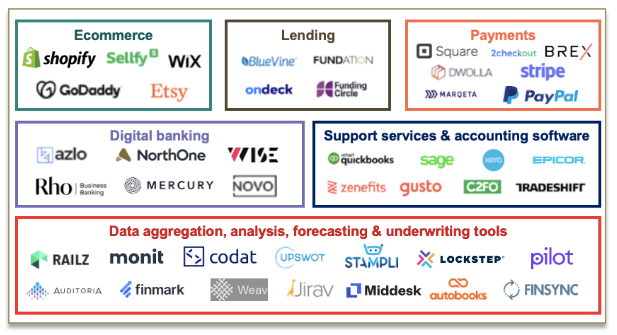

SMB Fintech Stack (Source: Canapi)

SMB Fintech Stack (Source: Canapi)

The first pure-play online bank Security First Network Bank (SFNB) launched in 1995, just a year after Amazon.com. But unlike ecommerce, digital-only banking was slow to catch on. The legacy players held onto their market share by providing digital services that were “good enough” to retain customers loath to switch banks.

But that began changing 3 or 4 years ago, first in the UK, then elsewhere as well-financed digital players started making inroads with consumers, first Monzo, then Revolut, Starling, Nubank, Chime, just to name a few. But we still haven’t seen a breakout small business bank. The digital small biz lenders are grabbing share, Kabbage, Square, Paypal, Amazon, Brex, etc. But there is not yet a place where small businesses flock to get deposit, payment, and financing needs met in a single interface.

So who are the best business banks? Let’s start with a definition. I don’t believe they need to be regulated as a bank as long as they facilitate the big three products under one UI:

- deposits (e.g., cash-holding account)

- debit or charge cards

- credit lines

Under that definition, PayPal is a business bank as is Square and Amazon. But Kabbage which only offers a credit line, is not.

Finally, the company must be predominantly focused on small-business financial services (eliminates Paypal, Amazon, Square) delivered primarily digitally (rules out Wells Fargo, BofA, and the majority of traditional banks). We are also including divisions of traditional FIs if they operate under a separate autonomous brand, such as BBVA’s Azlo (which closed this month).

NEW: Looking for digital lenders or corporate charge/credit cards?

Check out our latest lists: SMB online lenders (26) | SMB charge/credit cards (15)

Leading USA digital small business banks

ranked by our FAB score (Fintech Attention Barometer*)

| Company | FAB Score | Review Date | Founded | HQ | Funding ($M)** | Visits (Jul ’21) |

| Mercury | 114 | 25 Aug ’21 | 2017 | SF | $152 | 470,000 |

| NOVO | 85 | 25 Aug ’21 | 2016 | NYC | $46 | 600,000 |

| Rho | 63 | 25 Aug ’21 | 2018 | NYC | $120 | 17,000 |

| Lili | 53 | 25 Aug ’21 | 2018 | NYC | $80 | 100,000 |

| Grasshopper | 23 | 25 Aug ’21 | 2016 | NYC | $131 | 5,000 |

| Relay FI | 23 | 25 Aug ’21 | 2018 | Toronto | $19 | 100,000 |

| NorthOne | 20 | 25 Aug ’21 | 2016 | NYC | $23 | 82,000 |

| Hatch | 17 | 25 Aug ’21 | 2018 | SF | $19 | 65,000 |

| Oxygen | 15 | 25 Aug ’21 | 2018 | SF | $24 | 20,000 |

| Unlaunched | ||||||

| Guava | 0 | 25 Aug ’21 | 2018 | NYC | INA | INA |

| Kuma | 0 | 25 Aug ’21 | INA | LA | INA | INA |

| Dormant | ||||||

| Joust (ZenBusiness) | 0 | 25 Aug ’21 | 2017 | Austin | $11 | 0 |

| AZLO (BBVA) | 0 | 25 Aug ’21 | 2017 | SF | $0 | 0 |

| Seed (Cross River Bank) | 0 | 25 Aug ’21 | 2014 | SF | $6 | 0 |

Source: FintechLabs, Pitchbook, Crunchbase, Craft, SimilarWeb, SEMrush; 25 Aug 2021

*As nerds do, we are developing a proprietary score measuring the adoption of private digital financial services companies that do not release traditional metrics (# customers, deposits, AUM, etc). We call it the FAB score, standing for Fintech Attention Barometer. It’s a work in progress, so expect changes in the formula.

