Last week we highlighted Icon, one of our favorite early-stage startups at FinovateFall. This week we look at Monit, a Boston-based startup innovating in our favorite sector, small biz banking. And it has a unique pedigree, originating within Eastern Bank, which earlier spun out Numerated (2017). Numerated has done well, successfully raising a $15M Series B a year ago bringing total funding to $32M (implying a valuation in 9-figures). A nice gain on paper for Eastern’s 25% initial stake.

Can Eastern do it again with Monit? They are off to a great start. Monit officially launched just a year ago (August 2019) and is rumored to already be closing in on $1M in recurring revenues, which would likey value it at $10M to $20M+ in today’s frothy fintech environment (depending on how much of that revenue is from its benefactor Eastern Bank, which holds an undisclosed stake). The company is currently raising money from several VCs as well as from strategic partners, including additional banks.

Monit provides cash-flow projections and financial monitoring for SMBs using Quickbooks. But its vision is much bigger, hoping to provide a virtual CFO that highlights pertinent financial info from any major accounting system. It plans to primarily distribute through partners, initially financial institutions as well as other companies in the SMB financial management space. However, small businesses can sign-up directly, though the landing page to do so is not even mentioned on Monit’s homepage. The startup has a PPP loan forgiveness tool that’s especially important to businesses participating in this year’s PPP loan program.

Monit tries to keep its pricing simple with a flat-price model, generally in the six-figure range annually, that allows a bank to offer it to its entire customer base (or even prospects) without incurring additional per-client charges. A

How it works

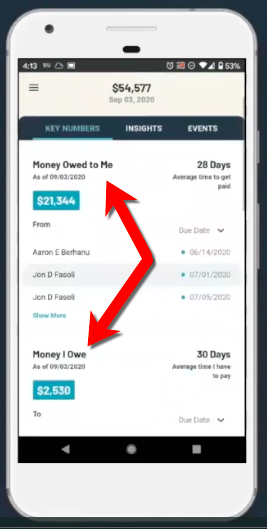

Customers hook Monit to their accounting software (currently limited to QuickBooks online) and

- Monit uses plain English descriptions to show biz owners “Money Owed to Me” and “Money I Owe”.

- Integrated overdue invoice followup via email

- PPP module this spring, which now includes a nifty “PPP forgiveness” piece.

More benefits below:

FI Opportunities:

- Great value-add to differentiate your business online/mobile banking

- Could serve as the cornerstone of fee-based premium account for SMBs

- Have a dedicated (white-labeled) financial companion available within weeks

- Fully integrated (single-sign-on) option

- Provides a PPP loan forgiveness tool (PR benefits, though only for Quickbooks users)

Funding: $750k per Crunchbase (as Signal Financial Technology)

Business model: Primarily B2B2C. The company is hoping to deliver to SMBs indirectly through partner FIs. However, they are testing direct sales and currently have a “lifetime free” offer at monit.io/free.

Number of employees: 8 shown on website and including contractors, the company currently has 10-12 FTEs

Co-founders:

- Steve Dow, CEO; Formerly Webster Bank, First Marblehead (LinkedIn)

- Sean Collins, Dev Head; Formerly founder at Cinch Financial (Linkedin)

Resources:

- Website, Twitter (5 tweets, 12 followers)

- Finovate Monit archives

- Finovate Best of Show post

- American Banker article (17 Sep 2020)

- Monit landing page at Eastern Bank

- Monit presentation summary for Finovate attendees (PDF)

- Monit canned demo (below)