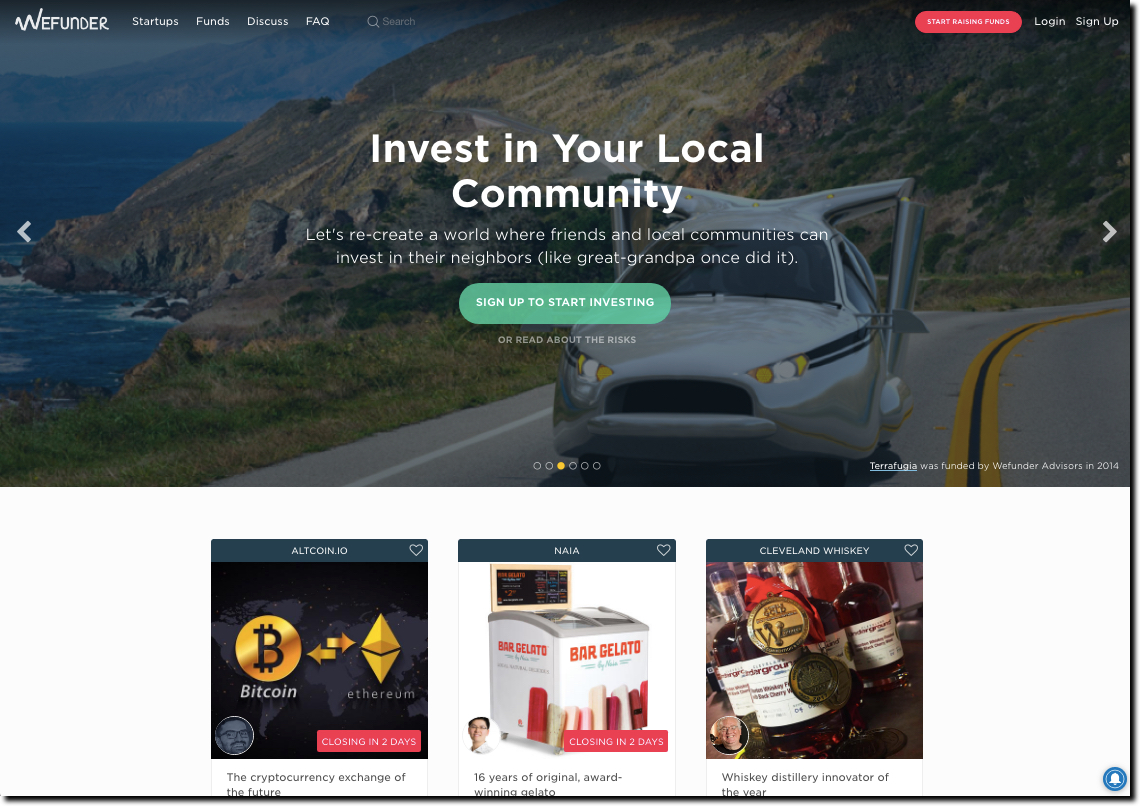

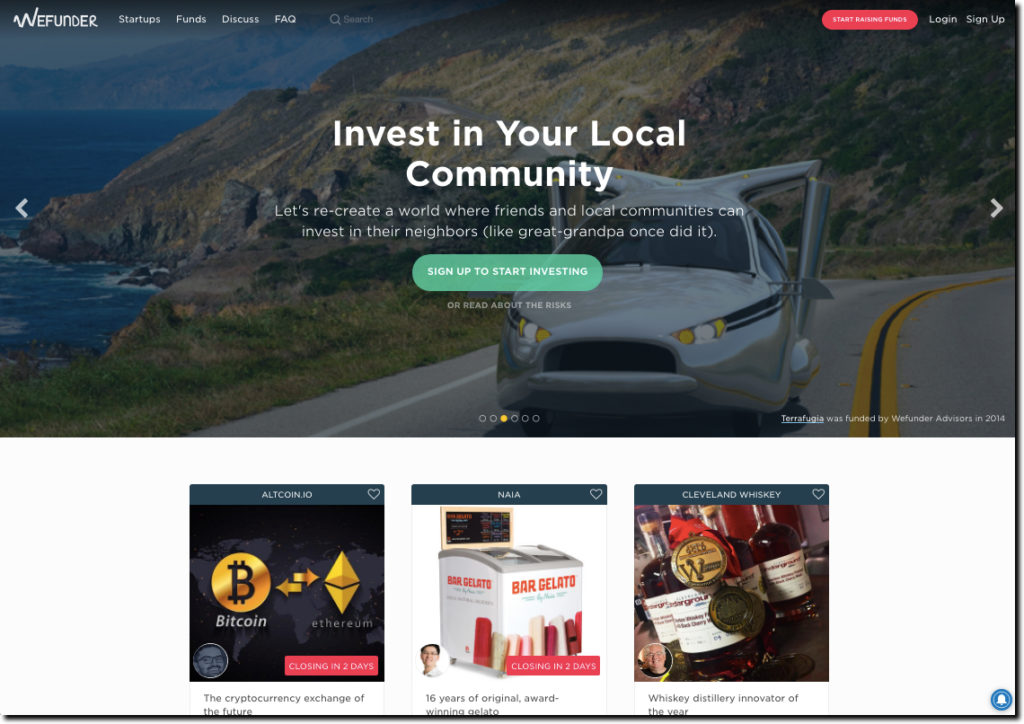

In the United States, equity or debt crowdfunding, especially to non-accredited investors, is still just a sliver of overall private-company fundraising. In its first full year (2017), so-called Reg CF activity, equity crowdfunding from non-accredited investors raised just $50 million (that’s not even enough to fuel a later round of a single hot VC company). And we’ve already surpassed that total in 2018, with $60 million raised through Aug 29. Even more impressive is the total number of investors, 155,000 in the two years since it went live, each investing just under $1,000 for a cumulative total of $152 million in 1,162 offerings (not all were funded). Wefunder, shown above, is the largest platform, raising almost one-third of the total thus far (source: Crowdfund Capital Advisors, Jan 2018).

While that’s good traction, it’s not the groundswell expected by its supporters. Part of the reason, just as it began rolling out in 2016, another fundraising technique took the space by storm. Yep, crypto/ICO fever which has raised almost 100x (more than $13 billion) worldwide in the same period. For those who still chafe at the many restrictions imposed on consumers wanting to invest a few thousand dollars into a small business in their community, it seems strange that the same person can blow their life savings on the latest crypto coin out of Malta.

In standard equity/debt crowdfunding, trusted financial institutions can play an important role by helping consumers discover and participate in the fundraising of local businesses, especially the FI’s SMB clients. There are several ways to do this:

- Make customers aware of local businesses raising money

In the years before the Jobs Act, this was expressly forbidden. But now the awareness step of private fundraising is crucially important. This includes companies raising on equity & debt platforms, but also through rewards-based sites such as Kickstarter and Indigogo. - Partner with crowdfunding platform(s)

