I’ve long been a fan of crowdfunding, Really, who wouldn’t be? On paper it’s the perfect culmination of digital finance. Take one budding entrepreneur. Connect her to capital. Change the world. Rinse. Repeat.

But like most things money related, when you get to the point of actually moving cash from your account to some stranger on the Internet, there are big issues around trust, risk, and basically not being taken advantage of. Add to that the U.S. regulations protecting the so-called non-accredited investors, and it’s been tough for U.S. crowdfunding companies to gain a foothold.

AngelList has more than 1,700 startups in the “crowdfunding” category (see notes 1, 2), but few U.S. entrants have made an impact in the overall market for small- to medium-business (SMB) capital. In fact, there are fewer than a dozen or SMB equity or debt crowdfunders live in the country including. I wrote about the newest entrant, HoneyComb Credit, yesterday in the Finovate blog. Others include:

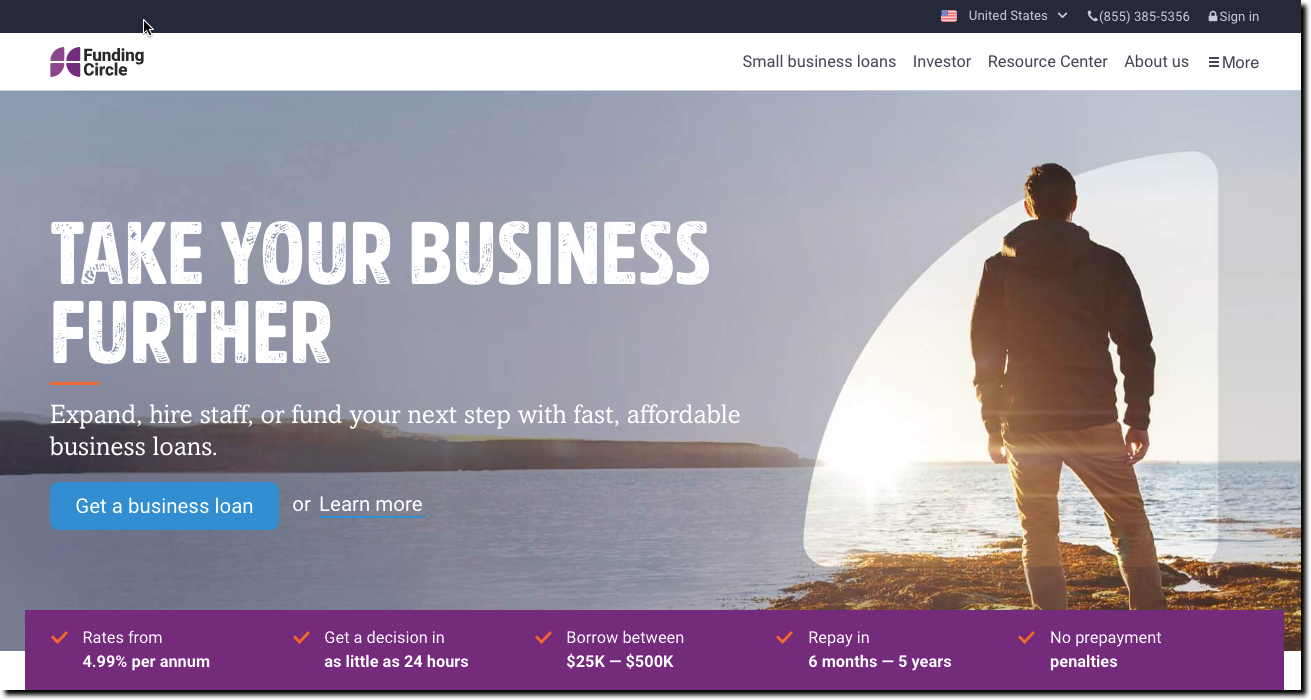

- Funding Circle (raised $375 million for itself), originally a UK-only platform, but now active in the United States (see note 1)

- P2Binvestor (raised $9.2 million)

- SeedInvest (raised $8.2 million)

- Crowdfunder (raised $6M)

- Fundable (acquired by Startups.co) and

- Wefunder (raised $2.3 million).

- Indiegogo (raised $56 million) is also now involved in equity crowdfunding, although it is currently a small piece of its overall rewards-based funding platform

There are many reasons why debt/equity platforms have failed to gain a large following (for instance the rules around crowdfunding have been slow to materialize, are complicated, and frankly don’t make sense in a lot of cases). Much of that is out of the startups’ control.

But one thing they do control is customer experience. What makes good UX in the area of crowdfunding? Platforms must address the following issues so that new customers will start engaging/investing:

- Easy way to discover and compare deals

- Clear understanding of the terms of their investment

- A way to get to know the founders (public Q&A, live ask me anything, video pitches, etc.)

- Guarantee loan repayments will continue if the platform goes out of business

- What happens to my pledge before the funding goal of the campaign is met?

- How do I get money to the platform safely and securely?

- How do I follow my investment after it’s been made?

- Who is behind the platform itself and why should I trust them?

- How does my return compare to other options?

- How do I bookmark companies I’m interested in to go back to later?

- How do I get questions answered from the founders themselves, either publically or privately?

- How do I know whether I can participate in the platform?

- What investments are available and when will more be available?

- How did you choose these opportunities and what did you do to vet them? And what is my recourse if they lied?

- What is the actual paperwork process? Do I need a lawyer to review?

- Who else is investing in them? Anyone I know or trust?

- What are benefits of being part owner? What “inside info” or continued benefits will I receive as an owner?

- Can I sell these investments?

- How do I keep apprised of new deals that fit my parameters?

- Multiple ways to interact with the platform, before, during and after on-boarding.

Bottom line: Crowdfunding has much promise for both startups and investors. But the UX around trustworthiness as well as investor onboarding must be improved to get skeptical investors on board.

Notes:

- This is a broad definition that includes companies such as Kickstarter and GoFundMe with a philanthropic mission.

- The situation in the UK is much better with 5 major crowdfunding platforms gaining traction. In addition to Funding Circle ($375M raised for itself) there is Crowdcube ($28M raised), Seedrs ($18M raised), SyndicateRoom ($12M raised) and VentureFounders ($9M raised).