Category: Challenger Banks

Challenger Banks for SMBs

The first pure-play online challenger bank was Security First Network Bank. It launched in 1995 just a year after Amazon.com. Over the next 20 years, digital bank startups would gain little traction, especially in the United States. But that changed in the latter part of the 2010s and now there are more than 250 challenger banks worldwide.

But we still haven't seen a breakout small business bank (see definition below). The digital small biz lenders are grabbing share: Kabbage (now part of AmEx), Square, Paypal, Amazon, Brex and others. But there is not a place where small businesses flock to get deposit, payment, and financing services within a single interface.

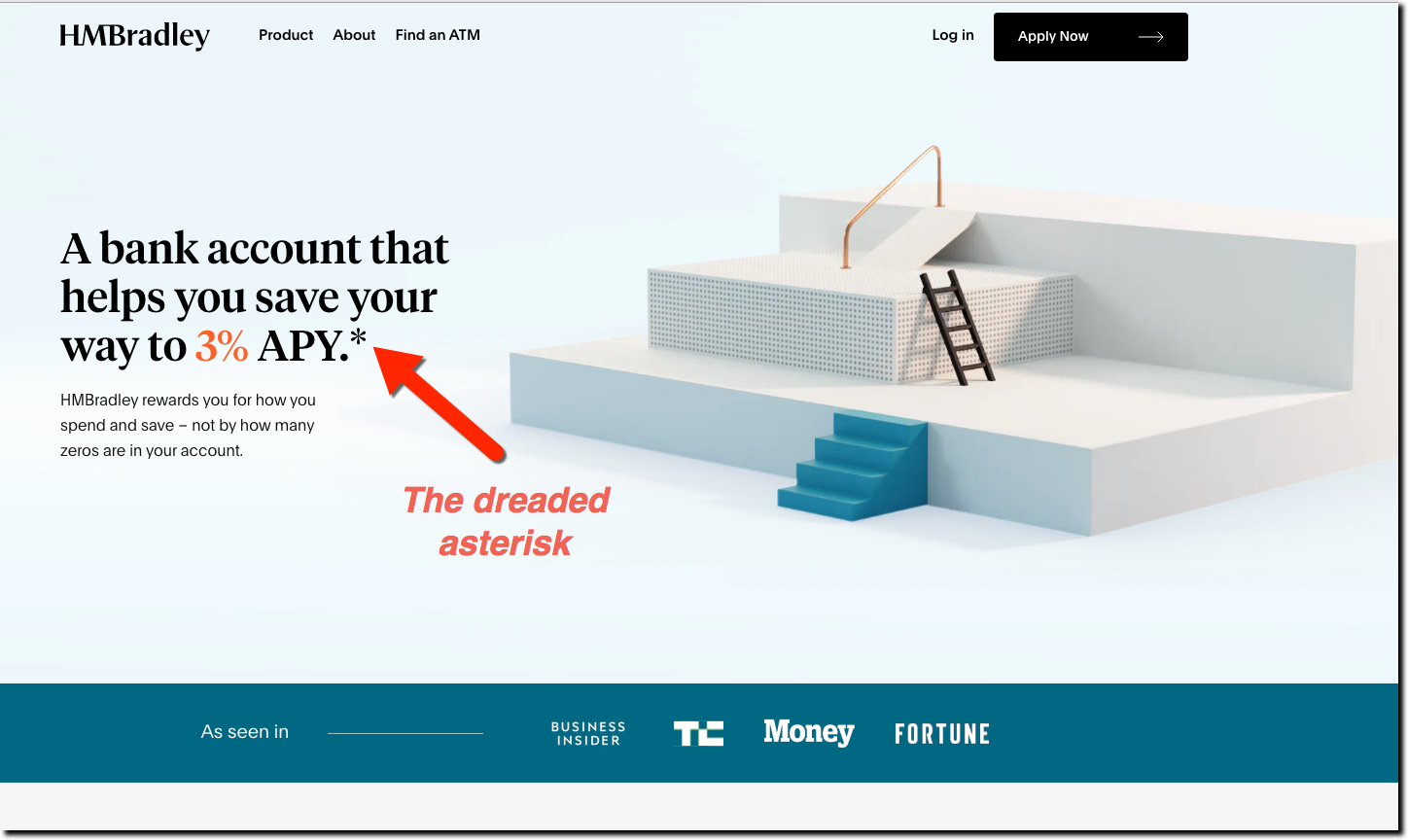

Challenger of the Month*

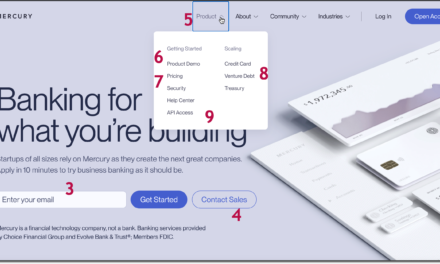

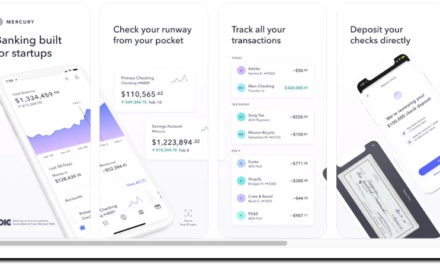

Startups of all sizes rely on Mercury as they create the next great companies.

Introducing Mercury Vault: Protect your cash with a money market fund and up to $5M in FDIC insurance – 12x the industry standard.

There are now more than a dozen startups aggressively competing to become that spot in the United States (see Table below)

The FAB Score Ranking (Fintech Attention Barometer) is a proxy for the size of a private fintech company.

| Rank | Learn More | FAB Score* | Founded | Funding $M | |||

|---|---|---|---|---|---|---|---|

