5-min demo (21 Nov 2021)

Melio is an SMB billpay & invoicing provider founded just 3 years ago (2018). It has grown rapidly, attracting $500M in funding and growing to 420 employees. Its latest round, 9 months ago (Aug 2021), valued the company at $4B, tied for the 78th most valuable fintech launched since 1999 (or #38 just looking at US-based fintechs). That first-3-year growth rate in market cap puts it in the top 4 or 5 of all time.

And they are doing it on the backs of a crypto exchange, it’s just plain old small-business payments, not known for their high margins or fast growth. And the core transaction product, bank transfers via ACH is FREE. What the company does that sets it apart, and apparently fees the valuation, is allowing bills to be paid from third-party credit cards for a 2.9% fee.

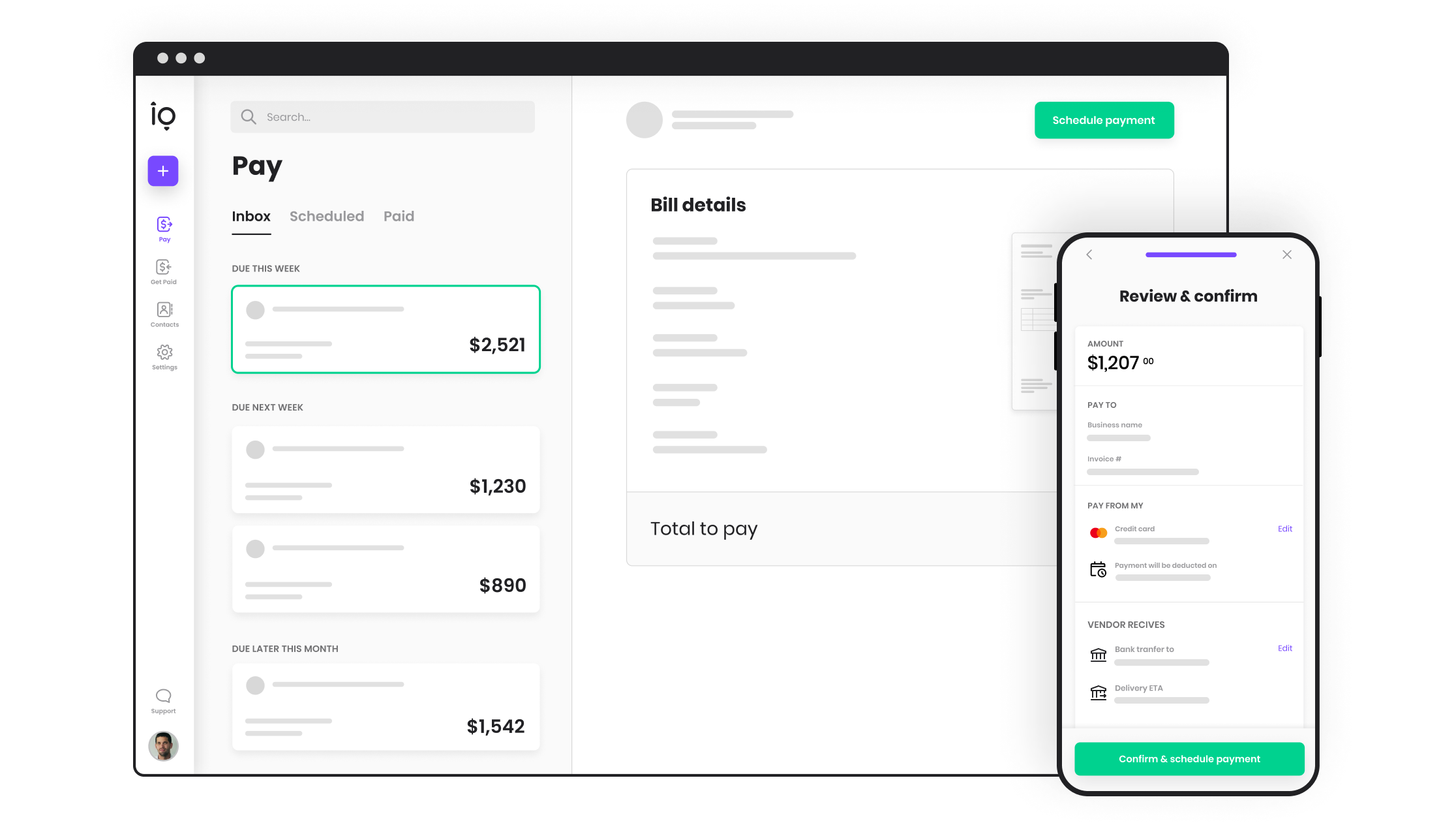

Product Features

- AR/AP dashboard

– approval workflows

– 1099 forms

– sync with QuickBooks Online

– scheduled payments

– payments tracking

– seamless recipient updates of preferred payment method - Accounts payable

– direct debit from bank account via ACH (free)

– charge to any credit/debit card (2.9% fee)

– paper check (free) - Accounts receivable

– from credit/debit cards (2.9% fee)

– invoicing tool with integrated email sending

Check it out yourself with its excellent interactive demo.

Pricing

Melio is completely fee-free other than the 2.9% charge on card payments (send or receive) and a $20 charge for international transfers (EU, Canada, UK supported)

Resources

Quality posts:

- 27 May 2021: Deep dive from Not Borings Packy Mccormick (sponsored, but unbiased); Melio: Disrupting the $25T B2B Payments Market

- 30 Aug 2021: Analysis of blockbuster funding @$4B from The Information (paywall): Payments Startup Melio to Triple Valuation to $4B

Company Vitals

Melio

FAB Score = 271 (updated 31 Jan 2022)

#6 on our list of largest digital AR/AP payment providers

– HQ: NYC

– Founded: 2018

– Raised $504M including $360M in 2021 (Crunchbase)

– Website visits: 565,000 (Dec 2021; SimilarWeb)

– Employees: 420 employees (Pitchbook)

– Articles: 41 (Crunchbase)

– Linkedin: 12,100 followers (454 employees)

– Twitter: 5,940 followers

– Capterra rating: 3.7 (73 reviews)

