Divvy is one of the biggest fintech success stories of the 2020s. Founded in late 2016 by Blake Murray and Alex Bean, the Lehi, Utah-based startup went from founding to a $2.3 billion exit in just 4.5 years. While several companies have reached $2.3B+ valuations in that time (see Appendix), few, if any have actually cashed in so quickly. The exit occurred in mid-2021 when Bill.com was looking to expand its offerings in the corporate card and expense management space.

Timeline of a fintech rocket ship:

- September 2016: Founded in Lehi, Utah by Blake Murray and Alex Bean

- March 2017: Launches corporate credit card and expense management platform

- Dec 2017: Raises $7M seed round

- April 2018: Adds automated expense reporting and budgeting tools

- May 2018: Raises $10.5M Series A

- July 2018: Raises $35M Series B

- April 2019: Raises $200M Series C; hits unicorn status

- Aug 2019: Hits milestone of 3,000 companies served and secures a major commitment from Credit Suisse to purchase up to $500M in receivables (Source: Press release)

- October 2019: Raises $200 million in a series C funding round, valuing the company at $1.6 billion. It is also named one of the top 100 private cloud companies in the world by Forbes.

- June 2020: Launches virtual cards; 2019 revenues of $32 million (source: Forbes)

- January 2021: Raises $165M series D with Paypal as lead investor bringing total capital raised to $418M

- May 2021: More than 10,000 customers, more than $1 billion in annual transactions (source: Nathan Latka)

- May 2021: Acquired by Bill.com for $2.3 billion in a cash ($665 million) and stock ($1.65 billion*) deal (source: SEC)

*Note: If the Divvy owners sold their Bill.com shares at the market peak (Nov 2021), they would have fetched around $3.7 billion. However, many shares could not be sold until after the 6-month lockup expired in December 2021. On the other hand, if they still owned it today, it is worth about $1.5 billion (as of July 2023).

Primary Pros & Cons

Pros:

- Streamline and automate corporate spending and expense management processes. With Divvy, businesses can easily track and manage employee expenses in real time, as well as set customized spending limits and receive instant notifications for purchases.

- Divvy’s platform also offers a range of features that can help businesses improve their financial management and control, such as the ability to issue virtual or physical corporate credit cards, reconcile expenses automatically, and generate reports on spending.

- By using Divvy, businesses can reduce the time and effort spent on manual expense management tasks, as well as improve their visibility into company spending and make more informed financial decisions. This can lead to increased efficiency and cost savings for the business.

- Divvy also provides lines of credit offering up to $15 million

Cons:

The main downside is the initial time investment to set up and get all employees on board using the platform. It’s also a fairly robust system best used by larger small businesses with employees and more complicated expense management needs.

Features & Benefits

The Divvy card and spend management system includes a wide range of features that are designed to help businesses streamline their corporate spending and expense management processes. Features include:

- Expense tracking and reporting in real-time. The platform also provides automatic expense categorization, making it easier to track and manage spending.

- Virtual cards that can be used for online purchases or one-time payments. Virtual cards provide an additional layer of security and can be used for expenses that don’t require a physical card.

- Automated expense reports: Users can create and submit expense reports automatically using the data from their card and other expenses tracked in the platform.

