The first pure-play online bank, Security First Network Bank (SFNB), launched in 1995, just a year after Amazon. But unlike ecommerce, digital-only banking was slow to catch on. The legacy banks (Wells Fargo, Bank of America, et al) maintained market share by providing digital services deemed “good enough” to retain customers loath to switch banks.

But that began changing in the mid-2010s, first in the UK, then elsewhere as well-financed digital players started making inroads with consumers. There was Monzo, Revolut, Starling, Nubank, Chime, just to name a few. But we still haven’t seen a breakout small business bank, partly because of the love/hate relationship business owners have with big banks.

In the adjacent SMB lending space (see our Top 30 Digital Lenders list), top brands such as Square (Block), Paypal, Amazon, Brex, and others have grabbed significant share. But there is not yet a place where small businesses flock to get deposit, payment, and financing needs met in a single interface.

So who are the best digital challenger business banks? Let’s start with our definition:

- Centered around deposit and debit/charge card services (eliminates Bluevine and most SMB lenders)

- Core business is small-business financial services (eliminates Paypal, Amazon, Block

- Primarily digitally delivered (rules out Wells Fargo, BofA, and the majority of traditional banks)

- Founded in 2000 or later

Resources: Looking for digital banks, lenders, payment providers, insurance or digital accounting for small businesses? Check out our latest lists: Small Business (SMB) savings/treasury accounts (7) | SMB online lenders (33) | SMB challenger banks (15) | SMB insurers (15) | SMB credit cards/expense management (16) | Billpay & invoicing (16)| Payment processors (7) | SMB digital accounting/bookkeeping (21)

The FAB Score (Fintech Attention Barometer) is a proxy for the size and growth of fintech companies founded since 1999.

Leading Digital Small Business Banking Providers (United States)

Ranked by our FAB score (Fintech Attention Barometer**)

| Rank | Company | FAB** | Reviewed | Founded | HQ | Funding ($M***) | Visits (Jan’26) |

| 1 | Mercury | 824 | 8 Jan 26 | 2017 | SF | $452 | 3,250,000 |

| 2 | Relay | 262 | 8 Jan 26 | 2018 | Toronto | $52 | 1,200,000 |

| Ad* | U.S. Bank | NA | 8 Jan 26 | 1863 | Minneapolis | NA | 29,000,000 |

| Ad* | Rho | 90 | 8 Jan 26 | 2018 | NYC | $205 | 290,000 |

| 3 | NOVO | 233 | 8 Jan 26 | 2016 | NYC | $317 | 710,000 |

| 4 | Found | 158 | 8 Jan 26 | 2019 | SF | $121 | 600,000 |

| 5 | Slash | 125 | 8 Jan 26 | 2020 | SF | $60 | 450,000 |

| 6 | Baselane | 117 | 8 Jan 26 | 2020 | NYC | $42 | 470,000 |

| 7 | Rho | 90 | 8 Jan 26 | 2018 | NYC | $205 | 290,000 |

| 8 | Grasshopper | 74 | 8 Jan 26 | 2016 | NYC | $219 | 110,000 |

| 9 | Lili | 48 | 8 Jan 26 | 2018 | NYC | $80 | 170,000 |

| 10 | Arc | 44 | 8 Jan 26 | 2021 | SF | $181 | 62,000 |

| 11 | Every | 40 | 8 Jan 26 | 2021 | SF | $32 | 91,000 |

| 12 | Viably | 36 | 8 Jan 26 | 2021 | NC | $71 | 9,600 |

| 13 | NorthOne | 27 | 8 Jan 26 | 2016 | NYC | $90 | 63,000 |

| 14 | Meow | 21 | 8 Jan 26 | 2021 | NYC | $27 | 55,000 |

| 15 | ZilBank | 10 | 8 Jan 26 | 2021 | Dallas | $0 | 19,000 |

| 16 | Arival | 8 | 8 Jan 26 | 2018 | Miami, FL | $11 | 18,000 |

Sources: FintechLabs, Pitchbook, Crunchbase, SimilarWeb; 9 Feb2026 (traffic and funding data); all other data as of 15 Oct 2025

*Our business model depends on revenue from referrals and sponsors. When you see a referral link in the URL, we may earn a fee for new accounts (thanks!). This can improve visibility on our website, but does not impact the company’s FAB score.