**Funding is the amount invested into the company as either equity or debt.

Challenger SMB Banks Currently Active in the United States

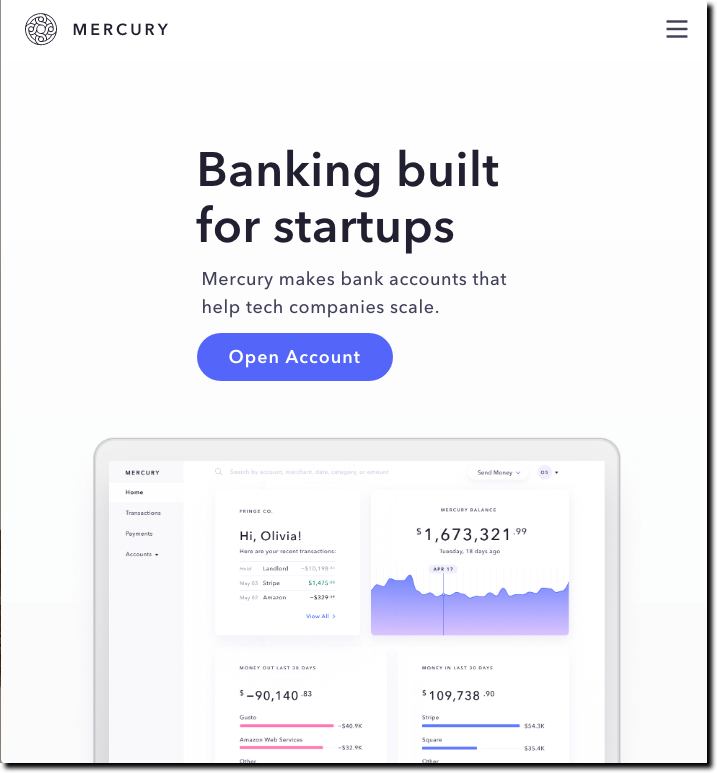

1. Mercury Technologies

FAB Score = 114

– HQ: San Francisco Bay Area

– Founded: 2017

– Raised $152M (Crunchbase)

– Website visits: 470,000 (July 2021; SimilarWeb & SEMRush average)

– Employees: 150 (Pitchbook)

– Articles: 3 (Crunchbase)

– Twitter: 10,300 followers

– Trustpilot: 4.3 (221 reviews)

2. Novo

FAB Score: 85

– HQ: NYC

– Founded: 2016

– Raised $46M (Crunchbase)

– App downloads (last 30 days): 15,400 (Apptopia)

– Website visits: 600,000 (July 2021; SimilarWeb & SEMRush average)

– Employees: 60 (Pitchbook)

– Articles: 27 (Crunchbase)

– Twitter: 1,790 followers

– Industry awards: 4 (Novo)

– Integrations: Wise, Xero, Slack

– TrustPilot: 4.2 (837 reviews)

– iOS app: 4.8 (5,745 reviews)

3. Rho

FAB Score = 63

– HQ: NYC

– Founded: 2018

– Raised $120M ($100M in 2021) (Crunchbase)

– Website visits (April 2021): 17,000 (SEMrush)

– Employees: 60 (Pitchbook)

– Articles (past 2 years): 20 (Crunchbase)

– Twitter: 712 followers

– Trustpilot: No reviews

4. Lili

FAB Score = 53

– HQ: NYC

– Founded: 2018

– Raised $80M (Crunchbase)

