We look at bank and credit union sites every day. And generally, there is much to like these days. The move to responsive design finally forced financial institutions to declutter their sites and focus on the user. But there is still much room for improvement (see note 2), especially in the critical area of mobile and online banking (aka digital banking).

This month, we’ll look at the top 10 areas for improvement. Without further ado, here is problem #1.

#1 Fostering financial insecurity

Problem: For more than two decades the biggest reason for not adopting digital banking has been “security concerns.” Or rather “the perception of security” since few customers have the wherewithal to evaluate technical safeguards. We also include privacy in this discussion since it is often used interchangeably with security.

Solutions

- Plain language discussions of security & privacy safeguards

- Clear links to the above, placed by the login box and in the footer area

- Understandable security & fraud protection guarantees

- Links to third-party credit monitoring solutions*

- Credit scores (or a link to Credit Karma or similar credit score services)

- Optional two-factor authorization*

- Graphical treatment that reinforces security at login

- Ability for customers to “lock-down” their account(s) either completely or selectively*

- Optional cybersecurity insurance*

- Customer forums with a moderated “security” thread

Inspiration:

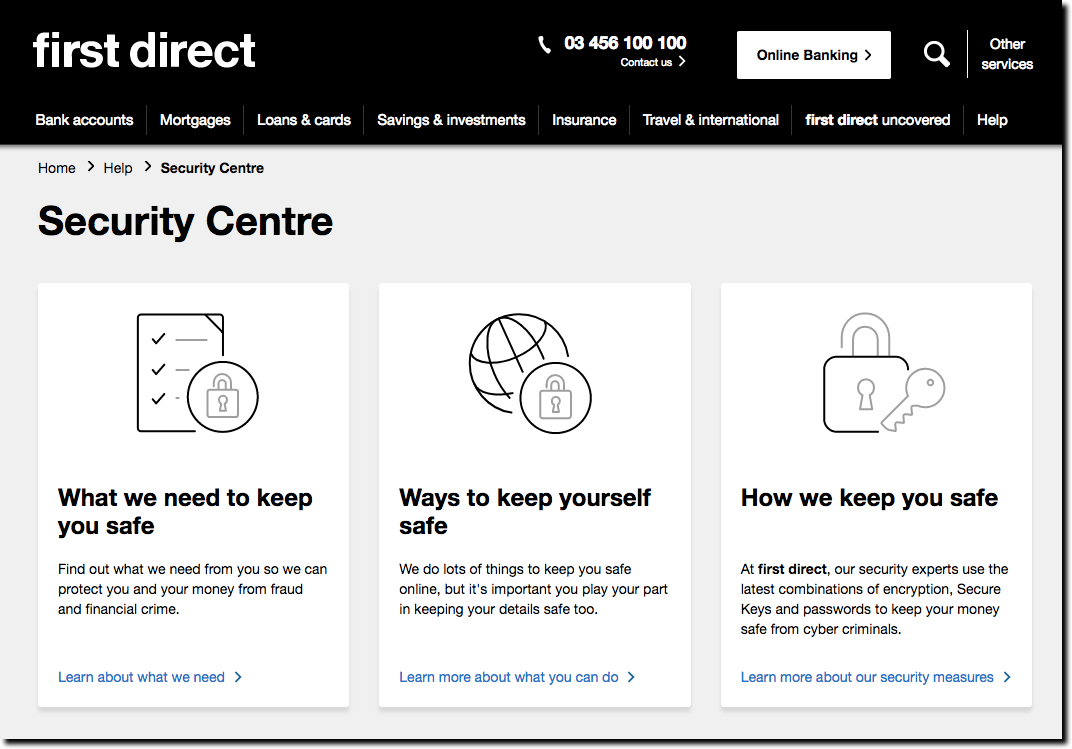

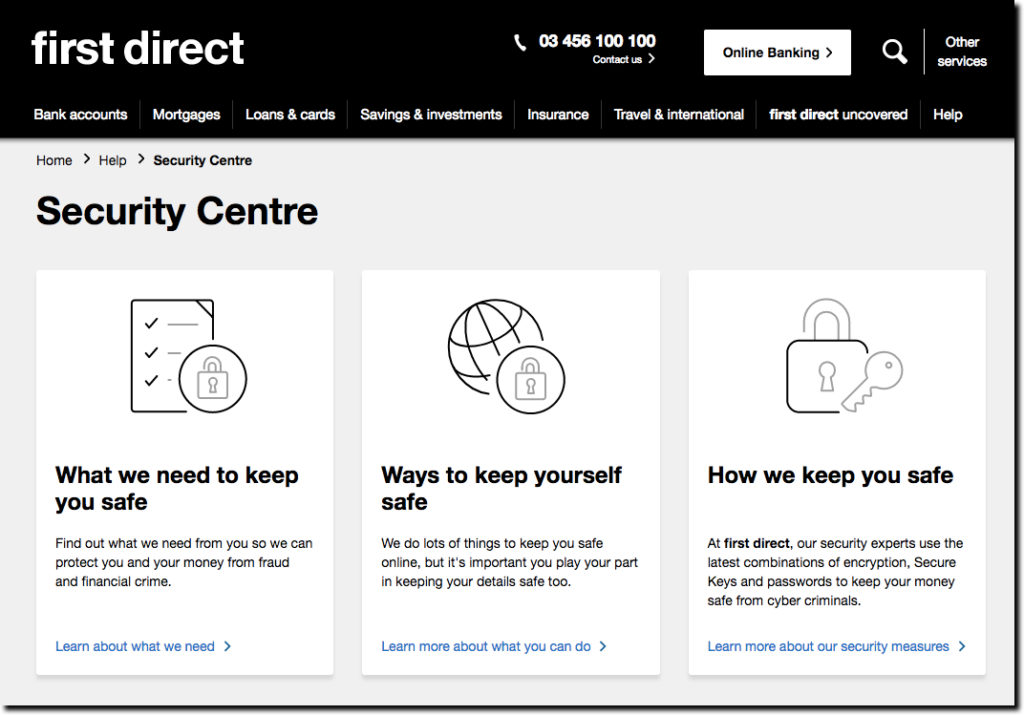

HSBC’s First Direct Bank was rated #1 in online banking security in a 2016 review of UK banks. You can see from its security info page (below, link) that they know how to reassure customers.

