The first pure-play online bank, Security First Network Bank (SFNB), launched in 1995, just a year after Amazon. But unlike ecommerce, digital-only banking was slow to catch on. The legacy banks (Wells Fargo, Bank of America, et al) maintained market share by providing digital services deemed “good enough” to retain customers loath to switch banks.

But that began changing in the mid-2010s, first in the UK, then elsewhere as well-financed digital players started making inroads with consumers. There was Monzo, Revolut, Starling, Nubank, Chime, just to name a few. But we still haven’t seen a breakout small business bank, partly because of the love/hate relationship business owners have with big banks.

In the adjacent SMB lending space (see our Top 30 Digital Lenders list), top brands such as Square (Block), Paypal, Amazon, Brex, and others have grabbed significant share. But there is not yet a place where small businesses flock to get deposit, payment, and financing needs met in a single interface.

So who are the best digital challenger business banks? Let’s start with our definition.

- Centered around deposit and debit/charge card services (eliminates Bluevine and most SMB lenders)

- Core business is small-business financial services (eliminates Paypal, Amazon, Block

- Primarily digitally delivered (rules out Wells Fargo, BofA, and the majority of traditional banks*)

- Founded in 2000 or later

Resources: Looking for digital banks, lenders, payment providers, insurance or digital accounting for small businesses? Check out our latest lists: Small Business (SMB) savings/treasury accounts (7) | SMB online lenders (33) | SMB challenger banks (15) | SMB insurers (15) | SMB credit cards/expense management (16) | Billpay & invoicing (16)| Payment processors (7) | SMB digital accounting/bookkeeping (21)

The FAB Score (Fintech Attention Barometer) is a proxy for the size and growth of fintech companies founded since 1999.

Leading Digital Small Business Banks (United States)

ranked by our FAB score (Fintech Attention Barometer**)

| Rank | Company | FAB** | Reviewed | Founded | HQ | Funding ($M***) | Visits (Jun’25) |

| 1 | Mercury | 634 | 15 Jul 25 | 2017 | SF | $452 | 2,300,000 |

| 2 | Relay | 198 | 15 Jul 25 | 2018 | Toronto | $52 | 880,000 |

| 3 | NOVO | 190 | 15 Jul 25 | 2016 | NYC | $296 | 510,000 |

| Ad* | Rho | 62 | 15 Jul 25 | 2018 | NYC | $205 | 150,000 |

| 4 | Found | 124 | 15 Jul 25 | 2019 | SF | $121 | 430,000 |

| 5 | Baselane | 74 | 15 Jul 25 | 2020 | NYC | $8 | 340,000 |

| 6 | Slash | 65 | 15 Jul 25 | 2020 | SF | $60 | 150,000 |

| 7 | Rho | 62 | 15 Jul 25 | 2018 | NYC | $205 | 150,000 |

| 8 | Lili | 46 | 15 Jul 25 | 2018 | NYC | $80 | 160,000 |

| 9 | Grasshopper | 42 | 15 Jul 25 | 2016 | NYC | $172 | 62,000 |

| 10 | Arc | 42 | 15 Jul 25 | 2021 | SF | $181 | 50,000 |

| 11 | Viably | 36 | 15 Jul 25 | 2021 | NC | $71 | 8,700 |

| 12 | NorthOne | 34 | 15 Jul 25 | 2016 | NYC | $90 | 100,000 |

| 13 | Every (NEW) | 30 | 15 Jul 25 | 2021 | SF | $32 | 40,000 |

| 14 | Meow | 19 | 15 Jul 25 | 2021 | NYC | $27 | 47,000 |

| 15 | ZilBank | 8 | 15 Jul 25 | 2021 | Dallas | $0 | 11,000 |

| 16 | Winden | 7 | 15 Jul 25 | 2021 | LA | $5.3 | 1,000 |

| 17 | Arival | 5 | 15 Jul 25 | 2018 | Miami, FL | $11 | 2,600 |

Sources: FintechLabs, Pitchbook, Crunchbase, SimilarWeb; 15 July 2025 (Employment and social data from June 2025)

*Our business model depends on revenue from referrals and sponsors. When you see a referral link in the URL, we may earn a fee for new accounts (thanks!). This can improve visibility on our website, but does not impact the company’s FAB score.

** The FAB score, Fintech Attention Barometer, is a proxy for the overall size of a private company since they typically do not release traditional metrics (# customers, deposits, AUM, etc). The score is based on VC funding, website traffic, mobile downloads, and the number of employees. It’s a work in progress, so expect changes in the formula.

