As a business expands beyond a single owner-operator, its financial needs become dramatically more complex. With more than one person making purchases, the basic bank-issued debit card becomes less than optimal.

As a business expands beyond a single owner-operator, its financial needs become dramatically more complex. With more than one person making purchases, the basic bank-issued debit card becomes less than optimal.

The drawbacks:

- Coordination

- Communication

- Controls

- Security

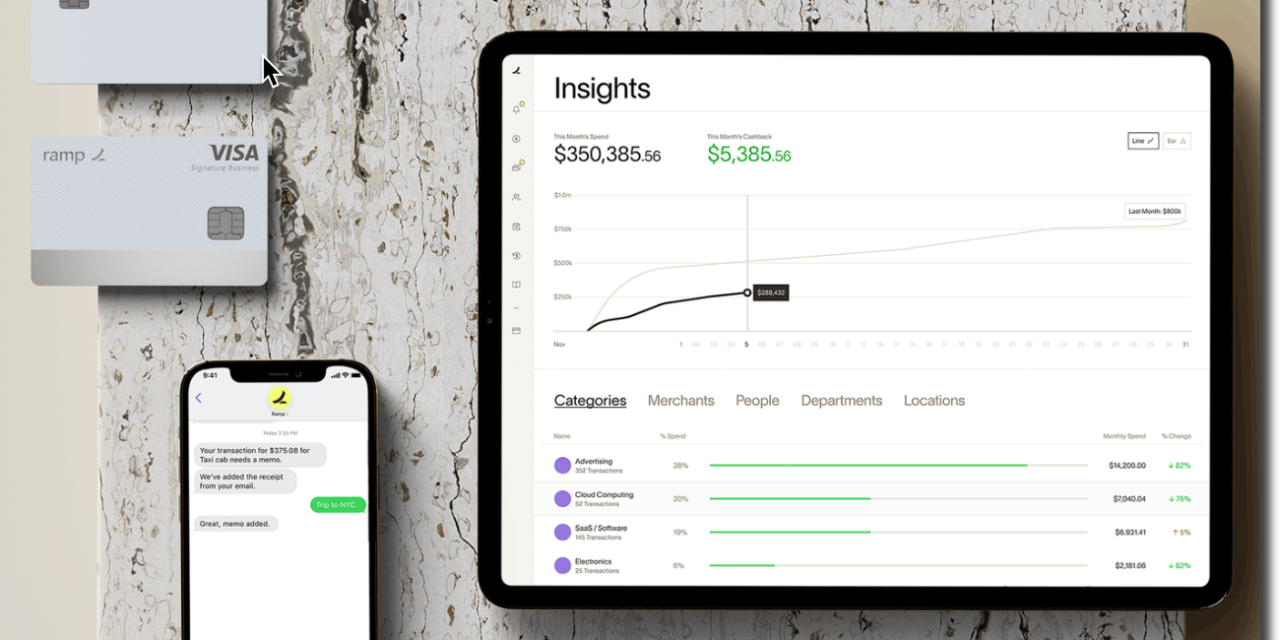

Those issues can be solved with a small-business-oriented credit or charge card such as those offered by Ramp, Divvy, American Express and dozens more (see our full list of digital challenger cards here).*

There are dozens of options, so what exactly are the most important features? Here are our favorite advanced features to look for in a digital smart charge card:

Must-have features:

- Email/SMS customer service (minimum of 8 hours per weekday, 4 hours per weekend day)

- Bullet-proof and clear fraud protection guarantee

- Two-factor authentication

- Customizable alerts

- Downloadable transactions (common file formats)

- Ant–fraud transaction scanning

- Mobile app

- Long-term (5+ years) transaction/statement archives

- Sortable/searchable data

- Virtual cards for authorized users

- Plastic cards*

- Robust transaction dispute tools

Should-have features:

- Large dynamic (changes with bank balance) spending limits (with floor level)

- Spend management (e.g. budgeting) tools*

- Expense management controls at the card-holder level*

- Lifetime statement/transaction archives*

- Dedicated account manager(s) you know by name (with contact info)*

- Positive pay for transactions over a certain amount*

- Unlimited plastic/digital cards*

- Expanded customer service hours (eg. 12 hours minimum per weekday)

