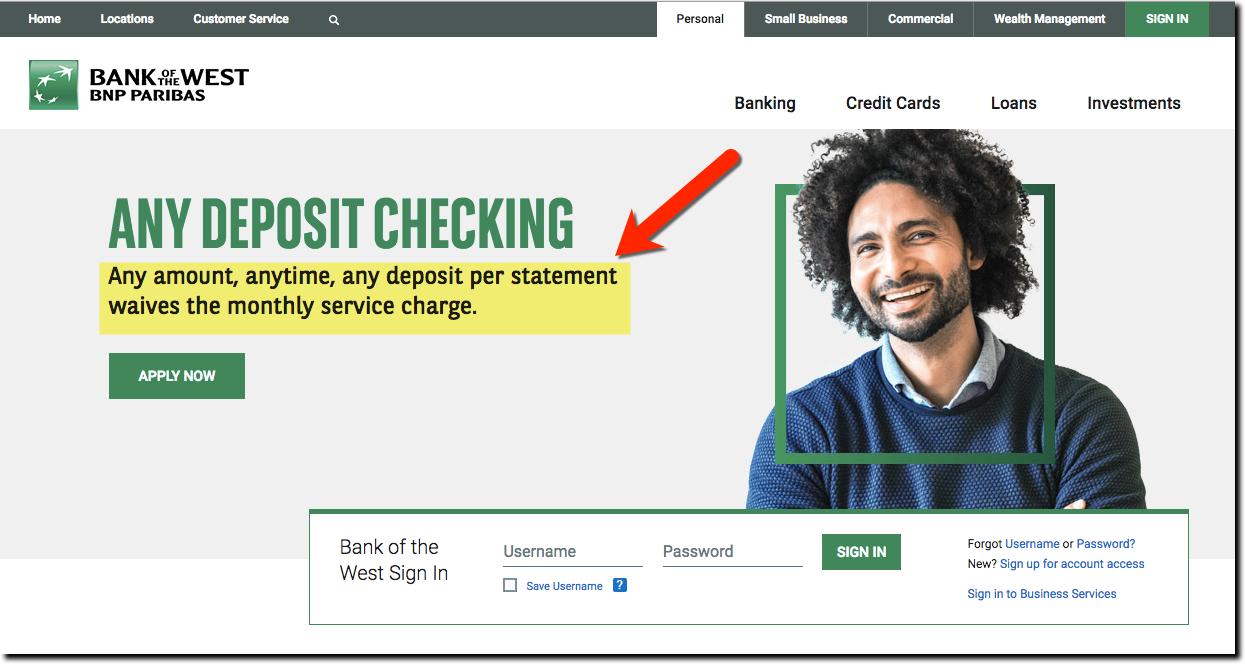

In addition to a relatively more progressive approach to overdraft fees, Bank of the West waives the $10 monthly checking account fees if there is ANY deposit activity (see note 1)

Many customers know they can get at least one overdraft fee waived by appealing to customer service or the branch manager. But it’s not a good experience. Driving to a branch or calling an 800 number and sucking up to some stranger that you hope isn’t having a bad day.

Many customers know they can get at least one overdraft fee waived by appealing to customer service or the branch manager. But it’s not a good experience. Driving to a branch or calling an 800 number and sucking up to some stranger that you hope isn’t having a bad day.

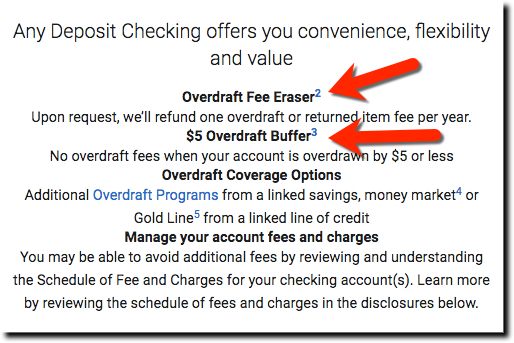

So I love that Bank of the West has formalized this unwritten policy and given it a snappy name: Overdraft Fee Eraser (see inset). The bank automatically refunds one overdraft every (rolling) year, no questions asked. But it is up to the customer to ask for the $35 refund. The bank also provides a $5 Overdraft Buffer, again formalizing a policy to not charge the fee on tiny negative amounts.

Our take: This is a much more friendly policy than most financial institutions. So we’ll give the bank a B+ for raising the bar. However, we still believe that $35 OD fees are NOT good business in an age when most payments are authorized in real-time. The fee is not customer friendly, it is not priced for the actual credit risk, and it especially impacts those that can least afford to pay it. U.S. banks are lucky that the CFPB powers were gutted by the current administration because I don’t think current OD prices would have gone untouched.

But let’s try some self-regulation here. Penalty fees continue to be one of the leading causes of customer dissatisfaction. While they can’t be avoided altogether, they can be rationalized. Here’s our 6-step approach to a consumer-friendly OD policy:

- Like Bank of the West, formalize the unwritten rules with an automatic or semi-automatic fee waiver for the first instance.

- Initiate an OD buffer that’s the size of the OD fee or cap your OD fee so that’s it’s not higher than the amount of the overdraft, e.g., a $7 overdraft results in a fee that’s at most $7.

- Tie fees to the size of the overdraft: A $35 OD fee is understandable if it covers a $1,500 mortgage payment, but it’s too much for the morning coffee and bagel. So develop a fee schedule that charges a larger fee for higher overdrafts. For example:

$0 to $5 = $0

$5 to $100 = $5

$100 to $200 = $10

$200 to $500 = $15

$500 to $750 = $20

More than $750 = 3% of OD amount - Provide OD protection options with reasonable fees for each transfer, more along the size of an ATM fee (eg. $2 per transfer).

- Create a premium/gold account that charges an annual fee and eliminates most OD fees. For example, a $50/year annual fee which includes a number of benefits, including first 5 overdrafts every year.

- Use advanced PFM tools such as Simple’s Safe-to-Spend to warn customers ahead of time when it appears they are headed towards a negative balance.

Notes:

*Mulligan is an old golf term used in friendly matches, meaning you get to take one shot over without penalty

1. Bank of the West is making it easier to waive monthly fees by allowing ANY type of deposit activity to qualify for the $10/mo fee waiver, not the direct deposit requirement used by many FIs. The bank also waives the monthly fee for anyone under 25 regardless of deposit activity.