Ramp is a New York City-based fintech startup founded in 2019 that offers corporate charge cards paired with an expense-management platform and finance tools. Its core mission is to help businesses save time and money. In just six years, Ramp has grown into a major player in fintech, reaching a $13-billion valuation, the fifth most valuable private USA-based fintech. It has more than 1,000 employees and a revenue run rate of $700 million.

Founded by repeat entrepreneurs aiming to align incentives between a finance platform and its customers, Ramp quickly gained a foothold by addressing long-standing frustrations with corporate spending management. The company’s history is marked by aggressive fundraising, from seed funding to multi-billion-dollar rounds led by prominent investors, fueling its expansion. Along the way, Ramp built a robust suite of financial tools – from corporate cards and expense management to bill pay, vendor negotiation, travel booking, and beyond – carving out a strong market position.

Ramp’s strategy of prioritizing customer savings and efficiency has differentiated it in a crowded market and helped it win business from startups and enterprises alike. While it faces intense competition (most notably from Brex, Amercian Express and incumbent financial institutions), its track record suggests it will be a central company to watch in the fintech space. With a $13 billion valuation and plans to keep expanding its product capabilities, Ramp is poised to further disrupt corporate finance and redefine how businesses manage and optimize their spending.

Traction

Revenue and Financial Performance:

-

Annualized Revenue: Ramp’s annualized revenue has reached $700 million as of January 2025, more than doubling from $300 million in August 2023.

-

Valuation: The company’s valuation expanded to $13 billion, up from $7.65 billion in April 2024. It is the 23rd most valuable fintech founded in the past 25 years, and the 5th largest of US-based private fintech (excluding crypto).

Customer Base and Transaction Volume:

-

Active Customers: Ramp serves over 30,000 businesses, ranging from high-growth startups to established enterprises. The startup is valued at something $400,000 per customer, a remarkable number.

-

Payment Processing: The platform processes $55 billion in payments on an annualized basis, a significant increase from $10 billion at the beginning of 2023.

Employee Count:

- Workforce Size: Ramp employs over 1,100 individuals as of March 2025, reflecting substantial growth from approximately 500 employees in mid-2023. Ramp hired more than 500 people in 2024.

Website Traffic and Digital Presence:

- Website Traffic: Ramp’s website has grown to 2.3 million visits in January according to SimilarWeb.