** The FAB score, Fintech Attention Barometer, is a proxy for the overall size of a private company since they typically do not release traditional metrics (# customers, deposits, AUM, etc). The score is based on VC funding, website traffic, mobile downloads, and the number of employees. It’s a work in progress, so expect changes in the formula.

***Funding is the amount invested into the company as either equity or debt.

****Financial technology companies, NOT banks. Refer to their summaries below for more info.

Challenger SMB Banks Currently Active in the United States

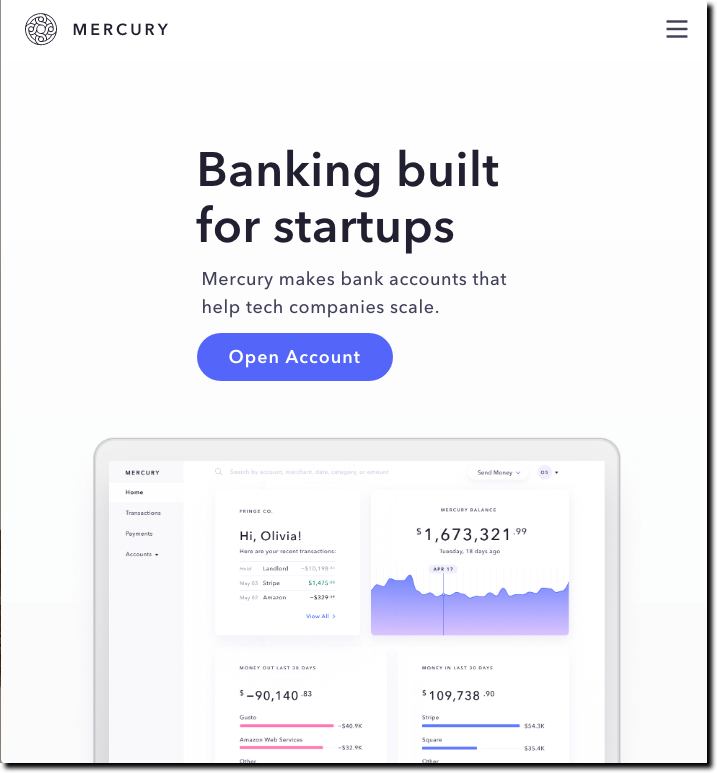

1. Mercury Technologies

FAB Score = 924 (up 50 from Jan ’26)

HQ: San Francisco Bay Area

Founded: 2017

Partner banks: Choice Financial Group, Evolve Bank & Trust, and a network of 20 banks to hold excess deposits; Patriot Bank (IO card issuer)

Traction

– More than 200,000 customers (Techcrunch, May 2024)

– Current run rate of $4B in payments per month (Techcrunch, May 2024); $50B processed in 2022, double the $23B in 2021

– Raised $452M (Crunchbase) including $300M in March 2025, $120M in 2021

– Valuation: $4.2B (FintechLabs)

– Website visits (Jan 2026): 3.25 million (SimilarWeb), 2.8M (SEMRush) <<<< Most website traffic

– Employees: 800 (Pitchbook) in Sep. vs 999 in Feb; 882 Nov ’24 & Aug ’24; 728 in March ’24; 681 Jan ’24; 669 Aug ’23

Social

– LinkedIn 86,000 followers (1,310 employees vs. 1,220 in June, 1,090 in Mar, 1,070 in Feb, 1,030 in Jan, 987 in Dec ’24, 952 Sep ’24, 806 May ’24)

– iOS app: 4.9 (8,400 reviews vs. 7,600 reviews in June; 6,600 in Mar; 6,100 in Jan)

– Trustpilot: 4.2 (2,030 reviws vs. 1,760 in June; 1,420 in Mar; 1,220 in Jan)