Product Videos

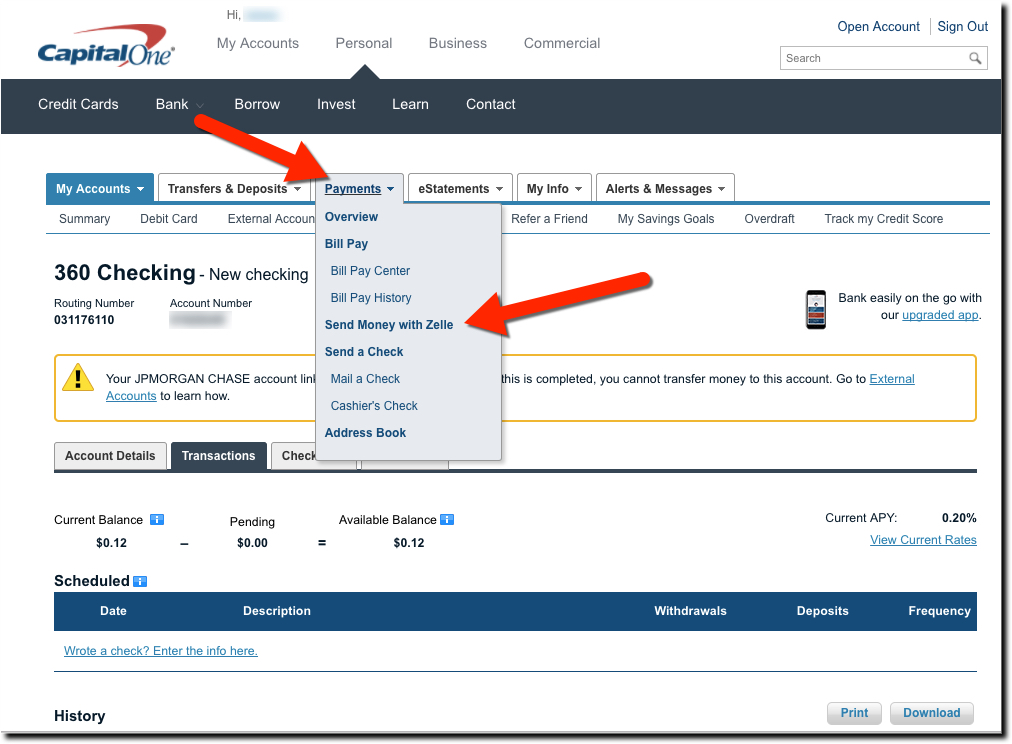

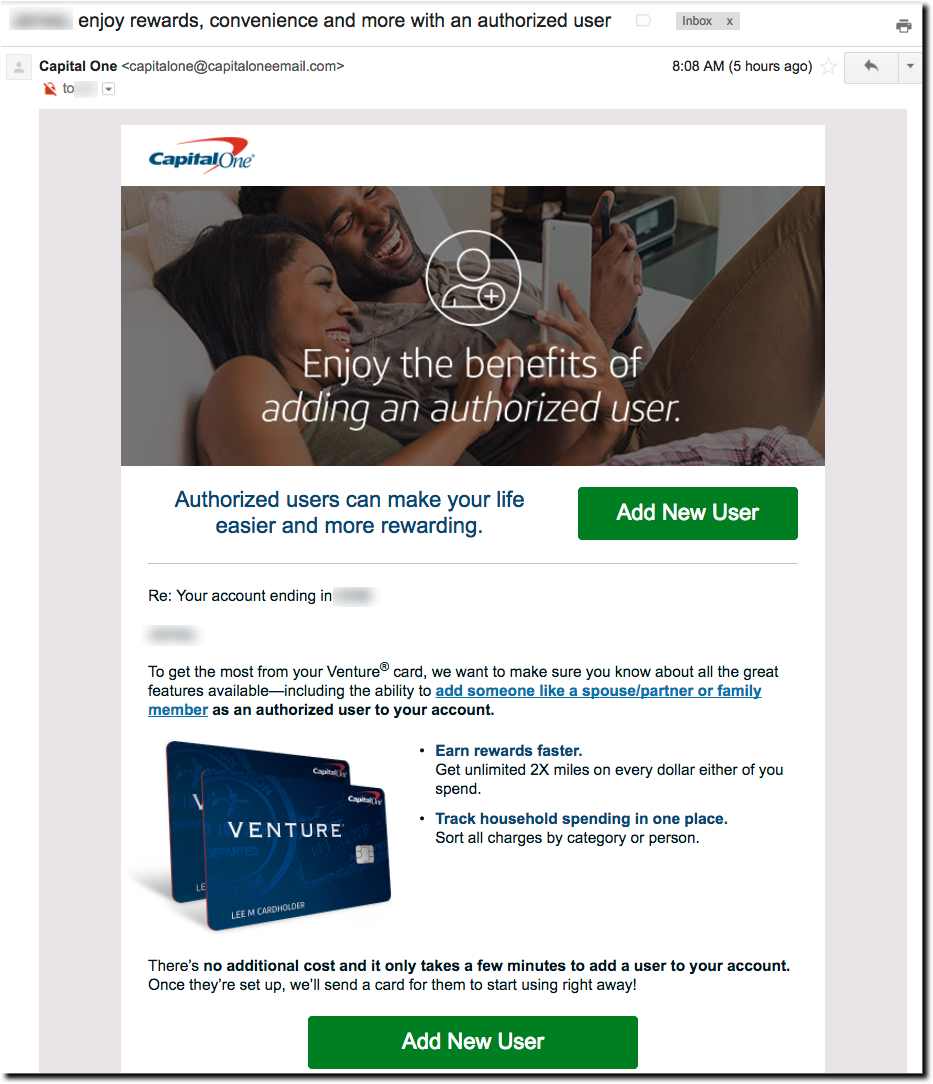

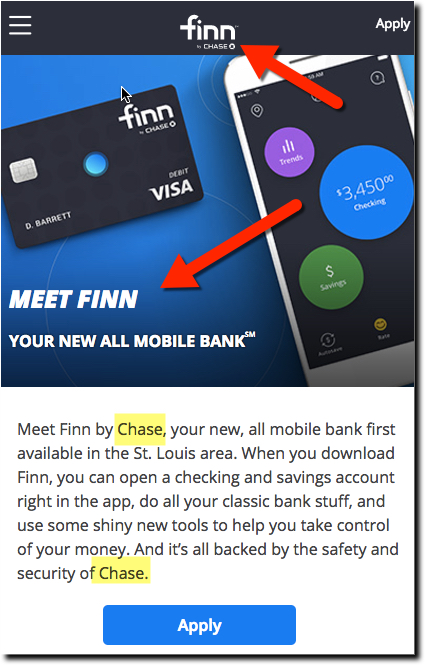

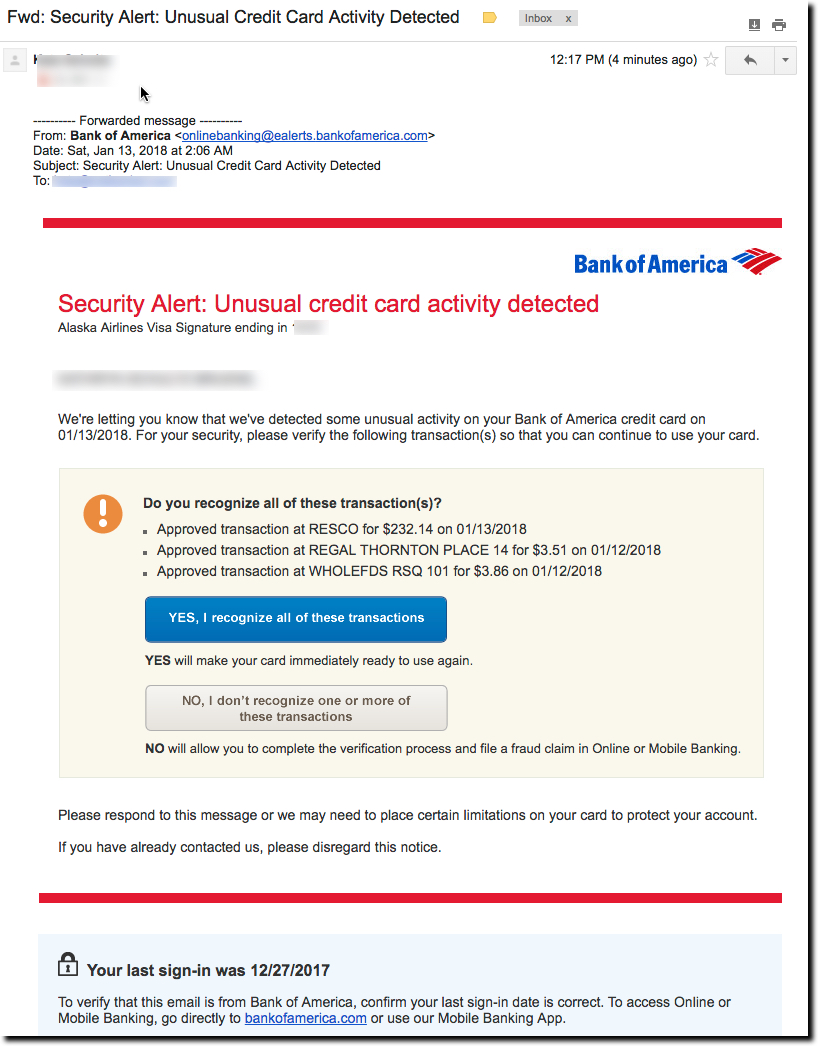

Product Screenshots

- How the FAB Score is calculated: As nerds do, we are developing a proprietary score measuring the adoption of private digital financial services companies. Since most do not release traditional metrics (# customers, deposits, AUM, etc) we rely on third-party estimates of website traffic, app downloads, as well as publically reported funding (equity + debt). We call it the FAB score, standing for Fintech Attention Barometer. It’s a work in progress, so expect changes in the formula.

- Disclaimer: We personally write and stand by everything published here. We receive referral revenues from certain companies which can impact their positioning on the site. However, the FAB score itself is cannot be altered by referrals or a sponsor relationship.