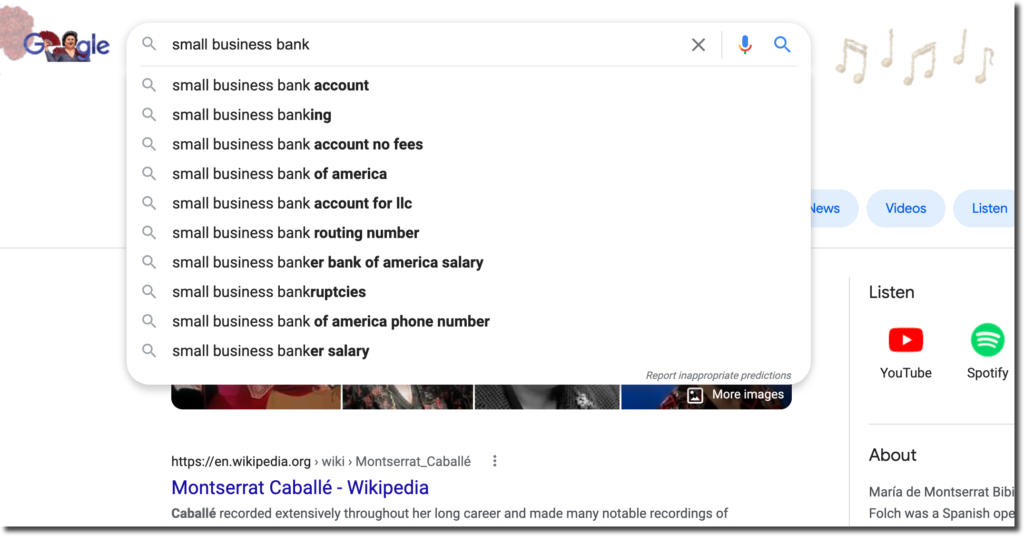

Running a small business is hard. Finding the right bank shouldn’t be.

We’ve been on both sides of the table, 5 years working at a bank followed by 25 years advising banks/fintechs on digital banking products. For much of that time, we’ve kept a list of digital features that small businesses can benefit from. Here is the latest iteration of what every small business owner should look for in a bank (digital or traditional).

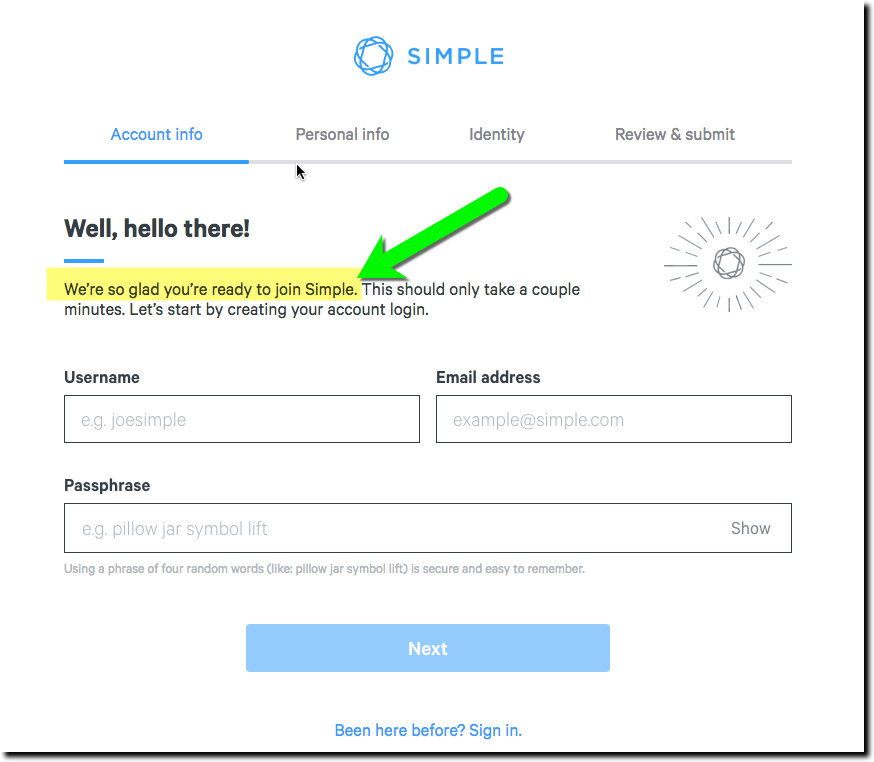

Business owners looking for a new, digitally-native SMB bank account should start here.

Update (25 April 2023): Added #16 (must have), #33, #34 (nice-to-have)

Must-have features:

- Email/SMS customer service (minimum 8 hours per business day, 4 hours per weekend day)

- Bullet-proof fraud protection (no cap in maximum dollars*)

- ACH/electronic payments*

- Bill payment*

- Two-factor authentication

- Immediate funds availability (with limits)*

- Customizable alerts

- Downloadable transactions (common file formats)

- Fraud transaction scans

- Wire/real-time transfers*

- Mobile app

- Mobile deposit capture

- Long-term (5+ years) transaction/statement archives

- Sortable/searchable data

- Debit card

- Multi-million FDIC insurance through banking networks*

Should-have features:

- Invoicing/bidding with embedded payments*

- Lifetime statement/transaction archives*

- Dedicated banker(s) you know by name

- Card processing*

- Overdraft protection*

- Positive pay for all items

- Credit/charge card*

- Extended hours customer service (12 hours per business day, 6 hour per weekend day)

- Elevated customer service*

- Enhanced security*

- Access on/off switch

- Custom permissions (for third-party access)

- Basic accounting features*

- Feeds/integrations to major accounting services*

- Expedited dispute resolution*

- Transaction annotation (by user)

- Daily statement delivery (email or text)

- Transaction filing system*

- Transaction display prioritization (shows most important transactions first)

- Three/four-factor authentication for large transactions*

- Annual transaction and account summaries*

- Automatic deposit/investment sweep features*

- Credit monitoring/alerts (personal, family & business)*

- Unlimited deposit sub-accounts

- Emergency security contacts (“break glass in case of fraud”)*

Nice-to-have features:

- Invoice financing*

- 24/7 customer service*

- Commercial lending*

- Commercial insurance*

- Equipment financing*

- Rewards

- Transaction feed

- Business dashboard*

- Employee expense management*

- Customer management features (basic)*

- Payroll features (basic)*

- Tax features (basic)*

- Automated savings plans

- Interest on deposits (bonus if pegged to independent standard)

- International transfers/remittances*

- Deposit locks (requires second-party authentication to release)*

- Token-based account access option*

- Transaction account aggregation of other financial institution accounts*

- Aggregated loan management dashboard (monitor credit from all sources in one dashboard)*

- Preformatted forms*

- Credit options for your customers (e.g. buy-now-pay-later lending)*

- Messaging integrated with billpay & invoicing*

- Buyers’ assurances (e.g., ecommerce seal of approval)*

- Business credit information hub (access to Dun & Bradstreet, Cortera, etc.)*

- Virtual safe deposit box to store important documents*

- Premium/VIP client service option*

- Virtual card numbers*

- Advanced accounts receivables tools*

- Advanced bookkeeping/accounting tools*

- Receipt capture/upload*

- Cash deposit via retail network (eg. GreenDot)*

- Crypto exchange/safekeeping*

- Option for paper tax statements (while keeping others paperless)

- Treasury bill access*

*Extra fees and service charges could be assessed