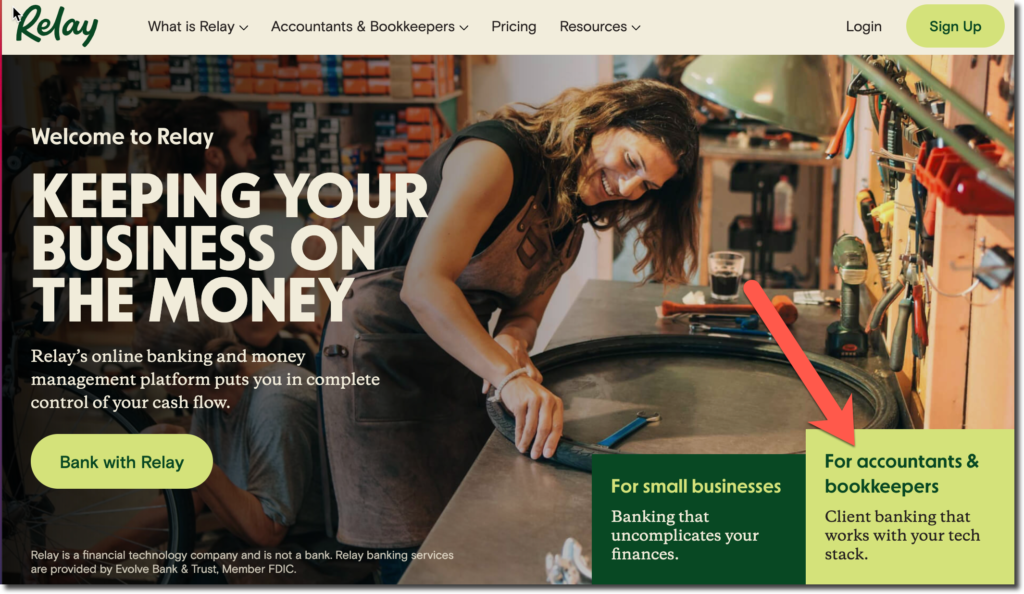

2. Relay

FAB Score: 262 (up 20)

– HQ: Toronto

– Founded: 2018

– Partner bank: Thread

Traction

– Raised $51.6 including $32M in 2024, $15M in 2021 (Crunchbase)

– Website visits (Jan 2026): 1.2M SimilarWeb; 970,000 SEMrush

– Employees (Pitchbook): 301 vs 261 in June; 199 in Mar ’25 & July ’24; 152 in May ’24, 142 Feb ’24, 128 Nov ’23

Social

– LinkedIn: 15,000 followers (305 employees vs. 283 in June; 251 in Mar; 250 in Feb; 241 Jan; 236 Dec ’24; 201 Sep ’24; 197 June ’24)

– Trustpilot: 4.6 (2,800 reviews vs 2,560 reviews in June; 2,260 in Mar; 2,100 in Jan)

– iOS: 4.8 (2,300 reviews vs. 2,100 reviews in June; 1,900 in Mar; 1,700 in Dec ’24)

3. Novo

FAB Score: 233 (up 19)

HQ: NYC

Founded: 2016

Traction

– Raised $317M including $125M in Aug 2023, $125M in 2022, and $41M in 2021 (Crunchbase)

– Website visits (Jan 2026): 710,000 (SimilarWeb); 480,000 (SEMrush)

– Employees (Pitchbook): 406 vs. 411 in June; 437 in Mar; 424 Sep ’24, 424 June ’24, 407 May ’24, 445 Mar ’24

– Integrations: Wise, Xero, Slack

Social

– LinkedIn: 42,000 followers (406 employees vs. 413 in June; 412 in Mar; 411 in Feb; 423 Jan; 437 Dec ’24; 441 Oct ’24; 433 Aug ’24; 393 Mar ’24)

– Industry awards: 4 (Novo)

– Trustpilot: 4.1 (4,350 reviews vs. 4,340 reviews in June; 4,280 in March; 4,210 in Jan)

– iOS app: 4.8 (19,300 reviews vs. 18,600 in June; 17,900 in Mar; 17,000 in Jan)

4. Found*

FAB Score = 158 (down 24)

HQ: San Francisco Bay Area

Founded: 2019

BaaS partner: Lead Bank*

Traction:

– Raised $121M including $46M in June 2024; $60M in Feb 2022; $12.75M in 2021 (Crunchbase)

– Website visits (Jan 2026): 600,000 (SimilarWeb), 1.0M (SEMrush)

– Employees (Pitchbook): 115 vs. 120 in June; 117 in Mar; 115 Nov ’24, 93 Aug ’24, 95 October ’23

Social:

– LinkedIn: 7,000 followers (116 employeees vs. 115 in June; 118 in Mar; 120 Feb; 116 Jan; 119 Dec ’24; 115 Sep ’24; 93 June ’24)

– Trustpilot: 4.5 (1,020 reviews vs. 919 in June; 789 in Mar; 669 in Jan)

– iOS: 4.8 (26,200 reviews vs. 24,800 in June; 23,300 in Mar; 21,500 in Jan) <<<Most iOS reviews

