There is a small business owner in one of every 3 US households. They have more complicated finances, spend far more money on financial services, and are often less satisfied. It’s a market ripe for newcomers, but until 10 years ago, there were no pure-play small-business financial challengers. But that has changed dramatically, especially since 2016.

One major players is Rho which offers a full-service banking and expense management offering. The company has historically targeted the larger size businesses within the SMB category, especially companies with 30 to 500 employees. (Initially, Rho had more narrowly targeted VC-backed startups with $1M to $30M in revenues. Source: Tearsheet podcast with Everett Cook, 6 Jan 2020).

These mid-market companies have substantial banking costs but aren’t big enough yet to get much attention at traditional large banks. For example, Mad Rabbit, an e-commerce company featured in a Rho case study, had been spending $2k per month on ACH, wire and account fees. Those costs dropped to zero at RHO, saving the company $25,000 per year.

There are thousands of business banking options for small businesses. But what makes Rho stand out:

- Focus on larger startups and mid-sized businesses

- Dedicated account manager for each client

- Embedded commercial-grade accounts payable (i.e., can replace Bill.com)

- Unlimited card accounts (virtual and plastic)

- $75M in deposit insurance

- Fee-free (including wires and ACH)

- Integrated high-rate savings through American Deposit Management’s partner banks

Product Features

Checking & Savings

- Dedicated account manager

- Free wires domestically and to 161 SWIFT countries

- Free ACH

- Free checks

- 1% FX fee across 67 currencies

- Up to 10 checking accounts per entity (EIN number)

- Competitive rate savings via partner banks with $75M FDIC insurance

- No monthly fees

- No minimum deposit

- APY of 0.01%

- Remote deposits of up to $250k allowed (higher limits possible)

- Flexible access controls across various employees and outside accountants

- Treasury services with yields up to 4.55%

- Capital markets access via third-party referrals

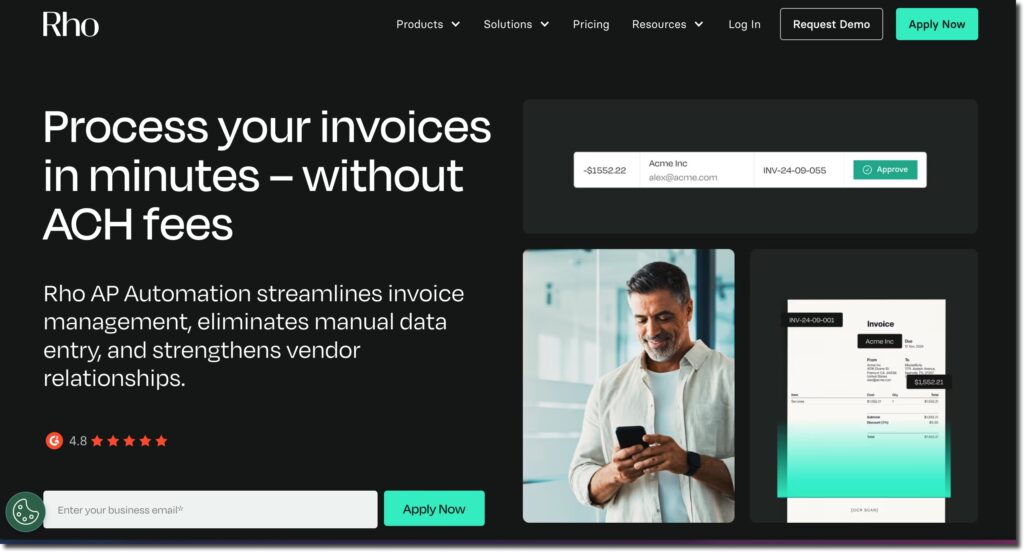

Accounts payable (billpay)

- Invoices sent to dedicated RHO inbox and auto-populated into the AP dashboard

- Payments due are automatically coded to match the clients accounting system

- Rho automatically assigns approvers for every invoice

- Records are automatically synced in real-time to QuickBooks

- Fee-free payment via ACH, wire or check

Corporate charge card

- Up to 1.25% cashback depending on repayment grace period chosen

- Expense management functions

- Fixed credit line (does not vary with bank balance ala Brex)

- No card fees (including no late, overlimit or foreign transaction fees)

