Founded just 5 years ago (Oct 2018), Toronto-based Relay Financial is the only non-USA company on our list of the largest USA digital-first small-business focused banking providers. With $15M in funding in 2021 (Series A, May 2021), it has built a full-featured small business banking- and money-management platform. Relays’s 280,000 monthly website visits (January 2023) is tied for fourth-highest among SMB challenger banks.

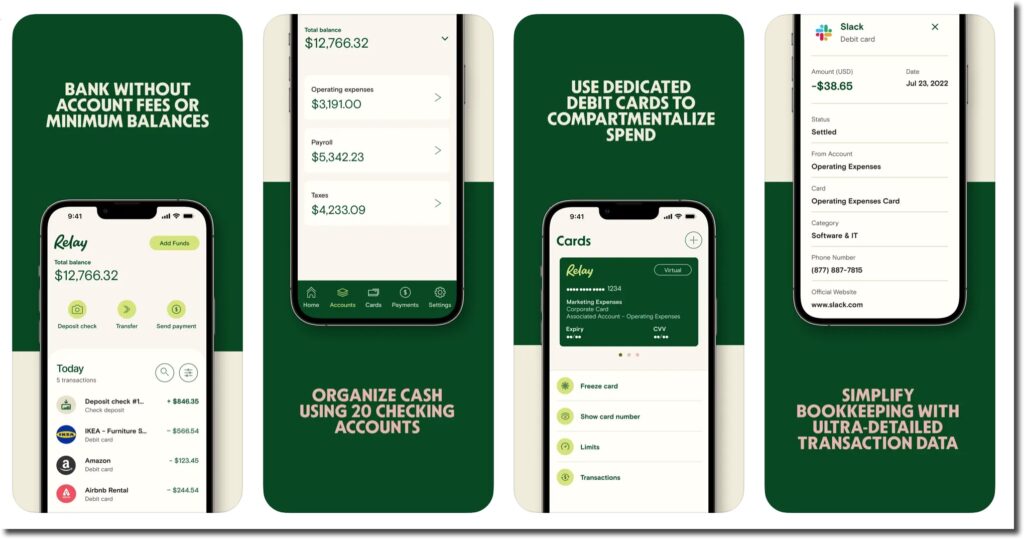

Having run a small business for much of my adult life, I can tell you first-hand that Relay has a compelling product. It’s not JUST a checking account, but a true money-management solution. Here are our favorite features:

- Free to start, then easy to graduate to the cost-effective PRO tier for a flat $30/month that includes free international and domestic wires (we often spent multiples of that on wire fees at Chase)

- Multi-account options: Relay offers up to 50 debit-card accounts and 20 checking accounts with each relationship. That makes it so much easier to segment incoming and outgoing expenses into various buckets for better expense management. Even opening a second account at Chase required a branch visit (see below) and a copious amount of paperwork, not to mention potential fees if we were below minimum balances.

- Digital-first support: With our business accounts at US Bank and Chase, whenever there was any type of complicated issue, the default response was “come to the branch.” That was usually a frustrating experience of waiting, first just to talk to the designated “business banker,” then sitting at their desk while they called other people to solve the issue. Generally, it felt like they had little regard for the cost of MY time.

- Advanced money management/billpay: When we outgrew Microsoft Money (then Mint) financial tracking programs and hired outside bookkeepers/accountants using Quickbooks, my understanding of our day-to-day financial situation went from fair to poor. Small business owners don’t generally have time to master Quickbooks, so you end up relying on canned monthly QB printouts while spending thousands monthly for labor-intensive bookkeeping entries.