***Funding is the amount invested into the company as either equity or debt.

Best Small Business New-Account Bonuses (United States)

ranked by BV (bonus value)*

| Company | Offer | BV (Bonus Value) | Product | Min Deposit | Min Days | Expires |

| Citibank | $2,000 | $1,260 | Checking | $200,000 | 45 | 7 Jul 25 |

| Citibank | $1,500 | $1,130 | Checking | $100,000 | 45 | 7 Jul 25 |

| Huntington Bank | $1,000 | $852 | Checking: Unlimited Plus | $20,000 | 90 | 19 Jun 25 |

| Citibank | $1,000 | $815 | Checking | $50,000 | 45 | 7 Jul 25 |

| PNC Bank | $1,000 | $778 | Treasury Management | $30,000 | 90 | 30 Jun 25 |

| M&T Bank | $1,500 | $760 | Checking | $100,000 | 90 | 30 Jun 25 |

| Associated Bank | $750 | $602 | Checking: Choice | $20,000 | 90 | 30 Jun 25 |

| BMO | $750 | $565 | Checking | $25,000 | 90 | 2 Sep 25 |

| M&T Bank | $750 | $528 | Checking | $30,000 | 90 | 30 Jun 25 |

| Central Bank | $500 | $478 | Checking | $3,000 | 90 | 31 Jul 25 |

| Chase | $500 | $475 | Checking | $10,000 | 30 | 6 Jul 25 |

| Citibank | $500 | $426 | Checking | $20,000 | 45 | 7 Jul 25 |

| M&T Bank | $500 | $389 | Checking | $15,000 | 90 | 30 Jun 25 |

| PNC Bank | $400 | $385 | Checking | $2,000 | 90 | 30 Jun 25 |

| Huntington Bank | $400 | $363 | Checking: Unlimited | $5,000 | 90 | 19 Jun 25 |

| Associated Bank | $400 | $363 | Checking: Balanced | $5,000 | 90 | 30 Jun 25 |

| BMO | $350 | $330 | Checking | $4,000 | 60 | 2 Sep 25 |

| Chase | $300 | $295 | Checking | $2,000 | 30 | 6 Jul 25 |

| Citibank | $300 | $282 | Checking | $5,000 | 45 | 7 Jul 25 |

| American Express | $300 | $275 | Checking | $5,000 | 60 | None |

| M&T Bank | $300 | $263 | Checking | $5,000 | 90 | 30 Jun 25 |

| Mercury | $250 | $249 | Checking | $10,000 | 1 | None |

| Axos Bank | $200 | $170 | Checking | $3,000 | 120 | 30 Sep 25 |

| Bank of America | $200 | $163 | Checking | $5,000 | 90 | 31 Dec 25 |

| Huntington Bank | $100 | $95 | Checking 100 | $2,000 | 30 | 10 Feb 25 |

| Associated Bank | $100 | $85 | Checking: Access | $2,000 | 90 | 30 Jun 25 |

| Axos Bank | $300 | $53 | Checking | $25,000 | 120 | 30 Sep 25 |

| Axos Bank | $400 | -$93 | Checking | $50,000 | 120 | 30 Sep 25 |

Source: FintechLabs, 9 June 2025 (all websites checked on June 9 from Seattle, with cookies enabled, and for Citibank, a 10010 zip code manually entered

*Bonus Value: We subtract 3% in potential foregone interest times the minimum time the initial deposit must stay in the account.

