Since Brex exploded in value in 2018/2019, a number of fintech startups are following its playbook in the SMB space: Attract VC-fueled startups as your beachhead and then expand from there. Mercury Bank is one of the fast followers, focusing on the core bank account whereas Brex was all about the corporate charge card (until moving into the broader banking space after a few years).

Mercury was started in 2017 in the SF Bay area and has seen rapid growth in website visitors. According to Similarweb estimates the site attracted 950,000 visits last month, more than triple the 280,000 in December. Not coincidently the company landed a large $120M venture round in July (2021). Consequently, this month the company reached #1 on our SMB challenger bank list for the first time.

Products

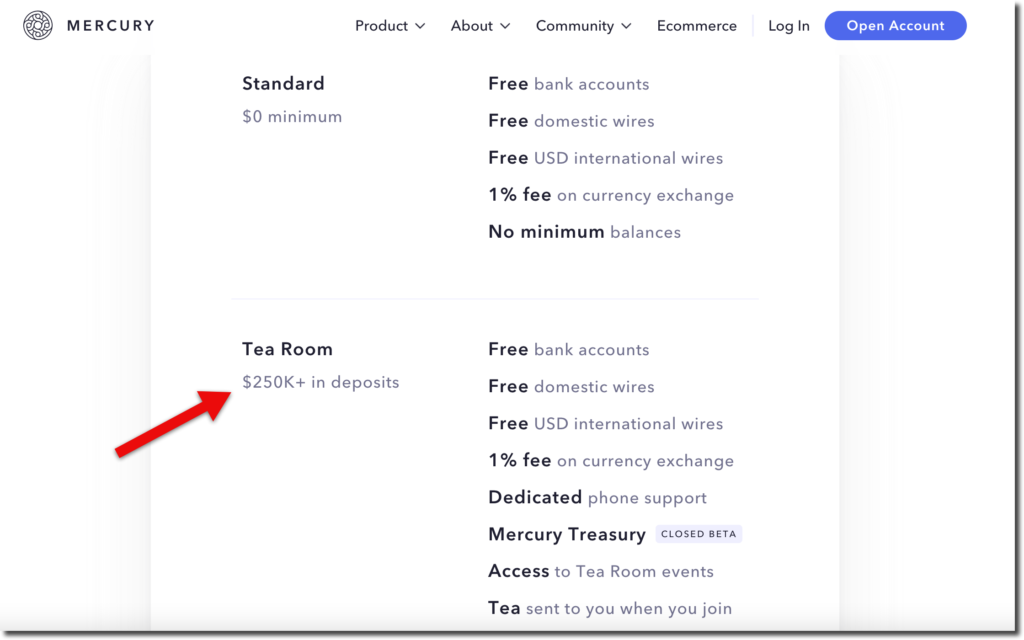

The company is currently the only USA SMB challenger offering a significant new account bonus, $250 for new accounts spending $10k on a Mecury debit card within 90 days. The company also has a novel pricing strategy. Its basic and premium accounts are both free of monthly fees. However, the minimum balance for the premium account is $250,000! Yep, that’s not a typo (see the screenshot below). The main advantage of premium is that it sweeps balances into money market and government-backed securities. The standard account is non-interest bearing. Premium accounts also receive free international wires, access to special events, and free tea (see note 1). Both types pay a 1% fee for currency exchange (see screenshot below).

In March 2022, the company made its first big product expansion, moving into the venture debt space with its own offering.

Mercury Bank pricing (15 Mar 2022)

- Mercury’s blog is called the “Tea,” a play on the millenial spilling the tea (i.e., gossiping).

Company vitals:

Mercury Technologies

FAB Score = 281 (updated 15 Mar 2022)

#1 on our list of U.S. SMB challenger banks

– HQ: San Francisco Bay Area

– Founded: 2017

– Raised $152M (Crunchbase)

– Website visits: 1.1 million (Jan 2022; SimilarWeb)

– Unique visitors: 390,000 (Feb 2022: SEMrush)

– Employees: 149 (Pitchbook)

– Articles: 13 (Crunchbase)

– Twitter: 14,700 followers

– Linkedin: 9,750 followers (234 employees)

– Trustpilot: 4.0 (332 reviews)

– Bank partner: Evolve Bank & Trust