*Found is a financial technology company, not a bank. Business banking services are provided by Lead Bank, Member FDIC

5. Slash

FAB Score = 125 (up 4)

HQ: SF

Founded: 2020

Traction:

– Raised: $60M including $41M in May 2025; $19M in 2023 (Crunchbase)

– Website visits (Jan 2026): 450,000 (Similarweb), 4,600 (SEMrush)

– Employees (Pitchbook): 40 vs. 35 in June; 31 in May; 29 in Mar; 28 in Feb; 21 Nov ’24; 18 Sep ’24; 18 Jan ’24; 19 Nov ’23

Social:

– LinkedIn: 4,600 followers (42 employees vs 38 in June; 29 in Mar; 27 in Feb; 29 Jan; 25 Dec ’24; 21 Sep ’24; 20 Aug ’24; 17 Jan ’24; 8 Nov ’23)

6. Baselane

FAB Score: 117 (up 28)

HQ: NYC

Founded: 2020

Traction:

– Raised: $42.3M including $34.4M in Oct 2025; $7.9M in 2021 (Crunchbase)

– Website visits (Jan 2026): 470,000 (SimilarWeb), 230,000 (SEMrush)

– Employees (Pitchbook): 57 vs. 50 in June; 47 Mar; 44 Nov ’24; 41 Sep ’24; 36 May ’24; 36 Mar ’24; 31 Feb ’24; 29 Nov ’23

Social:

– LinkedIn 4,600 followers (57 employees vs. 54 in June; 48 in Mar; 46 Feb; 44 Dec ’24; 45 Sep ’24; 36 June ’24; 33 Jan ’24; 30 Nov ’23)

7. Rho*

FAB Score = 90 (up 8)

HQ: NYC

Founded: 2018

Traction:

– Raised $205M (prior to 2022) (Crunchbase)

– Website visits (Jan 2026): 290,000 (SimilarWeb), 96,000 (SEMrush)

– Employees: 198 (Pitchbook), unchanged since Nov ’24; 200 in Dec 2023

Social:

– LinkedIn: 18,000 followers (288 employees vs. 259 in June; 225 in Mar; 212 Feb; 206 Jan; 205 Dec ’24; 212 Dec ’23)

– Trustpilot: 4.4 (46 reviews vs. 43 in June; 23 in Mar; 22 in Jan)

– G2: 4.8 scores (114 reviews vs 113 in June; 111 in Mar & Dec ’24)

– iOS store: 4.8 score (39 reviews vs. 38 in June through Dec ’24)

* Rho is a financial technology company, NOT a bank.

8. Grasshopper Bank (acquired by Enova for $369 million Dec 2025)

FAB Score = 74 (up 2)

HQ: NYC

Founded: 2016

Traction:

– Raised $219M including $46.6M in Aug 2025, $10M in Jan 2024, $30M Aug 2022 (Crunchbase)

– Assets: $620 million (12/31/22), 2.1x growth year over year (source: company)

– Deposits: $550 million (12/31/22), 2.2x growth year over year

– Loans: $450 million (12/31/22), 3.6x growth year over year

– Revenues: $17 million (2022), 2.4x growth year over year

– Website visits (Jan 2026): 110,000 (SimilarWeb), 69,000 (SEMrush)

– Employees (Pitchbook): 100 unchanged since Jan ’25, vs 119 Nov ’24, 119 Feb ’24, 120 August ’23

Social:

– LinkedIn 28,000 followers (159 employees vs. 153 in June; 131 in Mar; 124 in Feb; 120 Jan; 117 Dec ’24; 119 Sep ’24 & June ’24 & Jan ’24; 117 Nov ’23)

– Trustpilot: 3.8 (281 reviews vs. 255 in June; 237 in Mar; 220 in Jan)

9. Lili

FAB Score = 48 (up 4)

HQ: NYC

Founded: 2018

Traction:

– Raised $80M, most recently $55M in 2021 (Crunchbase)

– Website visits (Jan 2026): 170,000 (SimilarWeb), 200,000 (SEMrush)

– Employees (Pitchbook): 142 vs. 134 in June; 110 in Mar; 89 Nov ’24; 88 Sep ’24 & June ’24; 105 May ’24; 105 Nov ’23

Social:

– LinkedIn: 16,000 followers (151 employees vs. 137 in June; 124 in Mar; 120 in Feb; 112 Jan; 105 Dec ’24; 90 Sep ’24 & June ’24; 68 Feb ’24; 341 Feb ’23)

