Companies with a significant volume of credit/debit card payments rely heavily on payment processors to keep them afloat. Downtime equals lost revenue, so it’s not a function easily entrusted to a startup. That’s why there are fewer players in this category, and the three established ones (Adyen, Square, Stripe) continue to dominate the U.S. SMB market for third-party solutions. Notably, two of three (Adyen, Square) have gone public, further improving trust.

(Note: We exclude the payment arms Amazon or Shopify here since they primarily serve their own marketplaces).

Interestingly, 4 of the 9 startups were launched in the past 4 years. But those 4 are much smaller with combined website traffic of under 200,000 per month. In comparison, the big 3 each have more than 1 million visits each day!

Years since founding:

11 to 20 years >>> 3 startups

6 to 10 years >>> 2 startups

1 to 5 years >>> 4 startups

Note: We divided the payment providers into four categories:

- Charge card and expense management (see list here)

- Bill payments and/or invoicing specialists (list here)

- Payment processors (below)

- Subscription management platforms (list here)

Resources: Looking for digital banks, lenders, payment providers, insurance or digital accounting for small businesses? Check out our latest lists: Small Business (SMB) savings/treasury accounts (7) | SMB online lenders (33) | SMB challenger banks (15) | SMB insurers (15) | SMB credit cards/expense management (16) | Billpay & invoicing (16)| Payment processors (7) | SMB digital accounting/bookkeeping (21)

The FAB Score (Fintech Attention Barometer) is a proxy for the size and growth of fintech companies founded since 1999.

Top U.S. Payment Processing Challengers**

(ranked by FAB score**)

| Rank | Was (Jan’24) | Company | FAB Score | Reviewed | Founded | HQ | Total Fundin | Visits (Aug ’24) |

| 1 | 1 | Stripe | 12,240 | 6 Sep ’24 | 2010 | SF | $ 8,700 | 70,000,000 |

| 2 | 2 | Block/Square | 5,050 | 6 Sep ’24 | 2009 | SF | $ 870 | 39,700,000 |

| 3 | 3 | Adyen | 4,530 | 6 Sep ’24 | 2006 | Amsterdam | $ 1,366 | 35,100,000 |

| 4 | 4 | Balance | 223 | 6 Sep ’24 | 2020 | Tel Aviv | $ 431 | 11,000 |

| 5 | 5 | Nium | 76 | 6 Sep ’24 | 2015 | Singapore | $ 338 | 100,000 |

| 6 | 7 | Helcim | 50 | 6 Sep ’24 | 2020 | Calgary, Canada | $ 32 | 260,000 |

| 7 | 6 | PaymentCloud | 42 | 6 Sep ’24 | 2016 | LA | $ 45 | 170,000 |

| 8 | 8 | Link | 20 | 6 Sep ’24 | 2021 | SF | $ 30 | 18,000 |

| 9 | 9 | Chargezoom | 11 | 6 Sep ’24 | 2019 | LA | $ 12 | 8,100 |

Source: FintechLabs, 6 Sep 2024 using data from Crunchbase, SimilarWeb, Pitchbook

*Our business model depends on revenue from referrals and sponsors. When you see a referral link in the URL, we may earn a fee when a new account is started (thanks!). This can improve visibility on our website, but does not impact the company’s FAB score.

** The FAB score, Fintech Attention Barometer, is a proxy for the overall size of a private company since they typically do not release traditional metrics (# customers, deposits, AUM, etc). The score is based on VC funding, website traffic, mobile downloads, and the number of employees. It’s a work in progress, so expect changes in the formula.