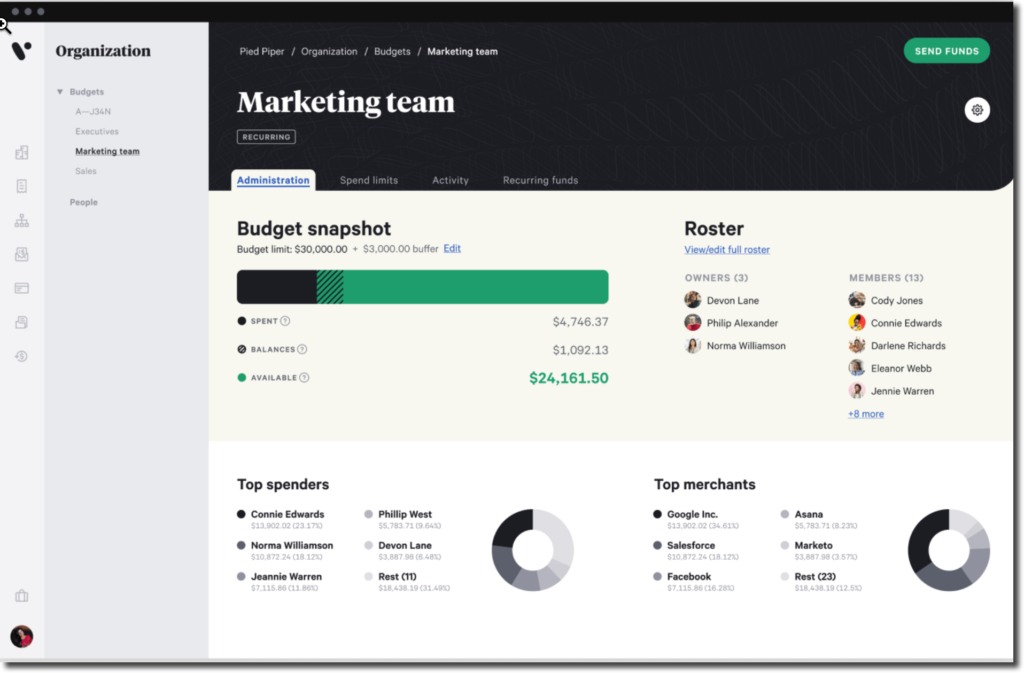

- Budgeting and spend-management tools that allow businesses to set and track spending limits, monitor employee expenses, and identify areas for cost savings.

- Integration with popular accounting software such as QuickBooks, Xero, and NetSuite to import and track expenses.

- Receipt scanning and OCR (optical character recognition)

- Customizable policy enforcement to set custom policies for expenses, including rules for what types of expenses are allowed and what types of receipts are required. The platform can automatically enforce these policies to ensure compliance.

- Advanced reporting and analytics tools that allow businesses to track and analyze their spending in detail. This includes the ability to drill down into specific categories of expenses, compare spending across departments or teams, and identify trends and patterns in spending.

- Mobile app featuring real-time notifications, receipt scanning, and the ability to submit expense reports.

- Customizable card designs to add the company logo or a custom image.

- Multi-currency support makes it easier to manage expenses in different countries. The platform automatically converts expenses to the company’s base currency.

- Employee self-enrollment to streamline the onboarding process and reduce the administrative burdens

- Advanced security features to protect against fraud and unauthorized spending. This includes real-time fraud monitoring, secure data storage, and encryption of sensitive data.

- Customer support via email, phone, and live chat.

- Customizable dashboards to track and monitor spending in real time. Dashboards can be configured to show specific data points and metrics, making it easier to track and analyze spending trends.

