Category: Savings

Top 8 U.S. Online Digital Bank Savings & Treasury Accounts for Small Businesses (SMB) (April 2023)

Other than a brief spike in 2018, it's been 15 years since short-term rates were high enough for most small-to-medium-size businesses (SMB) to worry about chasing yield on their parked cash. But that's changed dramatically in the past 6 months. With "risk-free" rates pushing 5%, even a business with $50k in reserve (throwing off $200/mo) has the incentive to sweep that out of a non-interest checking account.

Are we about to see a rush of fintech startups serving the interest-sensitive small business market? Maybe, maybe not. It depends on whether VCs believe we'll have a long-term run of rates higher than 3%. But what we will surely see is challenger banks dusting off their sweep features and emphasizing them in their marketing and branding.

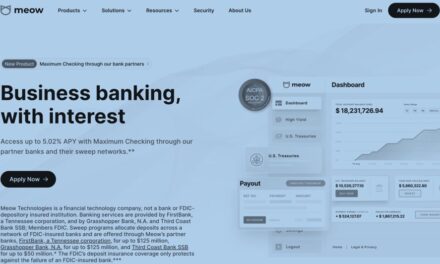

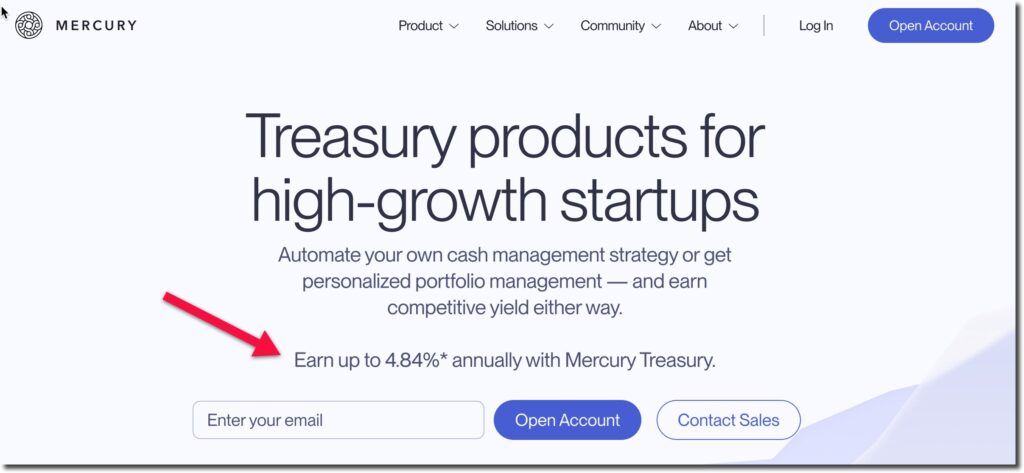

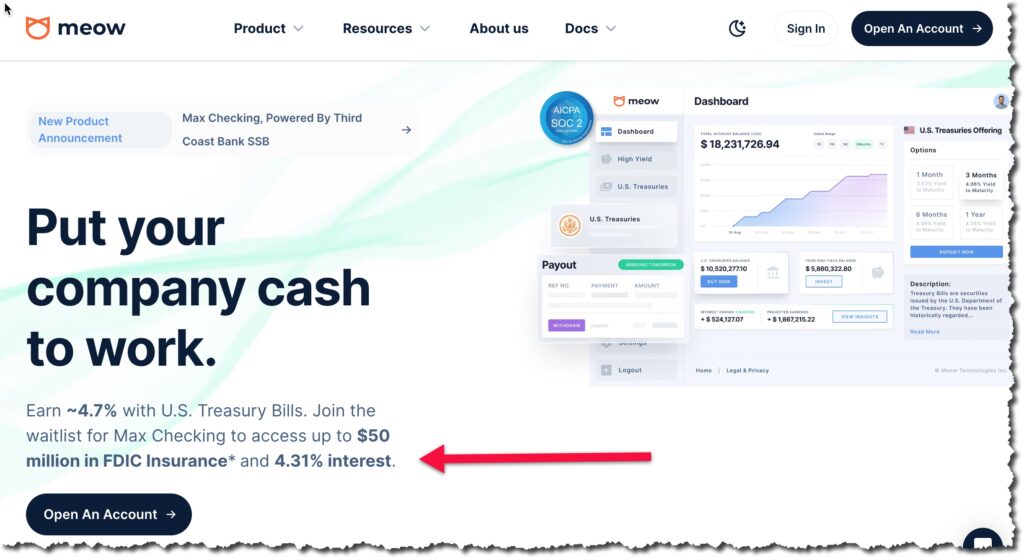

Case in point: Just days after the Feds took over SVB, Mercury was in the market with Mercury Vault, offering $5 million in FDIC insurance by distributing balances across 20 insured banks. And we've also seen the launch of uniquely named and QED backed, Meow, with an FDIC-deposit-aggregation service Max Checking Account featuring $50 million of FDIC insurance.

