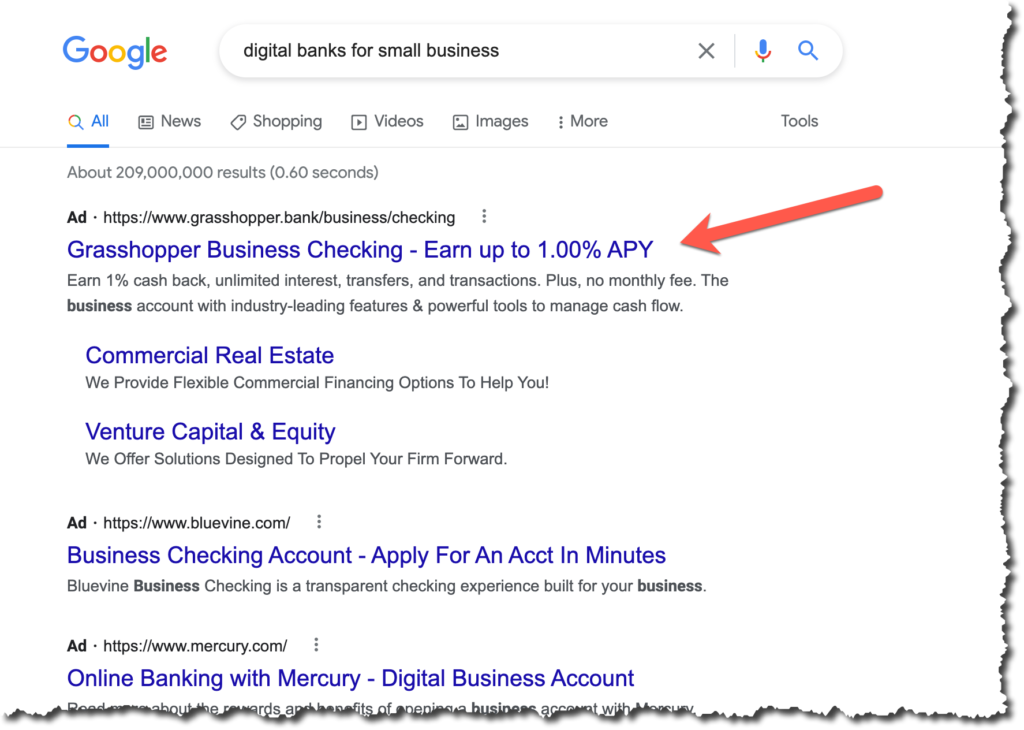

FintechLabs follows the small business digital banking space closely. While the summer is typically slow in terms of marketing initiatives, Grasshopper Bank is the exception in the small business banking space touting a 1% APY in the first paid result on a recent Google search (see screenshot below).

Grasshopper has become more aggressive after rebooting its efforts under new management last March and bagging a fresh $30M in funding last week. Today, they were paying top dollar for the first result on my Google search for “digital banks for small business.” And they have upped the ante with a 1% APY offer, almost unheard of for business accounts. With so much attention on rising interest rates, it could be a winning strategy. The problem is that most small businesses have bank balances where 1% annually is not a material return. Even with a healthy average of $25.000, it amounts to less $20 per month after tax.

Grasshopper has become more aggressive after rebooting its efforts under new management last March and bagging a fresh $30M in funding last week. Today, they were paying top dollar for the first result on my Google search for “digital banks for small business.” And they have upped the ante with a 1% APY offer, almost unheard of for business accounts. With so much attention on rising interest rates, it could be a winning strategy. The problem is that most small businesses have bank balances where 1% annually is not a material return. Even with a healthy average of $25.000, it amounts to less $20 per month after tax.

