Online and mobile channels continue to grow in importance. But how do you know if your digital channels are effective?

WHAT WE DO

For a decade, Fintech Labs has helped banks, credit unions, and other financial services companies improve digital banking ROI through better service offerings, more straightforward user interfaces (UI), and best-in-class customer experience (UX/CX).

ADVISORY SERVICES

Our team, each with at least 15 years of digital banking experience, will conduct an in-depth look at your digital channels to identify customer experience strengths and weaknesses. But we don’t stop at merely identifying gaps, we provide custom advice on how to fix them in a cost-effective manner.

WHO WE HELP

Our clients include financial institutions around the globe, both large banks and smaller community banks and credit unions.

Fintech Labs BLOG

Provides insights on digital banking UX, CX, UI and general fintech innovations.

Providing UX Insights to Stay Ahead

We have studied thousands of banking, lending and personal finance sites and performed custom analyses for financial institutions, both large and small. We look forward to helping you. Request a proposal today!

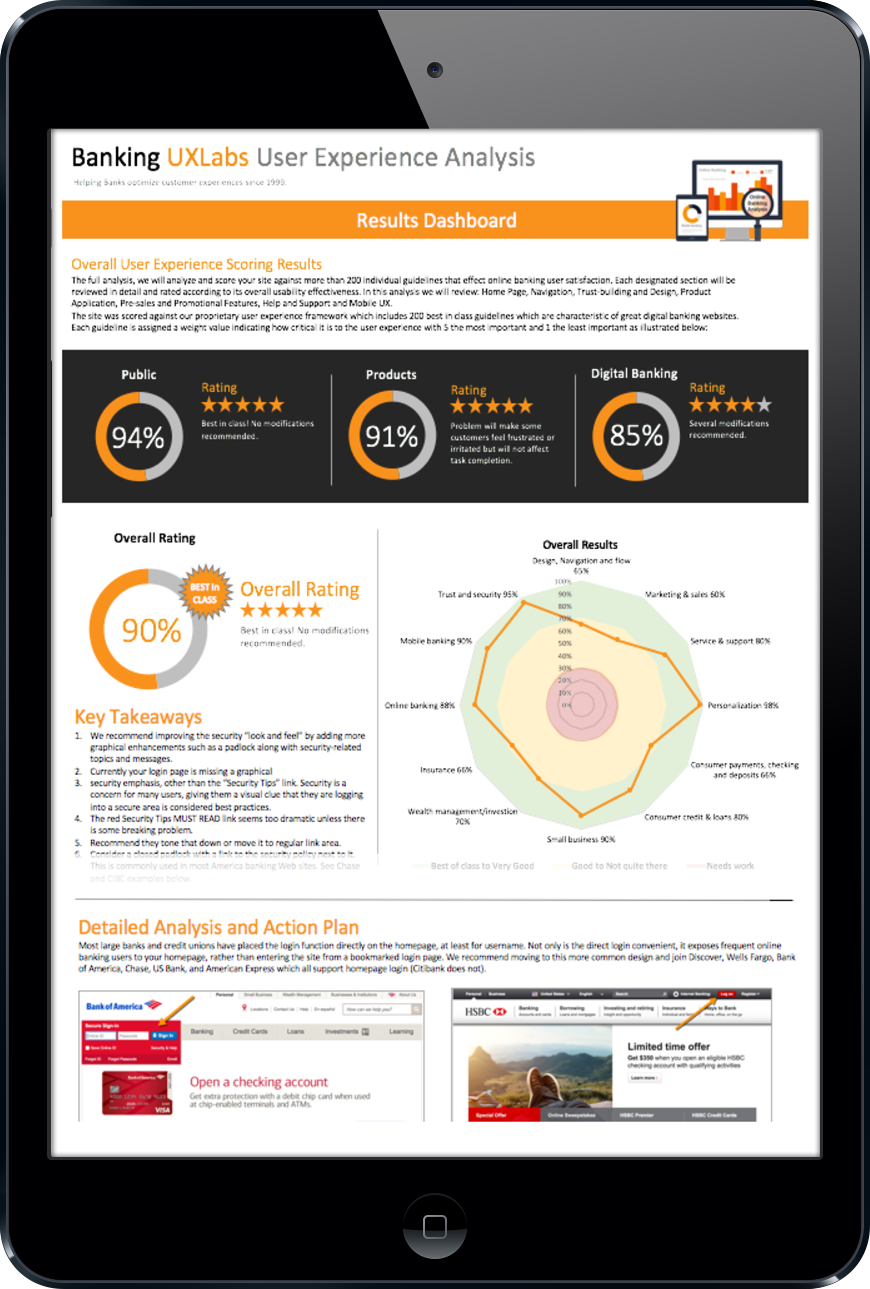

SCORING

Core banking areas compared and scored against our proprietary customer experience framework

CONTACT POINTS REVIEW

400+ digital contact points reviewed for customer experience effectiveness

SUMMARY

Key takeaways summarized and prioritized

Comprehensive Analysis Includes:

Comprehensive analysis is more than 100 pages in length along with a custom PowerPoint executive summary. Each analysis is custom-tailored to your needs.

Request A Free Proposal

UX EXPERIENCE ANALYSIS

At a glance, see strengths, weaknesses and gaps to the ideal user experience.

OPTIMIZATION SUGGESTIONS

Explains how to optimize your website and mobile offerings to align with the best practices at other financial institutions.

Years of Experience

100+ Key Touchpoints Reviewed

%

Satisfaction

Our clients include some of the leading financial institutions around the globe.