- LinkedIn: 171,000 followers and 1,630 employee connections

- G2: 4.8 score with 2,065 reviews

- iOS: 4.8 score with 23,000 reviews

Product Milestones

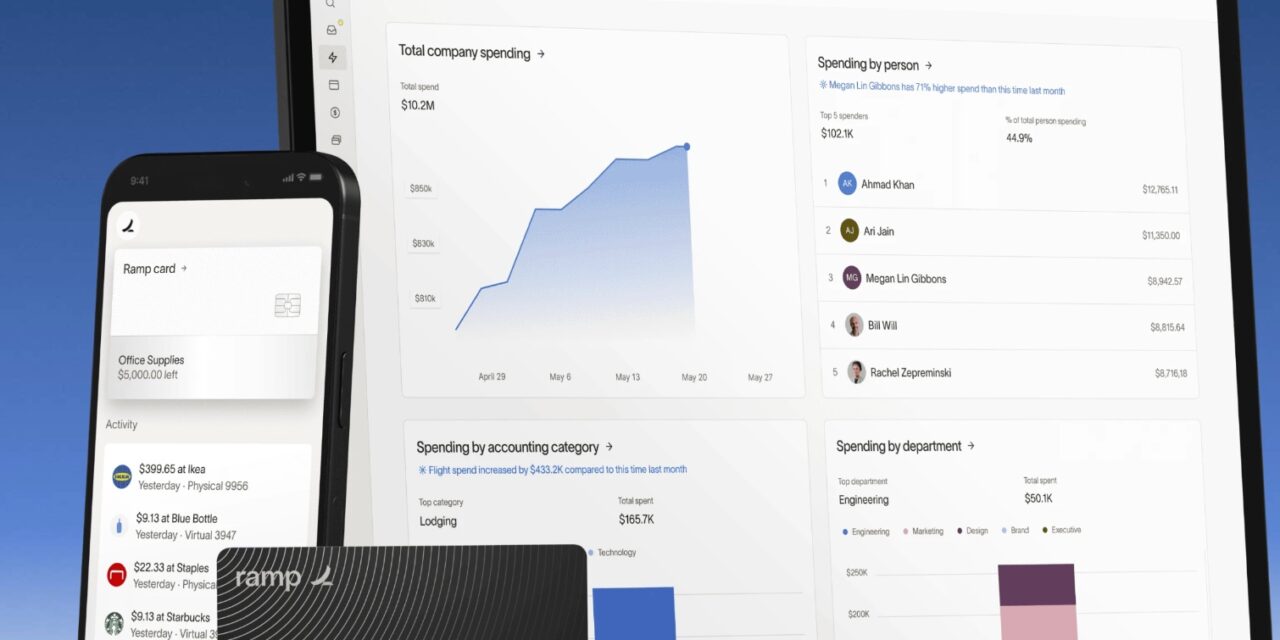

From its inception, Ramp has continually expanded its product suite beyond the original corporate card, evolving into a broader finance automation platform. A recent podcast with Ramp product head Geoff Charles discussed its product-led culture, layering of AI at every step of their work flows (“every employee uses AI every day”), and the latest expansion into the deposit side.

Key product developments and milestones include:

- Corporate Card and Spend Management (2019–2020): Ramp’s initial offering was a corporate charge card with Up to 1.5% cash back on all purchases, integrated with software to manage expenses in real time. Unlike American Express, Ramp’s rewards were deliberately straightforward (cash-back only) to keep employees focused on cost efficiency. The platform included tools for setting spending limits, collecting receipts via SMS/email, and providing managers a unified dashboard of company spend. By the end of 2020, Ramp’s software had begun identifying areas of wasteful spending for customers (such as duplicate subscriptions or unused SaaS seats), reinforcing its brand promise of helping companies save money.

- Bill Payments (2021): In October 2021, Ramp launched a Bill Pay to automate accounts payables. This move directly targeted incumbents such as Bill.com by offering Ramp’s invoice management and vendor payment platform for free. Businesses could scan or email invoices to Ramp; the platform’s AI would automatically capture invoice details and help schedule payments (via ACH or checks) with appropriate approvals. By integrating bill payments into the same dashboard as corporate card spend, Ramp gave finance teams a single system for both card expenses and vendor bills. This feature not only added convenience but also incentivized customers to route more spend through Ramp (generating interchange revenue). The free pricing undercut competitors and was designed to boost user adoption. Ramp’s Bill Pay gained traction quickly. By the end of 2023, Ramp reported $12 billion in annual run rate, up 5x from $2.5 billion in 2022.

- Savings Insights and Negotiation Tools: A distinctive aspect of Ramp’s platform is its focus on identifying cost savings. The software automatically flags anomalies or redundant spending (for example, duplicate subscriptions or opportunities to downgrade plans). Ramp took this a step further by integrating a “negotiation-as-a-service” tool through its mid-2021 acquisition of Buyer. The British Columbia-based startup specialized in analyzing big-ticket purchases (like annual software contracts) and negotiating better rates. This became “Ramp Purchases” (or Ramp’s negotiating tool), which uses data on pricing benchmarks to help companies save on vendors. By mid-2023, Ramp claimed its price intelligence and negotiation features, combined with expert advisors, had saved customers over $600 million and 8.5 million hours of work. These savings insights are a core part of Ramp’s value proposition and set it apart from competitors. In one statistic, the company noted that the average customer reduces spending by about 3.5% after switching to Ramp, indicating tangible savings delivered.

- Expense Management & Integrations: Ramp steadily enhanced its expense management capabilities, aiming to eliminate manual work for finance teams. The platform introduced features such as automatic receipt matching (using OCR), real-time expense categorization with integrations to accounting systems, and multi-level approval workflows. In late 2023, Ramp rolled out deep integrations with productivity tools, for example, Microsoft Teams and 365 Copilot, that allow employees to query an AI assistant about their expenses or to submit expense requests directly from Teams. The process leverages generative AI so that routine finance queries and tasks can be handled in natural language. Ramp has positioned these AI features as making “expense reports that write themselves,” aligning with its automation theme.