– TikTok: 232,000 followers; 600,000 likes (unchanged for a year)

– Trustpilot: 4.7 (3,820 reviews vs. 3,700 in June; 3,580 in Mar; 3,470 in Jan)

10. Arc

Fab Score = 44 (up 3)

HQ: SF

Founded: 2021

Banking services provider: Piermont Bank

Traction:

– Raised: $181M in 2022 (Crunchbase)

– Website visits (Jan 2026): 62,000 (SimilarWeb), 13,000 (SEMrush)

– Employees (Pitchbook): 29 unchanged from June; vs 45 in May ’25 through Nov ’23

Social:

– LinkedIn 16,000 followers (242 employees vs. 240 in June; 218 in Mar; 212 in Feb; 204 Jan; 64 June ’24; 48 Mar ’24; 18 Nov ’23)

11. Viably

FAB Score: 44 (up 8)

HQ: Charlotte, NC

Founded: 2016

Traction:

– Raised $71M including $50M (debt) in 2023 and $21M in 2022 (Crunchbase)

– Website visits (Jan 2026): 9,600 (SimilarWeb), 5,200 (SEMrush)

– Employees (Pitchbook) 37, unchanged since Dec. ’24; vs 39 in Oct ’24; 36 Sep ’24; 34 May ’24; 34 Mar ’24; 31 Jan ’24; 34 Nov ’23

Social:

– LinkedIn: 1,600 followers (19 employees vs. 22 in June; 29 in Mar; 33 in Feb; 34 Jan; 38 Dec ’24; 38 Sep ’24; 35 May ’24; 35 Mar ’24; 31 Jan ’24; 32 Nov ’23)

– iOS app: NA

12. Every

FAB Score = 40 (up 5)

HQ: San Francisco

Founded: 2022

Traction:

– Funding: $32M, most recently $22.5M in 2024 and $9.5M in 2023 (Crunchbase)

– Employees: 20 (Pitchbook, unchanged since Jan)

– Website visits (Jan 2026): 91,000 (SimilarWeb), 29,000 (SEMrush)

Social:

– LinkedIn 7,000 followers (316 employees vs. 258 in June; 211 in March, 193 in Feb, 166 in Jan, 137 in Dec ’24)

13. NorthOne

FAB Score: 27 (down 7)

HQ: NYC/Toronto

Founded: 2016

Traction:

– Raised $90M, most recently $67M in Oct 2022 (Crunchbase)

– Website visits (Jan 2026): 63,000 (SimilarWeb), 130,000 (SEMrush)

– Employees (Pitchbook): 57, unchanged from June; vs. 55 in May; 57 in Mar ’25 through Dec ’24; 61 Sep ’24 & May ’24; 62 Mar ’24; 63 August ’23

Social:

– LinkedIn 11,000 followers (60 employees vs. 55 in June; 54 Mar; 56 in Feb; 57 in Jan; 57 Dec ’24; 62 Sep ’24; 63 May ’24, 63 Mar ’24; 60 Jan ’24; 62 Nov ’23)

– Trustpilot: 4.3 (268 reviews vs. 246 in June; 248 in Mar; 212 in Jan)

– iOS app: 4.7 (2,800 reviews, unchanged since Dec ’24)

14. Meow

FAB Score: 21 (down 3)

– HQ: NYC

– Founded: 2021

– Banking service providers: FirstBank, Grasshopper Bank, Third Coast Bank

Traction

– Raised: $27 million, most recently $22 million in 2022 (Crunchbase)

– Employees: 27 (Pitchbook), unchanged since Sep ’24; 25 in May ’24 & Mar ’24; 27 in Nov ’23

– Website visits (Jan 2026): 55,000 (SimilarWeb); 30,000 (SEMrush)

– LinkedIn: 9,000 followers

15. Zilbank

FAB Score = 10 (unchanged)

HQ: Grand Rapids, MI

Founded: 2021

Traction:

– Funding: INA (Crunchbase)

– Employees: 5 (Linkedin)

– Website visits (Jan 2026): 19,000 (SimilarWeb), 760 (SEMrush)

Social:

– LinkedIn 2,700 followers (5 employees, unchanged since Dec ’24 vs. 4 in July ’24, 6 in Jan ’24, 5 in Nov ’23)