Challenger SMB Banks Currently Active in the United States

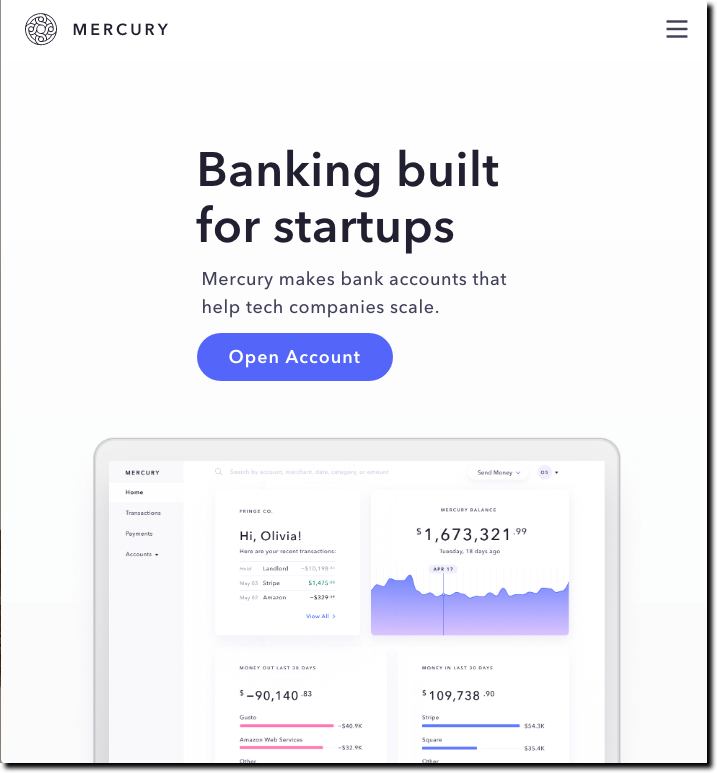

1. Mercury Technologies

FAB Score = 634 (down 20 from June ’25)

HQ: San Francisco Bay Area

Founded: 2017

Partner banks: Choice Financial Group, Evolve Bank & Trust, and a network of 20 banks to hold excess deposits; Patriot Bank (IO card issuer)

Traction

– More than 200,000 customers (Techcrunch, May 2024)

– Current run rate of $4B in payments per month (Techcrunch, May 2024); $50B processed in 2022, double the $23B in 2021

– Raised $452M (Crunchbase) including $300M in March 2025, $120M in 2021

– Valuation: $3.5B (FintechLabs)

– Website visits (June 2025): 2.3 million (SimilarWeb), 2.3M (SEMRush) <<<< Most website traffic

– Employees: 800 (Pitchbook) vs 999 in Feb; 882 Nov ’24 & Aug ’24; 728 in March ’24; 681 Jan ’24; 669 Aug ’23

Social

– LinkedIn 78,000 followers (1,220 employees vs 1,160 in May, 1,090 in Mar, 1,070 in Feb, 1,030 in Jan, 987 in Dec ’24, 952 Sep ’24, 806 May ’24)

– iOS app: 4.9 (7,600 reviews vs. 7,200 in May, 6,600 in Mar; 6,100 in Jan)

– Trustpilot: 4.2 (1,760 reviews vs 1,620 in May, 1,420 in Mar; 1,220 in Jan)

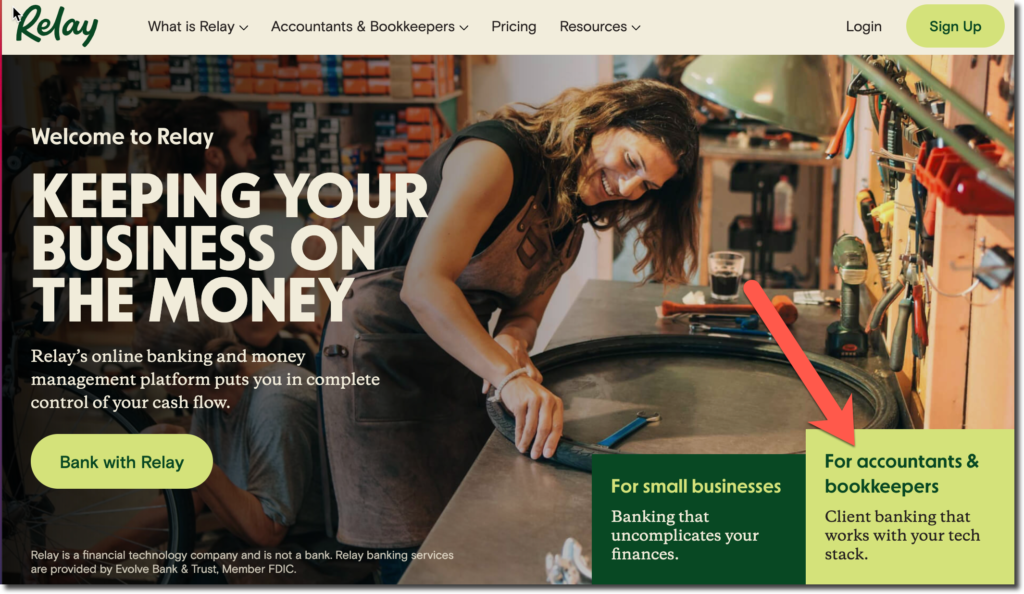

2. Relay

FAB Score: 198 (down 20)

– HQ: Toronto

– Founded: 2018

– Partner bank: Thread

Traction

– Raised $51.6 including $32M in 2024, $15M in 2021 (Crunchbase)

– Website visits: 880,000 SimilarWeb, 900,000 SEMrush (June 2025)