- Advanced Analytics and AI (2023–2024): As artificial intelligence technology matured, Ramp quickly embraced it to extend its platform. In 2023, the company announced new AI-powered features, including a tool that can automatically analyze a customer’s software stack to identify if they are overpaying on software contracts. This builds on Ramp’s earlier acquisition of negotiation tools, now supercharged with AI to scan contracts and benchmark prices. Ramp also integrated a GPT-4 based chatbot for finance teams, allowing users to ask questions like “How much did we spend on travel last quarter?” and get instant answers from Ramp’s data. These developments culminated in Ramp being named one of Fast Company’s “Most Innovative Companies” in finance for its use of generative AI to find savings.

- Travel and Procurement Solutions: In 2023, Ramp began expanding into adjacent areas of business finance. It introduced a travel booking portal in partnership with Priceline, enabling companies to book business trips within Ramp and automatically integrate those expenses into the platform. The system detects when a trip is booked and then auto-categorizes expenses as travel, further reducing manual reporting. Ramp also moved into procurement: in mid-2023 it announced plans to serve larger enterprises with more complex purchasing needs. To accelerate this, Ramp made its third acquisition, buying Venue, a small procurement workflow startup in August 2023 (the deal was finalized by January 2024). Venue’s technology was integrated as part of “Ramp Plus,” an offering aimed at streamlining purchase orders, vendor management, and collaboration on large purchases. With its new Venue capabilities, Ramp signaled a push into end-to-end procurement and accounts payable competing with larger spend management and ERP systems on a lightweight platform.

- Customer Support Automation: Another acquisition in mid-2023 was Cohere.io, an AI-powered customer support chatbot company. While not a direct finance feature, Cohere’s technology has been used to bolster Ramp’s customer experience and eventually embed AI assistance within the Ramp app.

- Treasury: On January 22, 2025, it introduced Ramp Treasury, a cash management solution designed to optimize how businesses handle their operating funds. There are two options:

- Ramp Business Account: A free, FDIC-insured account providing a 2.5% annual yield, significantly higher than the national average.

- Ramp Investment Account: Access to money market funds with yields up to 4.38%, though these are not FDIC-insured.

Integrated within Ramp’s existing platform, Treasury automates cash flow planning using artificial intelligence, enabling businesses to earn more on idle funds without sacrificing liquidity. Additional features include unlimited, free same-day payments and automated balance alerts, streamlining financial operations and enhancing efficiency.

Across all these developments, Ramp has maintained a consistent theme: integrate finance workflows into one platform and automate as much as possible with AI and smart design. Ramp touts itself as a holistic “finance automation platform” covering corporate cards, expense management, bill pay, accounting integrations, travel expense tracking, treasury and procurement in one solution. This broad product footprint has been key to its competitive positioning.

Founding & Early Days (2019–2020)

Ramp was founded in March 2019 by Eric Glyman, Karim Atiyeh, and Gene Lee. Glyman and Atiyeh were classmates at Harvard and previously co-founded Paribus, a price-tracking consumer app that was acquired by Capital One in 2016. After their time at Capital One, the founders moved to an area they thought was ripe for new thinking, business spending.

Ramp’s development began in 2019, and by August it onboarded its first test customers. It officially launched to the public in February 2020 just before the COVID-19 pandemic. Early adopters included high-growth startups (such as healthcare company Ro, mortgage lender Better.com, and productivity software firm ClickUp) as well as established businesses seeking more efficient finance operations. Within a year, Ramp was helping clients eliminate traditional expense reports and identify millions in unnecessary expenditures. This strong early traction set the stage for rapid growth in the years to follow.

Funding Rounds and Notable Investors

Ramp’s fast growth was matched by an aggressive fundraising trajectory, attracting top venture capital firms and investors:

- Seed and Series A (2019–2020): Shortly after founding, Ramp raised seed funding (around mid-2019) and a $15-million Series A (according to Crunchbase) by early 2020 to support product development and its public launch. These early rounds included investors like Founders Fund, BoxGroup, and Contrary Capital, as well as angels. The founders’ successful exit with Paribus and the promise of Ramp’s approach helped in securing early backing.