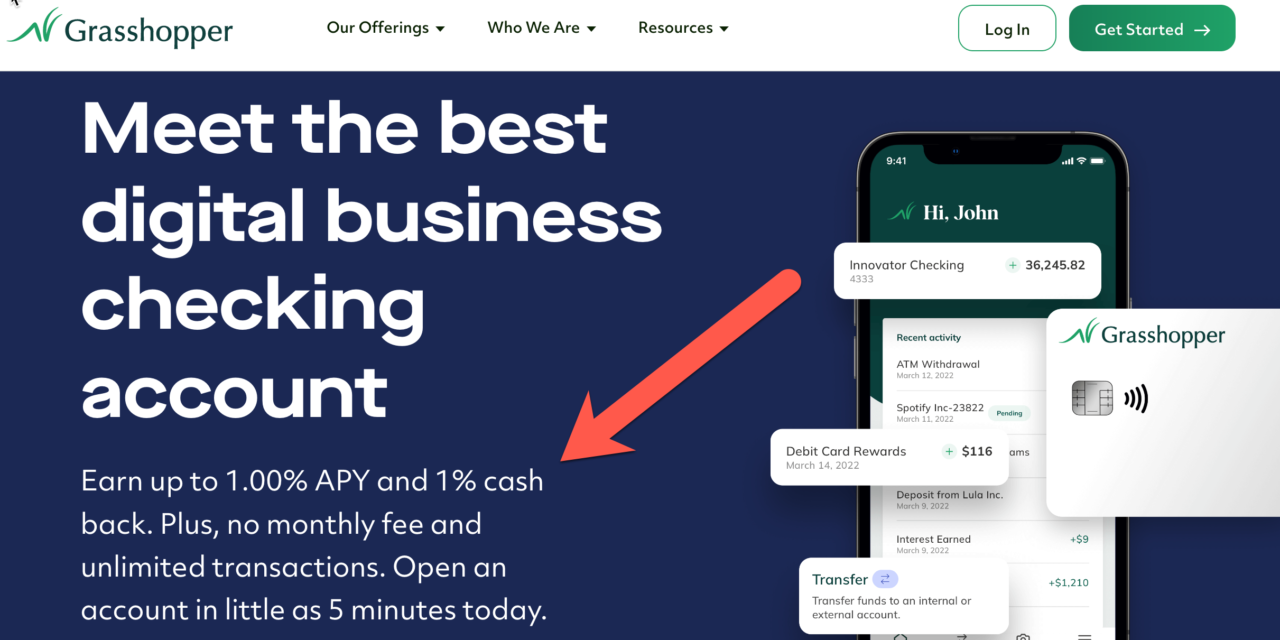

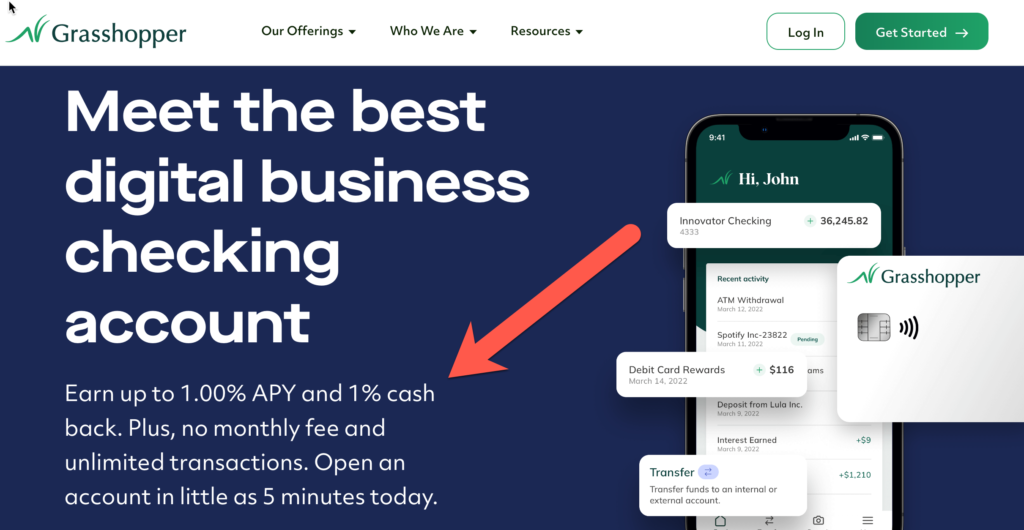

Furthermore, the 1% only applies to balances more than $10k. The better perk, which isn’t mentioned in the Google ad, is the 1% cash back on debit purchases (see screenshot below). But the account is well priced. Even if the 1% APY is beyond reach, the account has no fees, and includes the popular 1% cash-back on debit spend.

One thing Grasshopper needs to do better is explain its pricing. It’s frustrating when a the bank fails to disclose basic pricing on its website, especially when leading with price as a key copy point. If you scroll through the site you can see that the APY is good for balances above $10k, but there are no specifics listed as to how they measure the $10k (average vs minimum) and what is paid for lower balances. Even searching the FAQs for “pricing” and “APY” come back with no results.

