Breach Clarity’s FinovateWest 2020 demo (Nov 2020)

Breach Clarity was founded in 2016 (launched in 2019) by my long-time friend Jim Van Dyke and his colleague Al Pascual. Jim founded financial services consulting

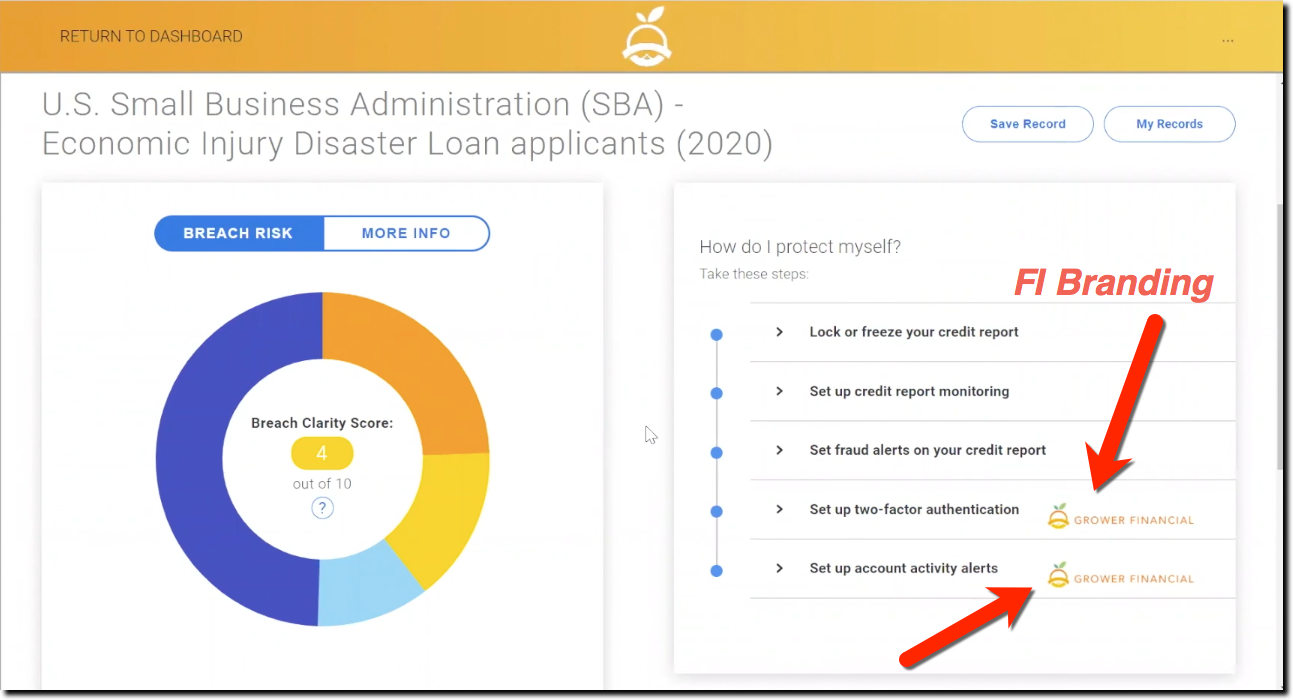

The initial premise was to bring clarity to the noise surrounding data breaches. The startup looks at each breach and assigns a score of 1 to 10 so consumers can better understand its severity. Breach Clarity then provides a checklist of actions consumers can take to protect themselves such as freezing credit, monitoring credit, and so on (see screenshot below).

But general educational guidelines can only take a consumer so far. The key to gaining and keeping attention is to personalize the “security feed.” And true to its mission, Breach Clarity’s latest enhancement does just that. It sends an alert when a customer’s personal info has been exposed in a data breach. And then provides specific steps to take to secure their finances including FI-specific enhanced security options within online banking (see screenshot below).

–

Co-branded page at Breach Clarity with action steps

Opportunities for financial institutions:

Bottom line: Security is the number one concern of digital consumers. Anything you can do to make them worry less is money in (your) bank.

Company vitals:

– 3 clients added since 2019 Finovate Fall demo including a co-branded offering with Sontiq

– Awarded Best of Show at FinovateWest (24 Nov 2020) and VentureTech (Sep 2020)

Founders:

– Jim Van Dyke, CEO

– Al Pascual, COO

References:

– American Banker profile (paywall) (20 Feb 2020)

– Finovate blog archive