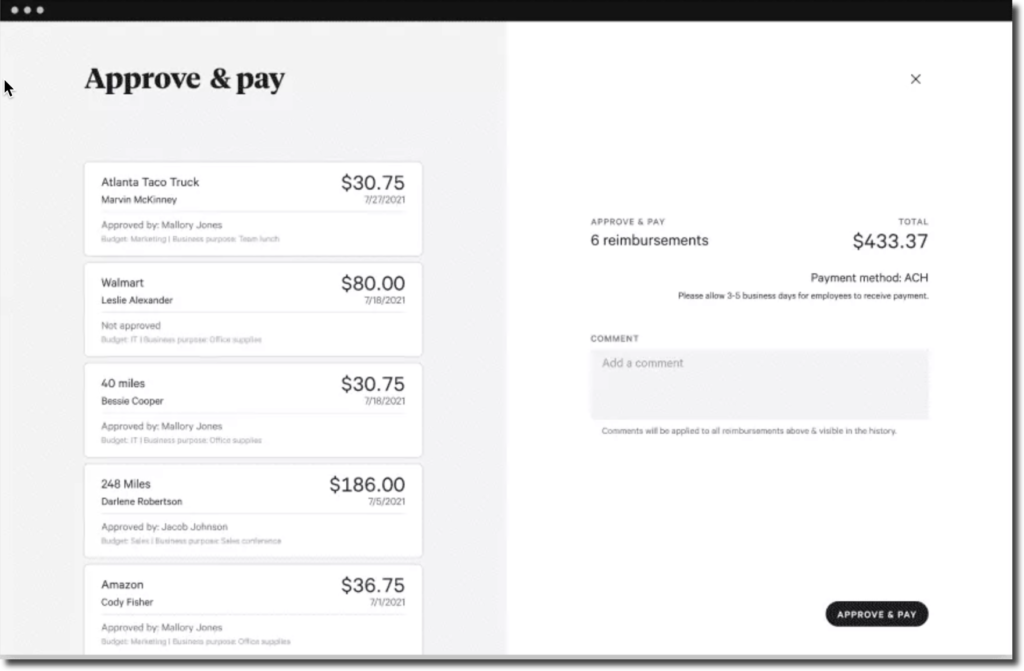

- Employee reimbursement including the ability to track and approve reimbursement requests.

- Integration with popular travel and expense management software such as Concur and Expensify

- Integration with popular HR software such as Divvy’s Workday and ADP making it easier to track employee expenses and manage payroll.

- Advanced permissions and controls with the ability to set different levels of access and control for employees and administrators. This includes the ability to set spending limits, restrict access to certain features, and monitor activity in real time.

- Automated approval features that allow businesses to set rules for approving expenses.

- Integration with popular project management software such as Asana and Trello, allows businesses to track expenses and project progress in a single platform.

- Customizable reports to track and analyze their spending in detail. Reports can be customized to show specific data points and metrics, and can be exported for further analysis.

- Real-time notifications to alert employees and administrators of important events and changes within the platform. This can help to keep everyone informed and ensure that expenses are tracked and managed effectively.

- Advanced search and filtering tools to quickly find and track specific expenses. This can be useful for identifying trends and patterns in spending, or for tracking expenses for a specific project or department.

- Multiple cardholder support to add multiple cardholders to a single account, making it easier to manage expenses for a team or department. Cardholders can be given different levels of access and control, depending on their role within the company.

- Integration with popular invoicing software such as FreshBooks and Zoho Invoice, allows businesses to track expenses and invoices in a single platform.

- Customizable expense categories to better track expenses, making it easier to organize and analyze spending.

- Advanced reconciliation features that allow businesses to easily match expenses to invoices and other financial documents. This can help to ensure that expenses are accurately tracked and accounted for.

- Integration with popular CRM software: Divvy’s platform integrates with popular CRM software like Salesforce and Zoho CRM, allowing businesses to track expenses and customer interactions in a single platform.

- Automatic expense categorization to make it easier to track and manage spending. Categorization can be customized to fit the needs of the business.

- Integration with popular e-commerce platforms such as Shopify and WooCommerce, allows businesses to track expenses related to online sales and transactions.

- Multi-lingual support including English, Spanish, and French.

- Advanced expense tracking features that allow businesses to track expenses in real time and identify trends and patterns in spending.

- Advanced fraud protection features that help to prevent unauthorized expenses and protect against fraud. This includes real-time fraud monitoring, secure data storage, and encryption of sensitive data.

- Automated account reconciliation features that help to ensure that expenses are accurately tracked and accounted for. This can save time and reduce the administrative burden on the business.

- Customizable notifications make it easier to stay informed about important events and changes within the platform.

- Integration with popular project management and time-tracking software such as Asana and Toggl, allows businesses to track expenses and project progress in a single platform.

- Advanced budgeting and spend-management features that allow businesses to set and track spending limits, monitor employee expenses, and identify areas for cost savings.

- Advanced expense approval workflow features allow businesses to set rules for approving expenses and streamline the approval process.