– Website visits: 100,000 (July 2021; SimilarWeb & SEMRush average)

– Employees: 42 (Pitchbook)

– Articles: 12 (Crunchbase)

– Tiktok: 87,000 followers

– Trustpilot: 2.4 (7 reviews)

5. Grasshopper Bank

FAB Score = 23

– HQ: NYC

– Founded: 2016

– Raised $131M prior to 2020 (Crunchbase)

– Website visits: 5,000 (estimate)

– Employees: 60 (Pitchbook)

– Citations: 8 (Crunchbase)

– Twitter: 788 followers

6. Relay FI

FAB Score: 23

– HQ: Toronto

– Founded: 2018

– Partner bank: Evolve

– Raised $19M (Crunchbase)

– Website visits: 100,000 (May 2021; SimilarWeb & SEMRush average)

– Employees: 16 (Pitchbook)

– Articles: 3 (Google News)

– Twitter: 529 followers

– TrustPilot: 3.8 (2 reviews)

– iOS: 3.4 (13 reviews)

7. NorthOne

FAB Score: 20

– HQ: NYC/Toronto

– Founded: 2016

– Raised $23.3M (Crunchbase)

– Website visits: 82,000 (July 2021; SimilarWeb & SEMRush average)

– Employees: 74 (Pitchbook)

– Articles: 15 (Crunchbase)

– Twitter: 2,530 followers

– TrustPilot: 3.8 (67 reviews)

– iOS: 4.6 (1,139 reviews)

8. Hatch

FAB Score = 17

– HQ: SF

– Founded: 2018

– Raised $19M (most recently, $14M in Feb 2020) (Crunchbase)

– Website visits: 65,000 (SEMrush)

– Employees: 48 (Pitchbook)

– Citations: 3 (Google News)

– Twitter: 695 followers

– TrustPilot: no reviews

– iOS: 5.0 (7 reviews)

9. Oxygen

FAB Score = 15

– HQ: San Francisco Bay Area

– Founded: 2018

– Raised $24M ($17M in 2020) (Crunchbase)

– Website visits: 20,000 (July 2021; SEMRush)

– Employees: 65 (Pitchbook)

– Articles: 17 (Crunchbase)

– Twitter: 1,610 followers

– Trustpilot: 1.7 (32 reviews)

– iOS: 4.8 (12,600 reviews)

10. Not Launched: Guava

FAB Score: TBD (launching soon)

– HQ: NYC

– Founded 2018

– Raised: Unknown (Crunchbase)

– Website visits: Unknown

– Employees: 2 (Pitchbook)

11. Not launched: Kuma Bank

FAB Score: TBD (waitlist)