| 1 | http://fintechlabs.com/wp-content/uploads/2021/12/Murcury-logo-square.jpg | 447 | SF | 2017 | $152 | 1.9 million | |

| 2 | http://fintechlabs.com/wp-content/uploads/2022/01/Novo-logo-square.jpg | 327 | NYC | 2016 | $296 | 950,000 | |

| 3 | http://fintechlabs.com/wp-content/uploads/2023/05/BluevineLogo.png | BlueVine | 260 | SF | 2013 | 768 | 760,000 |

| 4 | http://fintechlabs.com/wp-content/uploads/2023/02/Found-logo-600-300.png | Found | 123 | SF | 2019 | $75 | 410,000 |

| 5 | http://fintechlabs.com/wp-content/uploads/2023/02/Logo-1.png | Arc | 101 | SF | 2021 | 181 | 22,000 |

| 6 | http://fintechlabs.com/wp-content/uploads/2023/02/Relay-logo.webp | 89 | Toronto | 2018 | $19 | 390,000 | |

| 7 | http://fintechlabs.com/wp-content/uploads/2021/12/Loli-logo-square.jpg | 84 | NYC | 2018 | $80 | 250,000 | |

| 8 | http://fintechlabs.com/wp-content/uploads/2023/09/Slash-logo.png | Slash | 61 | SF | 2020 | $19 | 230,000 |

| 9 | http://fintechlabs.com/wp-content/uploads/2021/12/Northone-logo-square.jpg | 57 | NYC | 2016 | $90 | 95,000 | |

| 10 | http://fintechlabs.com/wp-content/uploads/2021/12/Grasshopper-Bank-logo-square.jpg | 51 | NYC | 2016 | $162 | 80,000 | |

| 11 (t) | http://fintechlabs.com/wp-content/uploads/2023/09/Moves-logo_RGB_BLK.webp | Moves | 34 | Dover, DE | 2020 | $14.1 | 120,000 |

| 11 (t) | http://fintechlabs.com/wp-content/uploads/2022/09/Winden-logo.png | Winden | 34 | NYC | 2021 | $5.3 | 140,000 |

