One of the few upsides of a global pandemic, surprisingly, is a near-constant stream of startup demos available on my home office screen (or let’s be honest, my porch overlooking the sound).

Today, I watched a 10 impressive demos at DC Fintech Week (see list at bottom of post). The one that most caught my attention, given my early days as a mortgage product manager, was Finlocker (see video below; and for a more thorough look at the company, watch the Nov 2019 demo by co-founder Peter Esparrago at Digital Mortgage event above).

Finlocker is a St. Louis, MO-based fintech that just landed a fresh $10M (total round size of $20M, the other $10M raised in 2019) to give them a total of $25.4M. They were founded in 2014, but the big funding ($20M) did not arrive until after the pandemic.

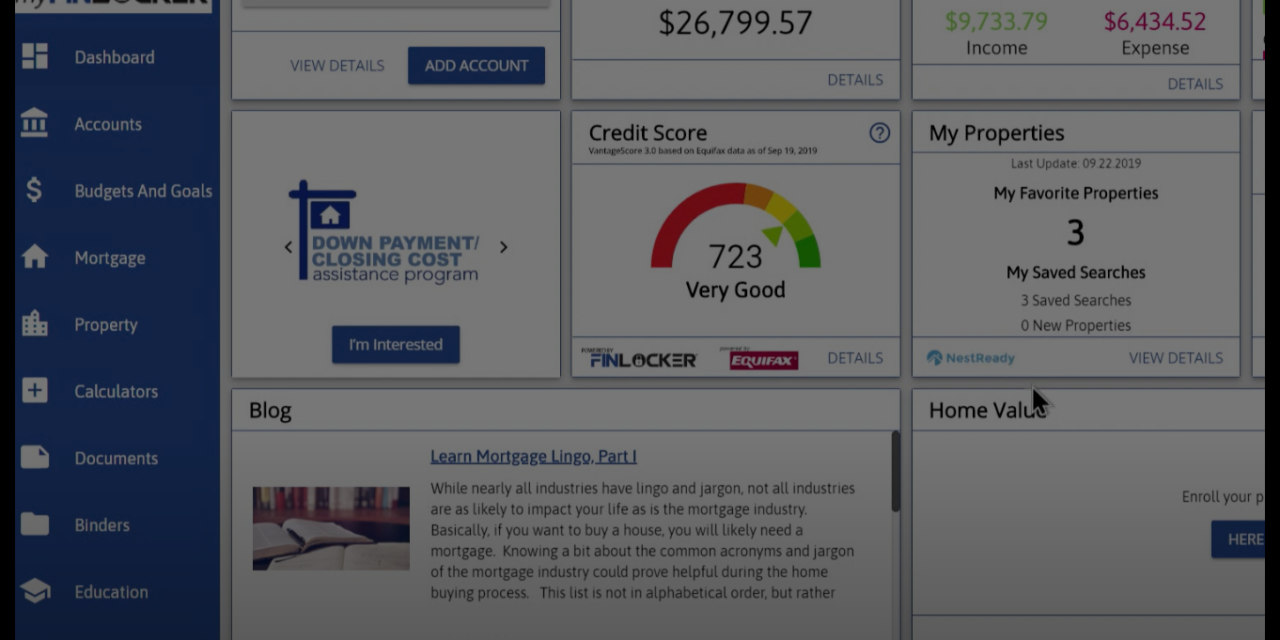

The company has built a Credit Karma-like product optimized around home buyers and the mortgage process. And, most importantly, delivered via its lender clients (aka B2B2C). Finlocker also hopes that its platform continues to be used by homeowners after they’ve secured that first mortgage, the vision that’s inspired the estimated $100M valuation. Finlocker hopes to be a white-labeled Credit Karma delivering offers only from the FI distributing the service.

Vitals:

- HQ: St. Louis, MO

- Founded: 2014

- Incubated: Six Thirty

- Founders: Barry Sandweiss, Peter Esparrago, Tim Stern

- Strategic investors: Transunion (though Equifax is currently its credit reporting partner)

Finlocker links: Website | Twitter | Linkedin | Crunchbase

References:

- $20M funding and TransUnion investment via NationalMortgageProfessionals.com (20 Oct 2019)

- Demo companies at DC Fintech Week 2020

– Plaid: John Pitts

– Sunny Day Fund: Sid Pailla

– Bondcliq: Chris White

– Complyadvantage: Charles Delingpole

– Theta Lake: Marc Gilman

– FinLocker: Brian Vieaux, President

– Transparent: Alex Fowler

– Chainalysis: Jackie Koven & Collin Almquist

– txtsmarter: Nuri Otus

– Silent Eight: Matthew Leaney