Mobile Banking Services Is Getting More Popular

According to the Fed, mobile banking was used by 53% of smartphone owner in 2015, just 7 years after Apple opened its smartphone iOS to outside apps. In newer data fielded in June by Convergys (published by BofA), 62% of are using mobile banking now.

Mobile is already a crucial touchpoint and is expected to be the favorite channel for the majority of customers within the next 3 or 4 years. And many will not open an account with a FI that doesn’t offer a minimal level of mobile capabilities.

But many banks and credit unions still don’t do enough to showcase their mobile offerings. Sometimes it’s even difficult to ascertain whether the bank even offers mobile banking services by looking at their website. App store visibility helps, but that’s not the primary method for discovery as yet.

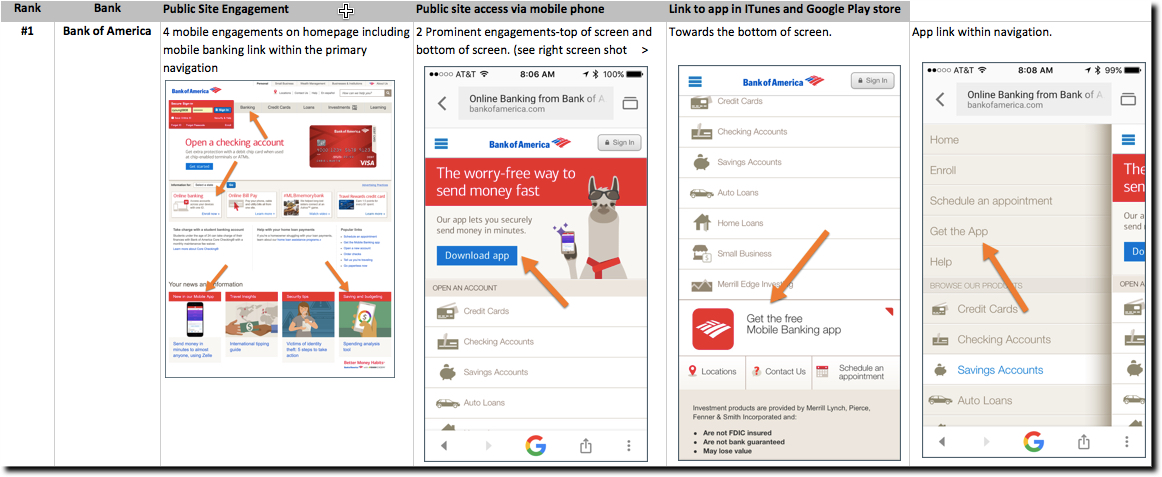

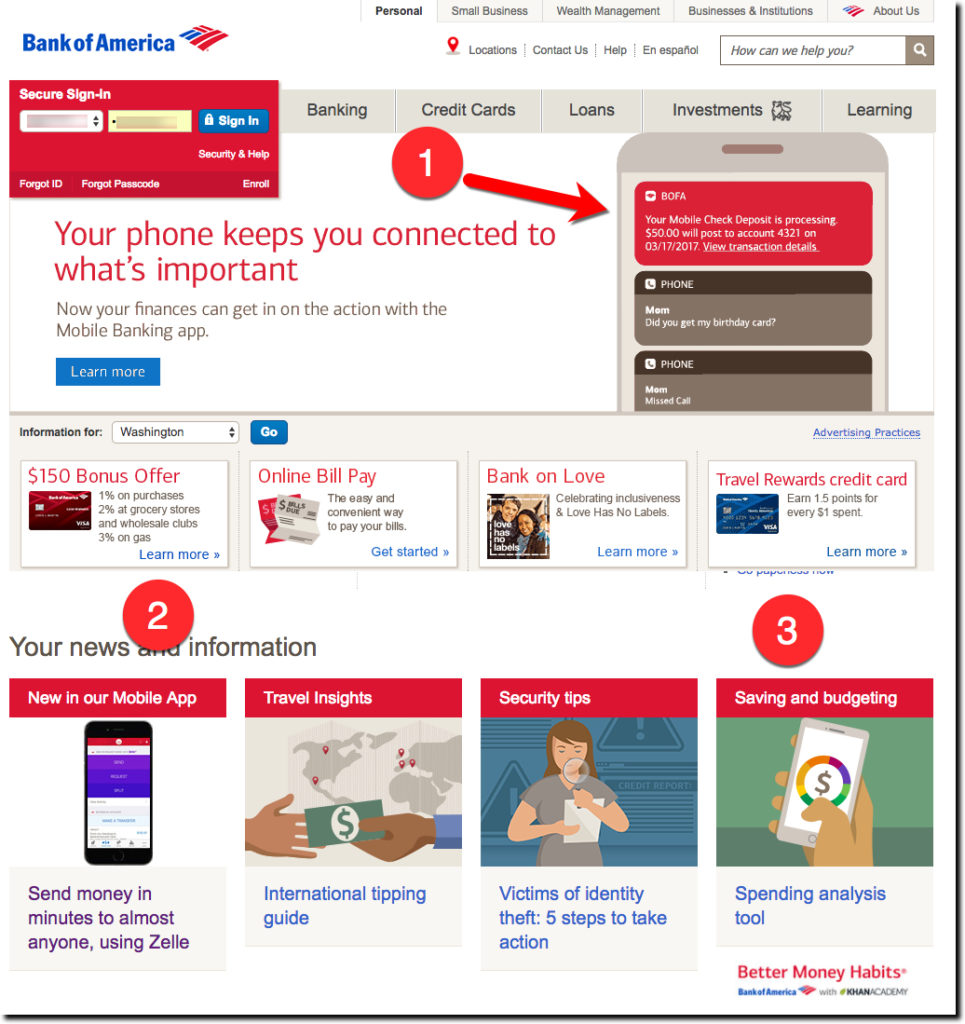

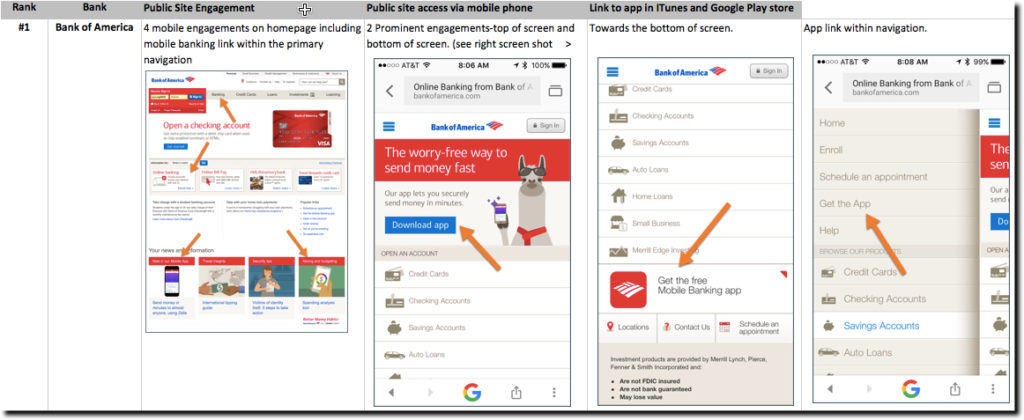

We recently ran the five largest U.S. consumer banks through our BUX (Banking UX) mobile banking scorecard, looking at two (of our 137) mobile banking best-practice guidelines:

- Is there prominent and permanent place on your website to feature your mobile banking services and benefits?

- Are there links directly to mobile banking app iTunes and Google Play app stores?

Results: We looked at how the 5 largest US banks fared on these two points. Bank of America was the best scoring 4 stars on our 5-star scale. Wells Fargo and U.S. Bank also passed the test with 3 stars. But Citibank and Chase earned just a single star, which is a failure to communicate mobile capabilities.