- Enhanced security*

- Card on/off switch

- Custom permissions for third-party access

- Feeds/integrations to major accounting services*

- Expedited dispute resolution*

- Transaction annotation (by user)

- Daily statement delivery (email)

- Transaction filing system with custom folders

- Transaction display prioritization (shows most important transactions first)

- Three/four-factor authentication for certain transactions*

- Annual transaction and account summaries*

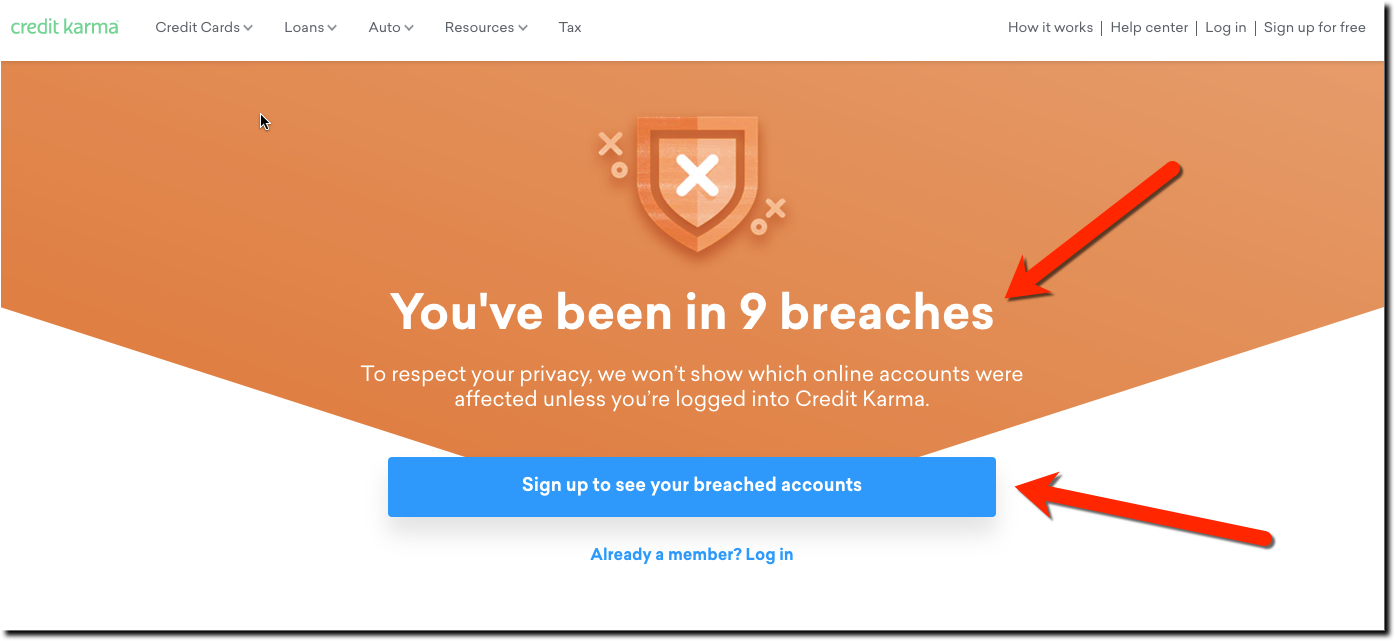

- Credit monitoring/alerts (personal, family & business)*

- Emergency security contacts (“break glass in case of fraud”)*

Nice-to-have features:

- Revolving options (for charge cards)*

- Software integrations*

- Immediate credit for disputed transactions (pending resolution)

- Rewards*

- 24/7 customer service*

- Equipment financing*

- Transaction feed with automatic prioritization (eg. Gmail priority inbox)

- Business dashboard*

- Security token-based account access option*

- Account aggregation of outside card accounts*

- Preformatted forms*

- Premium/VIP client service option*

- Receipt capture/upload*

- Emergency cash-advance for employees*

*May incur extra fees or service charges