- Series B (February 2021): Ramp announced a $115 million Series B round co-led by Stripe (the fintech giant’s first startup investment) and D1 Capital Partners, valuing Ramp at $1.6 billion. Reaching a unicorn valuation less than two years from founding made Ramp one of the fastest-growing startups in the U.S. at that time. This milestone round came on the heels of extraordinary growth, with 5-fold growth in transaction volume in the prior six months.

- Series C (August 2021): Just five months later, Ramp raised a Series-C round of $300 million, more than doubling its valuation to $3.9 billion. This 2.5x jump reflected surging investor enthusiasm for fintech and spend management startups in 2021. Founders Fund and Thrive Capital led the round. By late 2021, Ramp had raised over $600 million in equity financing total and was one of the fastest companies to achieve multi-unicorn status.

- Series D and Debt Financing (March 2022): Ramp continued its fundraising streak in 2022 raising $750 million at an $8.1 billion valuation. This financing included $200 million in new equity (led by Founders Fund with participation from all major existing backers like D1, Thrive, Redpoint, Coatue, and others) and $550 million in debt financing to fuel its corporate-card lending capacity. New investors such as General Catalyst, Sequoia Capital, Greylock, and Avenir also joined in this raise. Ramp reported serving over 5,000 businesses and powering more than $5 billion in annualized transaction volume as of early 2022.

- Down Round in 2023 (Series D Extension): Amid a broader fintech market downturn in 2022–2023, Ramp faced valuation pressures. In August 2023, the startup raised $300 million at a lowered valuation of $5.8 billion. This down round reflected tougher market conditions with rising interest rates and investor focus on profitability depressing fintech valuations across the board. The round was co-led by existing investor Thrive Capital and new investor Sands Capital, with continued participation from Founders Fund and General Catalyst. Despite the valuation pullback, Ramp saw this funding as an opportunity to continue expanding its product offerings while many competitors scaled back. By late 2023, Ramp had over 15,000 business customers on and was preparing new product features leveraging artificial intelligence.

- Series D-2 and Rebound (April 2024): In April 2024, Ramp secured an additional $150 million in an extension of its Series D, this time at a higher valuation of $7.65 billion. The raise co-led by Khosla Ventures and Founders Fund brought in new notable investors including Sequoia, Greylock, and 8VC. This uptick in valuation signaled renewed investor confidence as Ramp demonstrated continued revenue growth (tripling its run-rate from early 2022 to mid-2023) and prudent scaling of its team. Ramp’s ability to raise funding at an improved valuation, while many fintechs were still struggling, underscored its strong market position and trajectory.

- Secondary Share Sale (March 2025): By early 2025, Ramp’s valuation surged to $13 billion, nearly doubling from a year prior. This increase was achieved via a $150 million secondary transaction that allowed employees and early investors to cash out some shares. At this valuation, Ramp became one the 23rd most valuable fintech of the 21st century (see list). The company’s investor roster over the years spans top venture firms (Founders Fund, Thrive Capital, Redpoint, Coatue, Khosla Ventures, and D1 Capital among others) and notable individuals (such as Microsoft CEO Satya Nadella and former Citi CEO Vikram Pandit).

Market Positioning and Strategy

Ramp’s market positioning centers on being a modern, all-in-one finance tool that saves businesses money. In contrast to corporate card programs that incentivize spending through reward points, Ramp deliberately aligned its business model with customer cost savings. The company generates revenue primarily from interchange fees on card transactions, allowing it to offer its software (expense tracking, bill pay, etc.) essentially free. This “give the software away, earn from card usage” approach meant that Ramp had to convince customers to shift as much spending as possible onto Ramp cards – which it has encouraged by providing value (cash back, convenience, and insights) rather than by promoting more spending.

Value Proposition: Ramp pitches itself as “the finance team’s best friend,” emphasizing visibility and control. The platform provides a unified dashboard for all company spending, real-time alerts, and built-in analytics that highlight where money is going. By automating bookkeeping tasks (like coding transactions to the right accounts) and enforcing policy rules (e.g., blocking out-of-policy spend or flagging missing receipts), Ramp claims to significantly reduce the manual workload for finance departments. According to the company, customers close their books 86% faster on Ramp and cut their expenses by ~5% on average by eliminating waste. These efficiency stats are a cornerstone of Ramp’s marketing, appealing to CFOs who want both cost savings and better financial processes.

