Simple spend management tools top my list of advanced digital banking features (see previous post). And none are more important than subscription management. One of my favorite companies launched at Finovate was BillGuard (see footnote). It was ahead of its time with a dead-simple UI to help consumers spot and turn off recurring charges on their credit card statements.

The service is even more valuable in the small business space, where just one duplicate SaaS subscription can cost hundreds or even thousands per year. Enter Mercury and its latest product improvement, automated subscription management. Here’s how they describe it:

If managing your subscriptions makes you wince, you’re not alone. That’s why we built a Subscriptions page that allows you to track, view, and manage all your company’s debit and credit card subscriptions in one place. You can get notified about new subscriptions, spot duplicate ones, and effortlessly access vendor websites to cancel as needed — helping you cut costs and reclaim valuable time.

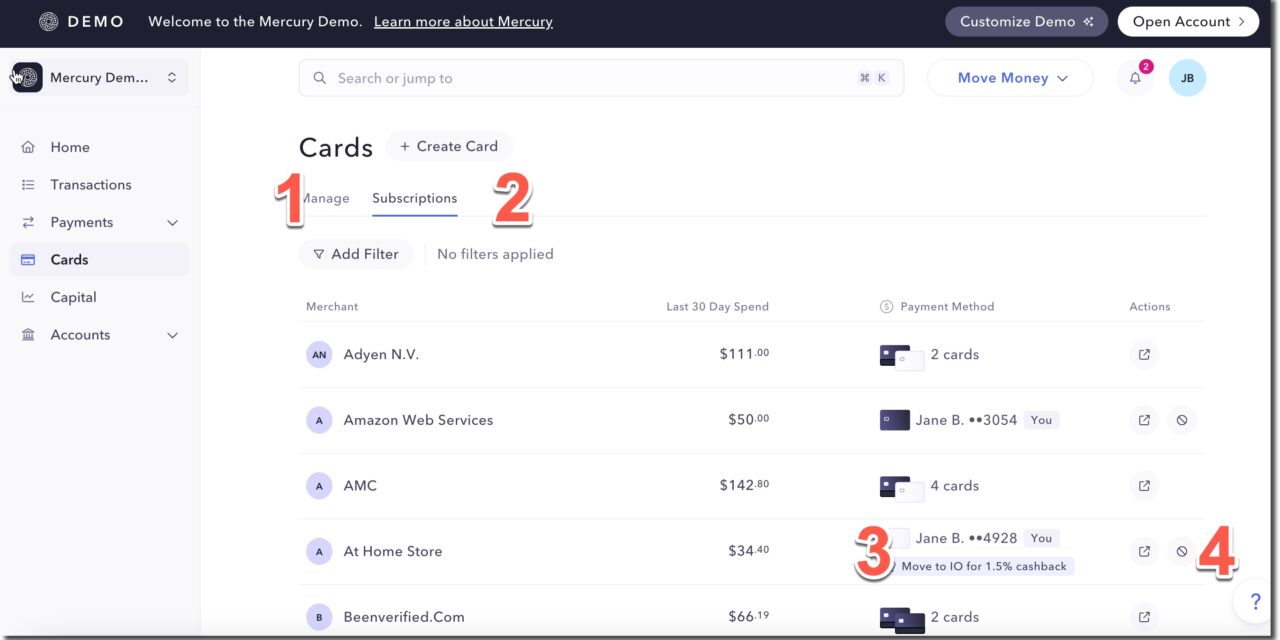

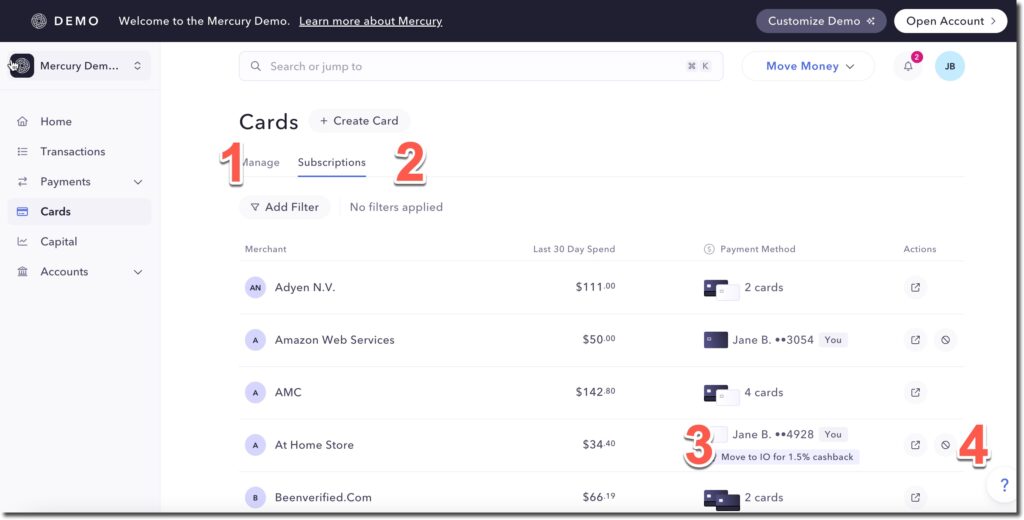

Card Management UX

The card management area now has two tabs, Manage for all transactions (see #1 on screenshot) and the other just for Subscriptions (see #2). Clicking on a subscription transaction reveals which company cardholders are making payments for that service. Also, Mercury prompts users to set up a virtual Mercury IO card to earn 1.5% cashback on subscription payments (see #3). It’s a powerful way to lock in users and keep spend within the Mercury ecosystem. Finally, there is an action button to cancel the subscription (see #4 above, and below for more info).