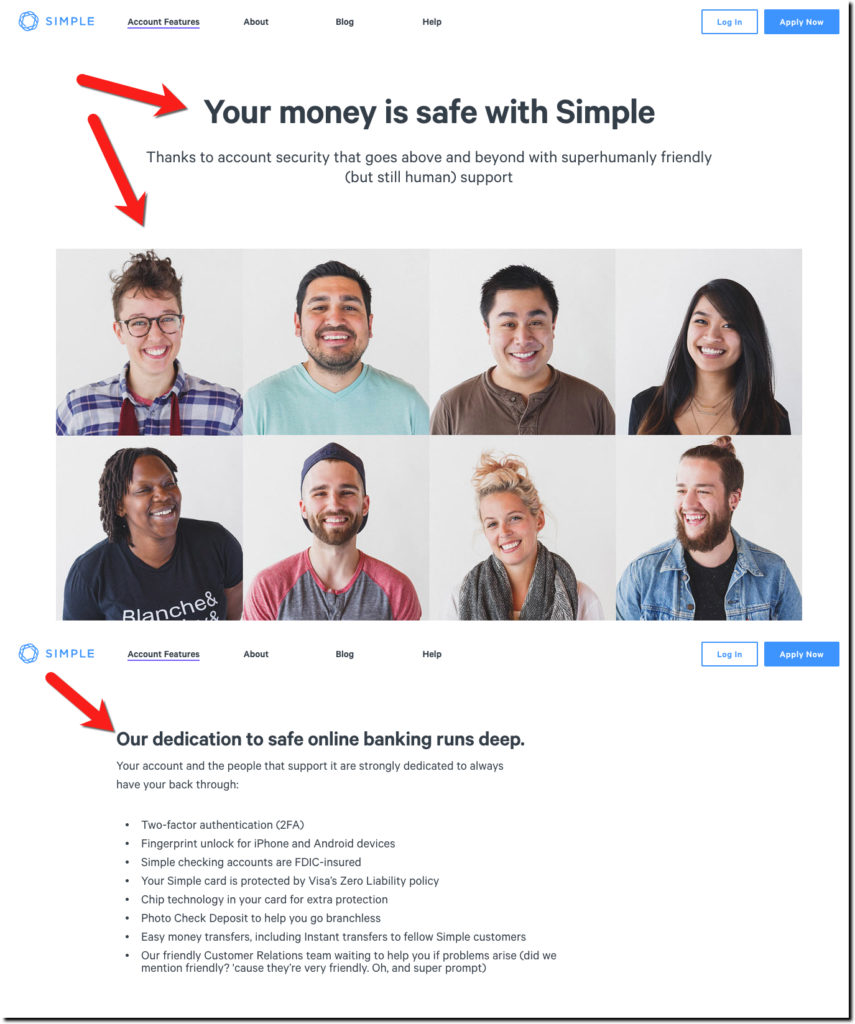

BBVA’s Simple digital bank knows how to avoid jargon which is especially refreshing on the security front. On its “security page” (below, link) It makes users feel more comfortable by first highlighting its people, then a list of technical safeguards, debit card on/off switch, and instant alerts.

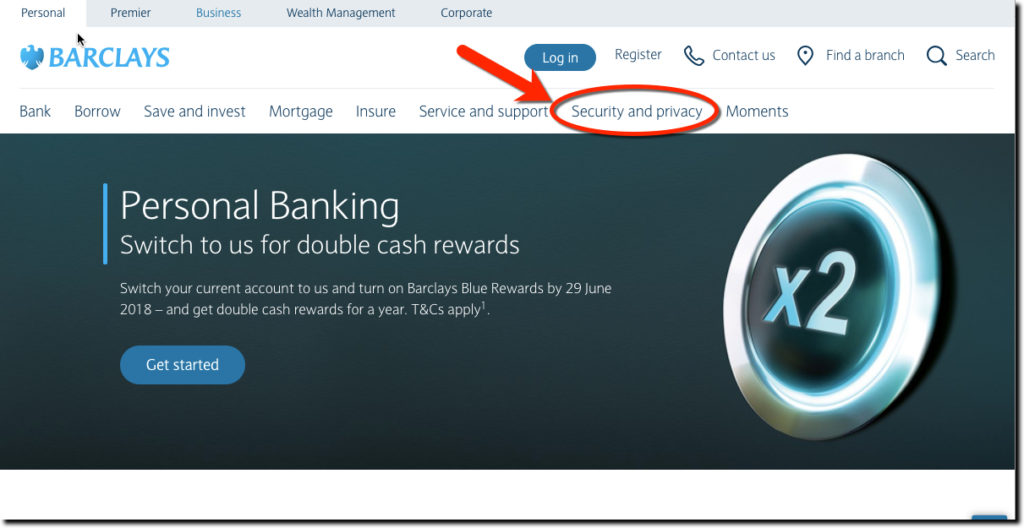

Barclays (UK) took the unusual step of adding “Security and privacy” to its primary navigation.

Notes:

- *Items with an asterisk are potential fee-based services that could be sold on their own or as part of value-add packages, aka “Digital Gold Banking”

- To make sure you are not committing any digital faux paus, request a proposal for a Digital Banking Analysis from BUX Advisors. Only 4 slots left for July and August, so contact us ASAP.