16. Arival

FAB score: 8 (unchanged)

HQ: Miami, FL

Founded: 2018

Traction:

– Raised: $10.8M including $5M in 2021 (Crunchbase)

– Website visits (Jan 2026): 18,000 (Similarweb), 5,400 (SEMrush)

– Employees: 40 (Pitchbook), unchanged since Aug ’24 vs. 44 in July ’24, 44 in May ’24, 43 in Nov ’23

Social:

– Articles: 6 (Crunchbase)

– LinkedIn 15,000 followers (45 employees vs. 40 in June; 49 in Mar; 46 in Jan, 46 in Dec ’24, 47 Sep ’24, 44 in June ’24, 42 in Mar ’24, 42 in Nov ’23)

Other SMB checking accounts at companies whose core business is not SMB banking

Bluevine

FAB Score = 428

HQ: San Francisco

Founded: 2013

Traction

– Raised: $769M prior to 2021 (Crunchbase)

– Valuation: $1B+ (estimate)

– Website visits: 2.1 million (SimilarWeb, Jan 2026)

– Employees: 543 in Aug vs. 591 in June (Pitchbook); 592 in Jan; 618 in Sep ’24; 606 in May ’24; 584 in Mar ’24; 579 in Nov ’23

– Articles: 133 (Crunchbase)

Social

– LinkedIn 60,000 followers (564 employees, down 29 since Jan, down 33 since Oct ’24, down 27 since Sep ’24, down 48 since June ’24, down 35 since Mar ’24, down 29 since Jan ’24, down 16 since Nov ’23)

– Trustpilot: 4.2 (8,350 reviews)

AngelList Banking

FAB Score = 187

HQ: San Francisco

Founded: 2010

Traction

– Raised: $170M including $144M in 2022 (Crunchbase)

– Valuation $4B

– Website visits: 720,000 (SimilarWeb, Jan 2026)

Unlaunched or No Longer Listed

Guava (pivoted to community July 2024)

Fab Score = 4 (unchanged)

HQ: NYC

Founded 2018

Banking services provider: Piermont Bank

Traction:

– Raised: $3.1M including $650k in Feb 2023 (Crunchbase)

– Website visits: 1,500 (SimilarWeb, Nov 2024)

– Employees: 10 (Pitchbook), unchanged since August ’23

Social:

– LinkedIn: 2,000 followers (14 employees, down 2 since Oct, down 2 since Mar, down 1 since Feb, unchanged since Jan, down 3 since Nov ’23)

– Articles: None (Crunchbase)

Moves (CLOSED May 2024)

FAB Score: 11 (down 5)

HQ: Dover, DE

Traction:

– Raised: $6.6M including $4.8M in 2022 (Crunchbase)

– Website visits: 19,000 (Similarweb, Nov 2024)

– Employees: 17 (Pitchbook), unchanged since Mar, down 25 since Feb, down 28 since Nov

Social:

– Articles: 10 (Crunchbase)

– Linkedin: 2,000 followers (15 employees, unchanged since May, down 1 since Mar, down 9 since Feb, down 20 from Jan, down 29 since Nov ’23)

Lance (pivoted to Sequence spend management Sep 2023)

FAB Score: 7 (NEW)

HQ: NYC

Founded: 2018

Traction:

– Raised: $4.7M (Crunchbase)

– Website visits: <5,000 (Similarweb, Sep 2023)

– Employees: 31 (Pitchbook)

Social:

– Articles: 7 (Crunchbase)

– Linkedin: 1,200 followers (81 employees)

Vergo (pivoted to spend management for construction industry Sep 2023)

FAB Score = 10 (down 6)

HQ: NYC

Founded: 2021

Traction:

– Raised $4.2M including $4.1M in June 2022 (Crunchbase)

– Website visits: 16,000 (SimilarWeb, Nov 2024)

– Employees: 29 (Pitchbook)

Social:

– Articles: 3 (Crunchbase)

– Linkedin: 1,300 followers (25 employees, unchanged)

– Trustpilot: NA

LiveOak Bank (discontinued business checking Aug 2023)

FAB Score = 45 (down 6)

HQ: Wilmington, NC

Founded: 2008

Traction:

Raised: $152 million (Crunchbase)

Revenue (TTM): $392M (Yahoo)

Valuation: $1.4B (Public; 30 Aug 2023, up $100M since 14 July)

Website visits: 440,000 (Similarweb, Jan 2026)

