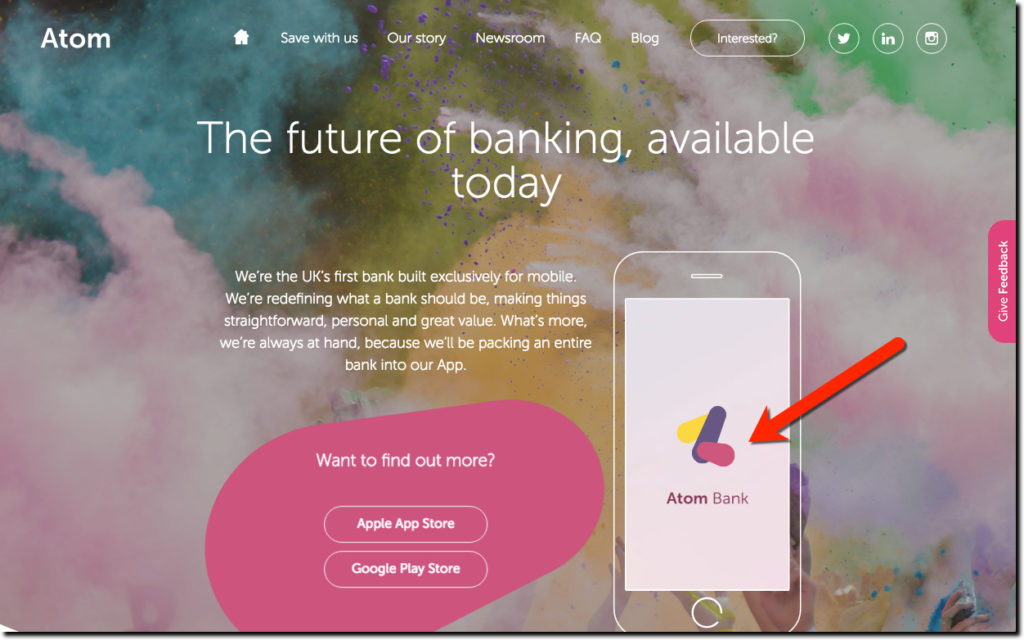

There is one big difference between established banking brands and the upstarts when it comes to homepage design. Upstarts almost always post prominent screenshots of their mobile experience, whereas legacy banks often relegate mobile to the depths of the secondary navigations. And even after you find the mobile banking page, it often contains little more than uninspiring copy and App Store buttons more prominent than the mobile UI itself.

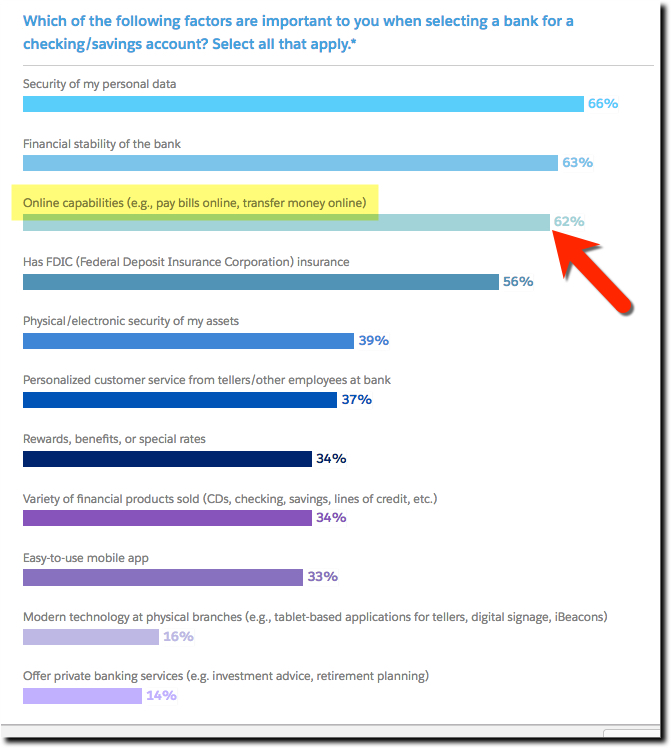

In our opinion this is a big mistake. Online and mobile capabilities are fast becoming table stakes for anyone under the age of 65 when selecting a bank. Recent Salesforce data showed that when switching banks, online capabilities were at parity with the usual security, soundness and branch network factors (see inset, click to enlarge). And for millennials, mobile was a factor 50% more often than online (Source: Financial Brand, 23 Jan 2017).

