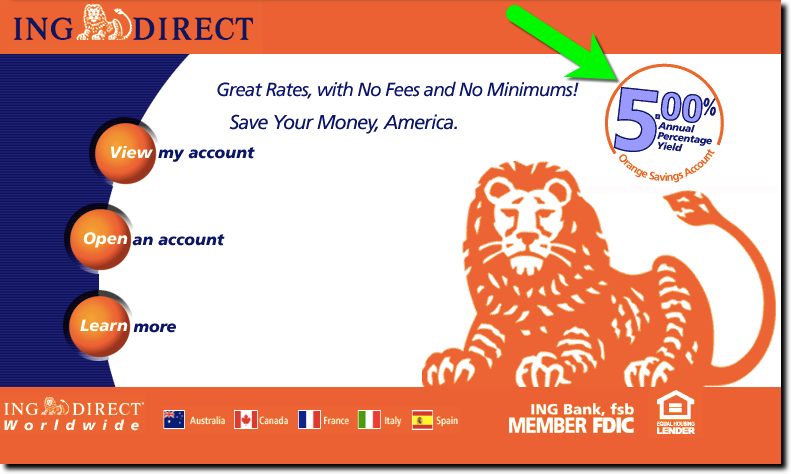

When my kids were young (early 2000’s), there was a lot more incentive to save. I remember setting up their first savings accounts at ING Direct when the direct bank touted its 5% APY in bold orange advertising all over the east coast (see below). Even with low account balances, the interest earned every month was material.

While we may are not likely to see 5% rates (in the USA) anytime soon, it’s relatively painless to offer that kind of rate to the kids of your customers to help make savings seem more worthwhile. There are three ways to accomplish it.

- Boost rates for the first few hundred dollars in the account

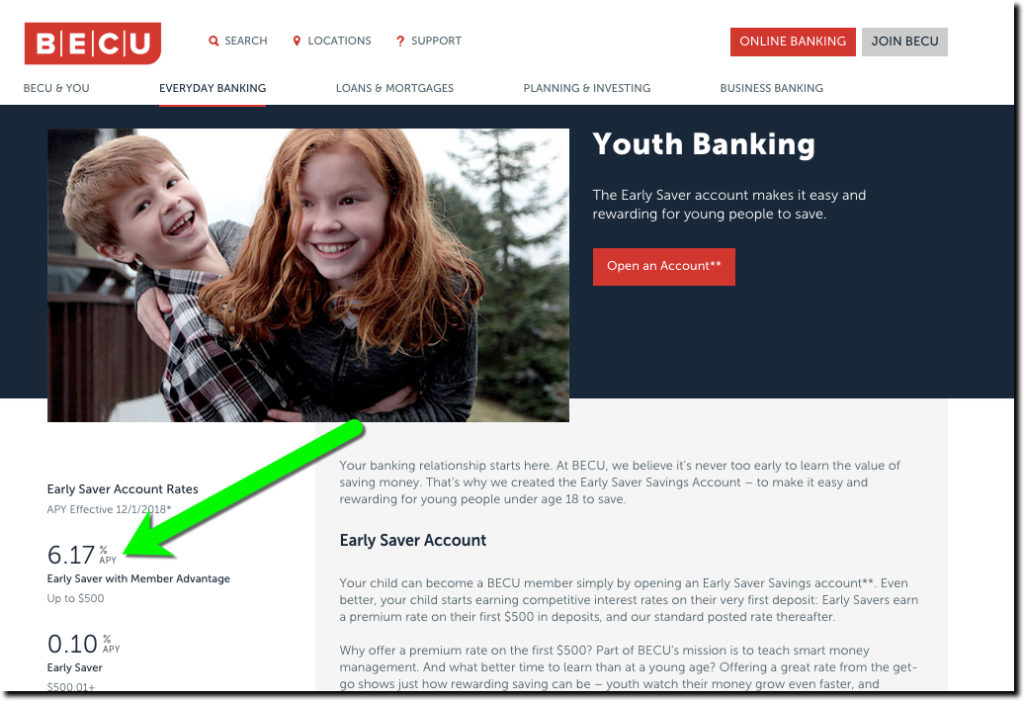

BECU (see above) offers 6% on the first $500 in the account, basically paying an extra $25 per year to the youngest members (age limit = 18). That’s the most effective method, but also the most expensive. - Let parents cover the extra interest from their accounts

Instead of paying the extra $25 annually yourself, pass the cost on to the parents. This is nice because it costs you nothing, and allows parents to pay premium rates at any level and on any amount. You can also add deposit matching, eg parents match each savings dollar their kids put aside. - Use shopping affiliate fees and rebates to boost returns

This is the merchant-funded rewards model. Use kickbacks from spending to fund returns in the bank account. For example, if you or your child purchases something through an affiliate link or special offer, add those funds to the account as essentially “extra interest.” This is a good way to get “free” money into youth accounts, but it’s a bit counter-intuitive because it requires spending to earn extra savings.

Benefits to banks:

A major customer acquisition goal should be establishing accounts for the children of your customers. The earlier the better, but certainly before their senior year of high school. If you provide good service, with solid integration to the parents, there is no reason why the kids of today (or their kids) would ever need to leave your bank. What’s the lifetime value of customers you retain for multiple generations? Hard to calculate, but it’s a lot more than the $10 to $25/yr BECU spends to subsidize youth savings accounts.