Small business owners often have a love/hate relationship with their banks and financial providers. When I looked for data to support that claim, I was surprised to see the JD Powers research that concluded small businesses were pretty happy with their banks last year. But remember, banks were facilitating a bunch of money giveaways in the form of government-backed PPP grants during 2020/2021. That helped drive satisfaction to an all-time high, measured as “83%” (whatever that means) per JD Powers. That sounds pretty good, but I think we all know that doesn’t capture the very real small business frustrations with their finances.

For example, I’m on the board of 15-unit cooperative condo hotel. Financial services, primarily credit card processing and insurance, are the biggest ongoing expense items by far (not counting labor). We couldn’t run the business without them (love) and 99+% of the time they work seamlessly (love). However, when we do have problems, it seems like we can barely get anyone’s attention since they know we are locked in (hate). It’s also difficult to even understand if the prices we pay are competitive since it’s so hard to switch or price-shop complex products such as commercial hotel insurance (hate). And some of the services (specifically the ACH payment module), look like they haven’t changed since they launched 20 years ago and is practically unusable at first (hate).

That’s 3 hates vs. 2 likes. Not enough bad mojo to switch banks, but also an overall impression that leads to pretty shabby net promotor scores. That’s why banks pay massive bonuses for new accounts (in April, Wells Fargo offered us $1,500 to open a new checking account with no spending requirements and a modest minimum balance, something like $5k).

If you are a bank, how do you go about changing this love/hate dynamic:

- Provide a dedicated point of contact (e.g., business banker).

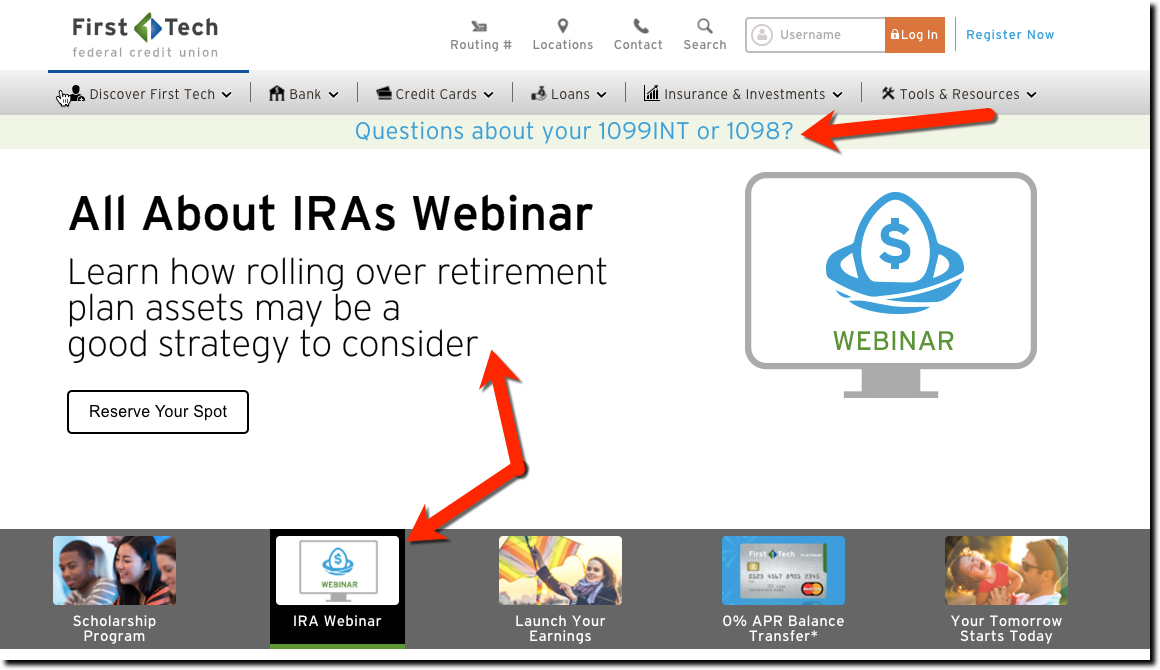

In the JD Powers, this one feature correlated with a 10% higher satisfaction score. And in my example, if I felt there was someone looking out for my interests, it would change the balance of my relationship from 60% hate to 60% like. Night and day in terms of net promoter. - Do an annual UX audit with real customers; then communicate about shortcomings and fixes:

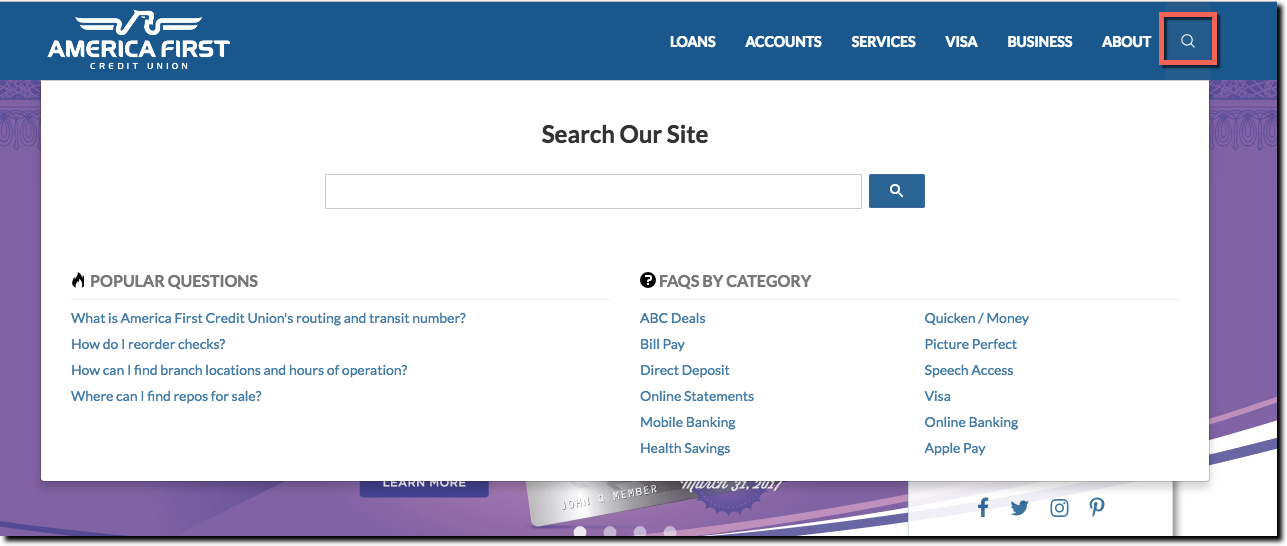

Find out what the irritation points are in your digital banking. Even if you can’t afford to fix them right away (case in point, the horrid ACH module mentioned above), you could at least communicate with customers about how to use the feature more effectively, workarounds for better flow, or even an apology for an outdated UX. Knowing the bank recognizes your frustration has plans to eventually improve can go a long way in easing or even changing the “hate” score. - Invite SMB customers to compare prices

You don’t see this often, but the best companies don’t mind if customers compare prices. Because even if you are premium priced, your superior bundle of services will likely be perceived as the optimal choice for the vast majority of clients. Just the fact that you are so confident instills customer perceptions that you price fairly. You probably won’t make cost a “love” but taking it out of the “hate” category is just as important.

Note: Image licensed from iStockphoto