– Employees: 261 (Pitchbook), vs. 199 in Mar ’25 & July ’24; 152 in May ’24, 142 Feb ’24, 128 Nov ’23

Social

– LinkedIn: 13,000 followers (283 employees vs. 273 in May; 251 in Mar; 250 in Feb; 241 Jan; 236 Dec ’24; 201 Sep ’24; 197 June ’24)

– Trustpilot: 4.6 (2,560 reviews vs. 2,390 in May; 2,260 in Mar; 2,100 in Jan)

– iOS: 4.8 (2,100 reviews vs 2,000 in May; 1,900 in Mar; 1,700 in Dec ’24)

3. Novo

FAB Score: 190 (down 1)

HQ: NYC

Founded: 2016

Traction

– Raised $296M including $125M in Aug 2023, $125M in 2022, and $41M in 2021 (Crunchbase)

– Website visits (June 2025): 510,000 (SimilarWeb); 390,000 (SEMrush)

– Employees (Pitchbook): 411 vs 408 in May, 437 in Mar; 424 Sep ’24, 424 June ’24, 407 May ’24, 445 Mar ’24

– Integrations: Wise, Xero, Slack

Social

– LinkedIn: 41,000 followers (413 employees vs. 414 in May; 412 in Mar; 411 in Feb; 423 Jan; 437 Dec ’24; 441 Oct ’24; 433 Aug ’24; 393 Mar ’24)

– Industry awards: 4 (Novo)

– Trustpilot: 4.2 (4,340 reviews vs 4,330 in May; 4,280 in March; 4,210 in Jan)

– iOS app: 4.8 (18,600 reviews vs. 18,400 in May; 17,900 in Mar; 17,000 in Jan)

4. Found

FAB Score = 124 (down 2)

HQ: San Francisco Bay Area

Founded: 2019

BaaS partner: LendingClubBank

Traction:

– Raised $121M including $46M in June 2024; $60M in Feb 2022; $12.75M in 2021 (Crunchbase)

– Website visits (June 2025): 430,000 (SimilarWeb), 850,000 (SEMrush)

– Employees: 120 (Pitchbook) vs 117 in Mar; 115 Nov ’24, 93 Aug ’24, 95 October ’23

Social:

– LinkedIn: 7,000 followers (115 employees vs. 118 employees in May; 118 in Mar; 120 Feb; 116 Jan; 119 Dec ’24; 115 Sep ’24; 93 June ’24)

– Trustpilot: 4.5 (919 reviews vs. 851 in May; 789 in Mar; 669 in Jan)

– iOS: 4.8 (24,800 reviews vs 24,100 in May; 23,300 in Mar; 21,500 in Jan) <<<Most iOS reviews

5. Baselane

FAB Score: 74 (down 24)

HQ: NYC

Founded: 2020

Traction:

– Raised: $7.9M in 2021 (Crunchbase)

– Website visits (June 2025): 340,000 (SimilarWeb), 260,000 (SEMrush)

– Employees: 50 (Pitchbook) vs. 47 Mar; 44 Nov ’24; 41 Sep ’24; 36 May ’24; 36 Mar ’24; 31 Feb ’24; 29 Nov ’23

Social:

– LinkedIn 4,300 followers (54 employees vs. 53 in May; 48 in Mar; 46 Feb; 44 Dec ’24; 45 Sep ’24; 36 June ’24; 33 Jan ’24; 30 Nov ’23)

6. Slash

FAB Score = 65 (up 1)

HQ: SF

Founded: 2020

Traction:

– Raised: $60M including $41M in May 2025; $19M in 2023 (Crunchbase)

– Website visits (June 2025): 150,000 (Similarweb), 11,000 (SEMrush)

– Employees (Pitchbook): 35 vs 31 in May; 29 in Mar; 28 in Feb; 21 Nov ’24; 18 Sep ’24; 18 Jan ’24; 19 Nov ’23

Social:

– LinkedIn: 2,800 followers (38 employees vs 33 in May; 29 in Mar; 27 in Feb; 29 Jan; 25 Dec ’24; 21 Sep ’24; 20 Aug ’24; 17 Jan ’24; 8 Nov ’23)

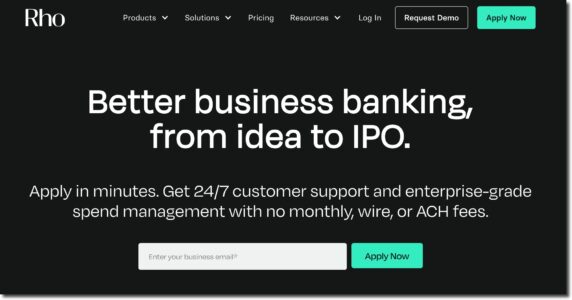

7. Rho

FAB Score = 62 (up 8)

