Here are the top 5 articles this week mentioning fintech startups:

- Banks and Retailers Are Tracking How You Type, Swipe and Tap (NY Times)

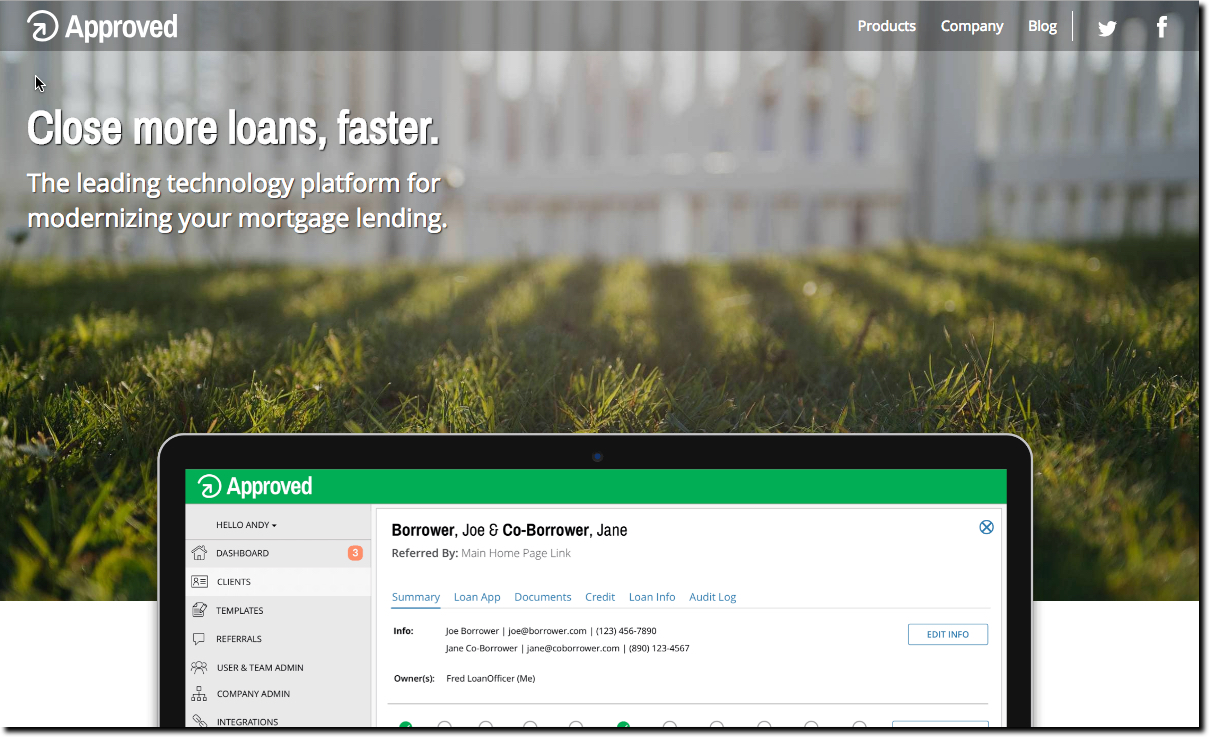

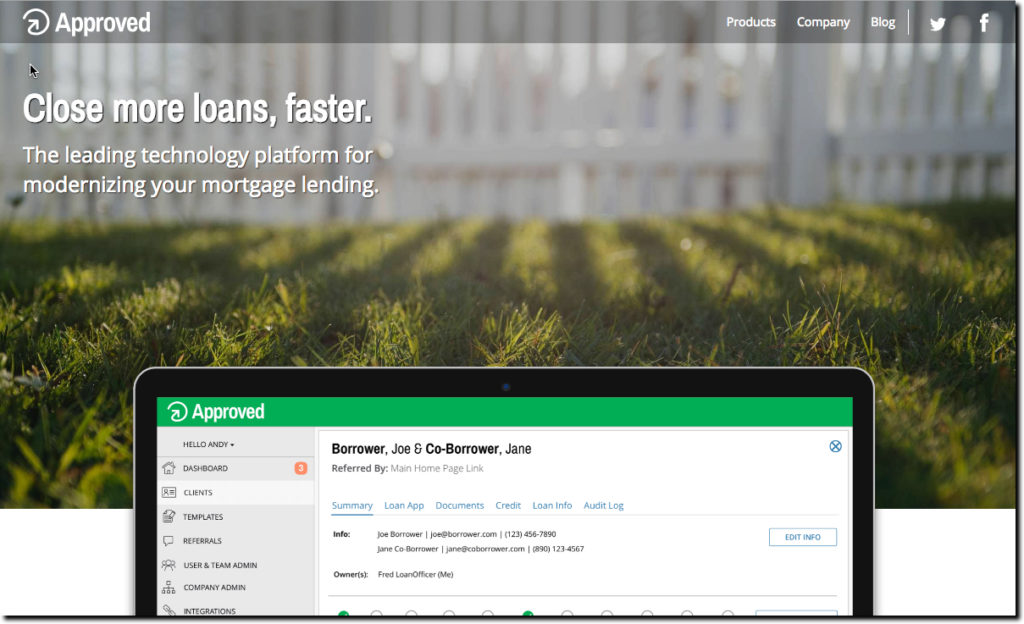

To fight fraud, companies are cataloging behavioral biometrics. Few financial institutions will discuss their efforts, but one did so for this article. Royal Bank of Scotland is rolling out technology from BioCatch to all 18.7 million retail and business accounts. Quoted in the article is Neil Costigan, CEO of BehavioSec. Other companies mentioned include Forter and NuData, acquired last year by Mastercard. - Credit Karma Acquires Mortgage Platform Approved (TechCrunch)

In a surprise move, multi-unicorn Credit Karma, known for actually putting the “free” into “free credit reports” industry, acquired San Diego based Approved for an undisclosed sum. The Approved founders are Redfin alums, so it’s hard to know whether this acquisition signals a move into mortgage processes, or if the giant startup is looking to get into the real estate listing business. Approved had previously raised only a seed round of $1M in April 2017 so this could have been an aqui-hire. - UK Government Announces Winners of Prize by Tech Firms Helping UK Renters Boost their Credit Score (Crowdfund Insider)

Three startups, Bud, CreditLadder, and RentalStop split the £1.4 million prize, each taking home a major infusion of about US$500,000 to further their efforts to make rental payments part of the credit score in the UK. - 21 Fintech Startups in the 2018 Inc 500 List (Fintech Labs)

Only 4% of the Inc 500 this year were fintech companies, but many of the biggest private fintech companies do not play along with this annual rite, which requires them to disclose annual revenues going back to 2014. Nevertheless, it’s an interesting cross-section of what’s hot in the industry. Five of the 21 companies were involved in the crowdfunding space, 5 were in other types of lending, 3 were in insurance, 2 in wealth management, 2 in real estate, and 1 each in payments, equity management, digital banking and financial marketing. - How Fintech is Changing Financial Services for Gig Economy Workers (Bankrate)

In her first major roundup at her new gig, the uber-talented called out several fintech startups looking to help gig economy workers make ends meet. She profiled Steady which hopes to help consumers find more gigs. Last week that startup bagged a $9M Series A, along with celebrity advisor Shaquille O’Neal. She also mentioned Cogni, a stealth startup also looking to serve gig economy workers.