Product features:

- Virtual or physical Visa debit cards for employees (max 50)

- Simple card controls (see inset right) including:

1. Daily transaction limit

2. Daily ATM withdrawal limit

3. Foreign transaction authorization

4. Freeze/unfreeze card

5. Change PIN - Multiple checking accounts (max 20!)

- Billpay

- ACH or wire payments (checks coming soon)

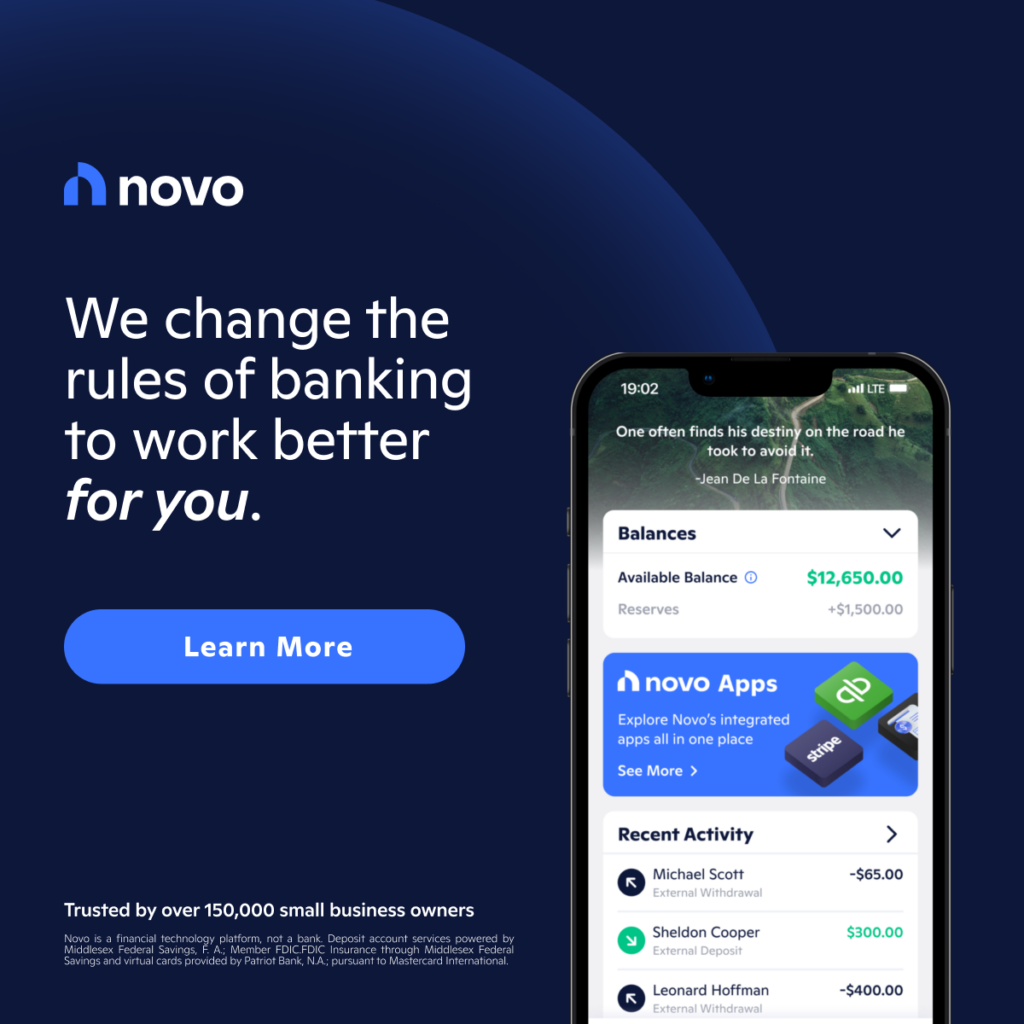

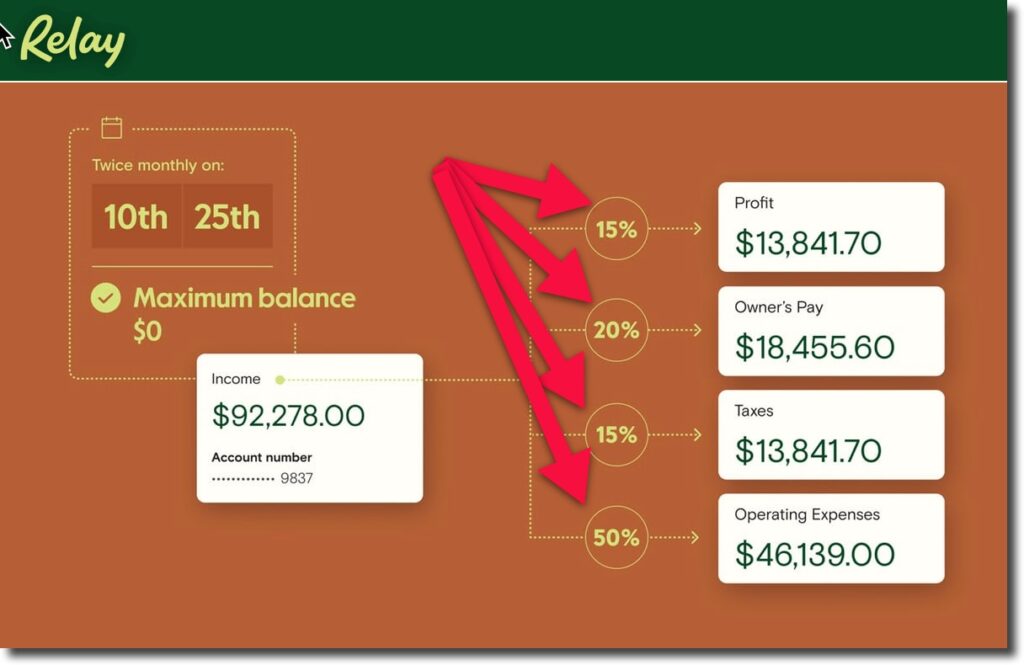

- Automatic transfer rules to distribute deposits among various checking accounts (i.e., sweep account; see screenshot below)

- One-click card freezing

- Direct feed to Quickbooks Online and Xero

- Team access & permissions with spending limits (ie, read-only access)

- Auto import of bills from Quickbooks and Xero (Pro version)

- Ability to establish multi-step approval rules for incoming bills (i.e. smart billpay) (Pro)

- Multi-stage & batch bill payment workflow (Pro)

- Free domestic & international wires (Pro)

- Same-day ACH (Pro)

- 24/7 support

- Remote deposit (with $40k daily deposit limit!)

- Integrations with Gusto, Plaid, Yodlee

- Referrals to certified financial pros to assist with financial management (including Proft First Professionals)

- $2.5 million in FDIC insurance*

Pricing:

- Standard = Free (no monthly fees, no overdraft fees, no minimum balance)

- Pro = $30/mo (after 14-day free trial) including free outgoing domestic and international wire transfers

Accountant /Bookkeeper Partner Program