HQ: NYC

Founded: 2018

Traction:

– Raised $205M (prior to 2022) (Crunchbase)

– Website visits (June 2025): 150,000 (SimilarWeb), 58,000 (SEMrush)

– Employees: 198 (Pitchbook), unchanged since Nov ’24; 200 in Dec 2023

Social:

– LinkedIn: 15,000 followers (259 employees vs. 244 in May; 225 in Mar; 212 Feb; 206 Jan; 205 Dec ’24; 212 Dec ’23)

– Trustpilot: 4.5 (43 reviews vs. 32 in May; 23 in Mar; 22 in Jan)

– G2: 4.8 scores (113 reviews unchanged since May; 111 in Mar & Dec ’24)

– iOS store: 4.8 score (38 reviews vs 37 in May through Dec ’24)

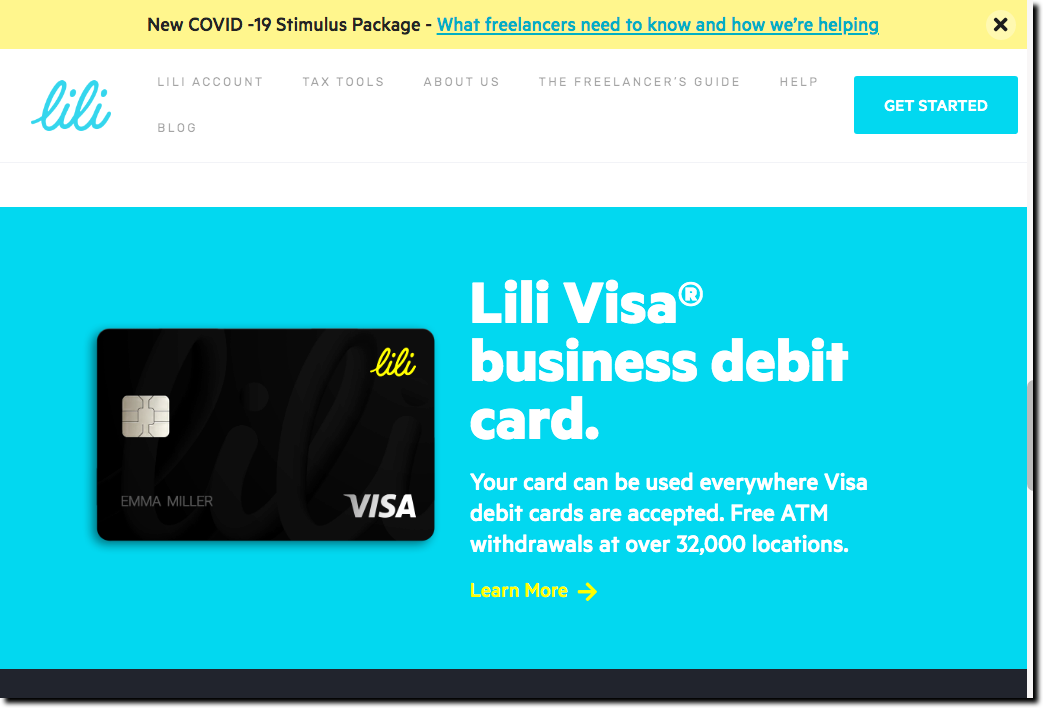

8. Lili

FAB Score = 46 (up 2)

HQ: NYC

Founded: 2018

Traction:

– Raised $80M including $55M in 2021 (Crunchbase)

– Website visits (June 2025): 160,000 (SimilarWeb), 140,000 (SEMrush)

– Employees (Pitchbook): 134 vs 128 in May; 110 in Mar; 89 Nov ’24; 88 Sep ’24 & June ’24; 105 May ’24; 105 Nov ’23

Social:

– LinkedIn: 16,000 followers (137 employees vs. 134 in May; 124 in Mar; 120 in Feb; 112 Jan; 105 Dec ’24; 90 Sep ’24 & June ’24; 68 Feb ’24; 341 Feb ’23)

– TikTok: 233,000 followers; 600,000 likes (unchanged for a year)

– Trustpilot: 4.7 (3,700 reviews vs. 3,640 in May; 3,580 in Mar; 3,470 in Jan)

9. Grasshopper Bank

FAB Score = 42 (unchanged)

HQ: NYC

Founded: 2016

Traction:

– Raised $172M including $10M in Jan 2024, $30M Aug 2022 (Crunchbase)

