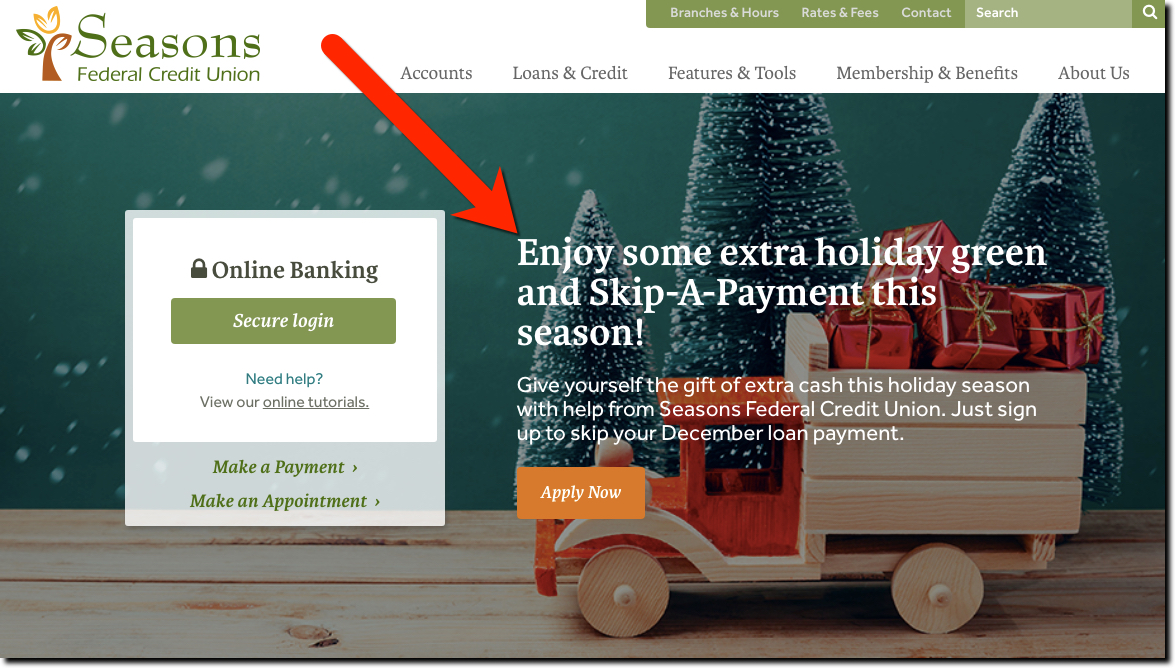

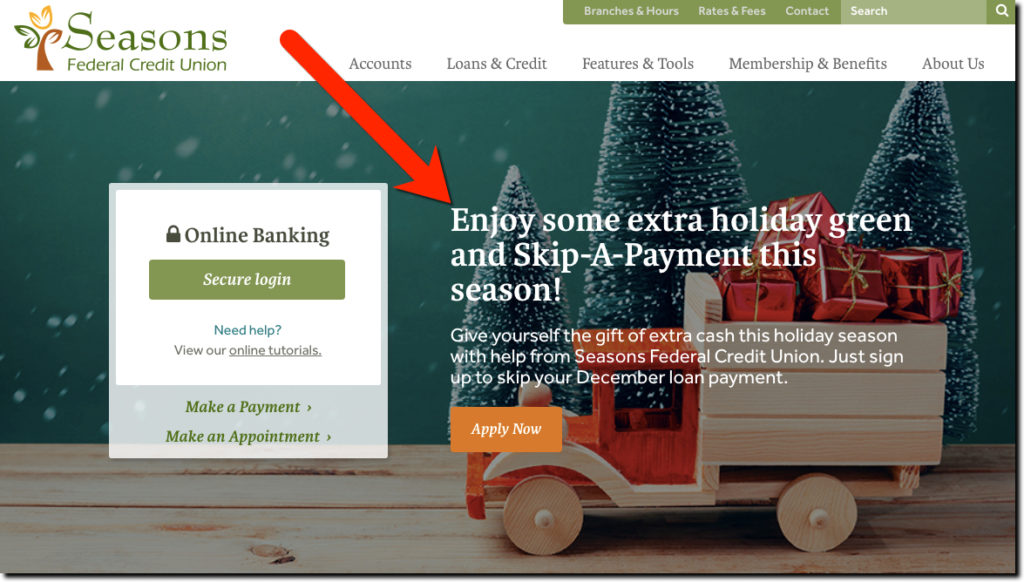

I’ve always liked the (mostly) credit union tradition of allowing members to skip a loan payment, especially in December. It’s a win-win. Members get financial relief during a time of increased spending and the financial institution creates goodwill and increased loan balances. In addition, it makes a terrific homepage hero image in December (see Seasons FCU above).

But I’m not sure what I think about Seasons $25 processing fee. While it’s more cost effective than a payday loan or an overdraft, it takes away from the customer friendliness of the offer. Best case it comes off as an upsell. Worst case it feels like a bit of a bait-and-switch. While I understand the rationale behind the fee, covering costs and all, but overall I think it’s a short-sighted decision.

Instead, it would be better if the CU created a premium loan program that featured a skip option. Members would feel better about purchasing an annual VIP program in the $25 to $50 per year range (see below) instead of a one-time processing fee. In addition, the CU could add additional benefits to increase retention and member satisfaction.

VIP Loan Program

$25 to $75/year

- Skip one payment per year

- Dedicated customer service rep to handle any problems with your loan

- Ability to refinance the loan free of charge

- Auto payments with 0.25% discount

- Get-out-of-jail free card to waive one late fee (no more than a week late)

- Merchant discounts

- Etc. etc.