- 3 to 14 clients: 17% discount on client’s monthly fee ($25/mo); 5% revenue share on card spend

- 15 to 49 clients: 20% discount ($24/mo); 10% revenue share

- 50 to 99 clients: 23% discount ($23/mo); 15% revenue share

- 100+ clients: 27% discount ($22/mo); 20% revenue share

Latest feature: Rules that automatically split deposits into multiple accounts

*Relay is a financial technology company, not an FDIC-insured bank. Banking services and FDIC insurance are provided through Thread Bank and Evolve Bank & Trust; Members FDIC. The Relay Visa Debit Card is issued by Thread Bank.

Company Vitals

FAB* Score: 89

– HQ: Toronto

– Founded: 2018

– Partner bank: Thread

Traction

– Raised $19.4M including $15M in 2021 (Crunchbase)

– Website visits: 390,000 (SimilarWeb, July 2023)

– Employees: 128 (Pitchbook)

Social

– Linkedin: 4,600 followers (122 employees)

– TrustPilot: 4.6 (1,004 reviews)

– iOS: 4.6 (517 reviews)

Product Videos

Interview and demo of Relay Financial (29 minutes; 9 Feb 2021)

Updated review of Relay Financial, with emphasis on new features (14-minutes, 21 March 2023)

Product Screenshots

iOS screenshots (March 2023)

Fab score:

* The FAB score, Fintech Attention Barometer, is a proxy for the overall size of a private company since they typically do not release traditional metrics (# customers, deposits, AUM, etc). The score is based on VC funding, website traffic, mobile downloads, and the number of employees. It’s a work in progress, so expect changes in the formula.