– Assets: $620 million (12/31/22), 2.1x growth year over year (source: company)

– Deposits: $550 million (12/31/22), 2.2x growth year over year

– Loans: $450 million (12/31/22), 3.6x growth year over year

– Revenues: $17 million (2022), 2.4x growth year over year

– Website visits (June 2025): 62,000 (SimilarWeb), 92,000 (SEMrush)

– Employees: 100 (Pitchbook), unchanged since Jan, vs 119 Nov ’24, 119 Feb ’24, 120 August ’23

Social:

– LinkedIn 27,000 followers (153 employees vs. 151 in May; 131 in Mar; 124 in Feb; 120 Jan; 117 Dec ’24; 119 Sep ’24 & June ’24 & Jan ’24; 117 Nov ’23)

– Trustpilot: 4.0 (255 vs 247 in May; 237 in Mar; 220 in Jan)

10. Arc

Fab Score = 42 (up 2)

HQ: SF

Founded: 2021

Banking services provider: Piermont Bank

Traction:

– Raised: $181M in 2022 (Crunchbase)

– Website visits (June 2025): 50,000 (SimilarWeb), 20,000 (SEMrush)

– Employees: 45 (Pitchbook) 29 vs 45 in May ’25 through Nov ’23

Social:

– LinkedIn 15,000 followers (240 employees vs 228 in May; 218 in Mar; 212 in Feb; 204 Jan; 64 June ’24; 48 Mar ’24; 18 Nov ’23)

11. Viably

FAB Score: 36 (up 1)

HQ: Charlotte, NC

Founded: 2016

Traction:

– Raised $71M including $50M (debt) in 2023 and $21M in 2022 (Crunchbase)

– Website visits (June 2025): 8,700 (SimilarWeb), 610 (SEMrush)

– Employees: 37 (Pitchbook), unchanged since Dec. ’24; vs 39 in Oct ’24; 36 Sep ’24; 34 May ’24; 34 Mar ’24; 31 Jan ’24; 34 Nov ’23

Social:

– LinkedIn: 1,600 followers (22 employees vs. 25 in May; 29 in Mar; 33 in Feb; 34 Jan; 38 Dec ’24; 38 Sep ’24; 35 May ’24; 35 Mar ’24; 31 Jan ’24; 32 Nov ’23)

– iOS app: NA

12. NorthOne

FAB Score: 34 (up 3)

HQ: NYC/Toronto

Founded: 2016

Traction:

– Raised $90M including $67M in Oct 2022 (Crunchbase)

– Website visits (June 2025): 100,000 (SimilarWeb), 160,000 (SEMrush)

– Employees (Pitchbook): 57 vs. 55 in May; 57 in Mar ’25 through Dec ’24; 61 Sep ’24 & May ’24; 62 Mar ’24; 63 August ’23

Social:

– LinkedIn 10,000 followers (55 employees vs. 54 in May through Mar; 56 in Feb; 57 in Jan; 57 Dec ’24; 62 Sep ’24; 63 May ’24, 63 Mar ’24; 60 Jan ’24; 62 Nov ’23)

– Trustpilot: 4.3 (246 reviews vs 247 in May; 248 in Mar; 212 in Jan)

– iOS app: 4.7 (2,800 reviews, unchanged since Dec ’24)

13. Every

FAB Score = 30 (up 1)

HQ: San Francisco

Founded: 2022

Traction:

– Funding: $32M including $22.5M in 2024, $9.5M in 2023 (Crunchbase)

– Employees: 20 (Pitchbook, unchanged since Jan)

– Website visits (June 2025): 40,000 (SimilarWeb), 24,000 (SEMrush)

Social:

– LinkedIn 6,000 followers (258 employees vs 241 in May; 211 in March, 193 in Feb, 166 in Jan, 137 in Dec ’24)

14. Meow

FAB Score: 19 (up 5)

– HQ: NYC

– Founded: 2021

– Banking service providers: FirstBank, Grasshopper Bank, Third Coast Bank

Traction

– Raised: $27 million including $22 million in 2022 (Crunchbase)

– Employees: 27 (Pitchbook), unchanged since Sep; 25 in May ’24 & Mar ’24; 27 in Nov ’23

– Website visits (June 2025): 47,000 (SimilarWeb); 19,000 (SEMrush)

– LinkedIn: 8,000 followers

15. Zilbank

FAB Score = 8 (unchanged)

HQ: Grand Rapids, MI

Founded: 2021

Traction:

– Funding: INA (Crunchbase)

– Employees: 5 (Linkedin)