Employees: 886 (Pitchbook), unchanged

Social:

Articles: 3 (Crunchbase)

Linkedin: 18,000 followers (915 employees, up 9 since May)

Trustpilot: 4.2 (70 reviews, up 37)

Winden (closed Sep 2025)

HQ: LA

Founded: 2021

Traction:

– Raised: $5.3M in 2022 (Crunchbase)

– Employees: 20 (Pitchbook), unchanged since August ’24

– Website visits (June 2025): 1,000 (SimilarWeb), 1,300 (SEMrush)

Social:

– LinkedIn 2,000 followers (8 employees unchanged since May; 7 in March & Feb; 8 in Jan, 6 in Dec ’24, 6 in Sep ’24, 13 in May ’24, 14 in Mar ’24)

– Trustpilot: No reviews

Oxygen (removed Feb 2023, because they appear to be more focused on consumers)

FAB Score = NA

– HQ: San Francisco Bay Area

– Founded: 2018

– Raised $45M including $20M in 2023 (Crunchbase)

– Website visits: 12,000 (SimilarWeb, Jan 2026)

– Employees: 92 (Pitchbook), down 5 since March

– Articles: 22 (Crunchbase)

– Linkedin: 5,700 followers (97 employees, up 2 since March)

– Trustpilot: 3.3 (192 reviews)

– iOS app: 4.8 (24,100 reviews)

Zifi (Zions Bank)

Pivoted to card processing provider (April 2023)

– HQ: Salt Lake City, UT

– Founded: 2022

– Raised: NA (unit of Zions Bank)

– Website visits: 24,000 (SEMrush, April 2023); 4,300 (SimilarWeb)

– Linkedin: 267 followers (12 employees, up 12 since March)

Challengers Closed to New Accounts

Nearside (formerly Hatch) (removed Feb 2023)

Note: Plastiq acquired Nearside in Nov ’22 for a reported $130M and is shutting down its banking services

FAB Score = 66 (down 2)

– HQ: SF

– Founded: 2018

– Raised $73M including $58M in 2021 (Crunchbase)

– Website visits: 8,000 (SimilarWeb, April 2023)

– Employees: 57 (Pitchbook), unchanged

– Articles: 5 (Crunchbase)

– Linkedin: 1,500 followers (24 employees, down 15 since March)

– TrustPilot: no reviews

– iOS: 4.3 (183 reviews)

Solid (was Wise) >> pivoted to Fintech as a Service in 2021

FAB Score: NA

– HQ: SF

– Founded: 2018

– Raised $18M prior to 2021 (Crunchbase)

– Website visits: 1.9 million (Mar 2022; SEMrush)

– Employees: 126 (Pitchbook)

– Articles: 4 (Crunchbase)

– Linkedin: 2,020 followers (56 employees)

Joust (acquired by ZenBusiness, 30 July 2020; currently referring customers to Radius Bank)

– Target: Freelancers

– HQ: Austin, TX

– Founded: 2017

– Raised: $11M (Crunchbase)

– Website visits: Unknown

– Employees: 18 (Pitchbook)

– Citations: 5 (Crunchbase)

– Twitter followers: 448

– Trustpilot: NA

– iOS: 4.1 (28 reviews)

Seed (Acquired by Cross River Bank currently closed to new customers)

– HQ: San Francisco Bay Area

– Founded: 2014

– Raised $5.2M (2015) (Crunchbase)

– App downloads (last 30 days): 425 (Apptopia)

– Website visits: 210 (May 2021; SEMrush)

– Number of employees: 12 (Pitchbook)

– Citations: 4 (Crunchbase)

– Twitter: 810 followers

Addendum: Other SMB/SME challenger banks around the world (not a definitive list):

UK

- Alicia Bank – Raised $147M in Nov 2021

- CountingUp

- Allca Bank — was CivilizedBank

- Redwood Bank

- Tide – Raised $195M (through Nov 2021)

- OakNorth – Raised $1B (through Nov 2021); first SMB banking unicorn

Germany

- Kontist – Raised $48 million (through Nov 2021)

- Penta – Raised $83 million (through Nov 2021)

Australia

- Judo(public)

- Volt

- Zeller – Raised A$50M in June 2021

France

Rest of world

- Holvi – Finland: Acquired by BBVA March 2016

- Juni – Sweden: Serving ecommerce companies. Raised $21.5M A-round July 2021

- Tochka – Russia