Kindur has been in the fintech news lately, first when it raised $10M in December (led by Anthemis) and then more recently when it launched its investment management service.

One of the best profiles was on a recent episode of The Bank On It podcast which interviewed Kindur founder Rhian Horgan, a 17-year JPMorgan employee. She unveils a compelling narrative about how retirees whose assets are housed in 401(k)s are more stressed than those with simple pension plans, even in the case where the 401(k) owner is better off by financial measures.

What stresses retirees out about their financial future is a complex topic. And there are many ways to approach it. But there is no doubt that humans crave a certain amount of certainty, especially with their finances. So, I love what Kindur is attempting to pull off, even if it doesn’t appeal to everyone.

The product:

Kindur is a specialized robo advisor, charging 0.5% (50bp) to take over management of your assets while converting a portion of them into fixed payout annuities. Like all robos, Kindur measures your risk tolerances and creates a portfolio constructed of ETFs. Human CFPs, “coaches” are available to help customers get started and answer ongoing questions.

The differentiation:

Unlike most robos targeting young to middle-age investors, Kindur is focused on the near-retiree, someone who is typically 5 years away from retirement. In the USA, that’s the 55+ age group, a group that is relatively neglected by digital marketers.

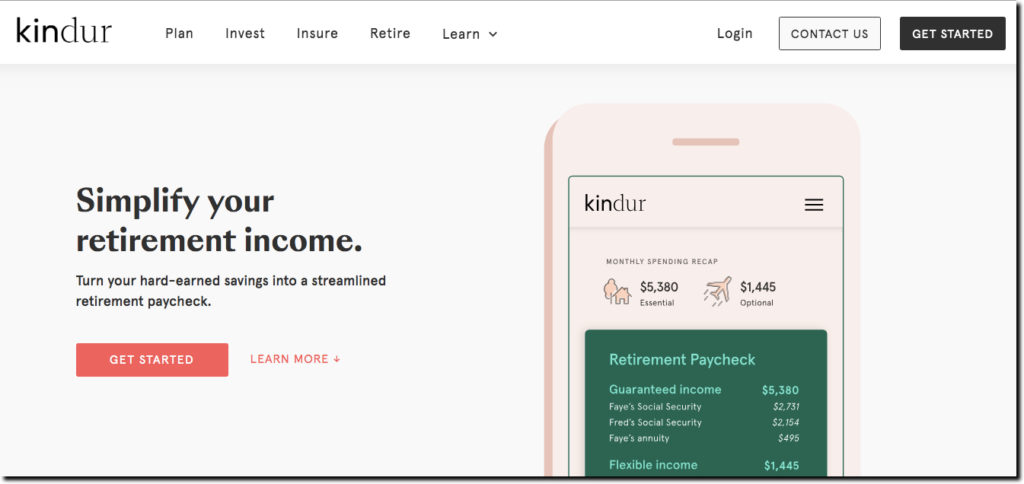

But the startup’s marketing strategy is not what defines them. Their special sauce is integrating annuities into the ETF portfolio so that clients have a fixed retirement income stream, what Kindur cleverly calls your “retirement paycheck.”

Bottom line:

Simplifying retirement options is a fantastic idea and every financial institution would do well to adopt similar techniques.