We’ve been debating whether it’s time to add a crypto category in our fintech services directory for small businesses (SMB/SME). We hadn’t really seen a killer use case for normal businesses* given that accepting payments via crypto is still too complicated, expensive and slow (at least in the U.S. where other payment methods work fine).

But I think we have found a fairly straightforward use case: social (aka utility) tokens (the fungible kind) used to reward frequent customers for participating in a community and/or buying goods & services. They are basically a web3 version of a decades-old technique of incentivizing users with free miles, green stamps, stars, etc.

However, crypto-powered tokens have more potential because the token is liquid and has the potential (though not the likelihood) to appreciate. Not only can tokens be redeemed for free or discounted stuff at the retailer, they can also be easily sold on secondary markets to cash out.

They also have the added appeal of being able to appreciate in value if the wider market decides they are worth more than their straight-up redemption value.

Creating value in social tokens:

- Discounts: Tokens can be used for discounts, with more tokens equal higher discounts.

- Merchandise: Tokens used to buy goods and services. Works especially well with digital goods.

- Rewards: Customers receive tokens for various activities (eg. referrals)

- VIP access: Token holders can gain exclusive access to content and experiences.

- Recognition: Token achievements can be gamified with leader boards, lifetime achievement badges, etc.

- Sweepstakes: Customers can be entered into drawings/games for bonus tokens.

- Tipping: Tokens can be used to tip and/or recognize exemplary employee performance.

- Gifting: Tokens can be used to gift products and services to others.

Overall, there are many advantages to using a token as the foundation of a customer loyalty program. However, there are some serious drawbacks too, primarily having to do with the newness of the technology.

Pros:

- Easy to understand: They are pretty much like the customer loyalty programs that have been popular for decades

- Flexible: Can be used to provide discounts, SWAG, members-only events, freebies, etc etc

- Low cost: You can use web3 platforms such as Rally, Coinvise, to run the programs for a low cost

- Secondary market: Users can easily unload their token hoards for cash/cyrpto

- Revenue from secondary sales/transfers

- PR opportunity

- Word of mouth/referrals

- Token platforms can run the entire backend

- Appeals to younger customers, many of which are already investing in crypto

Cons:

- POS integrations may be complicated

- Staff training

- Tech/customer support

- Co-branding with other platforms can be confusing

- Regulatory scrutiny

Case study:

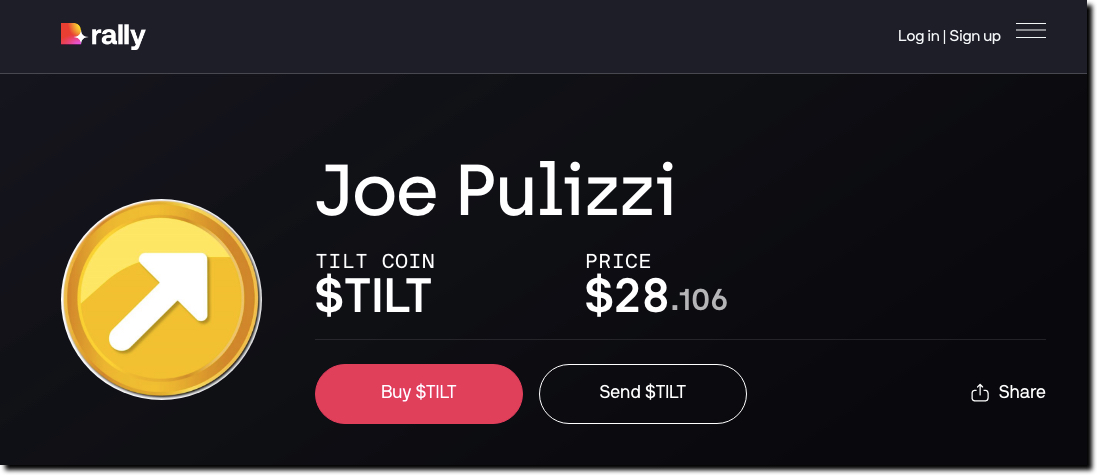

It’s still difficult to find non-crypto-industry examples of social tokens in use. One we ran across recently is a media startup called The Tilt run by an experienced event founder, Joe Pulizzi who sold his Content Marketing Institute to Informa in 2016.

The Tilt launched a social token $TILT in March 2021 on the Rally network (note 2). It gives out tokens to reward basic activities that help build its business/community, for example signing up for its newsletter, referring new customers, writing an article, etc. The token can be spent for merch, training courses, and other Tilt products. Tokens can also be held for appreciation and be bought and sold on the Rally secondary market.

What about NFTs?

NFTs are another viable route to encouraging and rewarding membership-powered businesses. They are getting much of the press now with a number of high-profile, and celebrity-packed examples such as Gary Vanyerchuck’s Vee Friends, Mark Cuban’s Mavs, multi-celebrity backed Bored Apes and more every day.

They are much like social tokens, but their unique characteristics (eg the non-fungible aspect) make them easier to turn into a speculation game by making certain tokens rarer than others. It’s working great for the NFTs that capture popular attention (case in point, Gary Vaynerchuk’s VeeFriends, see note 3). But for most companies who don’t already have a massive following, NFTs are unlikely to catch the attention of speculators to drive up the price and create revenues from secondary market sales.

One of the best examples so far that is not celebrity powered is LinksDAO by fintech veteran Mike Dudas. It raised $11M in Janauary (2022) issuing (aka minting) 9,000+ NFTs to fund an organization looking to purchase and operate a top-100 golf course on behalf of its NFT members (see note 4). NFT owners get to decide on the future path of the golf course, but for now, it’s speculators driving the price (see note 5) and secondary transactions fueling the DOA’s revenue (they get 7.5% of transaction volume).

Pros:

- Potential (albeit tiny) that speculators will jump in driving publicity/value

- Great for creators to showcase skills

Cons:

- Lots of education of staff, customers/stakeholders

- NFT world is full of scams, come-ons and eventually will have the bubble burst

- Requires new marketing skills to create/moderate Discord servers and other NFT peculiarities

- Security/scam monitoring

- Artwork must be created

Bottom line: While the whole area seems not quite ready for prime time (meaning there are more questions than answers), that can be the exact reason to jump in now. Early movers (or even fast followers) can often reap extraordinary benefits (or lose their shirt!).

Notes:

(1) We define “normal businesses” as those not in the crypto space itself. Nor any businesses involved with products in legal gray areas such as cannabis and “adult” entertainment that are generally not allowed to use the Mastercard/Visa/AmEx rails.

(2) The Tilt token is the most popular token on Rally having appreciated nearly 100x in the past year.

(3) VeeFriends is a fascinating success story (so far). It’s like the Topps sports card business but built in one year instead of eight decades. See here for the detailed case study of VeeFriends.

(4) Under current U.S. rules, the DAO can’t actually own the golf course as that would run afoul of securities laws. This is actually an unintended consequence of the regulation. NFT owners would actually be MORE protected if they owned the underlying asset. Owners of LinksDAO NFTs currently only have the “right” to purchase a membership to the future golf club (see analysis here).

(5) The base NFT price more than doubled in mid-January when NBA star Steph Curry bought into the project. The price has retreated about 15% since then, but it’s still about double the BC (before Curry) price.