There is also an easy-to-use filter to find results by card number, cardholder, internal account, merchant, active subs, and inactive subs. We generally favor filtering over most transaction search methods because it helps users craft better prompts while learning what’s available.

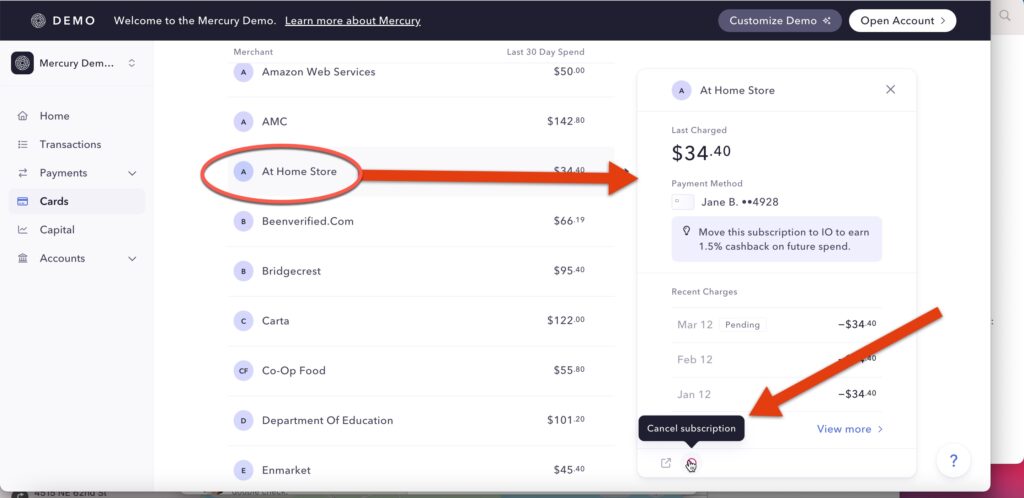

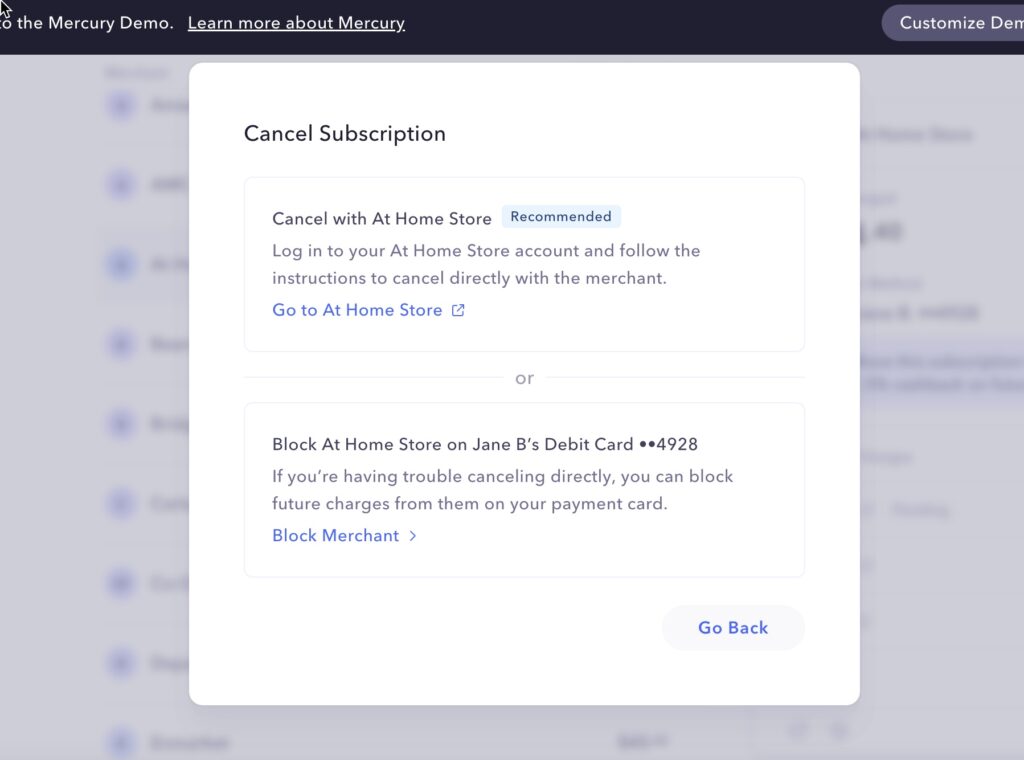

Another nice feature. Mercury embeds a Cancel subscription button on the merchant detail window. Not only is this a time saver, it fosters action, rather than procrastination to turn off unneeded charges. Selecting cancel leads to two options:

- Login and cancel at the merchant (via direct link to merchant)

- Block future charges to this merchant

Check out the demo for yourself here.

Notes:

1. BillGuard launched its service in 2011 winning Best of Show at Finovate (see demo). The company was acquired by Prosper in 2015 for a reported $30 to $40 million, not a bad outcome in 2015. However, the service was discontinued in 2017 since it was not core to Prosper’s consumer lending business.

2. FintechLabs may receive advertising and/or affiliate revenue from companies mentioned.