***Funding invested into the company as either equity or debt.

Challenger Payment Providers in the United States

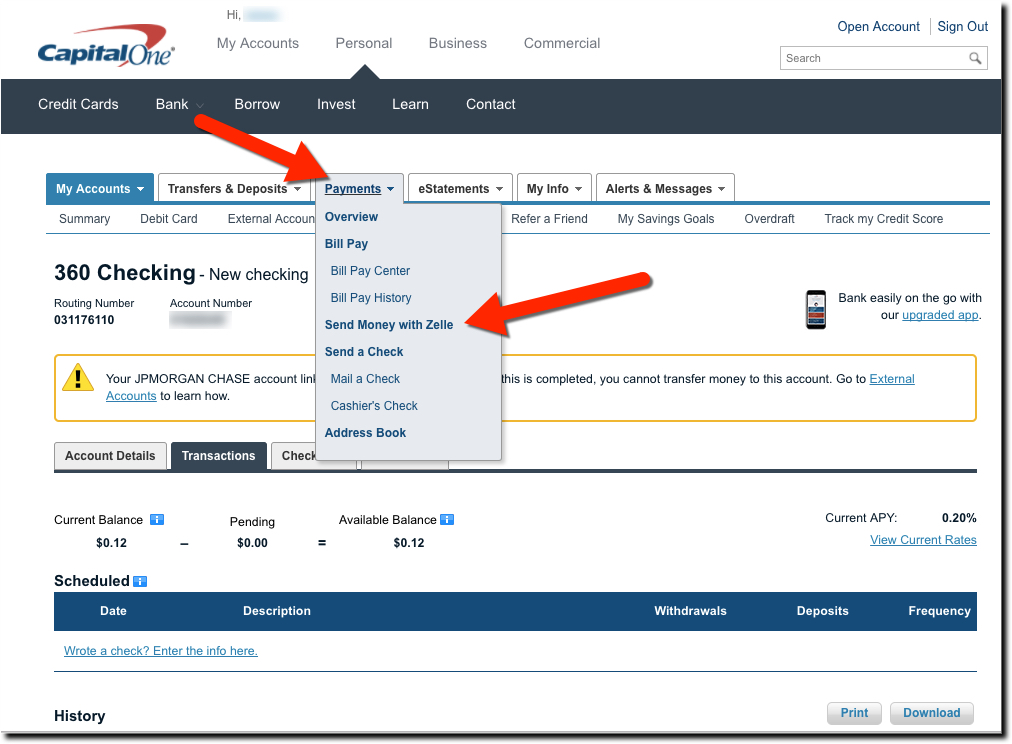

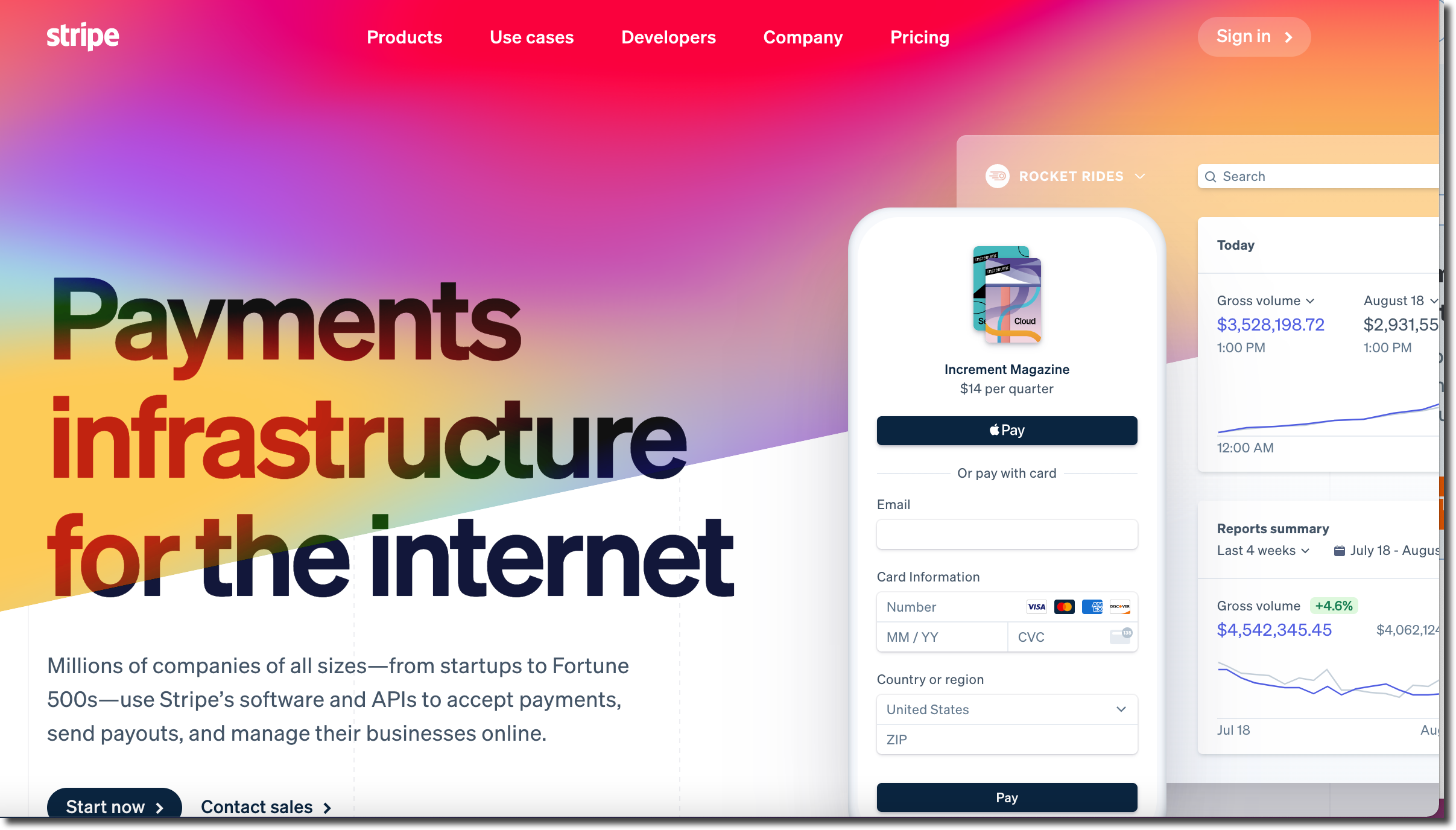

1. Stripe

FAB Score = 12,240 (up 1,190 from Jan 2024)

– HQ: San Francisco

– Founded: 2010

– Raised $8.7B including $6.5B in 2023 (Crunchbase)

– Website visits: 70 million (Aug 2024; SimilarWeb)

– Employees: 8,020 (Pitchbook), unchanged since June 2023

– Articles: 3,900 (Crunchbase)

– Linkedin: 900,000 followers (9,940 employees, up 1,340 since Jan ’24, 1,940 since June ’23)

– Trustpilot rating: 2.2 (14,500 reviews, up 1,500 since Jan)

2. Block/Square

FAB Score = 5,050 (down 80)

– HQ: San Francisco

– Founded: 2009

– Went public Nov 2015 (NYSE:SQ) at $2.9B valuation

– Raised $870M including $11M in 2021 (Crunchbase)

– Revenue: $23.5B TTM

– Market cap: $37.6B (6 Sep 2024)

– Website visits: 45.0M (Aug 2024; SimilarWeb)

– Employees: 13,000 (Pitchbook), up 600 since Jan. ’24, up 600 since June ’23

– Article citations: 8,500 (Crunchbase)

– Linkedin: 577,000 followers (7,110 employees, down 170 since Jan ’24, down 60 since June ’23)

– Rating: 4.2 (5,010 reviews per TrustPilot, up 690 since Jan)

3. Adyen

FAB Score = 4,530 (up 340 since Jan)

– HQ: Amsterdam

– Founded: 2006

– Went public June 2018

– Raised $1.4B all prior to 2021 (Crunchbase)

– Market cap: $39B (6 Sep 2024)

– Revenues: $1.9B TTM (Yahoo Finance)

– Website visits: 35.1 M (Aug 2024; SimilarWeb)

– Employees: 4,230 (Pitchbook), up 350 since Jan ’24, up 900 since June ’23

– Articles: 1.050 (Crunchbase)

– Linkedin: 265,000 followers (4,600 employees, up 120 since Jan ’24, up 400 since June ’23)