Looking for digital banks, lenders, payment providers, insurance or digital accounting for small businesses? Check out our latest lists: SMB online lenders (33) | SMB challenger banks (12) | SMB insurers (15) | SMB charge cards/expense management (16) | Billpay & invoicing (16)| Payment processors (7) | Subscription processors (7) | SMB digital accounting/bookkeeping (21)

The FAB Score Ranking (Fintech Attention Barometer) is a proxy for the size of a private fintech company.

| Rank | Company | FAB* | Top APY (5Apr'23)** | Min Balance** | Founded | HQ | Funding ($M***) | Visits (Jan '23) |

| 1 | Mercury | 367 | 4.39-4.84% | $250k | 2017 | SF | $152 | 1,500,000 |

| 2 | Lili | 92 | 2.00% | None | 2018 | NYC | $80 | 290,000 |

| 3 | LiveOak Bank | 68 | 4% + $300 | $30k | 2008 | Wilmington, NC | $75 | 185,000 |

| 4 | Grasshopper | 39 | 2.25% | $25k | 2016 | NYC | $162 | 22,000 |

| 5 | Baselane | 28 | 4.00% | None | 2020 | NYC | $7 | 95,000 |

| 6 | Meow**** | 25 | 5%/4.3% | None | 2021 | NYC | $27 | 27000 |

| 7 | Zamp | 21 | 5.00% | $100k | 2022 | India | $25 | 6,000 |

| 8 | Mayfair | 16 | 4.35% | $2.5k | 2021 | SF | $14 | 15,000 |

Source: FintechLabs, Crunchbase, SimilarWeb, 10 April 2023

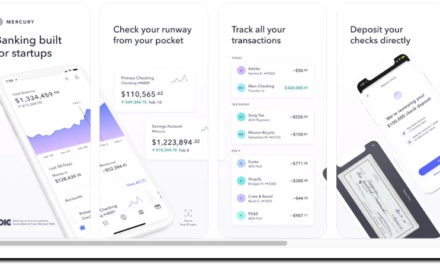

1. Mercury Technologies

FAB Score = 367 (unchanged since January 2023)

- HQ: San Francisco Bay Area

- Founded: 2017

- Banking service providers: Choice Financial Group and Evolve Bank & Trust

- Raised $152M (Crunchbase) including $120M in 2021

- Valuation: $1.7B (based on July 2021 round)

- Website visits: 1.5 million (Jan 2023; SimilarWeb) <<<< Most website traffic

- Employees: 400 (Pitchbook)

- Articles: 17 (Crunchbase)

- Linkedin: 20,700 followers (796 employees)

- iOS app: 4.8 (1,400 reviews)

- Trustpilot: 3.6 (550 reviews)

2. Lili

FAB Score = 92 (+2)

- HQ: NYC

- Founded: 2018

- Banking service provider: Choice Financial Group

- Raised $80M including $55M in 2021 (Crunchbase)

- Website visits: 290,000 (SimilarWeb, Jan 2023)

- Employees: 105 (Pitchbook)

- Articles: 17 (Crunchbase)

- Linkedin: 9,700 followers (113 employees)

- TikTok: 240,000 followers; 600,000 likes

- Trustpilot: 4.7 (1,818 reviews)

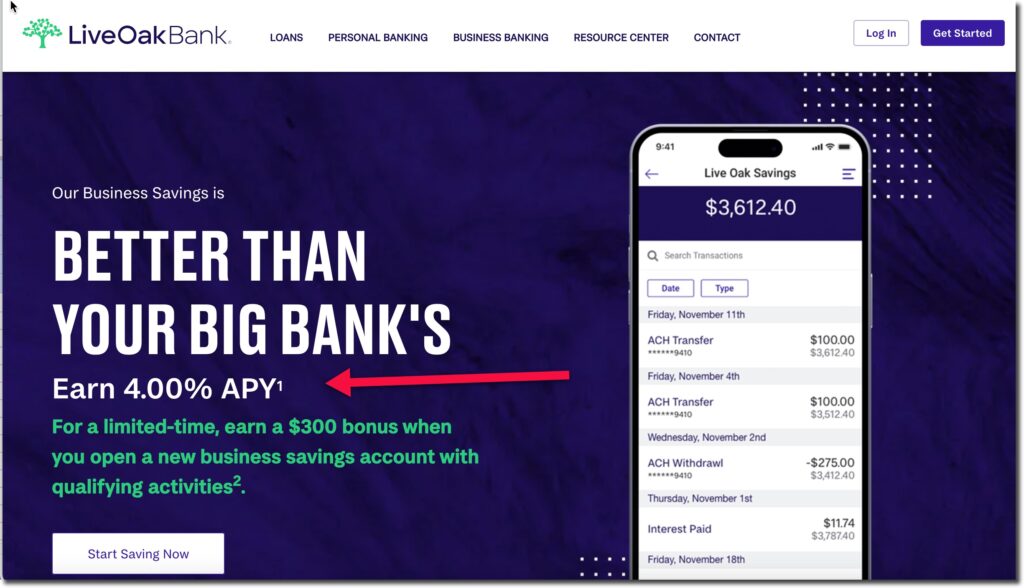

3. LiveOak Bank

FAB Score = 68 (NEW)

