Everyone loves a startup (aka challenger bank), especially when they have a compelling story. However, when it comes to trusting someone with your money, many small business owners prefer to deal with companies embedded in the local economy, even if it means not getting the latest online banking features or the best interest rate. The list below are the biggest national brands offering small business banking services. There are also thousands of community banks and credit unions to choose from as well.

If you don’t need a local presence, are are primarily wanting the best online and mobile services, refer digital challenger bank list (here). For more info on choosing a small business bank, see our previous post.

Challenger of the Month*

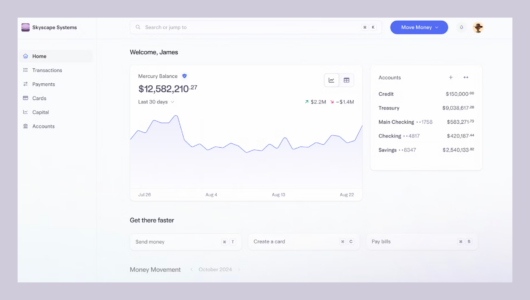

Mercury Bank

Banking for what you’re building. Startups of all sizes rely on Mercury.

HQ: SF | Founded: 2017 | Raised $136M (including $120M in 2021) | Valuation: $1.7 billion | Website visits: 2.2 million/month | Employees: 728 | Article citations: 20 | Linkedin: 37,000 followers | Trustpilot: 3.9 (822 reviews) | iOS app: 4.9 (3,800 reviews)

Resources: Looking for digital banks, lenders, payment providers, insurance or digital accounting for small businesses? Check out our latest lists: Small Business (SMB) savings/treasury accounts (7) | SMB online lenders (33) | SMB challenger banks (15) | SMB insurers (15) | SMB charge cards/expense management (16) | Billpay & invoicing (16)| Payment processors (7) | Subscription processors (7) | SMB digital accounting/bookkeeping (21)

Table: Largest Traditional Branch Banks & Card Issuers Serving U.S. Small Businesses

ranked by monthly website visits

|

Web

Traffic (M)

|

Assets

($ Billions) |

|||||

| Rank | Company | July 25 | Jan 25 | Oct 24 | 30 June ’25 | 30 Sep ’23 |

| 1 | Chase | 192 | 182 | 179 | $3,790 | $3,390 |

| 2 | Citibank | 135 | 99 | 116 | $1,830 | $1,660 |

| 3 | CapitalOne | 133 | 145 | 133 | $649 | $469 |

| 4 | Bank of America | 113 | 114 | 111 | $2,670 | $2,470 |

| 5 | Wells Fargo | 99 | 99 | 99 | $1,740 | $1,700 |

| 6 | TD Bank | 46 | 13 | 13 | $356 | $366 |

| 7 | US Bank | 29 | 27 | 27 | $671 | $657 |

| 8 | PNC Bank | 28 | 24 | 24 | $555 | $553 |

| 9 | BMO | 26 | 25 | 24 | $254 | $261 |

| 10 | Truist | 22 | 20 | 21 | $536 | $535 |

| 11 | Navy FCU | 20 | 21 | 18 | $192 | $168 |

| 12 | Huntington Bank | 12 | 9.1 | 8.7 | $207 | $186 |

| 13 | Regions Bank | 11 | 11 | 9.7 | $158 | $153 |

| 14 | Fifth Third Bank | 9.8 | 10 | 9.0 | $209 | $212 |

| 15 | Citizens Bank | 7.9 | 9.0 | 7.2 | $218 | $225 |

| 16 | M&T Bank | 7.9 | 8.3 | 7.5 | $211 | $209 |

| 17 | Key Bank | 6.1 | 7.8 | 6.2 | $182 | $186 |

| 18 | BECU | 4.0 | 4.6 | 4.0 | $30 | $29 |

| 19 | First Citizens | 3.6 | 4.0 | 3.5 | $229 | $214 |

| 20 | Santander Bank | 3.2 | 3.3 | 3.1 | $103 | $102 |

| 21 | First Horizon | 2.8 | 2.6 | 3.2 | $82 | $82 |

| 22 | Mercury Bank | 2.6 | 2.4 | 2.1 | NA | |

| 23 | America First CU | 2.2 | 2.3 | 2.1 | $23 | $18 |

| 24 | Comerica | 2.0 | 2.0 | 2.4 | $78 | $86 |

| 25 | Flagstar Bank | 1.9 | 2.8 | 2.7 | $92 | $111 |

| 26 | Umpqua Bank | 1.5 | 1.6 | 1.8 | $52 | $52 |

| 27 | Frost Bank | 1.4 | 1.3 | 1.2 | $51 | $49 |

| 28 | First Tech FCU | 1.2 | 1.1 | $17 | $17 | |

| 29 | Zions Bank | 1.1 | 1.3 | 1.0 | $89 | $87 |

| 30 | Synovus | 1.1 | 1.3 | 1.3 | $61 | $59 |

| 31 | Old National Bank | 1.1 | 1.1 | $71 | $49 | |

| 32 | HSBC (USA) | 1.0 | 1.1 | 1.0 | $170 | $163 |

| Cards/Payments | ||||||

| 1 | PayPal | 504 | 341 | 405 | ||

| 2 | Shopify | 177 | 157 | 115 | ||

| 3 | American Express | 99 | 84 | 88 | $212 | $175 |

| 4 | Stripe | 92 | ||||

| 5 | Square | 42 | 50 | 40 | ||

| 6 | Ramp | 3.1 |

Source: FintechLabs, 7 Sep 2025; SimilarWeb, Federal Reserve

Website traffic is total monthly visits according to Similarweb.

Bank assets in US$ billions as of 30 June 2025 per US Federal Reserve, CU Assets as of 31 Dec 24

*FintechLabs is sponsor-supported; companies buying ads or paying referral fees may receive prominent mention