- No personal guarantee or collateral required

- Unlimited virtual or physical cards

- Spending controls for each card

- Card lock/unlock

- Auto-synced accounting

- Digital receipt uploads

- Category mapping

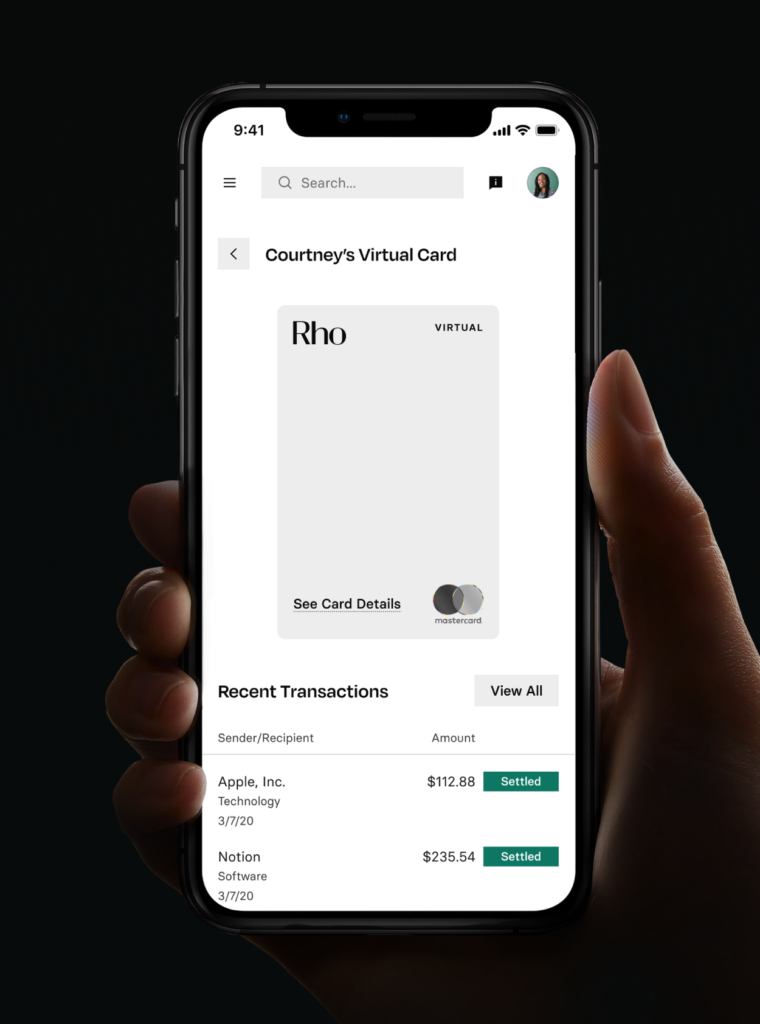

Expense Management

- Free: Avoid paying for a dedicated expense-management system

- Automated Policy Enforcement: Set spending rules to ensure compliance and prevent unauthorized expenses.

- Real-Time Receipt Capture: Submit receipts instantly via the Rho app.

- Multi-Level Approval Workflows: Set approval chains to ensure expenses are reviewed correctly.

- Instant Expense Submission: Submit expenses on the go with proper coding, reducing errors.

- Integration with Accounting Software: Seamless integration with major accounting platforms (QuickBooks Online, Oracle NetSuite, Microsoft Dynamics 365 Business Central, Sage Intacct).

- Employee Reimbursements: Manage out-of-pocket expense reimbursements efficiently, with direct manager approvals and ACH payments to employees’ bank accounts

Company Vitals

Rho

FAB Score = 53 (as of 20 Nov 2024)

Ranks:

#8 on our list of Digital Challenger SMB banks (USA)

#12 on our list of Digital Charge Cards for Small Businesses (USA)

HQ: NYC (SOHO)

Founded: 2018

Traction:

– Raised $205M ($200M since Jan 2021) (Crunchbase)

– Website visits: 103,000 (SimilarWeb, Oct 2024)

– Employees: 198 (Pitchbook), down 2 from Dec 2023

Social:

– Articles: 18 (Crunchbase)

– Linkedin: 11,000 followers (205 employees, down 7 from Dec ’23)

– Trustpilot: 3.6 score (21 reviews)

– G2: 4.8 score (111 reviews)

– iOS store: 4.8 score, 37 reviews

Fintech stack:

– Checking, card services from Webster Bank

– Savings accounts from American Deposit Management Co and its partner banks

Founders:

– Everett Cook, CEO

– Alex Wheldon, Products (CPO)

– Damian Kimmelman, Advisor

Quality articles:

– TechCrunch, 13 Jan 2021

– Bank Automation News (fka Bank Innovations), 13 Jan 2021 (paywall)

– Tearsheet (podcast), 6 Jan 2020

Product Videos

Watch the 3-min review below from Kruze Consulting, an established accounting resource for startups. While the video is a bit dated (Dec 2020), its central points are still valid.

- How the FAB Score is calculated: As nerds do, we are developing a proprietary score measuring the adoption of private digital financial services companies. Since most do not release traditional metrics (# customers, deposits, AUM, etc) we rely on third-party estimates of website traffic, app downloads, as well as publically reported funding (equity + debt). We call it the FAB score, standing for Fintech Attention Barometer. It’s a work in progress, so expect changes in the formula.

- Disclaimer: We personally write and stand by everything published here. We receive referral revenues from certain companies which can impact their positioning on the site. However, the FAB score itself is cannot be altered by referrals or a sponsor relationship.