Most (all?) consumer banking services are commodities. That’s why banks continue to spend billions on an otherwise superfluous branch network.

But instead of spending tens of millions on branches, why not invest a fraction of that in services that actually differentiate you? And that you can charge for? Some of the most significant opportunities are related to reducing risk for retail customers (consumers and small businesses):

- Financial fraud alerts

- Fraud protection & guarantees

- Financial and identity theft insurance

The WSJ featured one important nascent service last week: Using transaction and service behavior to protect seniors from the legions of crooks preying on older consumers. The article cited an SEC study released in June that estimated that nearly 7% of older consumers had experienced “financial exploitation” in the last 12 months. There are 20 million Americans over the age of 75, and that number is growing rapidly. Assuming half of them would pay $100 annually for financial protection, it’s a billion-dollar market (ARR).

But the market for fraud protection is not limited to older consumers. Virtually everyone with any assets worries about losing them. We estimate that 20 to 30 million U.S. households would pay $100 annually for financial protection if it was trustworthy and convenient to purchase (note 1). That’s a $2 to $3 billion annual opportunity. And there is no one that values fraud protection more than small businesses. We estimate that 2 to 3 million small businesses would pay $50/mo for financial protection, that adds up to another $1.5 to $2 billion in revenues.

If you are not ready for fee-based fraud protection services, here are some other things financial institutions can do in the meantime:

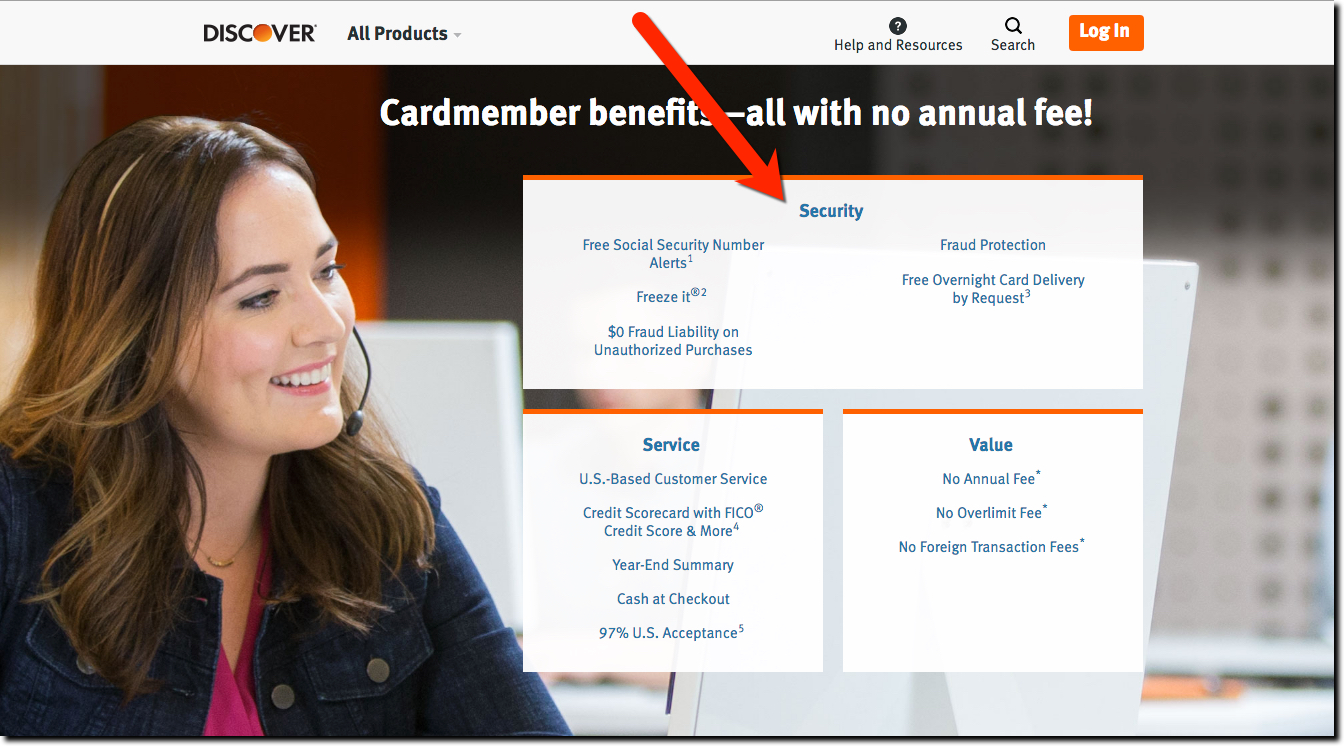

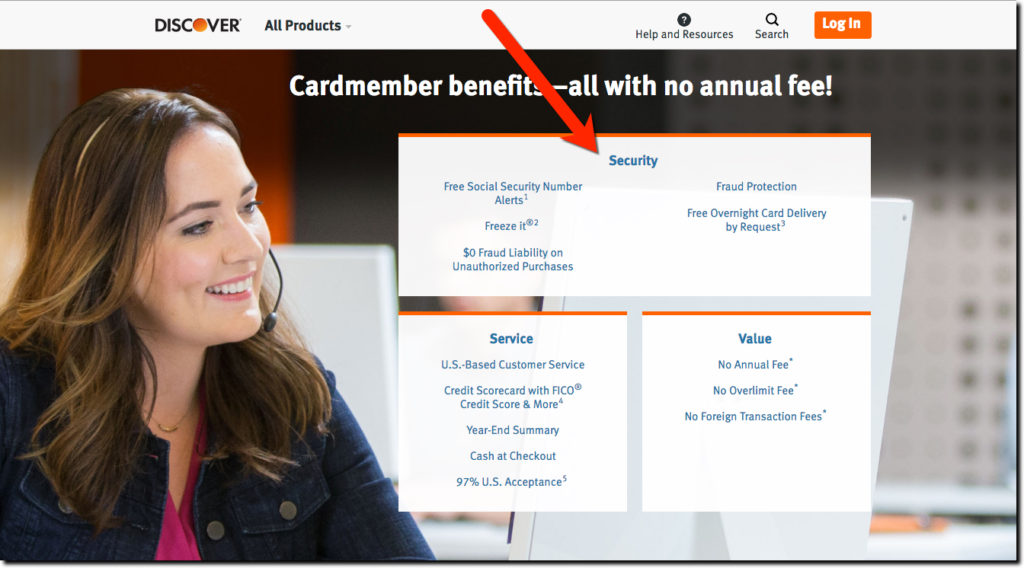

- Beef up your security benefits page (see Discover Card above and also more detail here)

- Provide credit scores (see Capital One’s Creditwise)

- Add a debit/credit card on/off switch (an increasingly common feature first offered almost 7 years ago by Malauzai client City Bank of Texas)

Note:

1. Banks, credit unions, card issuers are uniquely positioned as both trustworthy and convenient.

2. We are unaware of any comprehensive off-the-shelf fraud protection provider