A new lender debuts at FintechLabs this month: National Funding. We are excited to be working with an established brand founded almost a quarter-century ago. It has originated more than $4.5 billion in loans to more than 75,000 small businesses.

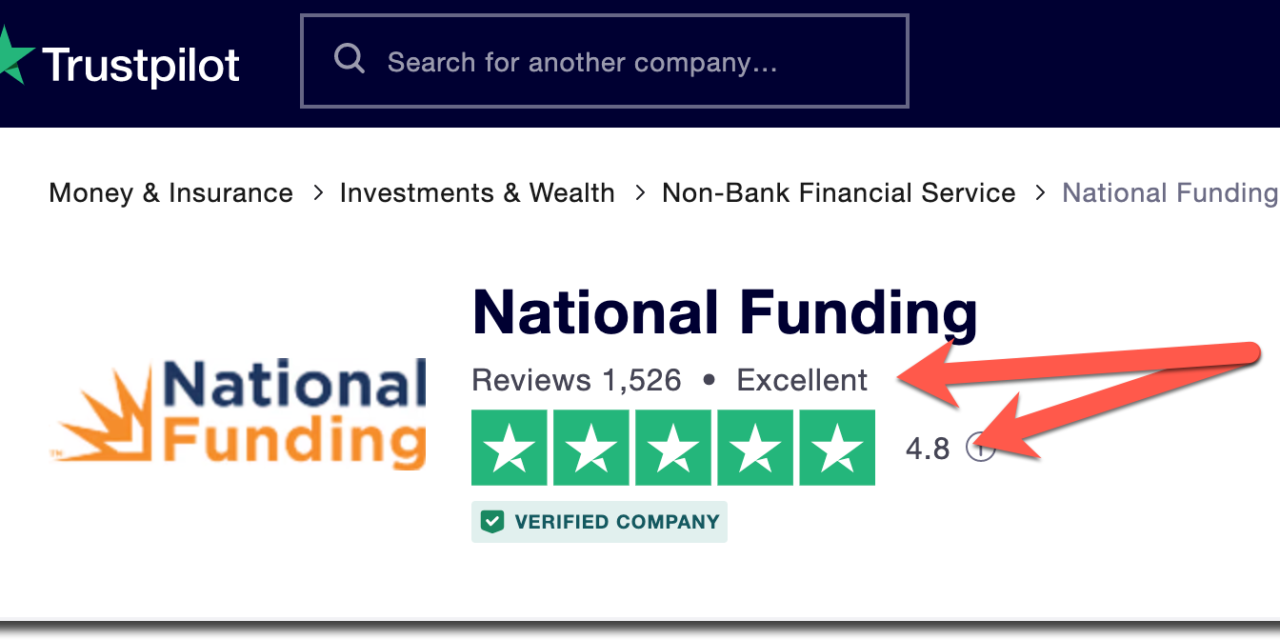

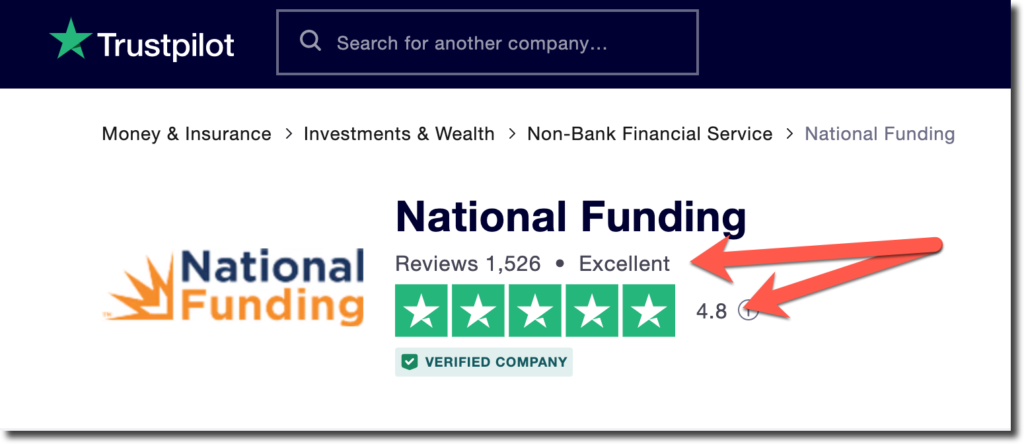

The company also prides itself on speedy execution: approvals in as little as 24 hours and funding in as little as 24 hours later. And most importantly, National Funding’s stellar reputation as demonstrated by its 4.8 score (out of 5) at TrustPilot, an independent review site, as well as an A+ Better Business Bureau accreditation (given to businesses scoring 97 or higher on its 100-point scale). In comparison, the best-known digital lending startup Kabbage (now owned by American Express), has a 3.3 TrustPilot score. Only 1 of the largest 25 digital lenders we follow has a higher score.

The San Diego-based SMB specialist was founded in 1999 and has raised more than $100M from Wells Fargo and others (per Crunchbase) and has 150 employees (per Linkedin). See the video below for more info.

The San Diego-based SMB specialist was founded in 1999 and has raised more than $100M from Wells Fargo and others (per Crunchbase) and has 150 employees (per Linkedin). See the video below for more info.

The lender focuses on larger small businesses ($250,000+ annual revenues) as well as those that have been around for at least 6 months. If you fit that criteria, by all means, check them out here.

Here are its specific loan offerings and borrower requirements:

Small Business Loans

- Maximum loan amount: $500,000

- Minimum loan amount: $5,000

- Maximum length: 24 months

- Funding speed: As soon as 24 hours after approval; typically 1 to 7 days

- Starting rate: 1.10 factor rate

- Fee: 1% t0 3% origination fee

- Repayment schedule: Daily or weekly

- Geographic availability: All 50 U.S. states

Borrower requirements:

- Annual gross revenue of $250,000 or more

- Fair to excellent credit

- 6 or more months in business

Equipment Financing

- Maximum loan amount: $150,000

- Term: Typically 2 to 5 years (6 years in special cases)

- Loan approval: As little as 24 hours

- Funding speed: 24 to 72 hours after approval

- Starting rate: 4.99% simple interest (and check out its “lowest payment guarantee“)

- Fee: 1% t0 3%

- Repayment schedule: Monthly

Borrower requirements:

- Annual gross revenue of $250,000 or more

- Fair to excellent credit (FICO 575+)

- 2 or more years in business

- Equipment quote from vendor