Extending credit to business clients is a core business model for thousands of banks, specialty lenders, and now fintech companies. For most businesses, cash flow management is critical to their day-to-day operations as well as long-term viability. So it’s no surprise that Ramp, already the most full-featured offering from a growing crop of SMB digital challengers, would add credit to its lineup (see press release, 23 Aug 2022).

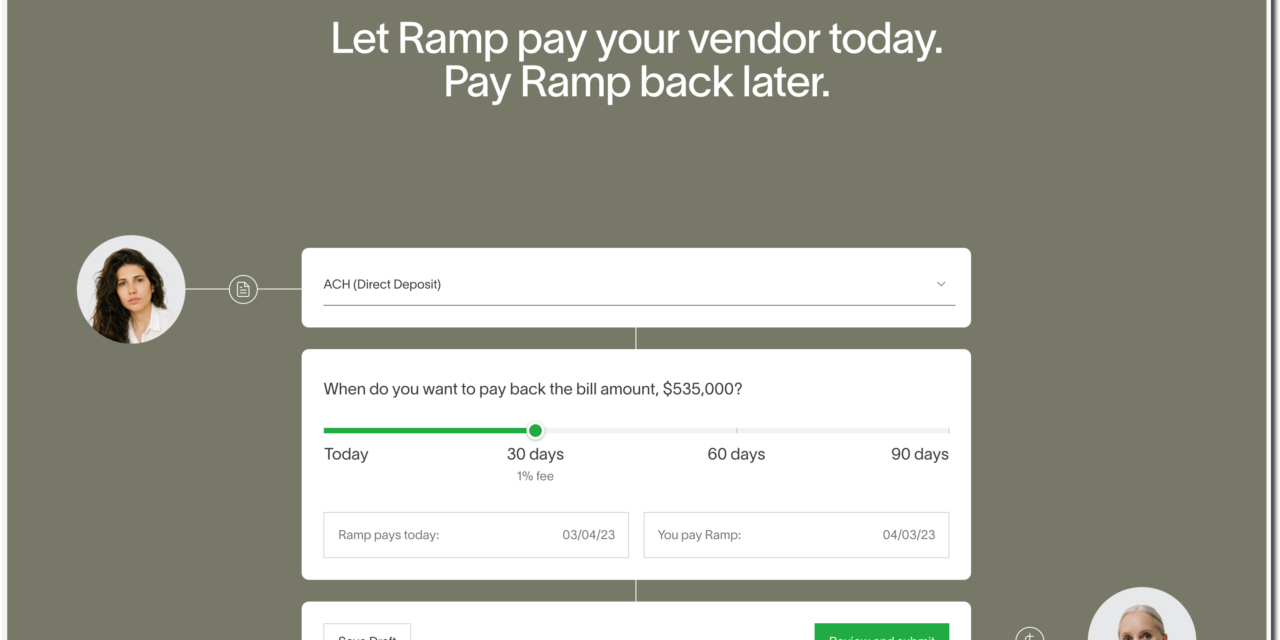

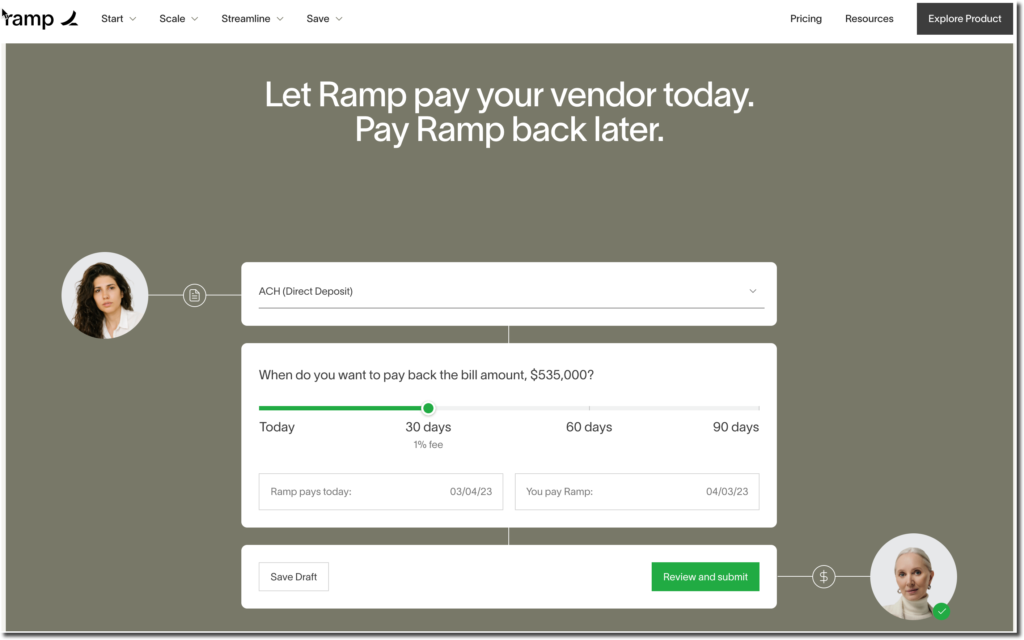

And they are doing it in a cautious way that enhances their existing accounts payable services. Yesterday, the startup began allowing selected clients to extend repayment on outgoing bill payments up to 90 days. The example on its website shows a business paying a $500,000 bill via ACH, but electing not to have the payment deducted from its bank account for 30 days for a 1% fee. Presumably, the fee and as well as the “flex payment” line will vary by customer.

It’s a fantastic way for businesses to keep their vendors happy with prompt payments even when cash balances are stretched.

Company Vitals

Ramp

FAB Score = 864 <<<Highest on list

– HQ: NYC

– Founded: 2019

– Valuation: $8.1B (based on Feb 2022 round) <<< Highest

– Billpay run rate: $1B annually (as of 22 Aug 2022)

– Raised $1.4B total <<< Highest

– Raised $1.3B since Jan 2021 (Crunchbase) <<< Highest

– Website visits (June 2022): 980,000 (SimilarWeb)

– Employees: 402 (Pitchbook) <<< Highest

– Articles: 37 (Crunchbase)

– Linkedin: 40,400 followers (438 employees)

– G2: 4.7 (618 reviews) (no reviews on TrustPilot)

Recent interview

40-minute interview (1 April 2022) of Ramp CEO Eric Glyman and CTO Karim Atiyeh interviewed by Packy McCormick (Ramp investor, and founder of the Not Boring newsletter).

Note: Certain companies pay referral fees to FintechLabs for new accounts. At the time of publication, Ramp is one of them.