HQ: Hollywood, CA

Challengers Closed to New Accounts

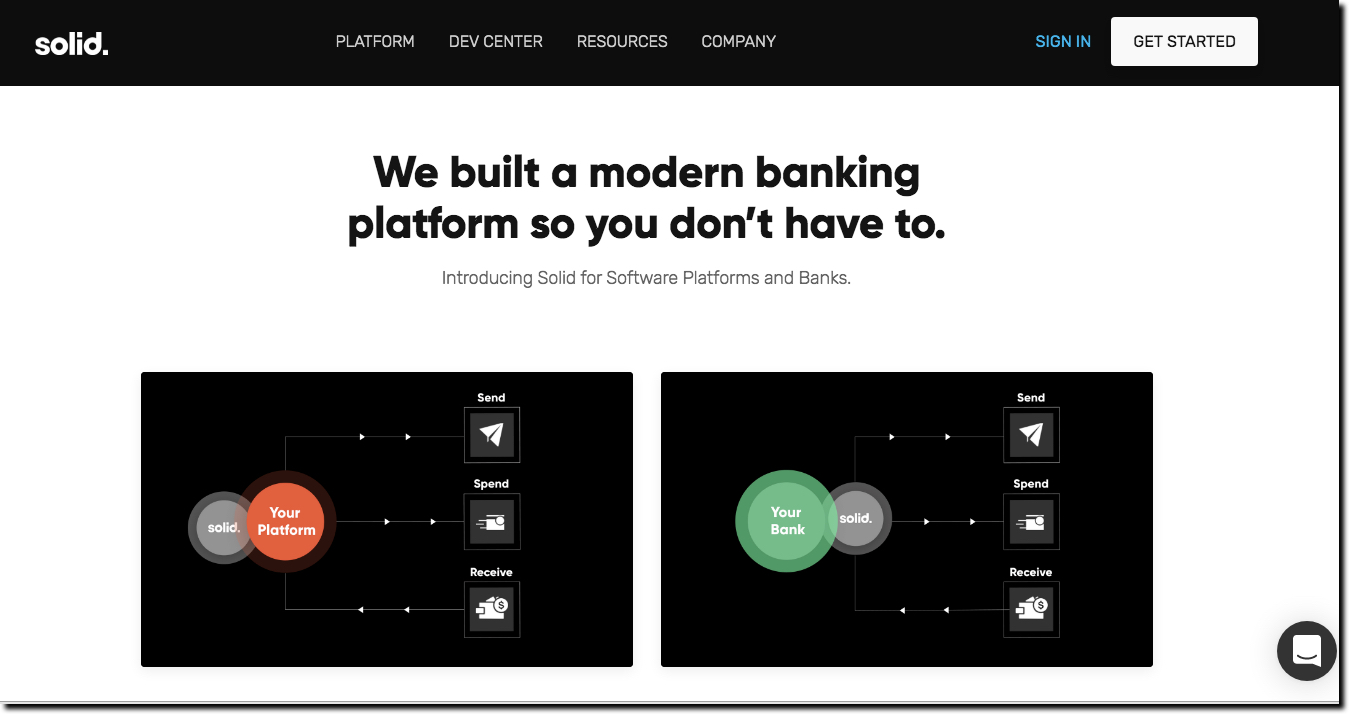

12. Solid (was Wise)*

FAB Score: 16

– HQ: SF

– Founded: 2018

– Raised $17.8 (Crunchbase)

– Website visits: 43,000 (July 2021, SEMRush)

– Employees: 50 (Pitchbook)

– Citations: 4 (Crunchbase)

*Note: Pivoted to BaaS. Don’t appear to be offering accounts directly.

13. Joust (acquired by ZenBusiness, 30 July 2020; currently referring customers to Radius Bank)

– Target: Freelancers

– HQ: Austin, TX

– Founded: 2017

– Raised: $11M (Crunchbase)

– Website visits: Unknown

– Employees: 18 (Pitchbook)

– Citations: 5 (Crunchbase)

– Twitter followers: 448

– Trustpilot: NA

– iOS: 4.1 (28 reviews)

14. Seed (Acquired by Cross River Bank currently closed to new customers)

– HQ: San Francisco Bay Area

– Founded: 2014

– Raised $5.2M (2015) (Crunchbase)

– App downloads (last 30 days): 425 (Apptopia)

– Website visits: 210 (May 2021; SEMrush)

– Number of employees: 12 (Pitchbook)

– Citations: 4 (Crunchbase)

– Twitter: 810 followers

Addendum: Other SMB/SME challenger banks around the world (not a definitive list):

UK

- CountingUp

- Allca Bank — was CivilizedBank

- Redwood Bank

- Tide – Raised $95M

- OakNorth – Raised $475 million, first SMB banking unicorn

Germany

- Kontist – German, raised $44 million

- Penta – German, raised $54 million

Australia

France

Rest of world

- Holvi – Finland: Acquired by BBVA March 2016

- Juni – Sweden: Serving ecommerce companies. Raised $21.5M A-round July 2021

- Tochka – Russia