Last week I traveled to the center of the U.S. credit union universe last week, CUNA’s GAC conference in Washington DC. We were there to tout the launch of our BUX Certified digital banking program and spent three days talking digital with visitors to the Tyfone booth (thanks Josh, Siva and Brian for including us).

The crowd of 5,000+ was treated to a remarkably frank, and charming, fireside chat with George W. Bush (he actually imitated himself intoxicated) and the funniest financial services keynote of all time, Unmarketing’s Scott Stratten. CUNA also unveiled a new national CU branding effort Open Your Eyes.

The CUNA branding effort is designed to attack what its research identified as the biggest issue in CU marketing, lack of awareness. I can’t argue with that research. But I continue to believe another major issue is perceived tech shortcomings. Because CUs focus on the local  community consumers assume they are not big enough to invest in the latest technology. And usually, that’s simply not true. Most major credit unions offer robust digital banking with all the important features needed in 2018.

community consumers assume they are not big enough to invest in the latest technology. And usually, that’s simply not true. Most major credit unions offer robust digital banking with all the important features needed in 2018.

But how to convince members?

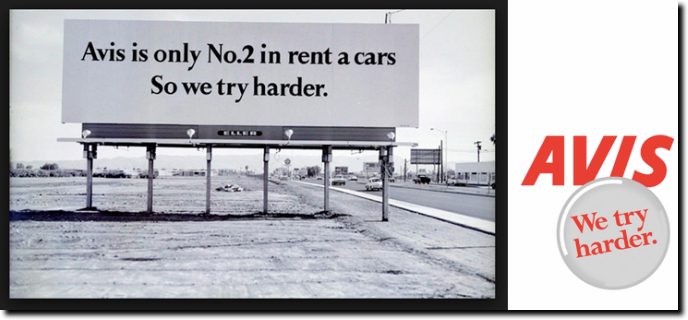

Like Avis, CU’s must fight the perception as tech laggards trying harder. Here’s our top-10 things to do to help improve your tech cred:

- Make sure the first impression of your website is modern, professional and clean (note 1)

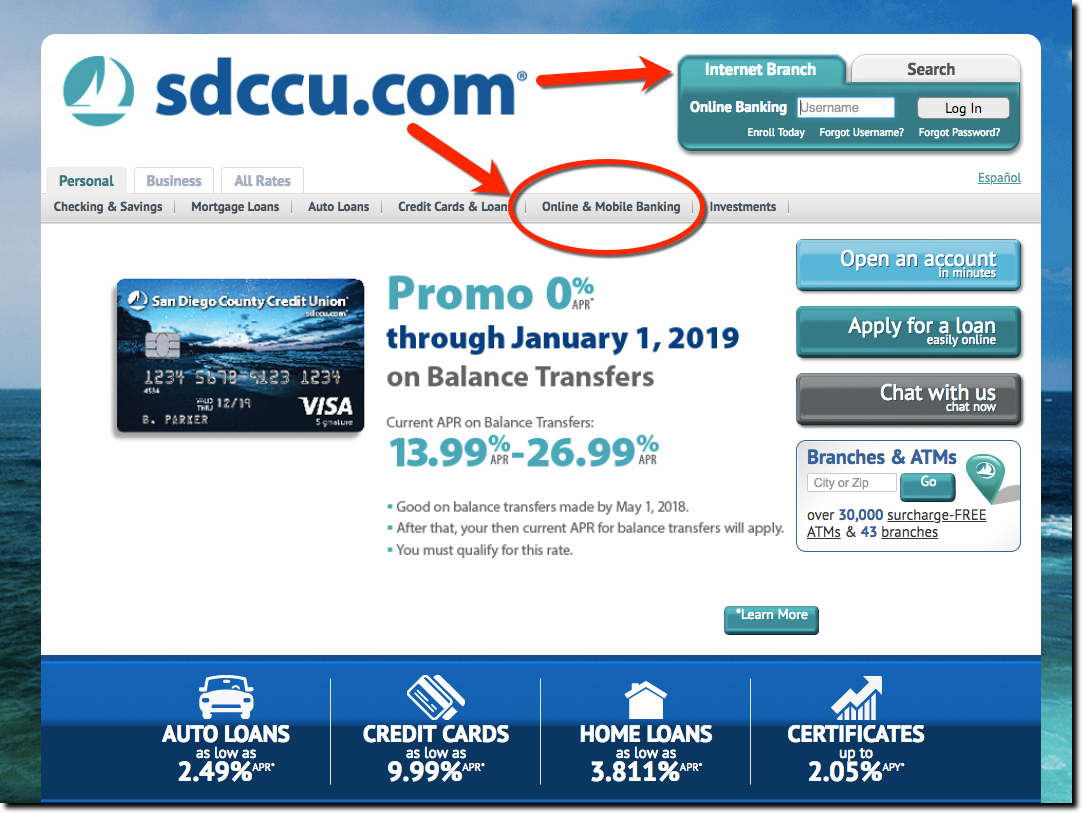

- Put Online Banking and/or Mobile Banking into your always-visible prime navigation (see SDCCU example at top).