HQ: Wilmington, NC

Founded: 2008

Raised: $75 million (Crunchbase)

Valuation: $1.1B (Public; 11 April 2023)

Website visits: 185,000 (Similarweb, Mar 2023)

Employees: 886 (Pitchbook)

Articles: 2 (Crunchbase)

Linkedin: 16,300 followers (893 employees)

Trustpilot: NA (4 reviews)

4. Grasshopper Bank

FAB Score = 39 (down 1)

- HQ: NYC

- Founded: 2016

- Raised $162M including $30M Aug 2022 (Crunchbase)

- Assets: $620 million (12/31/22), 2.1x growth year over year (source: company)

- Deposits: $550 million (12/31/22), 2.2x growth year over year

- Loans: $450 million (12/31/22), 3.6x growth year over year

- Revenues: $17 million (2022), 2.4x growth year over year

- Website visits: 22,000 (SimilarWeb, Jan 2023)

- Employees: 101 (Pitchbook)

- Articles: 17 (Crunchbase)

- Linkedin: 15,800 followers (104 employees)

- Trustpilot: 2 reviews

5. Baselane

FAB Score: 28 (+3)

- HQ: NYC

- Founded: 2020

- Banking service provider: Blue Ridge Bank

- Raised: $7.9M in 2021 (Crunchbase)

- Employees: 26 (Linkedin)

- Articles: 5 (Crunchbase)

- Website visits: 95,000 (SimilarWeb, Jan 2023)

- Linkedin: 1,300 followers (26 employees)

6. Meow

- HQ: NYC

- Founded: 2021

- Banking service provider: Third Coast Bank

- Raised: $27 million (Crunchbase)

- Employees: 27 (Pitchbook)

- Website visits: 27,000 (SimilarWeb, Jan 2023)

- Linkedin: 3,000 followers (66 employees)

7. Zamp

FAB Score = 21

Top APY: 5.00% (5 April 2023)

Minimum Balance: $100k

Founded: 2022

HQ: India

Funding: $25M (Crunchbase)

Employees: 28 employees (Linkedin)

Website traffic: 6,000 (March 2023, SimilarWeb)

Linkedin: 2,200 followers (28 employees)

8. Mayfair

FAB Score = 16

Top APY: 4.35% (16 April 2023)

Minimum balance: $2.5k

Founded: 2021

HQ: San Francisco

Funding: $14M (Crunchbase)

Employees: 106 (Linkedin)

Website traffic: 15,000 (Mar 2023, SimilarWeb)

Articles: 1 (Crunchbase)

Linkedin: 7,800 followers (106 employees)

Notes:

* The FAB score, Fintech Attention Barometer, is a proxy for the overall size of a private company since they typically do not release traditional metrics (# customers, deposits, AUM, etc). The score is based on VC funding, website traffic, mobile downloads, and the number of employees. It’s a work in progress, so expect changes in the formula.

**APY: Rate advertised at the time of publishing. May require a minimum deposit as listed in the next column.

***Funding: Includes equity and debt funding per Crunchbase.

****Meow offers an FDIC insured product (rate on left) or direct investment in T-bills (rate on right)

Disclaimer:

Our business model depends on revenue from referrals and sponsors. When you see a referral link in the URL, we may earn a fee when a new account is started (thanks!). This can improve visibility on our website, but does not impact the company’s FAB score.

Savings

| FAB Score* | Founded | Funding $M | ||

|---|---|---|---|---|

| http://fintechlabs.com/wp-content/uploads/2021/12/Murcury-logo-square.jpg | 447 | SF | 2017 | $152 |

| http://fintechlabs.com/wp-content/uploads/2022/01/Novo-logo-square.jpg | 327 | NYC | 2016 | $296 |

| http://fintechlabs.com/wp-content/uploads/2023/05/BluevineLogo.png | 260 | SF | 2013 | 768 |

| http://fintechlabs.com/wp-content/uploads/2023/02/Found-logo-600-300.png | 123 | SF | 2019 | $75 |

| http://fintechlabs.com/wp-content/uploads/2023/02/Logo-1.png | 101 | SF | 2021 | 181 |

| Company Overview | FAB Score* | Founded | Funding $M | |

|---|---|---|---|---|

| Ad | 2007 | $120,000 | NYC |

| 488 | 2020 | $950 | NYC |

| 362 | 2008 | 2500 | Atlanta |

| 309 | 2015 | 699 | Toronto |

| 282 | 2013 | $768 | SF |

| Company | FAB Score* | Founded | Funding ($M) | |

|---|---|---|---|---|

| 1058 | 2019 | $1,660 | NYC |

| 460 | 2008 | $401 | SF |

| 205 | 2016 | $312 | |

| 200 | 2016 | $418 | Utah |

| 196 | 2019 | $368 | NYC |

| FAB Score* | Founded | Funding ($M) | ||

|---|---|---|---|---|

| 230 | 2016 | $881 | SF | |

| 122 | 2017 | $520 | SF |

| 80 | 2017 | $306 | Wash DC |

| 63 | 2005 | $0 | London |

| 39 | 2015 | $142 | SF |