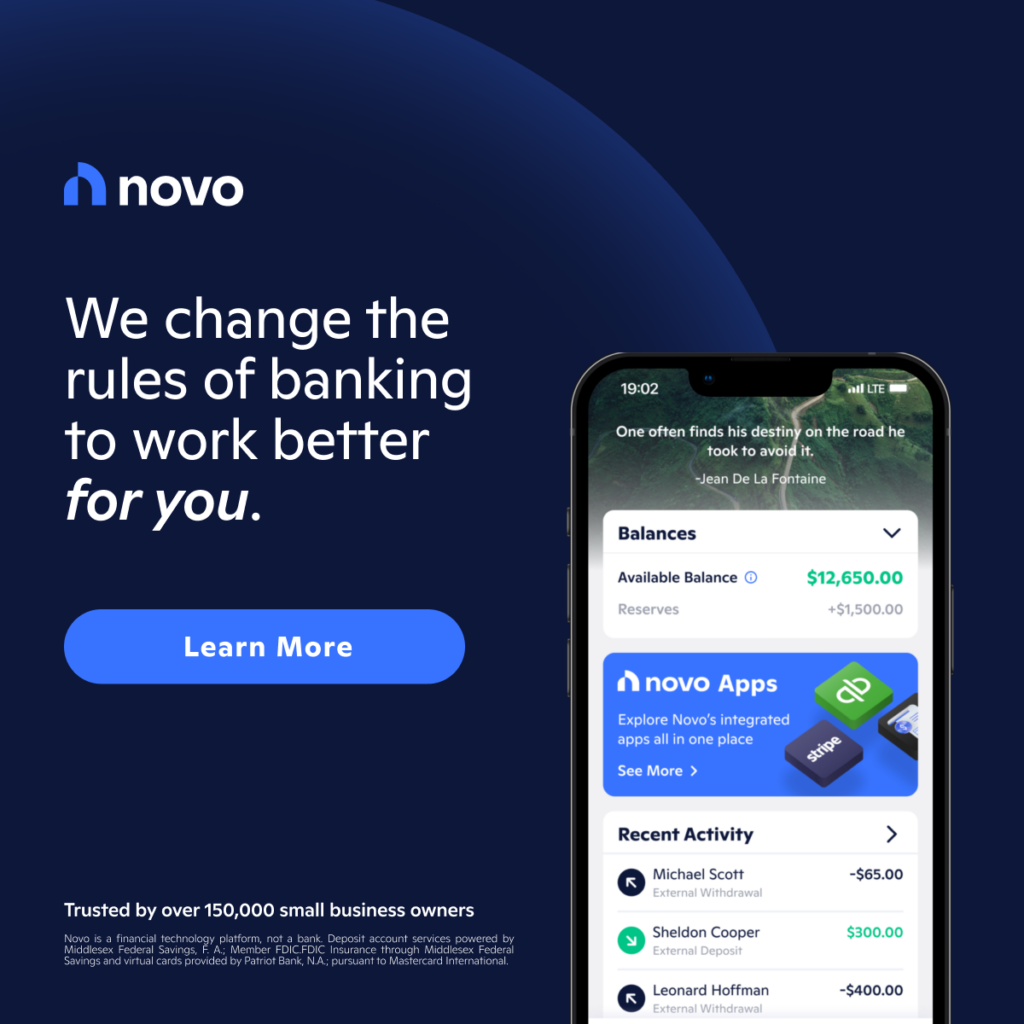

The NOVO website appeals to small businesses of all shapes and sizes, including international ones.

Last week, we listed 72 features of digital bank accounts. That’s a lot to take in. So what are the most important differentiating features from that list?

It depends on the business, but here are 7 advanced features that many small businesses would value in their banking provider, but rarely find.

- High-touch service: Business owners want to know there is someone at their primary financial providers that they can reach who will take ownership of problems or opportunities involving the flow of money. And not just a stranger at the end of an 800-number, but a living, breathing human with a name, email address and personal phone number.

- Security/fraud guarantees: While most banks address security concerns with boilerplate language and clip art, small business owners want comprehensive security and anti-fraud guarantees in language that anyone can understand.

- Invoicing: Most (all) non-retail businesses must send invoices. And while it’s easy to do with email and Word, once you have more than a few invoices outstanding the tracking and management of followups and payments received becomes a process rife with errors. A simple invoicing system directly integrated into online banking is a great way for many smaller businesses to save time, money, and headaches.

- Basic financial management/reporting: Most medium-sized businesses use professional accounting packages such as Quickbooks. However, millions of small businesses just getting started cannot afford the time or energy it takes to master these programs. So basic templates, reports and rudimentary dashboards are a great way to get novice business owners started.

- Invoice financing: Cash flow is an issue in most small businesses. The ability to choose to have immediate payment on an invoice, e.g., with the money fronted by the financial institution, is not only a great convenience, but a real relationship builder.

- Basic card processing: While retailers will need robust card processing services, a number of small businesses just need to accept cards every now and then. Paypal and Square created $100-billion businesses off this need. Banks should provide it as well.

- Basic insurance: Figuring out what type of insurance to buy for a new company is a time-consuming and often confusing exercise. A bank can provide much peace of mind by offering a simple menu of recommended insurance, along with integrations to the providers.