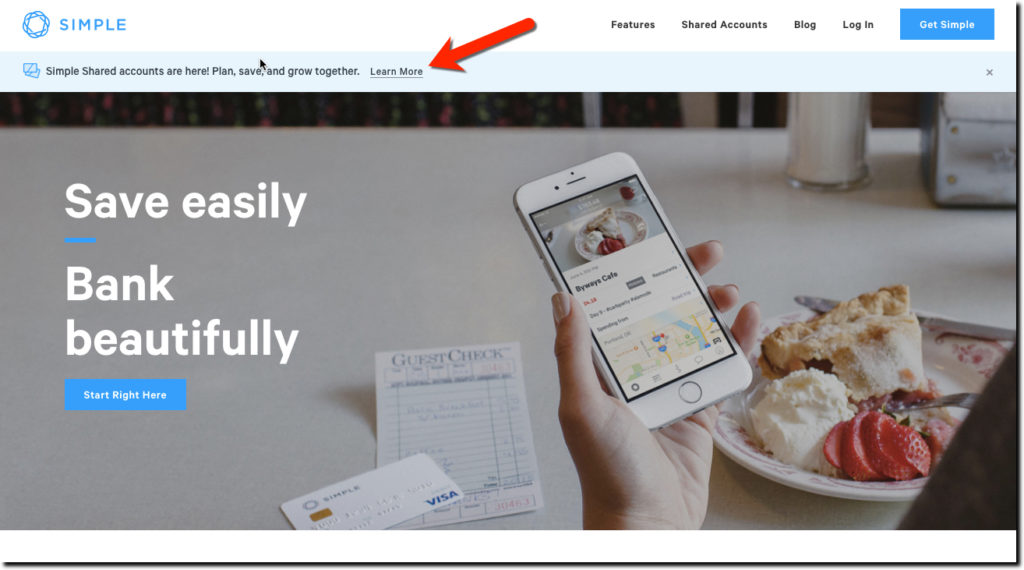

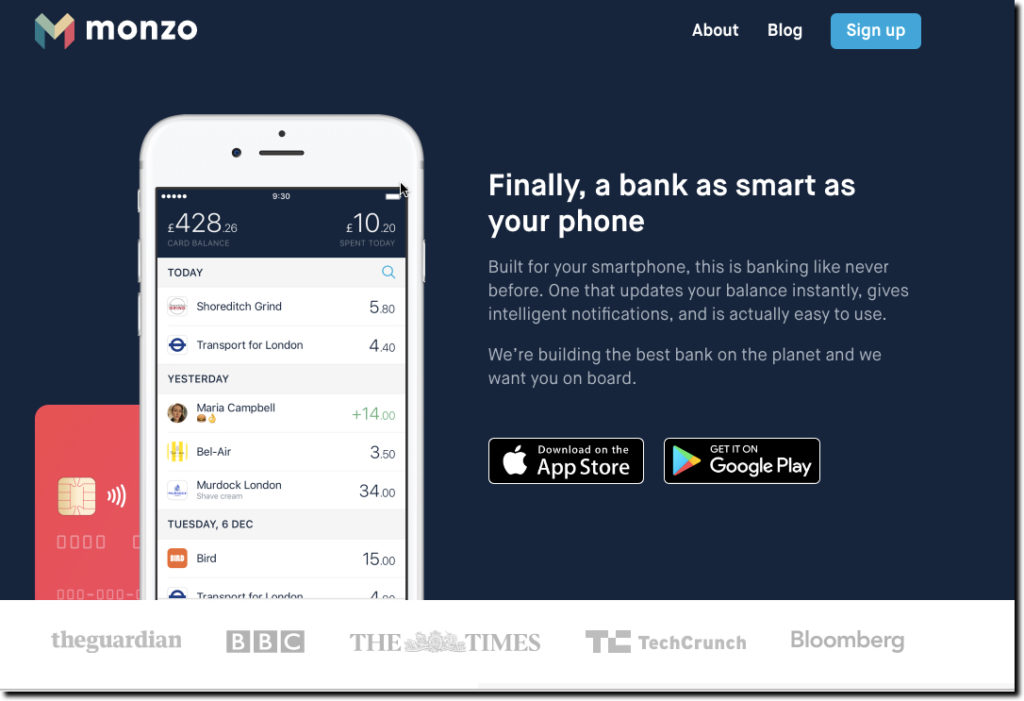

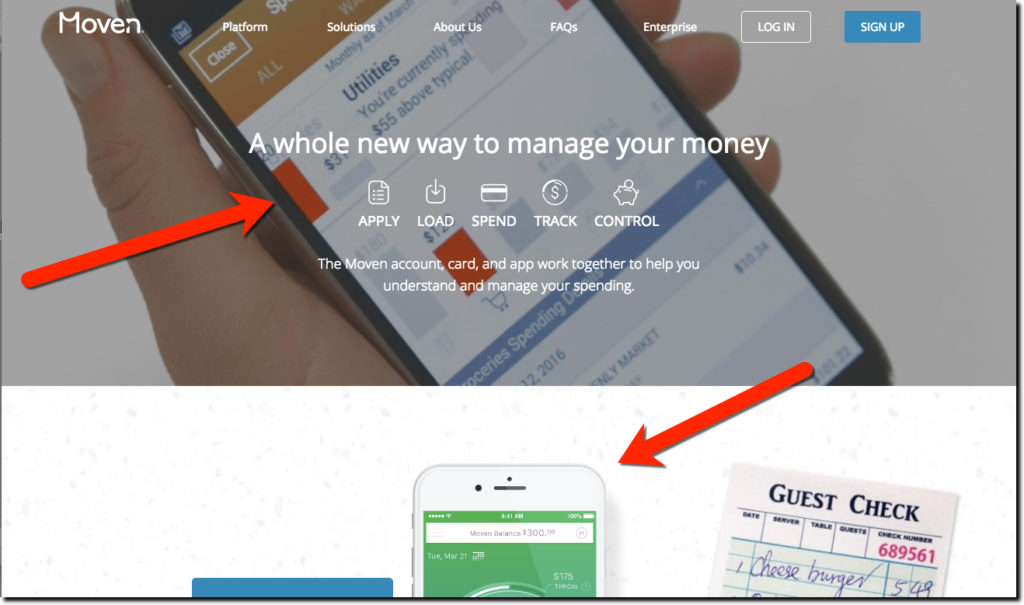

And it’s so easy too. You don’t have to arrange an expensive photo shoot or have endless debates about the happy couple’s expressions. You just take a screengrab on your mobile, email it to the website designer, fancy it up with an iPhone/Android skin, and boom you have a great visual.

Another advantage. On responsive sites, you can shrink the screen down to smartphone size and your smartphone screenshot stays intact and is extremely pertinent to the mobile user.

For extra credit, show your debit card behind the mobile phone, making it clear you are a “real” bank and not just a mobile facade. And consider dropping a watch into the photo for added tech cred (see Nubank below).

Here are some examples from prominent upstarts (in order of total funding or exit amount):

Atom Bank: The UK-wunderkind that has raised Square-like financing, $270 million and counting, even without Jack Dorsey. BBVA is the lead investor.

Nubank: Brazilian startup which has raised almost $180 million. It added a smartwatch screenshot to the mobile phone and debit card for the perfect digital trifecta.

BankMobile (duh): The Customers Bancorp unit that was just sold to Flagship Bank for $175 million.

Simple: The great recession fintech poster child, which raised $15 million before being acquired by BBVA for $117 million in 2014.

Monzo Bank: Another UK-based startup, which as picked up $45 million in funding, notable 10% from crowdfunding campaigns

Moven: With author and noted technologist Brett King as founder, Moven is the closest we have to a celebrity-run challenger bank (honorable mention to John Sculley at Lantern Credit). Moven, which has raised $24 million, is a Finovate crowd favorite, with multiple Best of Show wins.