Customer Segment: Ramp initially targeted high-growth startups and mid-sized companies, competing to win over clients that might otherwise use Brex, traditional corporate cards, or separate tools like Expensify and Bill.com. Over time, Ramp expanded its reach to larger enterprises as well. By 2022, it reported serving multi-billion-dollar companies. The platform supports international usage (transactions in 40+ currencies), though its customer base is primarily U.S.-based. Notably, Ramp formed a partnership with Amazon Business to help joint customers streamline purchasing, indicating a strategy to integrate into corporate procurement ecosystems.

Challenges and Achievements

Despite its rapid ascent, Ramp has navigated several challenges along the way:

Challenges:

- Competitive Pressure: Ramp faces well-funded competitors. Staying ahead on product innovation is an ongoing challenge. American Express just plunked down a rumored $600M for digital expense management startup Center. Brex and others also introduced AI features and global capabilities. Ramp’s broadening into areas such as travel and procurement pits it against specialized tools (e.g., SAP Concur for travel, Coupa for procurement) which have entrenched enterprise users. Convincing large clients to trust a younger startup over long-time incumbents can be a hurdle. Additionally, Ramp must maintain the quality of its customer support and platform reliability as it scales to tens of thousands of users; any major platform outage or security incident could shake confidence in a financial tool. So far, Ramp has navigated these issues well, but the stakes rise as the company grows.

- Banking and Credit Risk: Ramp’s card is a charge card (balance due monthly) typically with a credit limit based on the business’s finances. Ramp partners with a bank (Synchrony Bank initially, now Citibank for issuance and credit facilities) to offer the card. This means Ramp doesn’t carry the credit risk on its own balance sheet for the most part, but it still needs to closely manage risk of fraud or non-payment. As Ramp moves into lending adjacent services or extends float for bill payments, it must ensure losses are controlled. Any economic stress on its customer base (e.g., a wave of startup failures) could impact Ramp’s transaction volume or bad debt, a risk inherent to serving small and mid-sized businesses.

- Interchange Reform: Worldwide, interchange rates have faced competitive and regulatory pressure. Since it makes much of its current revenue from interchange, even small declines in prevailing rates would put pressure on Ramp’s revenues and margins. The current U.S. administration does not appear likely to push interchange rates down through regulation, so the risk seems low for the next four years at least.

Achievements:

- Hyper-Growth in Revenue and Customers: Ramp’s growth metrics are striking. The company went from $0 to $100 million in annualized revenue in roughly two years, and tripled that to $300+ million by 2024. Its customer count similarly skyrocketed from around 5,000 in 2021 to 15,000 in 2023 and now 30,000. Such growth in a B2B fintech is uncommon, making Ramp one of the fastest-growing SaaS/fintech startups ever. This was recognized by rankings like the CNBC Disruptor 50, which listed Ramp in 2023 for its outsized impact in the industry.

- High Valuation and Investor Confidence: Achieving a $13 billion valuation within 6 years of founding is a feat few startups accomplish. Ramp became a unicorn (>$1B) in under two years and a decacorn (>$10B) by year six, marking one of the speediest ascents in fintech. Even during industry lulls, Ramp attracted blue-chip investors at hefty valuations. The backing of firms like Founders Fund, Stripe (which co-led the Series B), Thrive, Sequoia, and more – plus tech luminaries like Satya Nadella – underscores the belief in Ramp’s long-term prospects. The 2025 secondary share sale not only gave liquidity to employees but also signaled to the market that Ramp’s stakeholders saw upside ahead at $13B.

- Innovation and Product Awards: Ramp’s product design and innovative features have garnered accolades. In 2022, Forbes featured an “inside story” on how Ramp built an $8B company so quickly, highlighting its novel approach. In 2023, Fast Company named Ramp among the year’s most innovative companies in finance for its use of generative AI. Ramp was also a newcomer on the 2023 Forbes Cloud 100 list (at #37, notably ranking above its rival Brex). These recognitions point to Ramp’s reputation as a forward-thinking disruptor in the staid world of corporate finance tools.

