According to Dealbook, $1.1 billion has been invested into youth banking startups. Half went to the one breakout performer, Greenlight (see profile below) which was valued at $2.3 billion in 2021. In total, 10 digital banks actively promoting teen/youth accounts. Nine specialize in the niche, and one, Revolut, is a broad consumer digital bank that also offers a dedicated youth account.

According to Dealbook, $1.1 billion has been invested into youth banking startups. Half went to the one breakout performer, Greenlight (see profile below) which was valued at $2.3 billion in 2021. In total, 10 digital banks actively promoting teen/youth accounts. Nine specialize in the niche, and one, Revolut, is a broad consumer digital bank that also offers a dedicated youth account.

If you are a parent thinking about your child’s financial future, here are 10 reasons why you should set up a separate account for your child before they hit high school at the latest (some accounts start at age 6):

Largest Youth Banking Providers (ranked by website traffic)

| Rank | Company | Founded | HQ | Visits (Jun’24) | Funding ($M***) |

| Digital Banks | |||||

| 1 | Revolut <18 | 2015 | London | 13.8 million | $1,700 |

| 2 | Greenlight | 2014 | Atlanta | 1.3 million | $557 |

| 3 | GoHenry (Acorns) | 2012 | Lymington, UK | 610,000 | $121 |

| 4 | Step | 2018 | Palo Alto, CA | 100,000 | $491 |

| 5 | FamZoo | 2006 | Palo Alto, CA | 35,000 | Unknown |

| 6 | Busykid (AKA Leapspring) | 2011 | Phoenix | 34,000 | 8.3 |

| 7 | Till | 2018 | Nantucket, MA | 20,000 | $6.0 |

| 8 | Jassby | 2017 | Waltham, MA | 14000 | $7.9 |

| 9 | Mazoola | 2008 | Philadelphia, PA | 7,500 | Unknown |

| 10 | Goalsetter | 2015 | NYC | 300 | 39.7 |

| Big Banks | |||||

| 1 | 186 million | ||||

| 2 | 121 million | ||||

| 3 | 115 million | ||||

| 4 | 4.5 million | ||||

| Cards | |||||

| 1 | 26.9 million | ||||

| 2 | Venmo Teen Account | 12.9 million |

Sources: FintechLabs.com, Similarweb, SEMrush, 24 July 2024

Note: Copper removed from list after shuttering bank services in May 2024

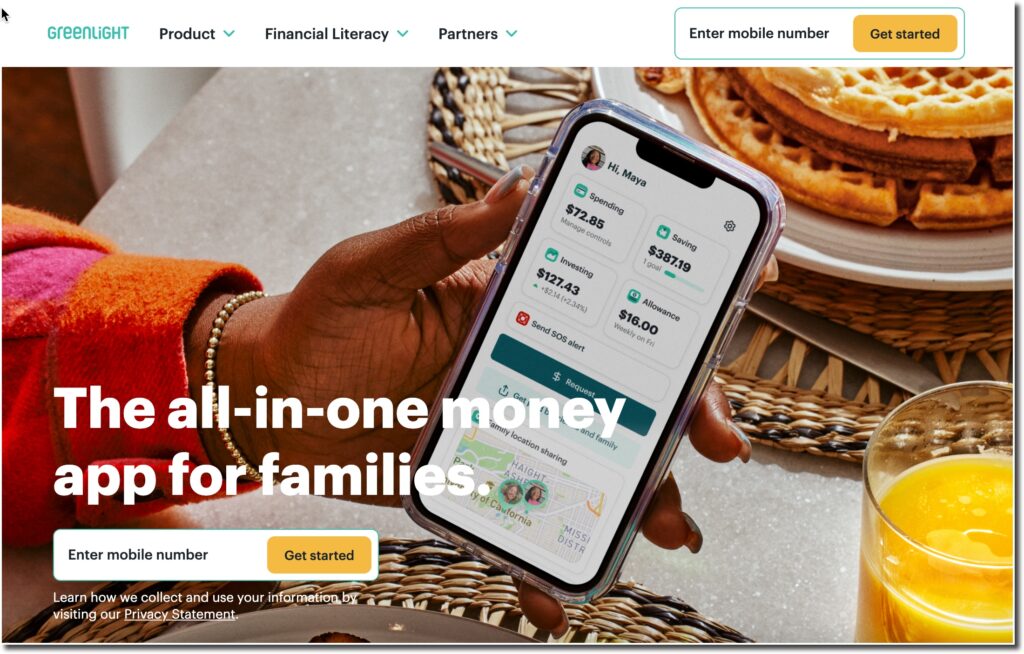

Greenlight

Founded 10 years ago in Atlanta, the challenger now gets more than 1 million monthly visits and has achieved relatively high brand awareness. The company was valued at $2.3 billion during its last round, though that was in the heady mid-2021 period. Its self-reported financial metrics don’t seem that unicornish, but its potential around white labeling (eg. US Bank) may be the underpinning of its valuation:

- 6 million users (kids + parents)

- 1+ million new accounts generated for partner banks and credit unions

- $5.5 million donated in 2023

- $198 million saved in 2023

- 47 million chores completed in 2023

- 414,000 Apple App Store reviews (4.8 score) as of 7/22/24 (app ranked #68 in Finance)

- 52,000 Google Play Store reviews (4.7 score) with more than 1 million downloads

- 515 employees (Pitchbook)

- 33,oo0 followers on Linkedin (626 employees)

- 3.9 TrustPilot score with 5,280 reviews