– Rating: 4.7 (3,630 reviews per FeaturedCustomers, up 800 since Jan)

4. Balance

FAB Score = 223 (unchanged)

– HQ: Tel Aviv

– Founded: 2020

– Raised: $431M including $416M in 2022, $15M in 2021 (Crunchbase)

– Website visits: 11,000 (Aug 2024; SimilarWeb)

– Employees: 104 (Pitchbook), up 4 since Jan ’24, up 8 since June ’23

– Articles: 46 (Crunchbase)

– Linkedin: 8,000 followers (108 employees, up 14 since Jan. ’24, up 10 since June ’23)

– Rating: 5.0 (Note: Only 5 reviews per Capterra)

5. Nium

FAB Score = 76 (up 29)

– HQ: Singapore

– Founded: 2015

– Raised $338M including $50M in Jun 2024, $200M in 2021, $13M in 2022 (Crunchbase)

– Website visits: 100,000 (Aug 2024; SimilarWeb)

– Employees: 985 (Pitchbook), down 15 since Jan ’24, up 40 since June ’23

– Articles: 214 (Crunchbase)

– Linkedin: 205,000 followers (1,010 employees, up 5 since Jan ’24, down 19 since June ’23)

– Rating: INA

6. Helcim

FAB Score: 50 (up 18)

HQ: Calgary, Canada

Founded: 2020

Raised: $32M including $20M in Feb 2024, $12M in 2022 (Crunchbase)

Website visits: 260,000 (Aug 2024; SimilarWeb)

Employees: 155 (Pitchbook), up 15 since Jan ’24, up 6 since June ’23

Article citations: 16 (Crunchbase)

Linkedin: 11,000 followers (151 employees, up 14 since Jan ’24, up 13 since June ’23)

Trustpilot: 4.1 (489 reviews, up 137 since Jan)

7. PaymentCloud (acquired by Electronic Merchant Systemes)

FAB Score = 42 (up 3)

– HQ: LA (Sherman Oaks)

– Founded: 2016

– Raised $45M including $35M in 2022, $10M in 2021 (Crunchbase)

– Website visits: 170,000 (Aug 2024; SimilarWeb)

– Employees: 93 (Pitchbook), up 7 since Jan ’24, up 7 since June ’23

– Articles: 24 (Crunchbase)

– Linkedin: 3,000 followers (86 employees, down 7 since Jan ’24, down 1 since June ’23)

– Rating: 4.7 (18 reviews per Capterra, up 2 since Jan)

8. Link

FAB score = 20 (down 2)

HQ: SF

Founded: 2021

Funding: $30M, including $20M in 2023, $10M in 2021 (Crunchbase)

Article citations: 20 (Crunchbase)

Website visits: 18,000 (Aug 2024, SimilarWeb)

Employees: 48 (Pitchbook), unchanged since Jan ’24, up 8 since June ’23

LinkedIn: 2,000 followers (50 employees, up 3 since Jan ’24, down 7 since June ’23)

9. Chargezoom

FAB Score = 11 (unchanged)

HQ: LA (Irvine)

Founded: 2019

Funding: $12M including $10M in 2022, $2M in 2021 (Crunchbase)

Web visits: 8,100 (Aug 2024, SimilarWeb)

Employees: 10 (Pitchbook), down 6 since Jan ’24, down 7 since June ’23

Article citations: 11 (Crunchbase)

Linkedin: 1,000 followers (17 employees, down 1 since June)

No longer accepting new business

Fast (winding down business)

– HQ: San Francisco

– Founded: 2019

– Raised $125M including $102M in 2021 (Crunchbase)

– Website visits: 210,000 (May 2023; SimilarWeb)

– Employees: 400 (Pitchbook), unchanged

– Articles: 110 (Crunchbase)

– Linkedin: 22,300 followers

– Rating: 4.5 (2,870 reviews per TrustPilot)

Note: We excluded PayPal from because they are more of an enterprise solution, and less importantly, was founded in 1998, so a little old/established for a “challenger” list.