- Customer Impact: Perhaps Ramp’s proudest achievement, as the founders often cite, is the cumulative savings delivered to clients. By early 2022, Ramp claimed to have saved its customers over $135 million in expenses by optimizing spending and eliminating waste. That figure grew to over $600 million by mid-2023. The platform has helped companies automate thousands of hours of work (e.g., closing books, filing expense reports) so finance teams can focus on higher-value tasks. Testimonials frequently note how much smoother expense handling is on Ramp versus older methods. This positive word-of-mouth has helped Ramp grow largely via referrals, reducing the need for heavy marketing spend.

- Adaptability & Expansion: Ramp successfully expanded its scope from a single-product startup to a multi-solution platform in a short time. Each expansion – cards to bill pay, domestic to international, expenses to travel booking, etc. – has been executed rapidly, often through savvy acquisitions of small startups (such as Buyer, Cohere, Venue). This shows Ramp’s ability to integrate new teams and technologies effectively, a significant operational achievement. It also reflects a clear strategic vision to own the “finance stack” for businesses. Few startups manage to broaden their product portfolio without losing focus; Ramp has so far navigated this well, continuing to ship improvements at a fast pace (often highlighting new releases in its blog and press updates every few months).

Sources:

- Ramp (company) – Wikipedia (Ramp (company) – Wikipedia) (Ramp (company) – Wikipedia)

- Ramp Blog – “Our journey as New York’s fastest growing startup” (Our journey as New York’s fastest growing startup) (Our journey as New York’s fastest growing startup)

- Reuters – “Fintech firm Ramp raises $300 mln at lowered valuation of $5.8 bln” (Aug 2023) (Fintech firm Ramp raises $300 mln at lowered valuation of $5.8 bln | Reuters) (Fintech firm Ramp raises $300 mln at lowered valuation of $5.8 bln | Reuters)

- FinTech Futures – “US start-up Ramp reaches $8.1bn valuation with fresh $750m funding” (Mar 2022) (US start-up Ramp reaches $8.1bn valuation with fresh $750m funding) (US start-up Ramp reaches $8.1bn valuation with fresh $750m funding)

- Fintech Nexus/TechCrunch – “Ramp raises another $150M… at a $7.65B valuation” (Apr 2024) (Fintech Nexus Newsletter (April 18, 2024): Ramp closes $150m funding round | Fintech Nexus) (Fintech Nexus Newsletter (April 18, 2024): Ramp closes $150m funding round | Fintech Nexus)

- Payments Dive – “Ramp may target US startups… (M&A targets)” (Apr 2024) (Ramp may target US startups this year: report | Payments Dive) (Ramp may target US startups this year: report | Payments Dive)

- Ramp Press page – Media highlights (Fast Company, Forbes, etc.) (Press – Media Resources | Ramp) (Press – Media Resources | Ramp)

- Boring Business Nerd – Ramp company profile (metrics and investor info) (Ramp – Company Profile) (Ramp – Company Profile)

- Reuters – “Ramp plans new AI tools to save businesses money” (May 2023) (Fintech firm Ramp raises $300 mln at lowered valuation of $5.8 bln | Reuters)

- CNBC – “Ramp one of Disruptor 50 startups” (2023) (Ramp (company) – Wikipedia) and other news reports.

Company Vitals

FAB Score = 1,140 (up 60 since Jan ’25)

HQ: NYC

Founded: 2019

Traction:

– Valuation: $13 based on a March 2025 secondary stock sales (FintechLabs) <<<< Highest

– Annual revenue run rates: $700M (Jan 2025), $300M (Aug 2023), $100M (March 2022) (Source: TechCrunch)

– Raised $1.8B including $156M in April 2024, $300M in August 2023, $750M in 2022 (Crunchbase) <<< Highest

– Website visits: 2.3M (SimilarWeb, Jan 2025) <<<< Highest

– Employees: 1,000 (Pitchbook), up 150 since Jan, up 150 since Nov ’24, up 9 since Sep ’24, up 301 since Jan ’24, up 70 from Oct ’23, up 342 since July ’23) <<<< Highest

– Articles: 118 (Crunchbase)

Social:

– LinkedIn: 171,000 followers (1,630 employees, up 270 since Jan, up 330 since Nov ’24, up 590 since Sep ’24, up 360 since July ’24, up 860 since Jan ’24, up 910 since July ’23)

– G2: 4.8 (2,065 reviews, up 15 since Jan)

Product Videos