– Website visits: 11,000 (SimilarWeb, May 2025), 950 (SEMrush, June 2025)

Social:

– LinkedIn 2,500 followers (5 employees, unchanged since Dec ’24 vs. 4 in July ’24, 6 in Jan ’24, 5 in Nov ’23)

16. Winden

FAB Score = 7 (down 2)

HQ: LA

Founded: 2021

Traction:

– Raised: $5.3M in 2022 (Crunchbase)

– Employees: 20 (Pitchbook), unchanged since August ’24

– Website visits (June 2025): 1,000 (SimilarWeb), 1,900 (SEMrush)

Social:

– LinkedIn 2,000 followers (8 employees unchanged since May; 7 in March & Feb; 8 in Jan, 6 in Dec ’24, 6 in Sep ’24, 13 in May ’24, 14 in Mar ’24)

– Trustpilot: No reviews

17. Arival

FAB score: 5 (unchanged)

HQ: Miami, FL

Founded: 2018

Traction:

– Raised: $10.8M including $5M in 2021 (Crunchbase)

– Website visits: 2,600 (Similarweb, May 2025), 2,500 (SEMrush, June 2025)

– Employees: 40 (Pitchbook), unchanged since Aug ’24 vs. 44 in July ’24, 44 in May ’24, 43 in Nov ’23

Social:

– Articles: 6 (Crunchbase)

– LinkedIn 15,000 followers (40 employees vs. 49 in Mar & Feb; 46 in Jan, 46 in Dec ’24, 47 Sep ’24, 44 in June ’24, 42 in Mar ’24, 42 in Nov ’23)

Other SMB checking accounts at companies whose core business is not SMB banking

Bluevine

FAB Score = 428

HQ: San Francisco

Founded: 2013

Traction

– Raised: $769M prior to 2021 (Crunchbase)

– Valuation: $1B+ (estimate)

– Website visits: 1.6 million (SimilarWeb, Jan 2025)

– Employees: 591 (Pitchbook), down 1 since Jan, down 27 since Sep ’24, down 15 since May ’24, up 7 since Mar ’24, up 13 since Nov ’23

– Articles: 133 (Crunchbase)

Social

– LinkedIn 60,000 followers (564 employees, down 29 since Jan, down 33 since Oct ’24, down 27 since Sep ’24, down 48 since June ’24, down 35 since Mar ’24, down 29 since Jan ’24, down 16 since Nov ’23)

– Trustpilot: 4.2 (8,350 reviews)

AngelList Banking

FAB Score = 187

HQ: San Francisco

Founded: 2010

Traction

– Raised: $170M including $144M in 2022 (Crunchbase)

– Valuation $4B

– Website visits: 580,000 (SimilarWeb, Jan 2025)

– Articles: 1,790 (Crunchbase)

Unlaunched or No Longer Listed

Guava (pivoted to community July 2024)

Fab Score = 4 (unchanged)

HQ: NYC

Founded 2018

Banking services provider: Piermont Bank

Traction:

– Raised: $3.1M including $650k in Feb 2023 (Crunchbase)

– Website visits: 1,500 (SimilarWeb, Nov 2024)

– Employees: 10 (Pitchbook), unchanged since August ’23

Social:

– LinkedIn: 2,000 followers (14 employees, down 2 since Oct, down 2 since Mar, down 1 since Feb, unchanged since Jan, down 3 since Nov ’23)

– Articles: None (Crunchbase)

Moves (CLOSED May 2024)

FAB Score: 11 (down 5)

HQ: Dover, DE

Traction:

– Raised: $6.6M including $4.8M in 2022 (Crunchbase)

– Website visits: 19,000 (Similarweb, Nov 2024)

– Employees: 17 (Pitchbook), unchanged since Mar, down 25 since Feb, down 28 since Nov

Social:

– Articles: 10 (Crunchbase)

– Linkedin: 2,000 followers (15 employees, unchanged since May, down 1 since Mar, down 9 since Feb, down 20 from Jan, down 29 since Nov ’23)

Lance (pivoted to Sequence spend management Sep 2023)

FAB Score: 7 (NEW)

HQ: NYC

Founded: 2018

Traction:

– Raised: $4.7M (Crunchbase)

– Website visits: <5,000 (Similarweb, Sep 2023)

– Employees: 31 (Pitchbook)

Social:

– Articles: 7 (Crunchbase)

– Linkedin: 1,200 followers (81 employees)

Vergo (pivoted to spend management for construction industry Sep 2023)

FAB Score = 10 (down 6)

HQ: NYC

Founded: 2021

Traction:

