Generally, I’m against cute financial product names. Does adding “Blue Ribbon” to your checking account really help it sell better? Or does it just add a layer of noise, costing you lost business in the end? Unless you can run an A/B test to prove it one way or another, we recommend keeping things simple and to-the-point (see note 1).

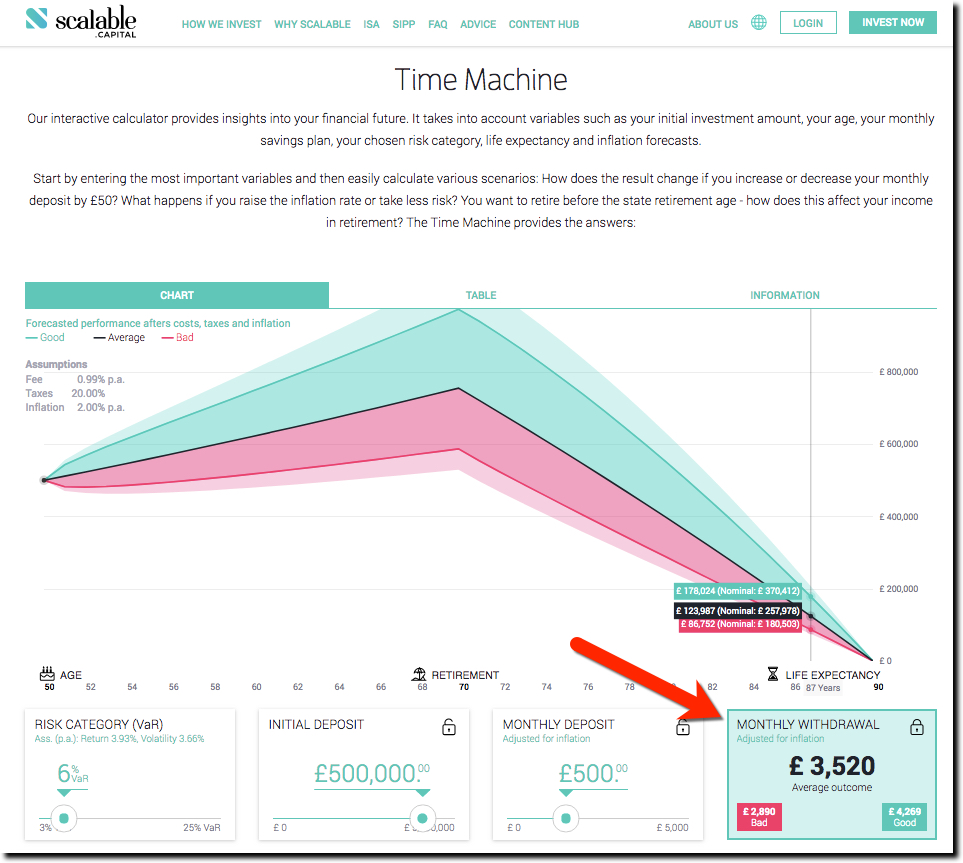

But there are exceptions to every rule. And I found one at European robo-investor Scalable Capital (note 2). In May (press release), the startup dubbed its retirement calculator “Time Machine” and I think it’s a perfect name. Why?

- Unlike simple products with standard industry names like “credit card” and “checking account,” retirement calcualators don’t have a well-understood label.

- By definition, moving forward (or backwards) in time, entices users to test it out.

- It sounds futuristic, good positioning for a robo-advisor

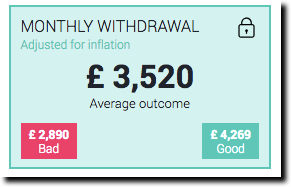

Scalable Capital’s Time Machine includes a user-friendly box in the lower right that cuts to the chase highlighting the range of monthly withdrawals available post-retirement.

Opportunity for banks

As much as I like how Scalable uses Time Machine to project into the future, there is also an opportunity for banks to use the same concept to go backward in time (note 3). For instance, to show users where their savings, spending or net worth stood last month, or last year, compared to today.

Notes

- Naming conventions are just one of the 400 touchpoints analyzed in our Digital Banking UX Audit.

- The startup should buy the misspelling, ScaleableCapital.com, which is how I want to type it in.

- My favorite weather app, Dark Sky, recently added a “Time Machine” function to its iOS app to look at historical weather, or to skip ahead to a future date.