FinovateSpring 2015 demo (7 minutes)

Founded in 2009, Kabbage was one of the first digital alt-lenders catering to small and medium businesses. They were a stalwart at early Finovates demoing 10 times between 2010 and 2015. While they were always disappointed not to win Best of Show, lending is a category that rarely excites an audience of well-do-do technologists.

But after exiting to American Express in 2020 (announced in August) for an estimated $850 million (but never publicly disclosed), the founders have to be pleased with how the journey played out. Though with nearly $500M in equity and another $2B in debt financing it’s hard to know exactly how well common stockholders faired in the buyout. Complicating the picture was that American Express only bought Kabbage’s IP and customer list, not its existing portfolio which is managed by a new entity K-Servicing.

Product line

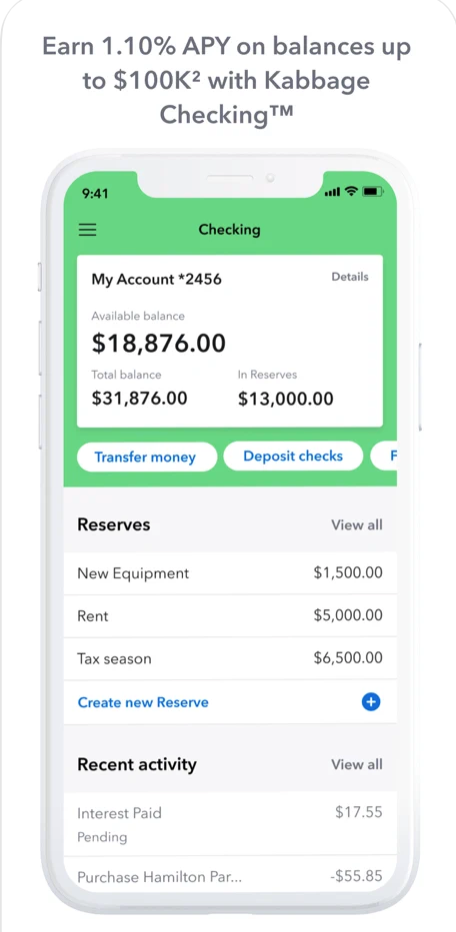

As part of American Express (since Oct 2020), Kabbage has expanded its product line into checking and credit card processing.

Primary:

- Small business credit lines from $1,000 to $150,000 (including PPP loans in the 2020 pandemic)

Secondary:

- Business checking, paying 1.1% APY (first $100k)

- Credit card processing

Tools:

- Small business revenue comparison tool

- Cash flow insights tool

Company Vitals

Acquired by American Express in October 2020

FAB Score = 265 (#1 on our list of the top 26 digital lenders to US small businesses)

– HQ: Atlanta

– Founded: 2008

– Raised: $2.5B (Crunchbase)

– Website visitors: 250,000 (SimilarWeb, Sep 2021)

– Employees: 188 (Pitchbook)

– Citations: 604 (Crunchbase)

– Linkedin: 37,000 followers

– Twitter: 26,700 followers

– Trustpilot: 3.7 (6,700 reviews)