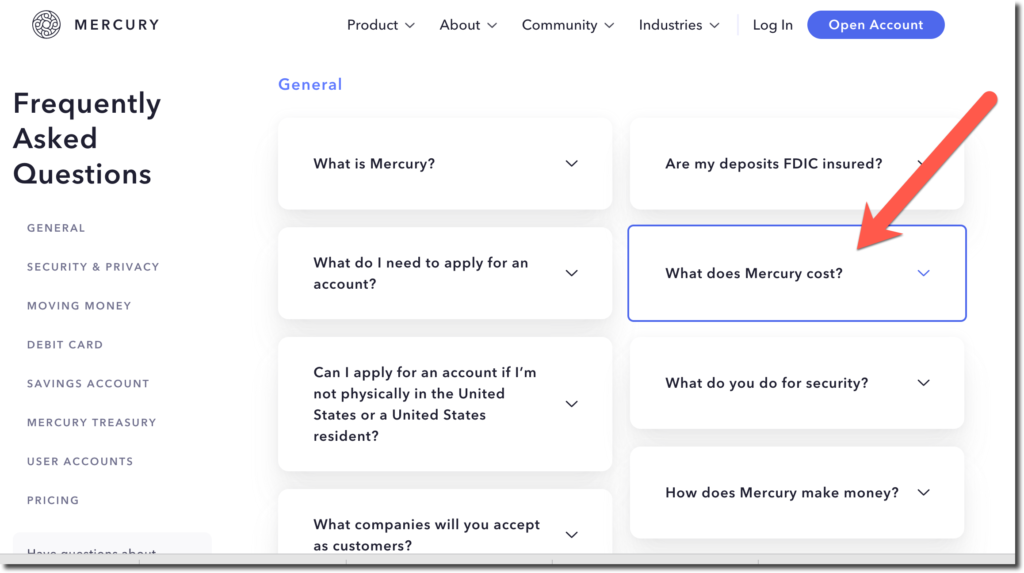

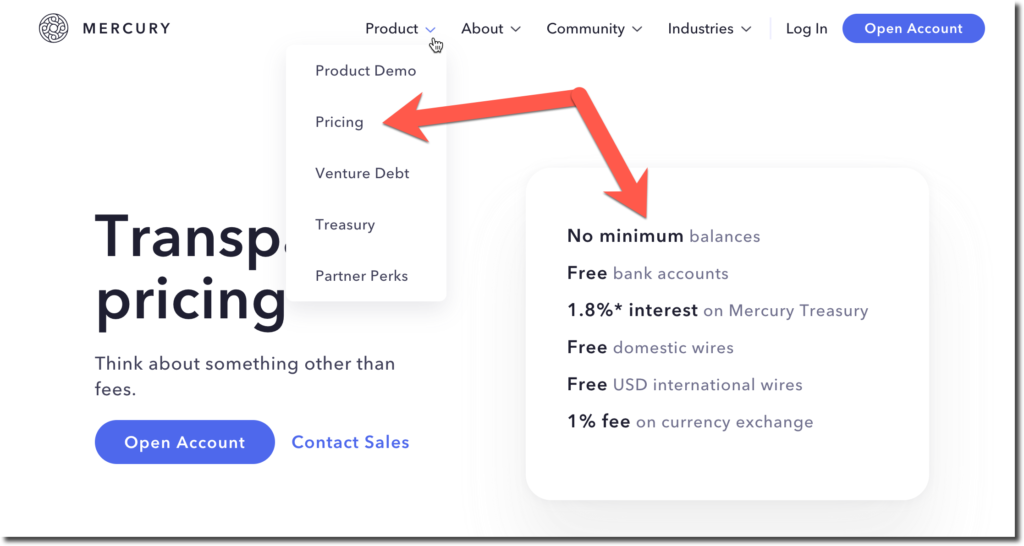

Compare that to the approach of Mercury, the top-scoring bank on our FAB score (see notes 1 & 2). Mercury includes a “Pricing” choice on it’s Product primary navigation dropdown. And it’s displayed on a clear URL <mercury.com/pricing> that reinforces its transparency (see first screenshot below). Even if you missed the Pricing navigation item, the bank includes a Pricing discussion in its first 4 questions in its FAQ (see second screenshot below).

Mercury Bank “Pricing” Page

Mercury Bank FAQ

Notes:

(1) The FAB score, Fintech Attention Barometer, is a proxy for the overall size of a private company since they typically do not release traditional metrics (# customers, deposits, AUM, etc). The score is based on VC funding, website traffic, mobile downloads, and the number of employees. It’s a work in progress, so expect changes in the formula.

(2) Our business model depends on revenue from referrals. So anytime you see a referral link in the URL, we potentially earn a fee upon establishing a new funded account (thanks!). In this case, Mercury supports our site and Grasshopper does not. However, those payments did not impact the opinions expressed in this blog post.