Company Vitals

– HQ: Utah

– Founded: 2016

– Valuation: $2.3B (June 2021 exit, source SEC)

– Raised $418M ($165M since Jan 2021) (Crunchbase)

– Website visits (June 2023): 520,000 (SimilarWeb)

– Employees: 443 (Pitchbook), unchanged

– Articles citations: 81 (Crunchbase)

– Linkedin: 33,900 followers (443 employees)

– Trustpilot: 3.1 (443 reviews)

– iOS app: 4.7 (8,400 reviews)

Founders

Blake Murray was CEO (until Sep 2022). He has a background in finance and previously worked as a financial analyst at Goldman Sachs. Murray has also served as the chairman of the board of directors for the Utah Technology Council.

Alex Bean was CTO (until Dec 2021). He has a background in computer science and previously worked as a software engineer at Adobe. Bean has also served as the chairman of the board of directors for the Lehi Chamber of Commerce.

Product Videos

7-minute demo by Jacob Graf, Head of Production Operations, Divvy (Jan 2019)

Product Screenshots

Appendix: Fastest fintech companies to a $2.5B valuation

Note: This appendix was generated by ChatGPT (10 Jan 2023), edited for readability, but not fully fact-checked

1 year

- Binance: Founded in 2017, valued at $2.5 billion in 2018

Binance is a digital currency exchange - Square: Founded in 2010, valued at $2.5 billion in 2011

Square is a financial technology company that offers a range of payment and point-of-sale solutions.

2 years

- Avant: Founded in 2012, valued at $2.5 billion in 2015

Avant is an online lending platform

- Robinhood: Founded in 2013, valued at $2.5 billion in 2015.

Robinhood is an online brokerage firm

- Affirm: Founded in 2012, valued at $2.5 billion in 2015.

Affirm is a financial technology company that offers point-of-sale financing to consumers. - Brex: Founded in 2016, valued at $2.5 billion in 2019

Brex is a financial technology company that offers corporate credit cards and expense management solutions. - Lemonade: Founded in 2015, valued at $2.5 billion in 2018.

Lemonade is an insurance technology company - Stripe: Founded in 2010, valued at $2.5 billion in 2013

Stripe offers a range of payment and point-of-sale solutions.

4 years

- Acorns: Founded in 2014, valued at $2.5 billion in 2018

Acorns offers a micro-investing platform and personal finance management tools.

- Chime: Founded in 2014, valued at $2.5 billion in 2018.

Chime is a financial technology company that offers mobile banking and financial management services. - Credit Karma: Founded in 2010, valued at $2.5 billion in 2014

Credit Karma is a personal finance company that offers credit scores, credit monitoring, and other financial tools. - LendingTree: Founded in 1996, valued at $2.5 billion in 2000.

LendingTree is an online lending marketplace - Lufax: Founded in 2011, valued at $10 billion in 2015

Lufax is a Chinese peer-to-peer lending platform - Monzo: Founded in 2015, valued at $2.5 billion in 2019

Monzo is a UK-based digital bank - Pico: Founded in 2o16, valued at $5 billion in 2020.

Pico is a Chinese fintech company that offers a range of financial services, including wealth management and insurance. - Plaid: Founded in 2011, valued at $2.5 billion in 2015

Plaid is a financial technology company that provides APIs that allow consumers to connect their bank accounts to financial apps.

- Revolut: Founded in 2016, valued at $5.5 billion in 2020.

Revolut is a fintech company that offers a range of financial services, including mobile banking and international money transfers. - SoFi: Founded in 2011, valued at $4 billion in 2015.

SoFi is a financial technology company that offers a range of financial services, including personal loans, mortgages, and investment products. - Toss: Founded in 2015, valued at $2.5 billion in 2019.

Toss is a South Korean fintech company that offers a range of financial services, including mobile banking and peer-to-peer payments.

*FAB score = Fintech Attention Barometer, a proprietary measure of company size calculated by Fintech Labs. Inputs primarily include funding, website traffic and employee count.