Americans love their airline rewards cards. But it’s a scale business today, and unless you are American Express (which paid $3B to airline partners last year according to WSJ) or one of the top-5 issuers, you just can’t compete for this lucrative, but low-margin spend. Most smaller banks have fought back with cash-back cards or accounts that pay above-market interest rates if you run your spending through the account (eg. Kasasa).

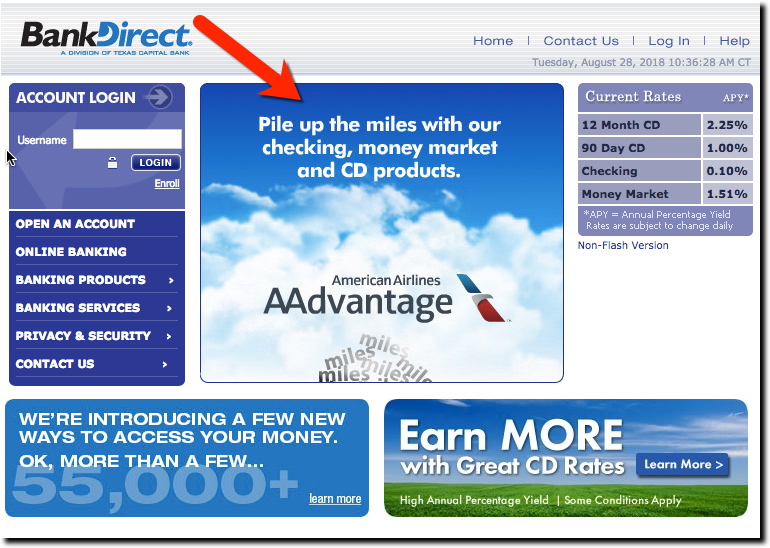

Only BankDirect (a division of Texas Capital) has embraced airline rewards across its deposit products since its launch more than 18 years ago. Essentially, it pays miles instead of interest, currently up to 1,200 miles annually per $1,000 on deposit (max of $50,000 deposit).

But there is an easier way to jump on the mileage rewards bandwagon. Automated balance transfers. While airline cards offer great mileage perks, they are known to charge high interest on revolving balances (NerdWallet says rates range from 17% to 25%). This is where the profits are generated for the issuers. You can help your customers arbitrage these prices by making it easy for them to spend on their rewards card but come to you for the loan.

Here’s how it works (this works best if you have an account aggregation engine, but it’s not required):

- Customers apply for your Frequent Flyer line of credit.

- Customers enter their rewards card login information into your account aggregation

OR

Customers put your credit line account number into the automatic payment tool at the rewards credit card issuer

OR

Customers set up an automatic credit line transfer to the rewards card through your billpay engine - Customers pay down their line of credit directly with you.

Extra credit: In order to attract customers into a slightly complicated product, you should also provide some type of reward. Some type of travel reward, even miles, makes the most sense.