Make it easier for your customers to participate by partnering with preferred crowdfunding platforms. Partnerships can run the gamut from a simple joint marketing agreement to a permanent presence on your website for selected deals. - Integrate with a crowdfunding platform

This is where you get serious. Either through white labeling or deep integrations including single-signon, provide direct access into the crowdfunding platform.

Put your capital to work in the platform

In any of the three scenarios outlined above, you can demonstrate your commitment to SMB clients, and your trust in the crowdfunding platform, by committing the first wave of cash commitments in the deal. Alternatively, you could match dollar for dollar the amount raised from your customers. Hopefully, this cash will provide an acceptable ROI on its own, making it a low-cost marketing tactic. For extra credit, take a small stake in the crowdfunding platform itself so you have a front-row seat to its mechanisms.

Why do this now?

You are probably thinking (rightly so), that you have enough headaches with regulatory compliance, 2019 budgeting, and negotiating the 3-year IT queue. But we believe crowdfunding deserves to move up your roadmap for several reasons:

- Attracts new SMB customers (which is difficult/expensive)

Helping them gain exposure for capital raising gives is priceless and can lead to lifetime business clients as well as the personal accounts of the owners. - Customers are looking for alternative investments

With the stock market at all-time highs and interest rates still relatively low, customers are searching for alternative assets (eg the crypto craze). This is a win-win. Customers get a potentially higher yield investment while supporting their community. - Leads to more commercial loans

SMB clients who successfully raise through crowdfunding are eventually going to need more money. You are first in line to provide lucrative lines of credit and commercial loans down the road. - Elevates your brand

Being involved in a new area of digital financial services helps your brand seem modern and digitally savvy. Unless you are serving a Luddite base, that’s good for your brand perceptions among customers, employees and other stakeholders.