There is little dispute that the primary financial relationship follows the paycheck. If you can snag the weekly/biweekly direct deposit, you have a very sticky customer. You have to really let them down to lose them at that point.

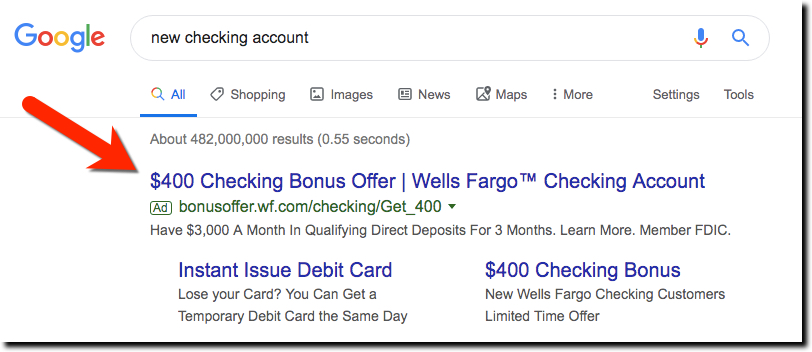

Traditionally, banks have dangled large monetary bonuses to get the direct deposit. For example, Wells Fargo would like to give me $400 to move my direct deposit over today (search of “new checking account” from Seattle IP address, landing page).

Traditionally, banks have dangled large monetary bonuses to get the direct deposit. For example, Wells Fargo would like to give me $400 to move my direct deposit over today (search of “new checking account” from Seattle IP address, landing page).

These incentives are expensive and may not have a positive ROI unless you are great at onboarding and upselling. Besides, you are giving away a lot of money for something people want/must do anyway.

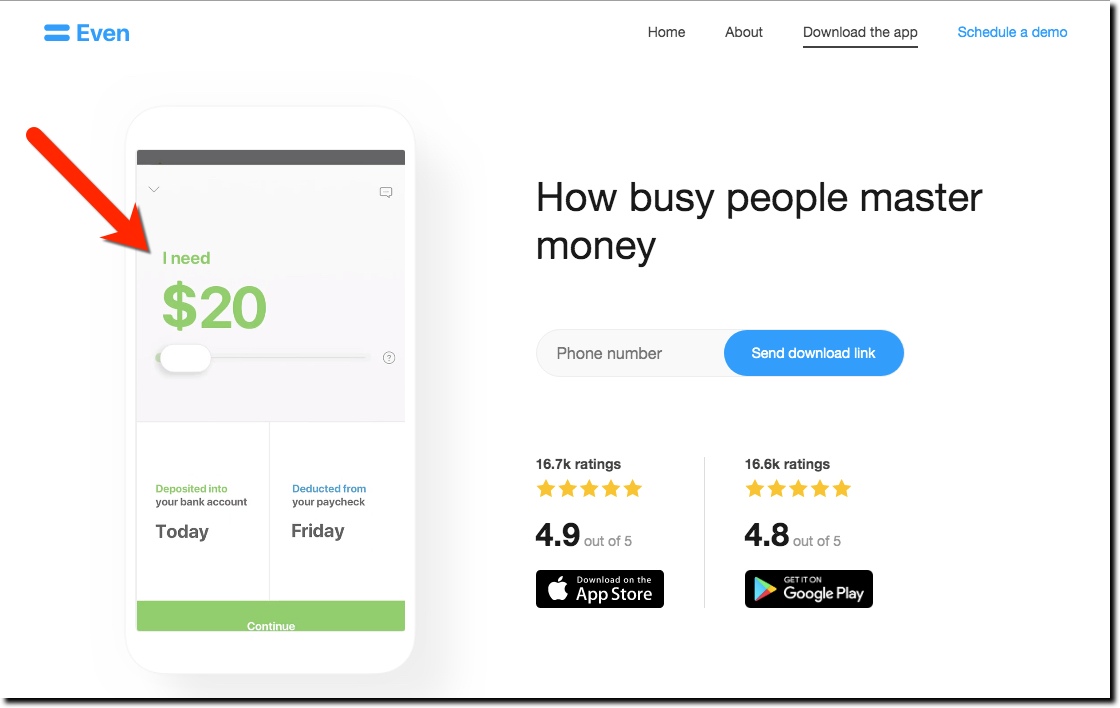

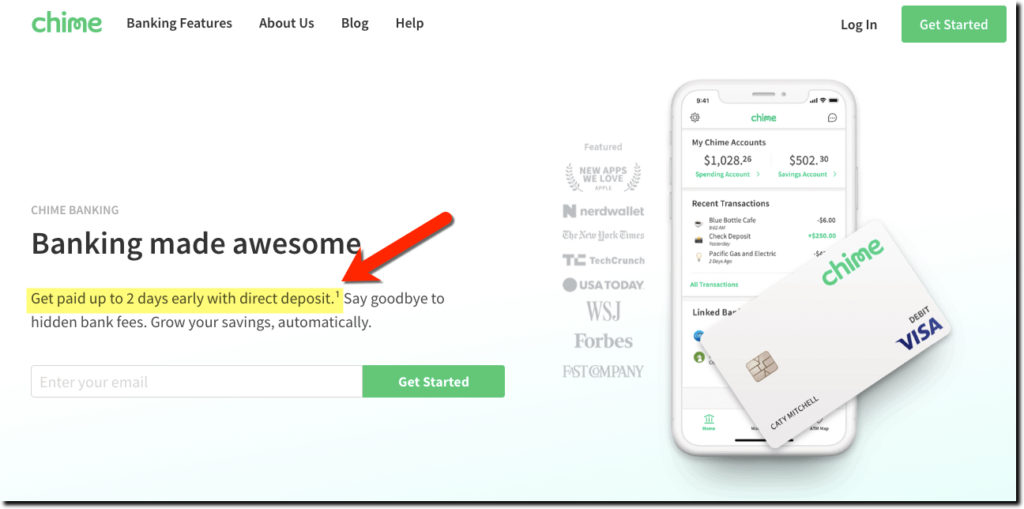

What about a lower-cost, and potentially more powerful, incentive? Namely, the ability to borrow small amounts against that direct deposit. This is the core value prop of Even, a Silicon Valley startup that has raised more than $50 million. And now Chime, with 3 million customers, has launched its version, the ability to tap into an upcoming paycheck deposit 2 days ahead of time (screenshot above). A similar approach is also being using in the SMB sector by USA challenger Qwil which is catering to cash-flow-challenged freelancers.

Bottom line: Sure you may lose a few NSF fees by helping customers avoid financial mishaps in the days before payday, but less stressed, and presumably more loyal, customers should make up for that in the medium/long term. And you can easily develop fees around the service that should make it profitable even without factoring in the hard-to-quantify retention gain.