– Raised $4.2M including $4.1M in June 2022 (Crunchbase)

– Website visits: 16,000 (SimilarWeb, Nov 2024)

– Employees: 29 (Pitchbook)

Social:

– Articles: 3 (Crunchbase)

– Linkedin: 1,300 followers (25 employees, unchanged)

– Trustpilot: NA

LiveOak Bank (discontinued business checking Aug 2023)

FAB Score = 45 (down 6)

HQ: Wilmington, NC

Founded: 2008

Traction:

Raised: $152 million (Crunchbase)

Revenue (TTM): $392M (Yahoo)

Valuation: $1.4B (Public; 30 Aug 2023, up $100M since 14 July)

Website visits: 150,000 (Similarweb, Nov 2024)

Employees: 886 (Pitchbook), unchanged

Social:

Articles: 3 (Crunchbase)

Linkedin: 18,000 followers (915 employees, up 9 since May)

Trustpilot: 4.2 (70 reviews, up 37)

Oxygen (removed Feb 2023, because they appear to be more focused on consumers)

FAB Score = NA

– HQ: San Francisco Bay Area

– Founded: 2018

– Raised $45M including $20M in 2023 (Crunchbase)

– Website visits: 230,000 (SimilarWeb, Jan 2023)

– Employees: 92 (Pitchbook), down 5 since March

– Articles: 22 (Crunchbase)

– Linkedin: 5,700 followers (97 employees, up 2 since March)

– Trustpilot: 3.3 (192 reviews)

– iOS app: 4.8 (24,100 reviews)

Zifi (Zions Bank)

Pivoted to card processing provider (April 2023)

– HQ: Salt Lake City, UT

– Founded: 2022

– Raised: NA (unit of Zions Bank)

– Website visits: 24,000 (SEMrush, April 2023); 4,300 (SimilarWeb)

– Linkedin: 267 followers (12 employees, up 12 since March)

Challengers Closed to New Accounts

Nearside (formerly Hatch) (removed Feb 2023)

Note: Plastiq acquired Nearside in Nov ’22 for a reported $130M and is shutting down its banking services

FAB Score = 66 (down 2)

– HQ: SF

– Founded: 2018

– Raised $73M including $58M in 2021 (Crunchbase)

– Website visits: 8,000 (SimilarWeb, April 2023)

– Employees: 57 (Pitchbook), unchanged

– Articles: 5 (Crunchbase)

– Linkedin: 1,500 followers (24 employees, down 15 since March)

– TrustPilot: no reviews

– iOS: 4.3 (183 reviews)

Solid (was Wise) >> pivoted to Fintech as a Service in 2021

FAB Score: NA

– HQ: SF

– Founded: 2018

– Raised $18M prior to 2021 (Crunchbase)

– Website visits: 1.9 million (Mar 2022; SEMrush)

– Employees: 126 (Pitchbook)

– Articles: 4 (Crunchbase)

– Linkedin: 2,020 followers (56 employees)

Joust (acquired by ZenBusiness, 30 July 2020; currently referring customers to Radius Bank)

– Target: Freelancers

– HQ: Austin, TX

– Founded: 2017

– Raised: $11M (Crunchbase)

– Website visits: Unknown

– Employees: 18 (Pitchbook)

– Citations: 5 (Crunchbase)

– Twitter followers: 448

– Trustpilot: NA

– iOS: 4.1 (28 reviews)

Seed (Acquired by Cross River Bank currently closed to new customers)

– HQ: San Francisco Bay Area

– Founded: 2014

– Raised $5.2M (2015) (Crunchbase)

– App downloads (last 30 days): 425 (Apptopia)

– Website visits: 210 (May 2021; SEMrush)

– Number of employees: 12 (Pitchbook)

– Citations: 4 (Crunchbase)

– Twitter: 810 followers

Addendum: Other SMB/SME challenger banks around the world (not a definitive list):

UK

- Alicia Bank – Raised $147M in Nov 2021

- CountingUp

- Allca Bank — was CivilizedBank

- Redwood Bank

- Tide – Raised $195M (through Nov 2021)

- OakNorth – Raised $1B (through Nov 2021); first SMB banking unicorn

Germany

- Kontist – Raised $48 million (through Nov 2021)

- Penta – Raised $83 million (through Nov 2021)

Australia

- Judo(public)

- Volt

- Zeller – Raised A$50M in June 2021

France

Rest of world

- Holvi – Finland: Acquired by BBVA March 2016

- Juni – Sweden: Serving ecommerce companies. Raised $21.5M A-round July 2021

- Tochka – Russia