| 13 | http://fintechlabs.com/wp-content/uploads/2022/04/Baselane-Logo-Blue-large.png | Baselane | 28 | NYC | 2020 | $7.9 | 99,000 |

| 13 | http://fintechlabs.com/wp-content/uploads/2023/02/Viably-logo-full-color.svg | Viably | 21 | NC | 2021 | $21 | 22,000 |

| 15 | http://fintechlabs.com/wp-content/uploads/2022/03/Zil-logo.png | Zil | 15 | Dallas | 2021 | $0 | 43,000 |

| 16 | http://fintechlabs.com/wp-content/uploads/2023/09/Arival_Bank-logo.jpeg | Arival | 11 | Miami, FL | 2018 | $10.8 | 21,000 |

| 17 | http://fintechlabs.com/wp-content/uploads/2021/12/Vergo-logo-square.jpg | Vergo | 10 | NYC | 2021 | $4.1 | 8,300 |

| 18 | http://fintechlabs.com/wp-content/uploads/2023/02/GuavaLogos_guavalogo.png | Guava | 5 | NYC | 2018 | $2.4 | 4,800 |

Sources: FintechLabs, Pitchbook, Crunchbase, SimilarWeb, SEMrush; 19 Feb 2023

* The FAB score, Fintech Attention Barometer, is a proxy for the overall size of a private company since they typically do not release traditional metrics (# customers, deposits, AUM, etc). The score is based on VC funding, website traffic, mobile downloads, and the number of employees. It’s a work in progress, so expect changes in the formula.

**Funding is the amount invested into the company as either equity or debt.

***Our business model depends on revenue from our sponsors and referrals. So anytime you see a sponsor or referral link in the URL, we potentially earn a fee upon establishing a new funded account (thanks!). This can impact their visibility on our website (for example, Revolut), but does not impact their FAB score.

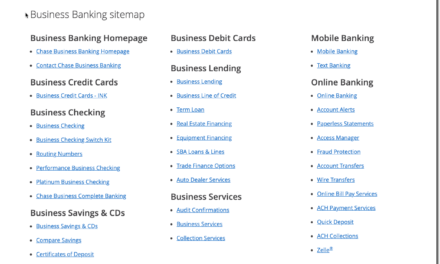

Challenger Banks

| FAB Score* | Founded | Funding $M | ||

|---|---|---|---|---|

| http://fintechlabs.com/wp-content/uploads/2021/12/Murcury-logo-square.jpg | 447 | SF | 2017 | $152 |

| http://fintechlabs.com/wp-content/uploads/2022/01/Novo-logo-square.jpg | 327 | NYC | 2016 | $296 |

| http://fintechlabs.com/wp-content/uploads/2023/05/BluevineLogo.png | 260 | SF | 2013 | 768 |

| http://fintechlabs.com/wp-content/uploads/2023/02/Found-logo-600-300.png | 123 | SF | 2019 | $75 |

| http://fintechlabs.com/wp-content/uploads/2023/02/Logo-1.png | 101 | SF | 2021 | 181 |

| Company Overview | FAB Score* | Founded | Funding $M | |

|---|---|---|---|---|

| Ad | 2007 | $120,000 | NYC |

| 488 | 2020 | $950 | NYC |

| 362 | 2008 | 2500 | Atlanta |

| 309 | 2015 | 699 | Toronto |

| 282 | 2013 | $768 | SF |

| Company | FAB Score* | Founded | Funding ($M) | |

|---|---|---|---|---|

| 1058 | 2019 | $1,660 | NYC |

| 460 | 2008 | $401 | SF |

| 205 | 2016 | $312 | |

| 200 | 2016 | $418 | Utah |

| 196 | 2019 | $368 | NYC |

| FAB Score* | Founded | Funding ($M) | ||

|---|---|---|---|---|

| 230 | 2016 | $881 | SF | |

| 122 | 2017 | $520 | SF |

| 80 | 2017 | $306 | Wash DC |

| 63 | 2005 | $0 | London |

| 39 | 2015 | $142 | SF |