- Over-emphasize tech prowess in all copy

- Include thumbnails of digital services on homepage

- Develop a feature-by-feature digital banking comparison chart to major banks and/or your major large competitors

- Include attractive list of digital banking features and benefits

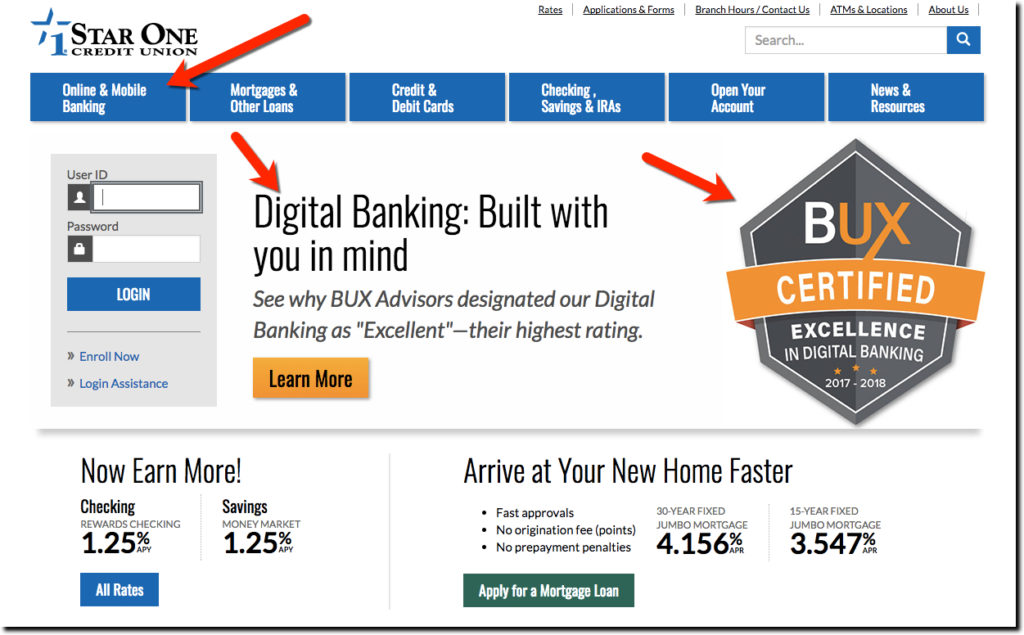

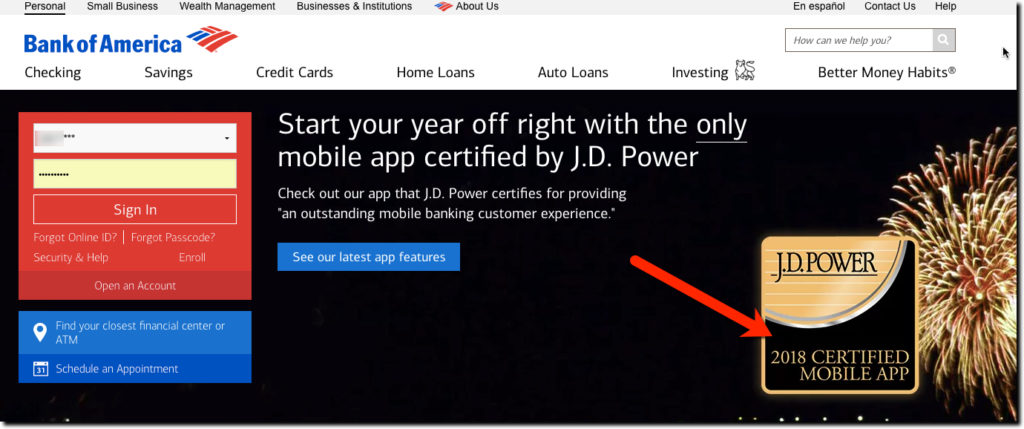

- Get your digital banking certified by BUX Advisors (see Star One below, note 2), JD Powers (see BofA example below) or both

- Display your digital banking awards and press mentions (note 1)

- Publish survey results showing the satisfaction your members have with your online and mobile banking

- Push into new digital features that create local press attention (eg. Alexa voice banking is a good new feature given all the hype around smart speakers, and what I’m sure will be major ad buys by Apple, Amazon and Google during the next few years)

Bottom line: Hurtling towards a future bringing us self-driving cars, voice enabled commerce and AI everywhere, you cannot afford to be wrongly pigeon-holed as a tech laggard.

The good news is that there are many low-cost ways to put yourself on equal footing with the big brands.

Examples

Star One (note 2) showcased BUX Advisors digital banking certification on homepage (screenshot Jan 2018)

Bank of America did the same thing at the start of the year (screenshot from Jan 2018)

*The same issue applies to many community banks as well

Notes:

- The core of our business is helping financial institutions understand how to improve their digital banking features and benefits (see more here).

- Star One is a BUX Advisors client and first to become BUX Certified