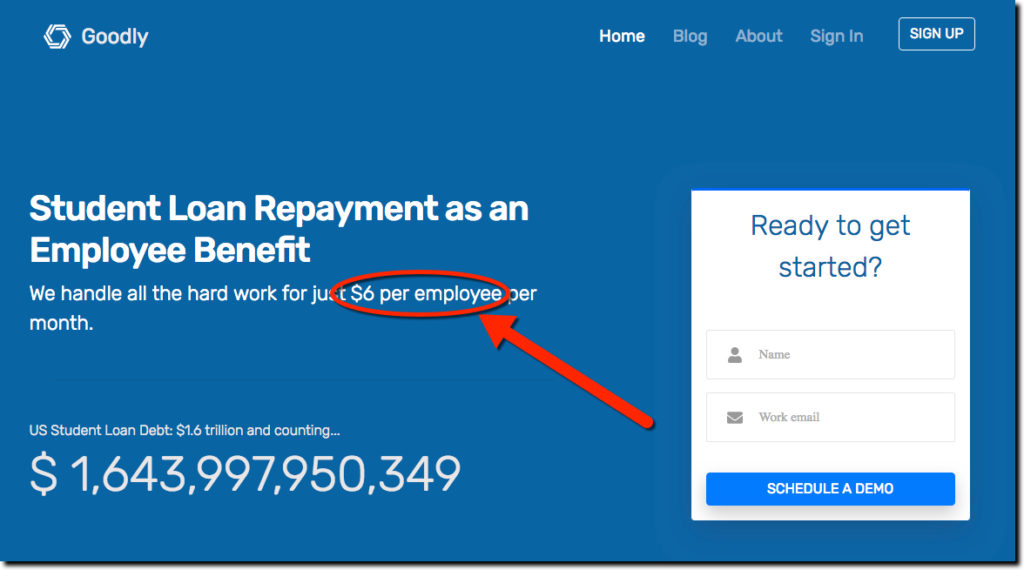

Bottom line: Helping students, parents, and employers proactively pay down student loan debt is a great way for banks to do something that creates good-will, locks in customers for decades, and drops fee-based cash to the bottom line. Goodly charges employers $6/mo per employee to administer the program (a price the startup features on its home page, see above). That’s a small price for an employer to both increase employee satisfaction/retention and compete for new employees.

Offering it directly to consumers is a little harder to monetize. However, we see it as part of a young-adult subscription bank account where millennials and younger pay $5 to $10/mo for a bundle of services (see our previous posts on the youth accounts).