Wells Fargo announced its Greenhouse mobile bank/app in late 2017 (press release). The bank began limited trials a year later and is expected to make it available nationwide by the end of this year. It’s similar to Chase’s ill-fated Finn, in that it’s trying to be a PFM-first experience (see note 1). But unlike Finn, Greenhouse customers are clearly part of Wells Fargo, though the reverse isn’t necessarily true so far.

Perhaps because it’s in a limited trial, the app is NOT currently visible within Wells Fargo’s main website, even after setting a location in an area where the trial is active. It’s not listed on any product page, but a Greenhouse landing page is discoverable via site search (or Google search). Also, Wells Fargo was advertising Greenhouse (2 July 2019) within the iPhone’s app store (when searching “Wells Fargo”, see inset).

Since Seattle is in the trial area of Greenhouse, and the bank was offering a $50 signup bonus (see note 2), I decided to risk another credit inquiry and start an account. It’s been a while since I’ve opened a new bank account, and unlike most of the previous several dozen, I was looking forward to my first seamless onboarding experience.

Unfortunately, I’ll have to wait a bit longer.

The application and approval worked well. However, the process was interrupted before I set up a username and password. When I went back to finish, the application had timed out and I was unable to complete the set-up because I didn’t have the account number. And since I was locked out of the new account, there was no way to find that. So I had to wait for a week for my ATM card and PIN number to arrive a week later by mail.

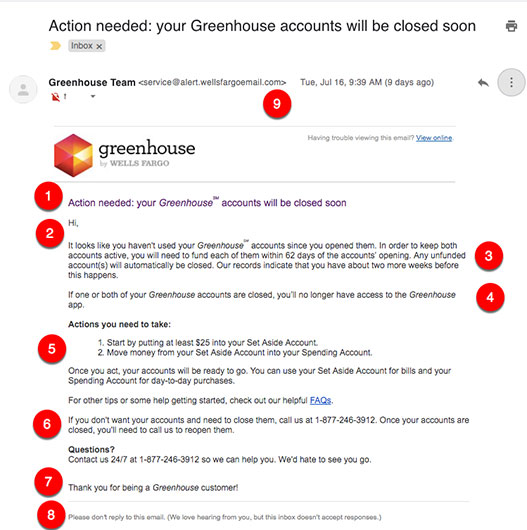

In the meantime, Wells Fargo sent me an email threatening to terminate my account for inactivity (see below). WTF WF! this is no way to treat a new customer. It also demonstrates the UX disconnect often found at large enterprises. No one is able to design the ENTIRE process from end to end. There are just too many departments to coordinate with and compromises must be made or nothing would ever get done.

In the meantime, Wells Fargo sent me an email threatening to terminate my account for inactivity (see below). WTF WF! this is no way to treat a new customer. It also demonstrates the UX disconnect often found at large enterprises. No one is able to design the ENTIRE process from end to end. There are just too many departments to coordinate with and compromises must be made or nothing would ever get done.

Anyway, I finally logged in yesterday and I was surprised by the UI mess I found, especially 2 years into its development. I LOVE what the bank is trying to do, but so far the execution is lacking. PNC’s Virtual Wallet has used a similar spend/save/reserve paradigm for a decade and it shouldn’t be that hard to reverse engineer what’s working there. I will cut the bank some slack and assume that they will shore up the UI issues prior to the national roll-out (ahem, email me if you need help). Otherwise, Wells Fargo is going to find that its app uptake isn’t what they hoped, and Greenhouse could quickly go the way of Finn.

We’ll look at the UI issues in Part 2 of this post next week. — Jim

Exhibit: Email from Wells Fargo Greenhouse notifying me of upcoming account closure (16 July 2019)

- Clear heading, but not very customer friendly for someone who had opened an account 2 weeks earlier AND already funded it with $50.

- Not personalized

- Confusing. I put $50 in why are they saying they are “Unfunded”

- More confusion, but after reading this a few times, I’m finally figuring it out. With Greenhouse, you automatically get two accounts, but since the funding process only puts money into one of them, the other is technically unfunded and subject to closure. And apparently, if one of the two accounts is closed, I can no longer use Greenhouse. Yikes.

- Still more confusion. These 2 steps are apparently not personalized for me. I’ve already done #1, but apparently, they are trying to get me to do step 2.

- Interesting that the primary call to action is for me to call and close my accounts.

- Thank you seems a little sarcastic after #6. And it’s not personalized.

- You cannot reply to the email. And there is no other email or text message address listed.

- Small issue: This email address looks vaguely suspicious.

Notes:

- PFM stands for personal financial management. And by “PFM first” we mean it tries to guide users into good financial habits rather than relying on the DIY experience of most mobile banking.

- This is another smaller UX issue, there were several activity thresholds to meet to earn the $50. During onboarding, there is no reminder of what those were, but I was able to go back and find the offer on the WF site to refresh my memory. Within the first 60 days, new customers must make at least 7 qualifying transactions which include debit/Zelle payments of at least $5 each and/or bill payments of at least $25 each.