Managing cash flow, invoices, bills, expenses and payments is overwhelming and costly. Digital invoices in a slew of formats, the occasional paper-only vendor, slow workflows, and disconnected accounting systems eat up valuable time and sap founder energy. Yet, its not an area that can be ignored or put off. Payment is the fuel of the business, and poor payment hygiene and sickened, if not killed, many a business.

BILL solves that for businesses by bringing payments and work flows together in one cloud-based hub. The key benefits:

-

Faster – pay in under half the time and get paid 2× faster

-

Smarter – intelligent workflows, automated reminders, AI-driven data entry

-

Secure – encrypted payments, masked bank info, customizable user roles

-

Unified – AP, AR, expense & spend control all in one platform

Features & Benefits

1.  Boost Efficiency Across AP, AR, Spend & Expense

Boost Efficiency Across AP, AR, Spend & Expense

-

AP & AR automation: BILL captures invoices via AI, routes them through approval workflows, and sends payments via ACH, virtual cards, credit cards, or checks. Invoicing clients is equally streamlined—create, send, and track professional invoices, set auto-reminders, auto-charge and auto-pay.

-

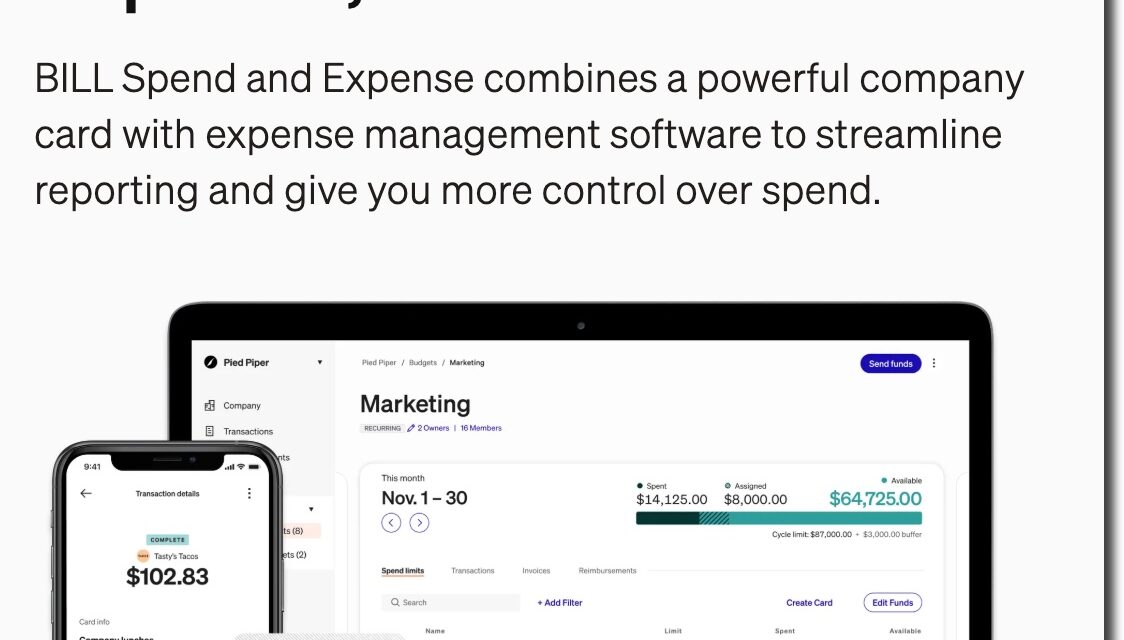

Spend & Expense management (via Divvy): Get corporate cards for employees, set budget controls and approval rules, auto‑match receipts, and track budgets in real-time.

2. Gain Centralized Control & Visibility

-

Central Inbox for tasks & notifications ensures nothing slips through the cracks—manage bills, invoices, approvals, and reminders in one place.

-

Full visibility via real-time transaction reporting, audit trails, unlimited document storage—ideal for staying organized and audit-proof.

3. Optimize Cash Flow

-

Get paid faster: Clients pay up to 2× faster thanks to streamlined invoicing and ACH/credit card options.

-

Maintain control of cash flow using credit cards for payables, and finance receivables through faster payout mechanisms.

-

Forecast predictively: Gain up to 13-month cash flow projections based on historical data and what‑if modeling—for better planning.

4. Secure

-

Multi-layered security: Encryption, passcode authentication, masked bank data, and granular user permissions protect your business.

-

Less fraud risk: Going digital avoids lost or stolen paper checks—and you control who has what access.

5. Integration with Accounting Systems

-

Syncs with major accounting systems: QuickBooks, Xero, Sage Intacct, Oracle NetSuite, Microsoft Dynamics—and more—via 2‑way sync or CSV.

-

Plug-and-play compatibility ensures financial data flows smoothly—no manual double entry, fewer errors.

6. Priced by Company Need

-

Multiple pricing tiers:

-

Essentials (~$45/user/month): Core AP & AR tools, bill/invoice automation.

-

Team (~$55/user/month): Adds granular roles, workflow controls, automatic sync.

-

Corporate (~$79/user/month): More customization, multi-entity, SSO, APIs, advanced sync.

-

Enterprise: Custom pricing—advanced features for large or complex businesses.

-

7. What Sets it Apart

-

Holistic financial ops: Few platforms unify AP, AR, expenses, spend management, and credit under one roof.

-

AI-first automation: Smart data capture, automated workflows, approval paths, and predictive insights elevate efficiency beyond basic accounting tools.

-

Built for small businesses, scaled for growth: Clean interface, mobile access, fast onboarding, yet powerful enough for multi-location/multi-entity operations.

-

Proven ROI: Users report cutting AP time in half and getting paid twice as fast. Real-world cases show up to 70% drop in data-entry time.

-

Strong partner ecosystem: Deep integrations with banks, accounting apps, and acquired tools like Divvy and Invoice2go make BILL stickier.

Quick Company Snapshot

-

Founded: 2006 (originally Cashboard, Inc.), renamed Bill.com; rebranded to BILL later.

-

Founder & CEO: René Lacerte—previously founded PayCycle.

-

IPO: December 2019 on NYSE (ticker: BILL); relocated HQ to San Jose, CA

-

2021 Acquisitions:

-

Divvy: $2.5 billion—add spend management, corporate card capabilities (see full profile).

-

Invoice2go: $625 million—mobile-first invoicing for freelancers/small businesses.

-

-

Scale:

-

Revenue: $1.4 billion (trailing 12 months)

-

Processed $275–290 billion in total payment volume (2024)

-

Served 470,000 SMB customers

-

-

Headquarters: San Jose, California (originally Palo Alto)

Company Vitals

FAB Score = 942

– HQ: San Jose, CA

– Founded: 2006

Traction:

– Raised $496M including $216M in its Dec 2019 IPO (Crunchbase)

– Annual revenue (TTM): $1.4B (Yahoo)

– Market Cap: $4.3B (NYSE:BILL)

– Website visits: 4.4M (June 2025; SimilarWeb)

– Employees: 2,190 (Pitchbook), unchanged since Jan ’25; vs 2,620 Jan ’24; 2,370 in Aug ’23

Social:

– LinkedIn: 64,000 followers (3,320 vs 3,180 in Jan ’25; 2,990 in Sep ’24; 2,930 in Jan ’24; 2,950 in Aug ’23)

– iOS rating: 4.9 (48,700 up 1,400 since Jan)

– Capterra: 4.2 (541, up 13 since Jan)

*FAB score = Fintech Attention Barometer, a proprietary measure of company size calculated by Fintech Labs. Inputs primarily include funding, website traffic and employee count.